Additionally, each virtual card is only intended for one use. It is made specifically for a single online transaction and is only good for 48 hours. Depending on the bank, the credit validity and limit term may change. By entering one's debit or credit card information online through the bank's net banking service, a virtual credit card can be generated. There are no fees associated with this process and service. They need not be issued physically by card issuers, as the name implies.

Since there are typically far fewer fees necessary for customers of virtual banks, virtual cards are less expensive than real cards. Additionally, since everything is managed online, the virtual bank may lower operating expenses, which allows them to lower the fees for the virtual cards they issue to their clients. In addition, compared to actual cards, virtual cards give their users additional security advantages. Additionally, users can customize their own spending caps on a virtual card, which enables them to increase their savings.

These are thus a few of the driving forces behind the expansion of the virtual cards business. If the smartphone is taken, there is a potential that the user's virtual card, which has access to the virtual card, can be used fraudulently. Furthermore, customer preferences for touchless transactions over traditional payments and the rapid advancement of payment technology are predicted to lead to lucrative market expansion for virtual cards in the coming years.

COVID-19 Impact Analysis

The COVID-19 pandemic significantly contributed to the market's expansion. After the pandemic, there has been an increase in the demand for contactless payment methods, which is opening up new prospects for the market for virtual cards. The risk of a virtual card potentially spreading illnesses is eliminated because it is not a tangible item. Therefore, the COVID-19 pandemic steadily hampered the growth of the virtual cards market during the initial period of the pandemic. However, the growth of the market expedited exponentially during the pandemic.Market Growth Factors

Rising trend of online payments all over the world

The digital revolution has increased access to and utilization of financial services all over the world, changing how people send and receive payments, borrow money, and save money. According to the World Bank, from 68% in 2017 and 51% in 2011, 76% of adults across the world now have an account with a bank, another financial institution, or a mobile money provider. It's significant that the expansion of account ownership was evenly divided among many more nations. The increase in the trend of digital or online payments is one of the major factors that is propelling the growth of the virtual card market.Widespread digitalization across the world

More quickly than any other innovation in human history, digital technologies have transformed civilizations and have now reached almost 50% of the population in developing countries. Technology may be a huge equalizer by improving connection, financial inclusion, access to commerce, and public services. AI-enabled frontier technologies, for instance, are assisting in the diagnosis and treatment of diseases as well as the extension of life span in the healthcare industry. Distance learning and virtual learning settings have allowed students who would otherwise be cut off from programs to participate. As the foothold of digitalization strengthens all over the world, the adoption of virtual cards would also propel. Hence, this factor is accelerating the growth of the virtual card market.Market Restraining Factors

Lack of knowledge and awareness about virtual cards

For card-not-present purchases, such as when customers shop online, virtual credit cards are made. Returning an item to the vendor may be challenging depending on the service they use. The majority of retailers prefer to pay customers back using the same card number that has been used to complete the transaction. An alternative to a refund can be store credit. When users employ a virtual card number to hold a reservation, things can get complicated. The rental business would aim to match the account number that is used to make the reservation with the credit card that is being used for payment in real-time when the customer makes a reservation for a rental automobile. Therefore, these challenges are majorly hampering the growth of the virtual card market.Card Type Outlook

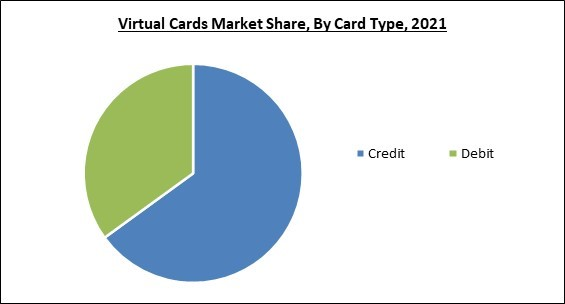

Based on Card Type, the Virtual Cards Market is bifurcated into Credit Card and Debit Card. In 2021, the debit card segment garnered a significant revenue share of the virtual cards market. Growing net banking usage around the world is anticipated to fuel the demand for virtual debit cards, which would drive the segment's growth. For instance, Google announced the creation of two new payment efforts in May 2022, including virtual cards and digital wallets. This initiative aims to provide people all over the world with improved security and convenience.Product Type Outlook

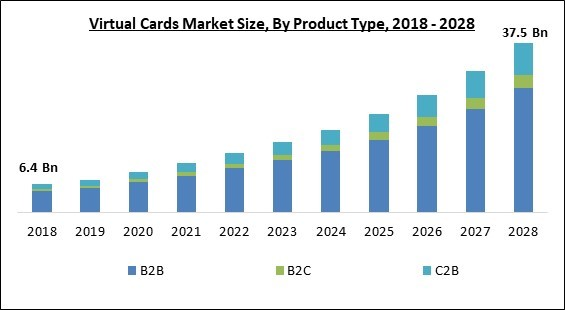

By the Product Type, the Virtual Cards Market is segmented into B2B Virtual Cards, B2C Remote Payment Virtual Cards, and C2B POS Virtual Cards. In 2021, the B2B virtual cards segment witnessed the highest revenue share of the virtual cards market. The demand for B2B payments and transactions between businesses has risen as a result of the growing export and import of products and services across the world, which is anticipated to drive the demand for B2B virtual cards.Application Outlook

On the basis of Application, the Virtual Cards Market is divided into Business Use and Consumer Use. In 2021, the business use segment procured the biggest revenue share of the virtual cards market. Virtual cards are used by businesses to make online payments to suppliers and merchants. Because they cannot be lost or stolen, unlike conventional credit and debit cards, these cards offer improved safety.Regional Outlook

Region-Wise, the Virtual Cards Market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2021, Europe accounted for the largest revenue share of the virtual cards market. The UK, Germany, and other European nations with a rising inclination for cashless transactions are projected to fuel the expansion of the regional industry. Additionally, a number of market players are introducing cutting-edge solutions in the European market to entice consumers to adopt virtual cards. For instance, Stripe introduced Stripe Issuing in European countriesCardinal Matrix-Virtual Cards Market Competition Analysis

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; JPMorgan Chase & Co. is the major forerunner in the Virtual Cards Market. Companies such as American Express Kabbage Inc., Mastercard, Inc., Marqeta Inc. are some of the key innovators in Virtual Cards Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Mastercard, Inc., American Express Kabbage Inc., JPMorgan Chase & Co., Stripe, Inc., Adyen N.V., BTRS Holdings Inc., Wise Payments Limited, Marqeta Inc., Skrill USA, Inc., and Wex, Inc.

Strategies deployed in Virtual Cards Market

Partnerships, Collaborations and Agreements:

- Jun-2022: Marqeta joined hands with Western Union, a leading fintech. Under this collaboration, Marqeta would integrate its solutions into the next-generation real-time multi-currency digital wallet and digital banking platform of Marqeta across Europe to offer the entire remittance service of Western Union online.

- June-2022: Marqeta partnered with Klarna, a Swedish fintech company. Following this partnership, Marqeta would support the Klarna Card in order to bring the Pay in 4 services of the company to a physical Visa card with the aim to allow consumers to pay over time in four equal interest-free payments for any online or in-store purchase.

- Apr-2022: American Express collaborated with Billtrust, a B2B accounts receivable automation and integrated payments company. Through this collaboration, the companies aimed to allow providers to accelerate the adoption of American Express virtual cards. Moreover, this collaboration would also enable suppliers to accelerate and automate virtual card payments.

- Apr-2022: TransferWise partnered with Max, a fintech company. Through this partnership, the companies aimed to launch the Wise Platform throughout Israel, which would enable customers to send money abroad in 32 currencies along with complete transparency on fees.

- Mar-2022: Marqeta entered into a partnership with Citi, an American multinational investment bank and financial services corporation. Under this partnership, Marqeta would offer its tokenization-as-a-service capabilities to Citi in order to streamline card provisioning into mobile wallets to allow Citi’s cardholder base to transform their plastic cards into virtual cards.

- Mar-2022: Mastercard partnered with Zeta, a Banking tech and credit card provider. Through this partnership, the companies aimed to offer modern credit card processing capabilities to fintech innovators and issuing banks at scale to optimize the security, safety, and convenience of e-commerce.

- Nov-2021: Marqeta came into a partnership with Mastercard and Paycast. Through this partnership, the companies aimed to empower and unveil a digital card product in order to provide a more convenient as well as faster approach for sellers to receive payments.

- Oct-2021: Marqeta entered into a partnership with Amount, a technology leader. With this partnership, the companies aimed to aid banks in rapidly leveraging the buy now, pay later space with the aim to alleviate the digital tools gap.

- Sep-2021: American Express came into a partnership with Extend, a fintech specializing in virtual cards. This partnership aimed to expand virtual Card solutions for businesses throughout the US by providing them an eligible American Express Business Card in order to create tokens via the desktop and app of Extend.

- Aug-2021: Stripe came into a partnership[ with UnionPay International, a subsidiary of China UnionPay. This partnership aimed to allow businesses throughout more than 30 countries in order to seamlessly and securely accept payments from a number of UnionPay cardholders.

- Jul-2020: JP Morgan came into a partnership with Marqeta, a payment start-up. With this partnership, the companies aimed to release virtual credit cards for their commercial card clients. Furthermore, Marqeta would integrate its unique card tokenization capabilities into the virtual card program to facilitate payments.

»Product Launches and Product Expansion:

- Nov-2022: Mastercard launched a new mobile virtual card solution. The new solution aimed to address the rising demand for contactless, digital, and commercial payments, which was propelled owing to the COVID-19 pandemic.

- Jan-2022: Mastercard rolled out Mastercard TrackTM Instant Pay, a cutting-edge virtual card solution. The new solution aimed to enable instant payment of supplier invoices in order to deliver enhanced automation and efficiency along with a wide choice for customers as well as providers.

- Oct-2021: JP Morgan rolled out Digital Bill Payment. Through this launch, the company aimed to increase its efforts in order to aid customers in digitizing the entire receivables journey through the latest innovations, including the request to pay.

- Aug-2021: JPMorgan unveiled request for pay, a real-time payments option. The new solution aimed to allow customers to send payment requests to their banks. Moreover, this solution would save a significant amount of time as well as cost for customers.

Acquisition & Mergers:

- Jan-2022: JP Morgan took over Viva Wallet, a leader in European cloud-based payments. Following this acquisition, the company aimed to expedite its growth with the addition of the large customer base of Viva Wallet.

- Oct-2021: Stripe took over Recko, a provider of payments reconciliation software. Through this acquisition, the company aimed to expand its portfolio throughout India.

- May-2021: Stripe acquired Bouncer, a startup in Oakland. With this acquisition, the company aimed to leverage Bouncer's technology in order to aid customers in authenticating themselves in case they are flagged mistakenly to operate the application legitimately.

- Jan-2020: WEX completed its acquisition of eNett and Optal. With this acquisition, the company aimed to strengthen its position beyond the United States, bring a unique and complementary product range, and add a skilled team with expertise in operating throughout international markets.

»Geographical Expansions:

- Jun-2021: Wise expanded its geographical footprint in India through its collaboration with the RBL Bank. This geographical expansion aimed to allow Indian customers to transfer money to 44 countries via the Liberalized Remittance Scheme.

- Apr-2021: Stripe expanded its geographical footprint with the launch of Stripe Issuing in various countries across the world. Through this geographical expansion, the company aimed to allow customers to create, manage, and supply virtual and physical payment cards to offer more control to businesses over how they spend their money. Furthermore, the company launched the new solution throughout Austria, Belgium, Cyprus, Italy, Latvia, Lithuania, Estonia, Finland, France, Germany, Greece, Ireland, Luxembourg, Malta, Portugal, Slovakia, the Netherlands, the UK, Slovenia, and Spain.

Scope of the Study

Market Segments Covered in the Report:

By Product Type

- B2B

- B2C

- C2B

By Card Type

- Credit

- Debit

By Application

- Business Use

- Consumer Use

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Mastercard, Inc.

- American Express Kabbage Inc.

- JPMorgan Chase & Co.

- Stripe, Inc.

- Adyen N.V.

- BTRS Holdings Inc.

- Wise Payments Limited

- Marqeta Inc.

- Skrill USA, Inc.

- Wex, Inc.

Unique Offerings from the Publisher

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Mastercard, Inc.

- American Express Kabbage Inc.

- JPMorgan Chase & Co.

- Stripe, Inc.

- Adyen N.V.

- BTRS Holdings Inc.

- Wise Payments Limited

- Marqeta Inc.

- Skrill USA, Inc.

- Wex, Inc.