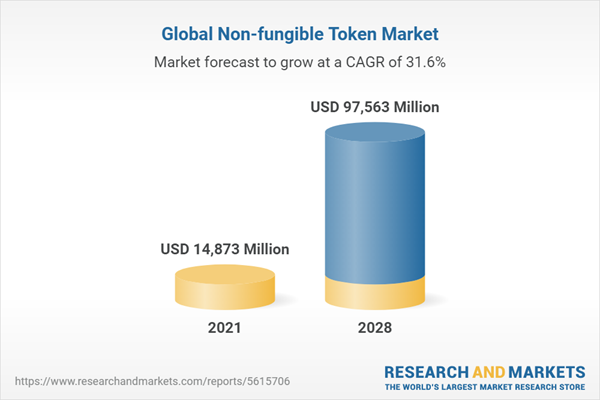

The Global Non-fungible Token Market size is expected to reach $97.6 billion by 2028, rising at a market growth of 31.6% CAGR during the forecast period.

Non-fungible tokens (NFTs) are blockchain-based cryptographic assets having unique metadata and identification codes that separate them from one another. They cannot be purchased or exchanged at face value, unlike cryptocurrencies. This is in contrast to fungible tokens, such as bitcoins, which are all similar and hence can be used as a medium of exchange. Each NFT's unique construction allows for a variety of applications. They are a great approach to digitally representing actual things, like real estate and artwork, for example. NFTs can also be utilized to eliminate intermediaries as well as link artists with audiences or for identity management asthey are based on blockchains. NFTs can eliminate intermediaries, streamline transactions, and open up new markets.NFTs, like Bitcoin, include ownership information to facilitate identification as well as transfer between token holders. In NFTs, owners can additionally add metadata or aspects related to the asset. For example, Fairtrade tokens can be leveraged to represent coffee beans. Artists can also sign their digital artwork in the metadata with their own signature. The ERC-721 standard gave rise to NFTs. ERC-721 defines the basic interface, such as ownership details, security, and metadata, that are required for the distribution and exchange of gaming tokens. The ERC-1155 standard expands on this notion by lowering transaction and storage costs for non-fungible tokens and combining multiple varieties of non-fungible tokens into an individual contract.

For example, Decentraland, an Ethereum-based virtual reality platform, has already implemented this notion. It may become possible to deploy the same concept of tokenized chunks of land (varying according to the value and location) in the physical world as NFTs get more complex and incorporated into the financial infrastructure. The most widely utilized token standard for NFTs is Ethereum. To construct NFTs, the ERC-1155 and ERC-721 token specifications are commonly employed. Blockchains, such as Flow, EOS, and Tezos, in addition to Ethereum, provide token specifications for constructing NFTs. Additionally, Ethereum's imminent switch from proof-of-work to proof-of-stake is predicted to cut the blockchain's energy consumption significantly. As a result, the utilization of Ethereum tokens for NFTs is projected to increase globally.

COVID-19 Impact Analysis

The COVID-19 pandemic caused a severe impact on the worldwide economy. Various businesses all over the world were demolished while others were significantly damaged due to the outbreak of the COVId-19 pandemic. In addition, governments all over the world were compelled to impose lockdown in their countries in order to regulate the diffusion of COVID-19 infections. Due to the lockdown scenario, various companies all over the world were temporarily closed, which caused significant business and monetary losses to businesses. In addition, the travel restrictions that were imposed by the government caused a major disruption in the worldwide supply chain. These factors considerably slowed down the growth of the global economy.

Market Growth Factors:

Generation of economic prospects

For a very long period, the primary focus of NFT experts has been on their essential characteristics. In the modern era, NFTs have a wide range of applications in the field of digital content. The primary reason for the viability of NFTs in the field of digital content in the industry's diversity. Content creators are frequently concerned about rival platforms sapping their income and earning potential. For example, a digital artist who publishes content on social media can monetize the site by selling ads to the artist's audience. While the artist receives proper visibility, it does not assist the artist in earning any money in exchange for platform benefits.

Allows building intellectual property with authenticity

The fundamental advantage of NFTs is that they allow people to own intellectual property. When intellectual property is included in a blockchain, it is easier to monitor ownership. It is also easy to ensure that the IP owner is not violating the IP of others. For example, a fashion designer can design a garment and then embed it in a blockchain smart contract. The blockchain can then store the one-of-a-kind design as well as the designer's ownership of it. The designer then has the option of selling the design to a customer. The consumer will be able to use the blockchain to authenticate the design and confirm that it has not been replicated.

Marketing Restraining Factor:

The threat of digital replica generation

While a blockchain's integrity is unassailable, NFTs can also be utilized to propagate fraud. There are various instances, in which, several artists have reported finding their work for sale as NFTs on online marketplaces without their permission. This clearly goes against the purpose of using NFTs to simplify the commercialization of paintings. An NFT's value proposition is that it uses a unique token to verify a physical work of art, ensuring that the token owner also possesses the original work of art. If someone develops an electronic replica of the original work, links a token to it, and sells it on a virtual marketplace, there is a severe concern.

Type Outlook

Based on Type, the market is segmented into Digital Asset and Physical Asset. In 2021, the digital asset segment acquired the largest revenue share of the non-fungible token market. The rising growth of the segment is attributed to the increased usage of NFTs by artists around the world to secure ownership of their digital assets. Artists can benefit from their work by preserving ownership of it through NFTs and not having to provide it to other platforms for the promotion. Simultaneously, the increased usage of NFTs to sell digital real estate in both the actual and virtual worlds is likely to propel the market forward.

End Use Outlook

Based on End Use, the market is segmented into Personal and Commercial. In 2021, the commercial segment registered a significant revenue share of the non-fungible token market. The increasing usage of NFTs for business objectives, such as supply chain management and logistics innovation, is likely to propel the industry forward. Companies in the logistics industry are progressively incorporating blockchain technology into their operations, opening up new chances for the industry to expand.

Application Outlook

Based on Application, the market is segmented into Collectibles, Art, Gaming, Sport, Utilities, Metaverse, and Others. In 2021, the collectibles segment procured the largest revenue share of the non-fungible token market. NFT coins that can be minted in NFT exchanges are known as crypto-collectibles. The increased demand for crypto assets can be linked to advantages, such as asset independence and ease of use. Sports collectibles, for example, allow fans to interact directly with their heroes, gaming collectibles allow players to exchange and play, and artist collectibles allow them to connect with potential clients and sell their work.

Regional Outlook

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. In 2021, North America accounted for the largest revenue share of the non-fungible token market. Millennials in the region are increasingly adopting NFTs, which is fueling the regional market growth. At the same time, the increase in the number of artists generating digital artwork in nations like the United States and Canada is likely to fuel regional market growth. The presence of key players in the blockchain business in the region is also encouraging for the regional market.

The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include Cloudflare, Inc., Gemini Trust Company, LLC, Ozone Networks, Inc., Dapper Labs, Inc., Semidot Infotech, and The Sandbox (BACASABLE Global Limited)

Scope of the Study

Market Segments Covered in the Report:

By Type

- Digital Asset

- Physical Asset

By End Use

- Personal

- Commercial

By Application

- Collectibles

- Art

- Gaming

- Sport

- Utilities

- Metaverse

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Cloudflare, Inc.

- Gemini Trust Company, LLC

- Ozone Networks, Inc.

- Dapper Labs, Inc.

- Semidot Infotech

- The Sandbox (BACASABLE Global Limited)

Unique Offerings from KBV Research

- Exhaustive coverage

- The highest number of market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Cloudflare, Inc.

- Gemini Trust Company, LLC

- Ozone Networks, Inc.

- Dapper Labs, Inc.

- Semidot Infotech

- The Sandbox (BACASABLE Global Limited)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | May 2022 |

| Forecast Period | 2021 - 2028 |

| Estimated Market Value ( USD | $ 14873 Million |

| Forecasted Market Value ( USD | $ 97563 Million |

| Compound Annual Growth Rate | 31.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 6 |