Global Virtual Cards Market - Key Trends & Drivers Summarized

What Are Virtual Cards and Their Growing Significance?

Virtual cards are digital versions of traditional bank cards that can be used for online transactions without revealing actual bank details. They provide a secure and flexible payment method, particularly useful in managing business expenses, online shopping, and B2B transactions. Virtual cards are generated through software platforms that allow users to set specific spending limits, expiration dates, and merchant categories, enhancing control over expenditures and reducing the risk of fraud and misuse.Technological Advancements Enhancing Virtual Card Security and Usability

The virtual cards market is propelled by advancements in encryption and tokenization technologies that safeguard sensitive payment data, making virtual cards a secure alternative to physical cards. These technologies mask real card details with a unique digital identifier, thus protecting user information during transactions. Furthermore, the integration of virtual cards with mobile wallets and payment apps enhances their usability, allowing seamless transactions across various online platforms.Why Are Virtual Cards Becoming Essential in Financial Management?

Virtual cards are becoming an integral part of modern financial management strategies, particularly in corporate settings. They simplify the reconciliation of expenses and streamline procurement processes, making them ideal for managing travel expenses, utility payments, and routine business purchases. Additionally, virtual cards are increasingly used in subscription management, enabling businesses and consumers to control recurring charges more effectively.What Drives the Growth of the Virtual Cards Market?

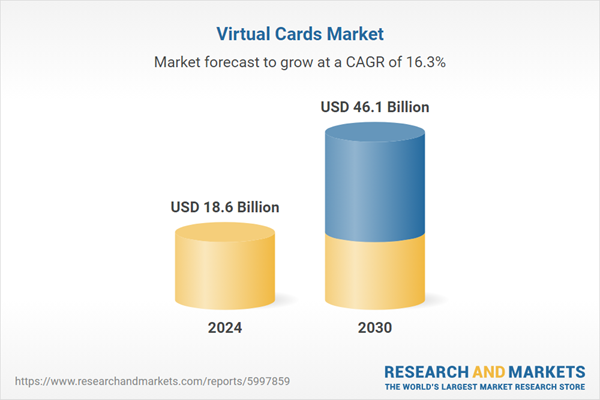

The growth in the virtual cards market is driven by several factors. The increasing volume of online transactions and the need for secure payment methods are primary growth drivers. As e-commerce and digital services expand, virtual cards offer a secure and convenient payment solution that meets the security expectations of both merchants and consumers. The rise in freelance and gig economy workers who require flexible, easy-to-manage financial tools for business transactions also contributes to the market growth. Additionally, businesses are adopting virtual cards to enhance expense management and reduce fraudulent activities. Regulatory changes promoting electronic payments and financial innovations further accelerate the adoption of virtual cards, ensuring their place as a staple in the evolving landscape of digital payments.Report Scope

The report analyzes the Virtual Cards market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Card Type (Credit Cards, Debit Cards); Application (Business Use Application, Consumer Use Application).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Credit Cards segment, which is expected to reach US$28.7 Billion by 2030 with a CAGR of a 17.4%. The Debit Cards segment is also set to grow at 14.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $5.0 Billion in 2024, and China, forecasted to grow at an impressive 23.6% CAGR to reach $11.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Virtual Cards Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Virtual Cards Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Virtual Cards Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aspectek, Cablematic Dos Mil SLU, ExKaliber LLC (Livin Well), Flowtron Outdoor Products, Foshan GreenYellow Electric Technology Co., Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 35 companies featured in this Virtual Cards market report include:

- ACI Worldwide, Inc.

- American Express Company

- Edenred SA

- EnKash

- HSBC Holdings Plc

- JP Morgan Chase

- Marqeta, Inc.

- Mastercard Inc.

- MineralTree

- Standard Chartered PLC

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ACI Worldwide, Inc.

- American Express Company

- Edenred SA

- EnKash

- HSBC Holdings Plc

- JP Morgan Chase

- Marqeta, Inc.

- Mastercard Inc.

- MineralTree

- Standard Chartered PLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 266 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 18.6 Billion |

| Forecasted Market Value ( USD | $ 46.1 Billion |

| Compound Annual Growth Rate | 16.3% |

| Regions Covered | Global |