As the number of COVID-19 cases increased worldwide, governments were looking into allowing private laboratories to increase blood screening. Immediate detection of COVID-19 cases necessitated a wide range of diagnostics to control the virus's rapid spread. For instance, according to an article published in the Nature Journal in May 2022, a machine-learning model for COVID-19 diagnosis was developed which showed that symptomatic patients with COVID-19 were efficiently diagnosed from the results of routine blood tests. Moreover, with the resumption of diagnosis services, the studied market is expected to grow over the forecast period.

The major factors attributing to the market's growth include rising blood donations, an increase in the incidence of infectious diseases, and government initiatives, all contributing to the market's rapid growth.

Rising blood donations, an increase in the incidence of infectious diseases, and government initiatives fuel the market's rapid growth. According to the article published in the National Library of Medicine in December 2021, approximately 234 million major surgeries are performed yearly. Blood transfusions are commonly prescribed in complicated childbirths to prepare for childhood acute anemia, trauma, and congenital maternal blood disorders. Moreover, the increasing blood donation activities are expected to boost the market's growth. For instance, in September 2022, Akhil Bhartiya Terapanth Yuvak Parishad (ABTYP), with 350 branches, launched a major mega-blood donation drive. The drive intends to organize over 2,000 camps and donate over 100,000 units of blood worldwide.

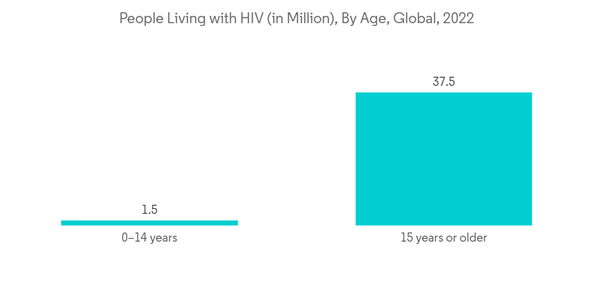

Furthermore, the rising prevalence of infectious diseases is anticipated to drive market growth over the forecast period. For instance, the Global HIV and AIDS Statistics 2021 fact sheet by the Joint United Nations Programme on HIV/AIDS (UNAIDS) estimated that approximately 38.4 million people were living with HIV worldwide in 2021, with 36.7 million being adults and 1.7 million being children (under the age of 15). In addition, as per the same source mentioned above, 1.5 million people were infected with HIV in 2021. Hence, the growing burden of infectious diseases such as HIV is expected to increase demand for early and effective diagnosis, driving market growth over the forecast period.

Various organizations and governments are launching campaigns to raise awareness about blood donation and screening before transfusion. For instance, every year, WHO celebrates World Blood Donor Day on June 14 to raise global awareness about the need for safe blood and blood products for transfusion. As a result, rising awareness and a high demand for safe blood transfusion are creating opportunities for market growth in emerging countries.

Additionally, growing strategic collaboration among the market players is expected to fuel the availability of advanced diagnostic tests in the market, hence anticipated to augment the market growth over the forecast period. For instance, in March 2023, TruDiagnostic, a health data company, formed a new partnership with NADMED, a Finnish nicotinamide adenine dinucleotide (NAD) diagnostic company, to launch a new NAD+ blood diagnostic test for patients in the United States.

Thus, all the factors above are expected to boost the blood screening market over the forecast period. However, the development of alternative technologies and the need for more legislation, regulations, and policies restrained the market's growth over the projected period.

Blood Screening Market Trends

Reagent Segment is Expected to Hold Significant Market Share Over the Forecast Period

The reagent segment of the market studied includes chemical, biological, or immunological components, solutions, or preparations intended by the manufacturer to be used during the blood screening process. COVID-19 was expected to significantly aid in the growth of the studied segment, owing to the high requirement of reagents to meet the increased global diagnostic demand for the screening of COVID-19 infection.Additionally, with the increasing burden of infectious diseases worldwide, the demand for blood screening rises, increasing the demand for reagents used in the various testing platforms. For instance, as per the Global Tuberculosis Report 2022, published by the World Health Organisation, approximately 10.6 million people worldwide suffered from tuberculosis (TB) all over the world in 2021, as compared to 10.1 million in the previous year. Thus, a rise in demand for reagents is expected due to an expected rise in infectious diseases.

Several market players are developing and distributing reagents for blood screening globally. For instance, in March 2022, Mylab planned to expand into the lab testing equipment and reagents market. Also, the growing number of product launches is expected to drive the market. For instance, in July 2021, Ortho Clinical Diagnostics launched its VITROS Immunodiagnostic Products IL-6 Reagent Pack, the latest addition to Ortho's VITROS Critical Care blood screening menu.

Therefore, due to the factors mentioned above, the reagent segment in the blood screening market is expected to grow over the forecast period of the study.

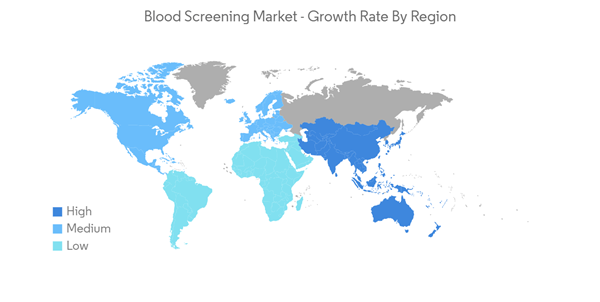

North America Holds a Significant Share in the Market and Expected to do Same during the Forecast Period

The growth of the North American blood screening market can be attributed to rising healthcare spending, rising infectious disease prevalence, and the highly developed healthcare systems in the United States and Canada.The increasing blood donation and blood transfusion rates are expected to boost the market over the forecast period. As per the American Red Cross, an estimated 36,000 units of red blood cells are required daily, and nearly 7,000 units of platelets and approximately 10,000 units of plasma are needed daily in the United States. Over 21 million blood components are transfused each year in the United States. The high demand for blood supply in the United States is expected to contribute to the market's growth over the forecast period.

With the increasing burden of infectious diseases worldwide, the market is expected to project growth over the forecast period. For instance, in October 2022, the US Department of Health & Human Services, supported by the Minority HIV/AIDS Fund, stated that approximately 1.2 million people in the United States suffer from HIV, and about 13% don't know it and need testing. Thus, with the increasing prevalence of infectious diseases, the demand for blood screening is expected to rise, boosting market growth.

In addition, there is also a considerable influx of product launches that boost the market growth. For instance, in June 2021, Grail launched the Galleri blood test, a single blood test capable of detecting the presence of multiple cancers. Now available by prescription in the US, the test is meant to screen people with an already elevated risk for cancer, such as adults over 50.

Thus, the market segment is expected to grow over the forecast period due to the abovementioned factors.

Blood Screening Industry Overview

The blood screening market is competitive. The market consists of several major players. The companies implemented certain strategic initiatives, such as mergers, new product launches, acquisitions, and partnerships, which helped them strengthen their market position. The major players are Danaher Corporation, BioRad Laboratories, Thermofisher Scientific, Abbott Laboratories, and BioMerieux S.A.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- F. Hoffmann-La Roche Ltd.

- Grifols

- Abbott Laboratories, Inc.

- bioMerieux

- Bio-Rad Laboratories, Inc.

- Becton, Dickinson and Company

- Danaher Corporation

- DiaSorin

- Siemens Healthineers

- Thermo Fisher Scientific, Inc.

- Ortho Clinical Diagnostics Inc.

- GE Healthcare

- PerkinElmer

- Bio-Techne Corporation

- GFE

- Trinity Biotech

- Mindray