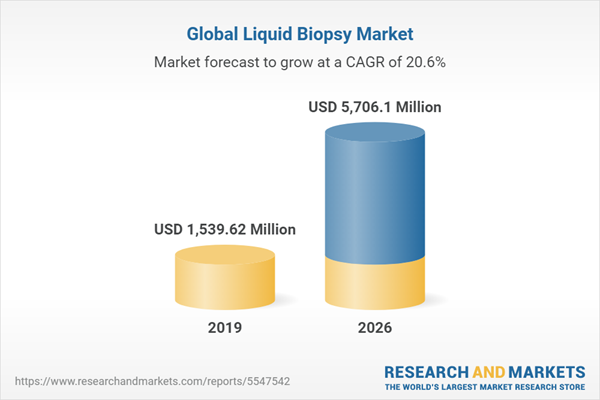

The global liquid biopsy market is projected to grow at a CAGR of 20.58% to reach US$5,706.095 million by 2026, from US$1,539.615 million in 2019. Liquid biopsy, also known as fluid biopsy, is a non-invasive method that allows for the collection and examination of non-solid biological tissue such as blood to provide a variety of information about a tumor. From a patient's blood sample, medical professionals can learn about numerous features of a tumor using liquid biopsies. The liquid biopsy can be used by doctors to determine which treatments are best for their patients. In the event of patients whose tissue cannot be biopsied or as an addition to thoroughly analyze medication response, liquid biopsies are a helpful alternative to surgical biopsies. These procedures also allow medical practitioners to acquire repeated samples during the treatment process (which is not possible with a Tumor biopsy) to evaluate the tumor's development and medication resistance in the patient. Liquid biopsies have been developed as a result of advancements in sensitive technologies for a variety of clinical applications, including disease detection, monitoring treatment response, patient stratification, and therapy selection, as well as detection of recurrence or the presence of residual disease after surgery.

The growing patient population base due to the increased occurrence of cancer may account for the market's rise. Increasing demand for non-invasive procedures will also help the liquid biopsy market expand during the projected period. Cancer is the biggest cause of mortality in the world, with over 10 million fatalities expected by 2020, in a report stated by World Health Organization (WHO). Although cancer incidence rates remain greatest in more developed locations, death rates in less developed nations are higher due to inadequate access to treatment facilities and a lack of understanding about the benefits of early identification. The most common cancers are lung cancer, colon cancer, breast cancer, and prostate cancer. Among all malignancies, lung cancer is the greatest cause of mortality. Breast cancer is the second most prevalent kind of cancer in the world, and it is also the leading cause of cancer-related deaths among women. Reduced cost, early prognosis, therapy monitoring, identification of tumor heterogeneity, acquired drug resistance, and patient comfort are all advantages of liquid biopsy over standard cancer diagnostics procedures (by eliminating the need for surgery).

One of the major reasons for the growth of the global liquid biopsy market is the growing technological advancements and the rising investments for their R&D. Increased investment for liquid biopsy research and development are supporting market revenue growth. Due to rapid technological developments and low DNA sequencing costs, CtDNA liquid biopsy is quickly becoming the most popular non-invasive technique for cancer profiling and therapy monitoring applications. Guardant360 CDx, which utilizes liquid biopsy and next-generation sequencing technology to detect patients with certain types of epidermal growth factor receptor (EGFR) gene mutations in a deadly form of metastatic non-small cell lung cancer, received FDA approval in August 2020.

A major restraint in the growth of the global liquid biopsy market is the uncertain regulatory situations for liquid biopsy, as well as negative reimbursement practices. Liquid biopsies are categorized as laboratory-developed testing (LDT). The US Food and Drug Administration has submitted a draught to tighten LDT rules; nevertheless, the LDT regulation is still unclear. Increased FDA rules on LDTs might significantly stifle the expansion of the molecular diagnostics and liquid biopsy industries. This is also likely to raise the price of launching new tests and cause them to be delayed on the market. Also, the lack of desired specificity and sensitivity limits the market growth during the forecast period. In addition to regulatory issues, the liquid biopsy industry has reimbursement issues which will further restrain the market growth of the global liquid biopsy market during the forecast period.

The COVID-19 pandemic has had a great impact on the world as a whole and has led to economic breakdown and loss of life. COVID-19, a coronavirus illness, has spread throughout the world. As a result of the rise in the number of coronavirus patients, governments throughout the world have enacted a slew of regulations and restrictions, stifling market growth in the early stages of the projected period. Early diagnostic initiatives have been halted because of this. Furthermore, there has been a decline in cancer-related screenings, consultations, treatments, and operations, with variations by cancer type and service location globally, leading to a rise in cancer morbidity and death in 2020. The pandemic has also had an influence on the logistics and supply of cancer diagnostic raw materials and components, as well as other critical commodities needed in liquid biopsy manufacturing. During the COVID-19 pandemic, these variables restrict the expansion of the liquid biopsy market.

The market leaders in the liquid biopsy market are F. Hoffmann-La Roche AG, Bio-Rad Laboratories, Inc., Genomic Health, Inc., Qiagen N.V., NeoGenomics Laboratories, Inc., Biocept, Inc., LungLife AI, Inc., Illumina, Inc., Cardiff Oncology and Guardant Health, Inc.

The growing patient population base due to the increased occurrence of cancer may account for the market's rise. Increasing demand for non-invasive procedures will also help the liquid biopsy market expand during the projected period. Cancer is the biggest cause of mortality in the world, with over 10 million fatalities expected by 2020, in a report stated by World Health Organization (WHO). Although cancer incidence rates remain greatest in more developed locations, death rates in less developed nations are higher due to inadequate access to treatment facilities and a lack of understanding about the benefits of early identification. The most common cancers are lung cancer, colon cancer, breast cancer, and prostate cancer. Among all malignancies, lung cancer is the greatest cause of mortality. Breast cancer is the second most prevalent kind of cancer in the world, and it is also the leading cause of cancer-related deaths among women. Reduced cost, early prognosis, therapy monitoring, identification of tumor heterogeneity, acquired drug resistance, and patient comfort are all advantages of liquid biopsy over standard cancer diagnostics procedures (by eliminating the need for surgery).

Growth Factors

The rising investments in research and development and the growing technological advancements

One of the major reasons for the growth of the global liquid biopsy market is the growing technological advancements and the rising investments for their R&D. Increased investment for liquid biopsy research and development are supporting market revenue growth. Due to rapid technological developments and low DNA sequencing costs, CtDNA liquid biopsy is quickly becoming the most popular non-invasive technique for cancer profiling and therapy monitoring applications. Guardant360 CDx, which utilizes liquid biopsy and next-generation sequencing technology to detect patients with certain types of epidermal growth factor receptor (EGFR) gene mutations in a deadly form of metastatic non-small cell lung cancer, received FDA approval in August 2020.

Restraints

Uncertain regulatory situations for liquid biopsy, as well as negative reimbursement practices, may stifle expansion

A major restraint in the growth of the global liquid biopsy market is the uncertain regulatory situations for liquid biopsy, as well as negative reimbursement practices. Liquid biopsies are categorized as laboratory-developed testing (LDT). The US Food and Drug Administration has submitted a draught to tighten LDT rules; nevertheless, the LDT regulation is still unclear. Increased FDA rules on LDTs might significantly stifle the expansion of the molecular diagnostics and liquid biopsy industries. This is also likely to raise the price of launching new tests and cause them to be delayed on the market. Also, the lack of desired specificity and sensitivity limits the market growth during the forecast period. In addition to regulatory issues, the liquid biopsy industry has reimbursement issues which will further restrain the market growth of the global liquid biopsy market during the forecast period.

Impact of COVID-19 on the Liquid Biopsy Market

The COVID-19 pandemic has had a great impact on the world as a whole and has led to economic breakdown and loss of life. COVID-19, a coronavirus illness, has spread throughout the world. As a result of the rise in the number of coronavirus patients, governments throughout the world have enacted a slew of regulations and restrictions, stifling market growth in the early stages of the projected period. Early diagnostic initiatives have been halted because of this. Furthermore, there has been a decline in cancer-related screenings, consultations, treatments, and operations, with variations by cancer type and service location globally, leading to a rise in cancer morbidity and death in 2020. The pandemic has also had an influence on the logistics and supply of cancer diagnostic raw materials and components, as well as other critical commodities needed in liquid biopsy manufacturing. During the COVID-19 pandemic, these variables restrict the expansion of the liquid biopsy market.

Competitive Insights

The market leaders in the liquid biopsy market are F. Hoffmann-La Roche AG, Bio-Rad Laboratories, Inc., Genomic Health, Inc., Qiagen N.V., NeoGenomics Laboratories, Inc., Biocept, Inc., LungLife AI, Inc., Illumina, Inc., Cardiff Oncology and Guardant Health, Inc.

Segmentation:

By Sample Tissue

- Blood

- Urine

- Saliva

- Others

By Biomarkers

- Circulating Tumor Cells (CTCs)

- Circulating Tumor DNA (ctDNA)

- Cell-Free DNA (cfDNA)

- Extracellular Vesicles (EVs)

- Others

By Application

- Screening

- Disease Prognosis

- Drug Response and Resistance

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- South Africa

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Taiwan

- Thailand

- Others

Table of Contents

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

5. Global Liquid Biopsy Market Analysis, by Sample Tissue

6. Global Liquid Biopsy Market Analysis, by Biomarkers

7. Global Liquid Biopsy Market Analysis, by Application

8. Global Liquid Biopsy Market Analysis, by Geography

9. Competitive Environment and Analysis

10. Company Profiles

Companies Mentioned

- F. Hoffmann-La Roche AG

- Bio-Rad Laboratories, Inc.

- Genomic Health, Inc.

- Qiagen N.V.

- NeoGenomics Laboratories, Inc.

- Biocept, Inc.

- LungLife AI, Inc.

- Illumina, Inc.

- Cardiff Oncology

- Guardant Health, Inc.

Methodology

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | December 2021 |

| Forecast Period | 2019 - 2026 |

| Estimated Market Value ( USD | $ 1539.62 Million |

| Forecasted Market Value ( USD | $ 5706.1 Million |

| Compound Annual Growth Rate | 20.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |