Digital Manufacturing Market Analysis:

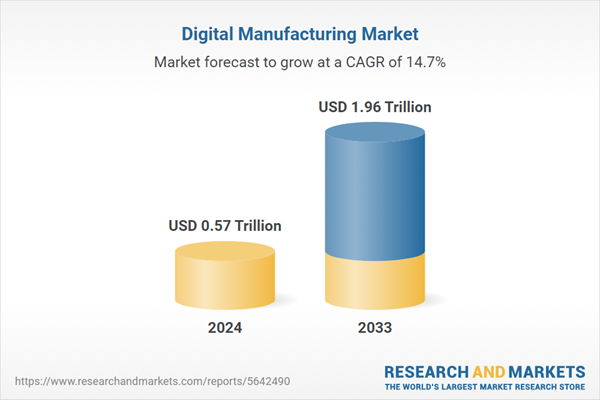

- Market Growth and Size: The global market is experiencing robust growth, with a considerable increase in market size attributed to the accelerating adoption of advanced technologies across industries.

- Major Market Drivers: Key drivers fueling the market include advancements in Industrial Internet of Things (IIoT) and connectivity, the rise of additive manufacturing and 3D printing, and the demand for smart factories through Industry 4.0 initiatives.

- Technological Advancements: Ongoing technological advancements, such as the integration of AI, robotics, and big data analytics, are transforming manufacturing processes, fostering efficiency, innovation, and connectivity within smart factories.

- Industry Applications: The market is segmented based on applications, including automation and transportation, aerospace and defense, consumer electronics, utilities and processes, and industrial machinery, with industrial machinery being the largest segment.

- Geographical Trends: Geographically, North America leads the market, driven by technological innovation, while the Asia Pacific region is rapidly growing due to increased industrial activities and technological adoption.

- Competitive Landscape: Key players in the market are actively investing in research and development, forming strategic collaborations, and creating comprehensive ecosystems to stay competitive and address the dynamic needs of industries undergoing digital transformation.

- Challenges and Opportunities: Challenges in the digital manufacturing market include the need for widespread adoption, overcoming resistance to change, and addressing cybersecurity concerns. Opportunities lie in sustainability-focused solutions, meeting evolving consumer demands, and navigating global supply chain complexities.

- Future Outlook: The future outlook for the global digital manufacturing market appears promising, with sustained growth anticipated as industries continue to prioritize digital transformation.

Digital Manufacturing Market Trends:

Advancements in Industrial Internet of Things (IIoT) and connectivity

The digital manufacturing market is propelled by the rapid advancements in the Industrial Internet of Things (IIoT) and connectivity technologies. The integration of sensors, actuators, and smart devices across the manufacturing ecosystem enables real-time data collection and analysis. This connectivity facilitates seamless communication between machines, allowing manufacturers to optimize production processes, monitor equipment health, and enhance overall operational efficiency. As more devices become interconnected, the industrial landscape transforms into a smart and interconnected environment, driving the adoption of digital manufacturing solutions. The ability to gather and analyze data from various sources empowers manufacturers to make data-driven decisions, predict maintenance needs, and implement proactive strategies for improved productivity.Rise of additive manufacturing and 3D printing

The digital manufacturing market is witnessing a rise due to the increasing prominence of additive manufacturing (AM) and 3D printing technologies. These innovative techniques enable the production of complex and customized components with greater speed and efficiency compared to traditional manufacturing methods. Additive manufacturing not only reduces material waste but also offers design flexibility and the ability to create intricate structures that were previously challenging or impossible. The growing adoption of 3D printing in industries such as aerospace, healthcare, and automotive is reshaping production processes, fostering innovation, and driving the demand for digital manufacturing solutions.Growing demand for smart factories and Industry 4.0 initiatives

The demand for smart factories and the implementation of Industry 4.0 initiatives are key drivers propelling the digital manufacturing market. Industry 4.0 represents the fourth industrial revolution, characterized by the integration of digital technologies, automation, and data exchange in manufacturing. Smart factories leverage technologies such as artificial intelligence (AI), robotics, big data analytics, and the Internet of Things (IoT) to create interconnected and intelligent manufacturing environments. These initiatives aim to enhance efficiency, reduce downtime, and improve overall operational performance. As manufacturers strive to stay competitive in a rapidly evolving global landscape, the adoption of digital manufacturing solutions becomes instrumental in achieving the goals of increased productivity, cost savings, and enhanced agility in responding to market demands.Digital Manufacturing Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on component, process type and application.Breakup by Component:

- Software

- Services

Software accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the components. This includes software and services. According to the report, software represented the largest segment.The market exhibits a robust segmentation based on components, with software emerging as the dominant segment. Software solutions play a pivotal role in orchestrating the digital transformation of manufacturing processes, offering a wide array of tools for design, simulation, process optimization, and data analytics. From computer-aided design (CAD) software to advanced manufacturing execution systems (MES), the software segment empowers manufacturers to enhance operational efficiency, streamline production workflows, and make data-driven decisions. The demand for sophisticated software solutions continues to surge as industries prioritize digitalization, and vendors innovate to deliver scalable, user-friendly platforms that cater to the evolving needs of modern manufacturing.

Complementing the software landscape, the services segment constitutes a vital component of the digital manufacturing market. Services encompass a spectrum of offerings, including implementation, consulting, training, and support, crucial for ensuring the seamless integration and optimal utilization of digital manufacturing solutions. Service providers assist businesses in navigating the complexities of adopting new technologies, customizing software to specific requirements, and maximizing the benefits of digitalization. As industries increasingly recognize the transformative potential of digital manufacturing, the services segment becomes integral in facilitating a smooth transition, providing expertise, and nurturing a collaborative partnership between solution providers and manufacturers.

Breakup by Process Type:

- Computer-Based Designing

- Computer-Based Simulation

- Computer 3D Visualization

- Analytics

- Others

Computer-based simulation holds the largest share in the industry

A detailed breakup and analysis of the market based on the process type have also been provided in the report. This includes computer-based designing, computer-based simulation, computer 3D visualization, analytics, and others. According to the report, computer-based simulation accounted for the largest market share.Within the realm of digital manufacturing processes, computer-based simulation emerges as the largest segment, playing a pivotal role in optimizing and validating various aspects of production. Simulation tools enable manufacturers to virtually replicate and analyze real-world scenarios, helping to refine processes, test the impact of design changes, and enhance overall operational efficiency. From simulating manufacturing workflows to assessing the performance of equipment, computer-based simulation is instrumental in minimizing risks, reducing costs, and ensuring the robustness of manufacturing processes.

Market segmentation based on process type in digital manufacturing delineates a landscape where computer-based designing holds a significant position. This segment encompasses a range of software tools facilitating the creation and refinement of digital models, prototypes, and schematics. Computer-aided design (CAD) software, among other applications, empowers manufacturers to ideate, conceptualize, and iterate designs efficiently. The emphasis on precision, speed, and innovation in the design phase positions computer-based designing as a crucial component in the digital manufacturing workflow.

The market segmentation based on process type includes a noteworthy segment focused on computer 3D visualization. This entails leveraging advanced visualization technologies to create immersive, three-dimensional representations of manufacturing processes, products, and facilities. Computer 3D visualization enhances communication, collaboration, and decision-making by providing stakeholders with realistic and interactive visualizations. This segment proves valuable in conveying complex information, facilitating design reviews, and fostering a deeper understanding of the manufacturing environment.

Analytics constitutes a significant segment in the market segmentation based on process type, representing the tools and techniques employed to extract actionable insights from the vast datasets generated during the manufacturing lifecycle. Advanced analytics, including predictive analytics and machine learning algorithms, enable manufacturers to make data-driven decisions, optimize processes, and proactively address potential issues. The analytics segment is crucial for unlocking the full potential of digital manufacturing by harnessing the power of data to drive continuous improvement, enhance quality, and achieve operational excellence.

Breakup by Application:

- Automation and Transportation

- Aerospace and Defense

- Consumer Electronics

- Utilities and Processes

- Industrial Machinery

- Others

Industrial machinery represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the application. This includes automation and transportation, aerospace and defense, consumer electronics, utilities and processes, industrial machinery, and others. According to the report, industrial machinery represented the largest segment.The industrial machinery segment stands out as the largest application segment in the digital manufacturing market. This sector leverages digital solutions for designing, simulating, and manufacturing a wide range of machinery and equipment. From CNC machining to 3D printing, digital manufacturing technologies enhance precision, reduce time-to-market, and enable customization in the production of industrial machinery. The demand for efficiency, quality, and innovation positions the industrial machinery segment at the forefront of digital manufacturing adoption.

In the market segmentation based on application, the automation and transportation sector plays a significant role, encompassing industries that leverage digital manufacturing to enhance efficiency in production and logistics. Automation processes, including robotics and intelligent control systems, are integrated to streamline manufacturing operations and improve transportation systems. This segment witnesses a growing demand for digital solutions to optimize supply chain management, increase production throughput, and enhance overall operational agility in the dynamic landscape of automation and transportation.

The aerospace and defense sector is a pivotal application segment within the digital manufacturing market. Here, advanced technologies are employed to design, simulate, and manufacture complex aerospace components and defense systems. Digital manufacturing solutions in this segment focus on precision engineering, materials innovation, and stringent quality control to meet the exacting standards of the aerospace and defense industries. The sector benefits from digital tools that enable efficient collaboration, rapid prototyping, and the optimization of manufacturing processes for enhanced performance and safety.

The consumer electronics segment is a key driver in the digital manufacturing market, characterized by the constant demand for innovation, rapid product development, and efficient production processes. Digital manufacturing solutions are applied to accelerate the design-to-production cycle, improve product quality, and address the dynamic market needs in the consumer electronics industry. This segment relies on digital technologies for computer-aided design, simulation, and visualization to create cutting-edge electronic devices that meet evolving consumer preferences.

The utilities and processes segment in the digital manufacturing market involves the application of digital solutions in industries such as energy, water, and chemical processing. Digital manufacturing facilitates process optimization, predictive maintenance, and real-time monitoring of critical infrastructure. This segment is instrumental in ensuring the reliability, safety, and efficiency of utilities and processes through the integration of digital technologies, data analytics, and automation.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest digital manufacturing market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.In the market segmentation based on region, North America emerges as the largest and most influential segment in the digital manufacturing landscape. The region is a hub for technological innovation and industrial transformation, with a strong presence of key market players and a robust ecosystem fostering digitalization. North American industries, spanning from automotive to aerospace and technology, are at the forefront of adopting digital manufacturing solutions to enhance efficiency, reduce costs, and maintain global competitiveness. Government initiatives supporting advanced manufacturing technologies further contribute to the dominance of North America in the digital manufacturing market.

The Asia Pacific region is a dynamic and rapidly growing segment in the market, driven by the industrial powerhouses of China, Japan, and South Korea. As manufacturing activities continue to expand in this region, there is a heightened focus on digital technologies to optimize production processes and accelerate innovation. The Asia Pacific segment witnesses significant investments in smart factories, Industry 4.0 initiatives, and the adoption of advanced manufacturing technologies across diverse industries. The region's economic growth, coupled with a strong emphasis on technological advancements, positions Asia Pacific as a key player in the global digital manufacturing landscape.

Europe stands as a prominent segment in the market segmentation based on region, showcasing a robust commitment to technological advancements in manufacturing. The region is characterized by a well-established industrial base, with countries such as Germany, France, and the United Kingdom leading in innovation and industrial automation. European manufacturers are increasingly integrating digital manufacturing solutions to enhance productivity, sustainability, and competitiveness. The European segment benefits from collaborative initiatives between industry and government, fostering a conducive environment for the widespread adoption of digital technologies in manufacturing.

In Latin America, the market is steadily gaining traction as industries recognize the transformative potential of advanced technologies. While the adoption may be at a somewhat nascent stage compared to other regions, Latin American countries are increasingly investing in digital solutions to modernize manufacturing processes. The region's diverse industries, including automotive, energy, and aerospace, are gradually incorporating digital manufacturing to improve operational efficiency and product quality, positioning Latin America as an emerging player in the global digital manufacturing landscape.

The Middle East and Africa segment in the market is characterized by a growing awareness of the importance of digital technologies in industrial processes. Countries in the region, such as the United Arab Emirates and South Africa, are witnessing increased investments in smart manufacturing initiatives and digital infrastructure. As industries in the Middle East and Africa look to diversify and modernize, digital manufacturing solutions play a pivotal role in enhancing production capabilities, improving supply chain efficiency, and fostering economic development in the region. The segment is poised for further growth as digital transformation gains momentum across diverse sectors.

Leading Key Players in the Digital Manufacturing Industry:

The key players in the market are actively engaged in strategic initiatives to stay at the forefront of technological innovation and meet the evolving needs of industries. These players are heavily investing in research and development to enhance their software solutions, focusing on features such as artificial intelligence, machine learning, and advanced analytics to provide more robust and intelligent digital manufacturing platforms. Collaboration and partnerships with other industry leaders, technology providers, and academic institutions are common strategies to broaden the scope of their offerings and tap into diverse expertise. Additionally, many key players are working towards creating comprehensive ecosystems that integrate seamlessly with emerging technologies like the Industrial Internet of Things (IIoT), enabling end-to-end digitalization of manufacturing processes. Moreover, a commitment to sustainability is reflected in the development of eco-friendly manufacturing solutions, aligning with the global shift towards greener and more efficient industrial practices.The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Autodesk Inc.

- Bentley Systems

- Incorporated CAD Schroer GmbH

- Dassault Systemes S.A.

- Mentor Graphics Corporation

- Siemens Aktiengesellschaft

- PTC Inc.

Key Questions Answered in This Report

1. What was the size of the global digital manufacturing market in 2024?2. What is the expected growth rate of the global digital manufacturing market during 2025-2033?

3. What are the key factors driving the global digital manufacturing market?

4. What has been the impact of COVID-19 on the global digital manufacturing market?

5. What is the breakup of the global digital manufacturing market based on the component?

6. What is the breakup of the global digital manufacturing market based on the process type?

7. What is the breakup of the global digital manufacturing market based on the application?

8. What are the key regions in the global digital manufacturing market?

9. Who are the key players/companies in the global digital manufacturing market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Digital Manufacturing Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Forecast

6 Market Breakup by Component

6.1 Software

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 Services

6.2.1 Market Trends

6.2.2 Market Forecast

7 Market Breakup by Process Type

7.1 Computer-Based Designing

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Computer-Based Simulation

7.2.1 Market Trends

7.2.2 Market Forecast

7.3 Computer 3D Visualization

7.3.1 Market Trends

7.3.2 Market Forecast

7.4 Analytics

7.4.1 Market Trends

7.4.2 Market Forecast

7.5 Others

7.5.1 Market Trends

7.5.2 Market Forecast

8 Market Breakup by Application

8.1 Automation and Transportation

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Aerospace and Defense

8.2.1 Market Trends

8.2.2 Market Forecast

8.3 Consumer Electronics

8.3.1 Market Trends

8.3.2 Market Forecast

8.4 Utilities and Processes

8.4.1 Market Trends

8.4.2 Market Forecast

8.5 Industrial Machinery

8.5.1 Market Trends

8.5.2 Market Forecast

8.6 Others

8.6.1 Market Trends

8.6.2 Market Forecast

9 Market Breakup by Region

9.1 North America

9.1.1 United States

9.1.1.1 Market Trends

9.1.1.2 Market Forecast

9.1.2 Canada

9.1.2.1 Market Trends

9.1.2.2 Market Forecast

9.2 Asia Pacific

9.2.1 China

9.2.1.1 Market Trends

9.2.1.2 Market Forecast

9.2.2 Japan

9.2.2.1 Market Trends

9.2.2.2 Market Forecast

9.2.3 India

9.2.3.1 Market Trends

9.2.3.2 Market Forecast

9.2.4 South Korea

9.2.4.1 Market Trends

9.2.4.2 Market Forecast

9.2.5 Australia

9.2.5.1 Market Trends

9.2.5.2 Market Forecast

9.2.6 Indonesia

9.2.6.1 Market Trends

9.2.6.2 Market Forecast

9.2.7 Others

9.2.7.1 Market Trends

9.2.7.2 Market Forecast

9.3 Europe

9.3.1 Germany

9.3.1.1 Market Trends

9.3.1.2 Market Forecast

9.3.2 France

9.3.2.1 Market Trends

9.3.2.2 Market Forecast

9.3.3 United Kingdom

9.3.3.1 Market Trends

9.3.3.2 Market Forecast

9.3.4 Italy

9.3.4.1 Market Trends

9.3.4.2 Market Forecast

9.3.5 Spain

9.3.5.1 Market Trends

9.3.5.2 Market Forecast

9.3.6 Russia

9.3.6.1 Market Trends

9.3.6.2 Market Forecast

9.3.7 Others

9.3.7.1 Market Trends

9.3.7.2 Market Forecast

9.4 Latin America

9.4.1 Brazil

9.4.1.1 Market Trends

9.4.1.2 Market Forecast

9.4.2 Mexico

9.4.2.1 Market Trends

9.4.2.2 Market Forecast

9.4.3 Others

9.4.3.1 Market Trends

9.4.3.2 Market Forecast

9.5 Middle East and Africa

9.5.1 Market Trends

9.5.2 Market Breakup by Country

9.5.3 Market Forecast

10 SWOT Analysis

10.1 Overview

10.2 Strengths

10.3 Weaknesses

10.4 Opportunities

10.5 Threats

11 Value Chain Analysis

12 Porters Five Forces Analysis

12.1 Overview

12.2 Bargaining Power of Buyers

12.3 Bargaining Power of Suppliers

12.4 Degree of Competition

12.5 Threat of New Entrants

12.6 Threat of Substitutes

13 Price Indicators

14 Competitive Landscape

14.1 Market Structure

14.2 Key Players

14.3 Profiles of Key Players

14.3.1 Autodesk Inc.

14.3.1.1 Company Overview

14.3.1.2 Product Portfolio

14.3.1.3 Financials

14.3.1.4 SWOT Analysis

14.3.2 Bentley Systems

14.3.2.1 Company Overview

14.3.2.2 Product Portfolio

14.3.3 Incorporated CAD Schroer GmbH

14.3.3.1 Company Overview

14.3.3.2 Product Portfolio

14.3.3.3 Financials

14.3.4 Dassault Systemes S.A

14.3.4.1 Company Overview

14.3.4.2 Product Portfolio

14.3.5 Mentor Graphics Corporation

14.3.5.1 Company Overview

14.3.5.2 Product Portfolio

14.3.5.3 SWOT Analysis

14.3.6 PTC Inc.

14.3.6.1 Company Overview

14.3.6.2 Product Portfolio

14.3.6.3 Financials

14.3.6.4 SWOT Analysis

14.3.7 Siemens Aktiengesellschaft

14.3.7.1 Company Overview

14.3.7.2 Product Portfolio

List of Figures

Figure 1: Global: Digital Manufacturing Market: Major Drivers and Challenges

Figure 2: Global: Digital Manufacturing Market: Sales Value (in Billion USD), 2019-2024

Figure 3: Global: Digital Manufacturing Market: Breakup by Component (in %), 2024

Figure 4: Global: Digital Manufacturing Market: Breakup by Process Type (in %), 2024

Figure 5: Global: Digital Manufacturing Market: Breakup by Application (in %), 2024

Figure 6: Global: Digital Manufacturing Market: Breakup by Region (in %), 2024

Figure 7: Global: Digital Manufacturing Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 8: Global: Digital Manufacturing (Software) Market: Sales Value (in Million USD), 2019 & 2024

Figure 9: Global: Digital Manufacturing (Software) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 10: Global: Digital Manufacturing (Services) Market: Sales Value (in Million USD), 2019 & 2024

Figure 11: Global: Digital Manufacturing (Services) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 12: Global: Digital Manufacturing (Computer-Based Designing) Market: Sales Value (in Million USD), 2019 & 2024

Figure 13: Global: Digital Manufacturing (Computer-Based Designing) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 14: Global: Digital Manufacturing (Computer-Based Simulation) Market: Sales Value (in Million USD), 2019 & 2024

Figure 15: Global: Digital Manufacturing (Computer-Based Simulation) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 16: Global: Digital Manufacturing (Computer 3D Visualization) Market: Sales Value (in Million USD), 2019 & 2024

Figure 17: Global: Digital Manufacturing (Computer 3D Visualization) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 18: Global: Digital Manufacturing (Analytics) Market: Sales Value (in Million USD), 2019 & 2024

Figure 19: Global: Digital Manufacturing (Analytics) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 20: Global: Digital Manufacturing (Other Processes) Market: Sales Value (in Million USD), 2019 & 2024

Figure 21: Global: Digital Manufacturing (Other Processes) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 22: Global: Digital Manufacturing (Automation and Transportation) Market: Sales Value (in Million USD), 2019 & 2024

Figure 23: Global: Digital Manufacturing (Automation and Transportation) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 24: Global: Digital Manufacturing (Aerospace and Defense) Market: Sales Value (in Million USD), 2019 & 2024

Figure 25: Global: Digital Manufacturing (Aerospace and Defense) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 26: Global: Digital Manufacturing (Consumer Electronics) Market: Sales Value (in Million USD), 2019 & 2024

Figure 27: Global: Digital Manufacturing (Consumer Electronics) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 28: Global: Digital Manufacturing (Utilities and Processes) Market: Sales Value (in Million USD), 2019 & 2024

Figure 29: Global: Digital Manufacturing (Utilities and Processes) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 30: Global: Digital Manufacturing (Industrial Machinery) Market: Sales Value (in Million USD), 2019 & 2024

Figure 31: Global: Digital Manufacturing (Industrial Machinery) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 32: Global: Digital Manufacturing (Other Applications) Market: Sales Value (in Million USD), 2019 & 2024

Figure 33: Global: Digital Manufacturing (Other Applications) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 34: North America: Digital Manufacturing Market: Sales Value (in Million USD), 2019 & 2024

Figure 35: North America: Digital Manufacturing Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 36: United States: Digital Manufacturing Market: Sales Value (in Million USD), 2019 & 2024

Figure 37: United States: Digital Manufacturing Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 38: Canada: Digital Manufacturing Market: Sales Value (in Million USD), 2019 & 2024

Figure 39: Canada: Digital Manufacturing Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 40: Asia Pacific: Digital Manufacturing Market: Sales Value (in Million USD), 2019 & 2024

Figure 41: Asia Pacific: Digital Manufacturing Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 42: China: Digital Manufacturing Market: Sales Value (in Million USD), 2019 & 2024

Figure 43: China: Digital Manufacturing Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 44: Japan: Digital Manufacturing Market: Sales Value (in Million USD), 2019 & 2024

Figure 45: Japan: Digital Manufacturing Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 46: India: Digital Manufacturing Market: Sales Value (in Million USD), 2019 & 2024

Figure 47: India: Digital Manufacturing Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 48: South Korea: Digital Manufacturing Market: Sales Value (in Million USD), 2019 & 2024

Figure 49: South Korea: Digital Manufacturing Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 50: Australia: Digital Manufacturing Market: Sales Value (in Million USD), 2019 & 2024

Figure 51: Australia: Digital Manufacturing Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 52: Indonesia: Digital Manufacturing Market: Sales Value (in Million USD), 2019 & 2024

Figure 53: Indonesia: Digital Manufacturing Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 54: Others: Digital Manufacturing Market: Sales Value (in Million USD), 2019 & 2024

Figure 55: Others: Digital Manufacturing Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 56: Europe: Digital Manufacturing Market: Sales Value (in Million USD), 2019 & 2024

Figure 57: Europe: Digital Manufacturing Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 58: Germany: Digital Manufacturing Market: Sales Value (in Million USD), 2019 & 2024

Figure 59: Germany: Digital Manufacturing Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 60: France: Digital Manufacturing Market: Sales Value (in Million USD), 2019 & 2024

Figure 61: France: Digital Manufacturing Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 62: United Kingdom: Digital Manufacturing Market: Sales Value (in Million USD), 2019 & 2024

Figure 63: United Kingdom: Digital Manufacturing Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 64: Italy: Digital Manufacturing Market: Sales Value (in Million USD), 2019 & 2024

Figure 65: Italy: Digital Manufacturing Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 66: Spain: Digital Manufacturing Market: Sales Value (in Million USD), 2019 & 2024

Figure 67: Spain: Digital Manufacturing Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 68: Russia: Digital Manufacturing Market: Sales Value (in Million USD), 2019 & 2024

Figure 69: Russia: Digital Manufacturing Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 70: Others: Digital Manufacturing Market: Sales Value (in Million USD), 2019 & 2024

Figure 71: Others: Digital Manufacturing Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 72: Latin America: Digital Manufacturing Market: Sales Value (in Million USD), 2019 & 2024

Figure 73: Latin America: Digital Manufacturing Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 74: Brazil: Digital Manufacturing Market: Sales Value (in Million USD), 2019 & 2024

Figure 75: Brazil: Digital Manufacturing Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 76: Mexico: Digital Manufacturing Market: Sales Value (in Million USD), 2019 & 2024

Figure 77: Mexico: Digital Manufacturing Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 78: Others: Digital Manufacturing Market: Sales Value (in Million USD), 2019 & 2024

Figure 79: Others: Digital Manufacturing Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 80: Middle East and Africa: Digital Manufacturing Market: Sales Value (in Million USD), 2019 & 2024

Figure 81: Middle East and Africa: Digital Manufacturing Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 82: Global: Digital Manufacturing Industry: SWOT Analysis

Figure 83: Global: Digital Manufacturing Industry: Value Chain Analysis

Figure 84: Global: Digital Manufacturing Industry: Porter’s Five Forces Analysis

List of Tables

Table 1: Global: Digital Manufacturing Market: Key Industry Highlights, 2024 and 2033

Table 2: Global: Digital Manufacturing Market Forecast: Breakup by Component (in Million USD), 2025-2033

Table 3: Global: Digital Manufacturing Market Forecast: Breakup by Process Type (in Million USD), 2025-2033

Table 4: Global: Digital Manufacturing Market Forecast: Breakup by Application (in Million USD), 2025-2033

Table 5: Global: Digital Manufacturing Market Forecast: Breakup by Region (in Million USD), 2025-2033

Table 6: Global: Digital Manufacturing Market: Competitive Structure

Table 7: Global: Digital Manufacturing Market: Key Players

Companies Mentioned

- Autodesk Inc.

- Bentley Systems

- Incorporated CAD Schroer GmbH

- Dassault Systemes S.A.

- Mentor Graphics Corporation

- Siemens Aktiengesellschaft

- PTC Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 146 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 0.57 Trillion |

| Forecasted Market Value ( USD | $ 1.96 Trillion |

| Compound Annual Growth Rate | 14.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 7 |