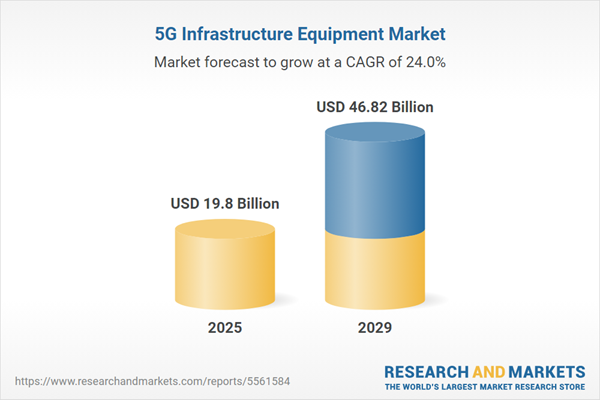

The 5G infrastructure equipment market size has grown exponentially in recent years. It will grow from $10.63 billion in 2024 to $19.8 billion in 2025 at a compound annual growth rate (CAGR) of 86.4%. The growth in the historic period can be attributed to mobile data surge, internet evolution, proliferation of smart devices, business and industry demands, telecom industry growth.

The 5G infrastructure equipment market size is expected to see exponential growth in the next few years. It will grow to $46.82 billion in 2029 at a compound annual growth rate (CAGR) of 24%. The growth in the forecast period can be attributed to enhanced data speed and capacity, iot integration, network upgrades and expansion, security and privacy focus, edge computing integration. Major trends in the forecast period include network slicing, open ran (radio access network), densification and small cells, massive mimo (multiple input multiple output) technology, ai and automation integration.

The primary driver of growth in the global 5G infrastructure market is the adoption of 5G for smart city networks. 5G networks offer numerous advantages such as high speed, minimal latency, wider bandwidth, a unified platform, increased device connectivity, and extended battery life, all of which are fueling the development of smart cities and causing a significant urban transformation. The low latency of 5G networks enables sensors and devices to efficiently manage a city's transportation and traffic system, redirecting traffic and alerting self-driving vehicles to road conditions. Furthermore, 5G's advanced features, including enhanced security, rapid response to emergencies, and personalized healthcare, are expected to enhance digital inclusion for urban residents. These capabilities will enable new standards of living, from automated grocery ordering and delivery to sophisticated building infrastructure management. As a result, the growing demand for 5G networks, driven by their enhanced features, is powering the adoption of 5G for smart city networks and, in turn, fueling the 5G infrastructure equipment market.

The increasing need for high-speed connectivity is expected to be a key driver for the growth of the 5G infrastructure equipment market in the future. High-speed connectivity, characterized by rapid data transmission rates, plays a crucial role in facilitating fast communication and efficient data exchange among devices. This high-speed connectivity is instrumental in enhancing the performance of 5G infrastructure equipment by enabling swift data transfers, reducing latency, and meeting the bandwidth requirements of advanced applications like augmented reality and the Internet of Things (IoT). For instance, a report from the Organization for Economic Co-operation and Development (OECD) in July 2023 highlighted that data usage per mobile broadband subscription in OECD countries increased by 17% in 2022. Furthermore, the overall volume of mobile data usage per subscription has doubled in just four years, growing from 4.7 gigabytes per month to 10.4 GB in 2022. This surge in data consumption demonstrates the growing demand for high-speed connectivity. As a result, this demand is fueling the growth of the 5G infrastructure equipment market.

The Internet of Things (IoT) has been a transformative force, driving innovation in both business and everyday life. It stands as a significant growth opportunity for 5G telecommunication service providers. Several factors are contributing to this trend, such as growing demand from consumers and businesses, along with the increased affordability of IoT devices. As a result, the adoption of IoT is expected to stimulate the development of 5G infrastructure. 5G technology will find substantial momentum through various IoT applications, including remote healthcare, traffic management and safety, smart grid automation, industrial process control, and remote applications in manufacturing, training, surgery, and education. The growth of IoT technology will lead to substantial investments by operators in 5G technology, spectrum, and infrastructure. This will further fuel the expansion of both IoT and 5G services, benefiting businesses and consumers alike.

Prominent companies in the market are committed to advancing their technologies and software, with a notable example being the development of advanced 5G IoT software stacks to maintain their competitive position in the 5G IoT market. These software stacks encompass a collection of hardware and software components as well as communication protocols that empower the seamless connection and management of IoT devices via 5G networks. For example, in February 2022, Radisys Corporation, a leading global provider of open telecom solutions based in the United States, introduced its Connect RAN 5G IoT software stack. This comprehensive solution offers a wide array of 5G Radio Access Network (RAN) technologies. The Connect RAN software designed for 5G IoT is equipped with unique features tailored to address diverse IoT use cases. These range from applications like metering and asset tracking to mission-critical scenarios requiring ultra-low latency, time-sensitive deployments in industrial settings, as well as XR (Extended Reality), video surveillance, and wearable technology implementations. Radisys' Connect RAN 5G IoT software stack enables businesses to bring new use cases to market swiftly, with a reduced initial capital investment, fostering innovation and growth in the 5G IoT sector.

In January 2023, Semtech Corporation, a prominent US-based semiconductor manufacturer, completed its acquisition of Sierra Wireless Inc. for a substantial amount of $1.2 billion. This strategic move is set to foster the creation of a comprehensive Internet of Things (IoT) platform, aimed at driving the transition to a more intelligent and sustainable world. The acquisition is poised to have a transformative impact, broadening Semtech's market reach considerably and is expected to approximately double the company's annual revenue. Furthermore, it will result in the development of a robust and diversified portfolio of connectivity solutions catering to the expanding IoT market. As a result, customers will have enhanced access to innovative end-to-end solutions across various industry segments. Sierra Wireless Inc., based in Canada, is a notable company specializing in communication equipment.

5G infrastructure equipment encompasses a network of both macro and small cell base stations, equipped with advanced computing capabilities to support the functionality of the 5th generation mobile network technology standard.

The primary infrastructure types in communication include small cells, macro cells, radio access networks (RAN), and distributed antenna systems (DAS). A radio access network (RAN) serves as a crucial component within a mobile network, facilitating the connection of end-user devices to the cloud, particularly smartphones. This is achieved by transmitting data wirelessly from end-user devices to RAN transceivers, which, in turn, relay the data to the core network, providing a link to the global internet. To ensure the efficient functioning of such networks, various cutting-edge technologies are employed. These include software-defined networking (SDN), network function virtualization (NFV), mobile edge computing (MEC), and fog computing (FC). These technologies find applications across diverse sectors such as energy and utilities, automotive, healthcare, retail, and more.

The 5G infrastructure equipment market research report is one of a series of new reports that provides 5G infrastructure equipment market statistics, including 5G infrastructure equipment industry global market size, regional shares, competitors with a 5G infrastructure equipment market share, detailed 5G infrastructure equipment market segments, market trends and opportunities, and any further data you may need to thrive in the 5G infrastructure equipment industry. This 5G infrastructure equipment market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Major companies operating in the 5g infrastructure equipment market include AT&T Inc., Verizon Communications Inc., Corning Incorporated, Fujikura Ltd., Hewlett Packard Enterprise Company, Belden Inc., Intel Corporation, Telefonaktiebolaget LM Ericsson, Qualcomm Technologies Inc., Huawei Technologies Co. Ltd., Samsung Electronics Co. Ltd., Cisco Systems Inc., NEC Corporation, Nokia Corporation, Mavenir Systems Inc., Oracle Corporation, Gogo Business Aviation LLC, Microsoft Corporation, Boingo Wireless Inc., RingCentral Inc., Cognizant Softvision LLC, Celonis SE, Zipwhip Inc., Biarri Networks Pty Ltd, NTT DOCOMO INC., ZTE Corporation, CommScope Holding Company Inc., A1 Telekom Austria Group, Airspan Networks Inc., Comba Telecom Systems Holdings Ltd., Dell Technologies Inc., Zayo Group Holdings Inc.

Asia-Pacific was the largest region in the 5G infrastructure equipment market in 2024. North America was the second largest region in the 5G infrastructure equipment market. The regions covered in the 5g infrastructure equipment market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the 5g infrastructure equipment market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The 5G infrastructure equipment market consists of sales of network hardware or communication devices supporting 5G technology such as spectrum, macro-network, small cell, and other network domains. Values in this market are factory gate values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in 5G infrastructure equipment market includes related services sold by the creators of the goods. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

5G Infrastructure Equipment Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on 5g infrastructure equipment market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for 5g infrastructure equipment ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The 5g infrastructure equipment market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Communication Infrastructure: Small Cell; Macro Cell; Radio Access Network (RAN); Distributed Antenna System (DAS)2) By Network Technology: Software Defined Networking (SDN) And Network Function Virtualization (NFV); Mobile Edge Computing (MEC); Fog Computing (FC)

3) By Application: Energy & Utilities; Automotive; Healthcare; Retail; Other Applications

Subsegments:

1) By Small Cell: Femtocells; Picocells; Microcells2) By Macro Cell: Cell Towers; Base Stations; Antennas

3) By Radio Access Network (RAN): Centralized RAN (C-RAN); Virtualized RAN (VRAN); Open RAN (O-RAN)

4) By Distributed Antenna System (DAS): Active DAS; Passive DAS; Hybrid DAS

Key Companies Mentioned: AT&T Inc.; Verizon Communications Inc.; Corning Incorporated; Fujikura Ltd.; Hewlett Packard Enterprise Company

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this 5G Infrastructure Equipment market report include:- AT&T Inc.

- Verizon Communications Inc.

- Corning Incorporated

- Fujikura Ltd.

- Hewlett Packard Enterprise Company

- Belden Inc.

- Intel Corporation

- Telefonaktiebolaget LM Ericsson

- Qualcomm Technologies Inc.

- Huawei Technologies Co. Ltd.

- Samsung Electronics Co. Ltd.

- Cisco Systems Inc.

- NEC Corporation

- Nokia Corporation

- Mavenir Systems Inc.

- Oracle Corporation

- Gogo Business Aviation LLC

- Microsoft Corporation

- Boingo Wireless Inc.

- RingCentral Inc.

- Cognizant Softvision LLC

- Celonis SE

- Zipwhip Inc.

- Biarri Networks Pty Ltd

- NTT DOCOMO INC.

- ZTE Corporation

- CommScope Holding Company Inc.

- A1 Telekom Austria Group

- Airspan Networks Inc.

- Comba Telecom Systems Holdings Ltd.

- Dell Technologies Inc.

- Zayo Group Holdings Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 19.8 Billion |

| Forecasted Market Value ( USD | $ 46.82 Billion |

| Compound Annual Growth Rate | 24.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 33 |