The heterostructure design of these lasers reduces optical losses, leading to higher optical efficiency and better overall performance. Thus, the Double Hetero Structure segment acquired $897.7 million in 2022. DH lasers exhibit improved temperature stability compared to homojunction lasers, making them suitable for harsh environments and applications requiring stable operation over a wide temperature range.

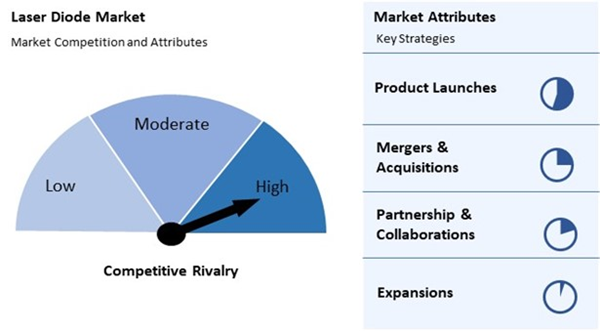

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In January 2024, Ushio, Inc. has introduced high-power red laser diodes boasting the world's highest optical output power of 4.2 W in pulsed mode. The HL63680HD achieves this feat even at high temperatures of 45°C, with an unmatched wall-plug efficiency of 45% in 638 nm pulsed operation at 25°C. Additionally, In January 2024, Jenoptik AG has launched a new single-bar diode laser package, LS, designed for optically pumping next-generation solid-state lasers. The LS incorporates an enhanced cooling system, utilising a double-sided open heat sink design for improved heat dissipation.

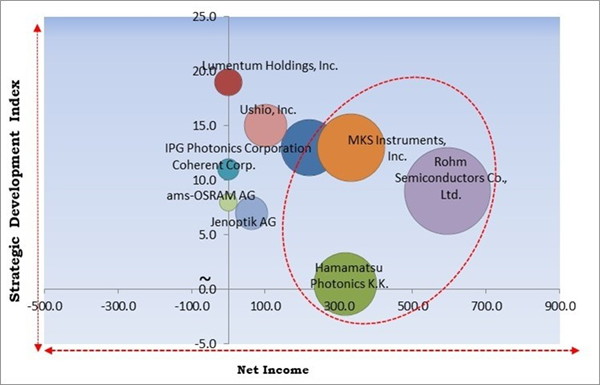

Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the Cardinal Matrix; Rohm Semiconductors Co., Ltd., MKS Instruments, Inc. and Hamamatsu Photonics K.K. are the forerunners in the Market. In July 2023, MKS Instruments, Inc. unveiled the Ophir Beam Watch Plus, a novel product designed for non-contact beam profiling to gauge focus shift. The BeamWatch Plus system employs high-magnification optics capable of measuring beams with spot sizes as small as 45µm, enabling finer, more accurate cuts and minimising material waste. Companies such as IPG Photonics Corporation, Ushio, Inc, Jenoptik AG are some of the key innovators in Market.Market Growth Factors

Laser diodes have become indispensable tools in automotive, aerospace, and electronics manufacturing industries due to their ability to deliver high precision and energy efficiency. Thus, as industries evolve and demand more advanced manufacturing solutions, the demand for laser diodes will increase.Additionally, Laser diodes are integral to various consumer electronic devices, including smartphones, tablets, and laptops. Therefore, as these trends continue to evolve, the consumer electronics sector is expected to grow further, offering new opportunities for innovation and expansion for the market.

Market Restraining Factors

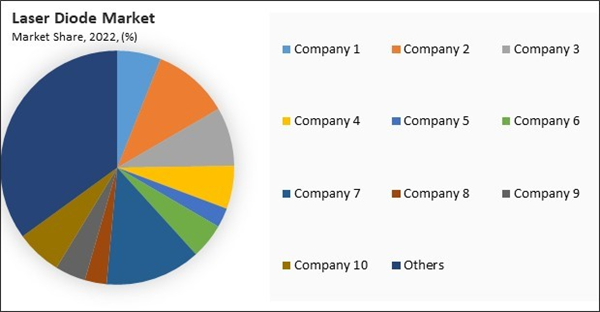

The high costs are primarily driven by the complexity and precision required in manufacturing laser diodes and the advanced technologies and materials used in their production. This, in turn, can slow the development of new applications and solutions that could benefit from laser diode technology. Thus, the high costs of these systems may hamper the market's growth in the coming years.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches and Product Expansions.

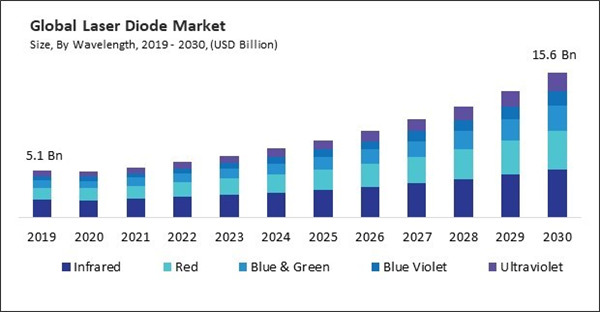

By Wavelength Analysis

Based on wavelength, the market is classified into infrared, red, blue & green, blue violet, and ultraviolet. The blue & green segment recorded a promising 16% revenue in the market in 2022. Blue and green laser diodes are used in biomedical and medical applications, such as photodynamic therapy, fluorescence microscopy, and ophthalmology.By Technology Analysis

Based on technology, the market is categorized into double hetero structure, quantum well & cascade, distributed feedback, separate confinement heterostructure (SCH), and vertical cavity surface emitting laser (VCSEL) & vertical external cavity surface emitting laser (VECSEL). The distributed feedback segment acquired a 37.3% revenue share in the market in 2022.By Doping Material Analysis

On the basis of doping material, the market is segmented into gallium arsenide (GaAs), gallium aluminum arsenide (GaAIAs), gallium nitride (GaN) & indium gallium nitride (InGaN), gallium indium arsenic antimony (GaInAsSb), aluminum gallium indium phosphide (AIGaInP), and others. The gallium indium arsenic antimony (GaInAsSb) segment procured a 12% revenue in the market in 2022.By End Use Analysis

On the basis of end use, the market is divided into telecommunication, industrial & automotive, medical & healthcare, consumer electronics, and others. The consumer electronics segment procured 35% revenue share in the market in 2022. They provide accurate depth sensing capabilities, enabling advanced features and functionalities.By Regional Analysis

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific region dominated the market with a 36.2% revenue share in 2022. Certain manufacturing powerhouses of global significance are located in the Asia-Pacific region, most notably in Japan, South Korea, China, and Taiwan.Market Competition and Attributes

The Laser Diode market is fiercely competitive, with several key players striving for dominance. Major companies such as Coherent Inc., IPG Photonics Corporation, and Rohm Semiconductors Co., Ltd. are prominent contenders, offering a wide range of laser diode products catering to various industries and applications. Additionally, companies like Hamamatsu Photonics, MKS Instruments, Inc., and Jenoptik AG contribute significantly to the competition with their innovative technologies and product offerings. Competition in the Laser Diode market is driven by factors such as technological advancements, product performance, pricing strategies, and customer service.

Recent Strategies Deployed in the Market

- Jan-2024: Jenoptik AG has launched a new single-bar diode laser package, LS, designed for optically pumping next-generation solid-state lasers. The LS incorporates an enhanced cooling system, utilising a double-sided open heat sink design for improved heat dissipation. With continuous wave output power surpassing 150 W at 9xx nm, the LS outperforms the CS, facilitating advanced pump or direct-diode-laser (DDL) applications.

- Jan-2024: Ushio, Inc. has introduced high-power red laser diodes boasting the world's highest optical output power of 4.2 W in pulsed mode. The HL63680HD achieves this feat even at high temperatures of 45°C, with an unmatched wall-plug efficiency of 45% in 638 nm pulsed operation at 25°C. Additionally, it delivers an optical output power of 3.0 W in continuous wave operation, ensuring a lifetime MTTF exceeding 20,000 hours. Notably, the emitter size and package of this new product match those of the conventional HL63520HD, simplifying the replacement process.

- Dec-2023: Ushio, Inc. has expanded its high-power laser diode portfolio in the 630 to 690 nm red wavelength range, adding five new wavelengths to the existing lineup of 1.2 W LDs. Leveraging Ushio's red wavelength technologies, these products offer 1.2W high power, 40% wall plug efficiency, and a long operational life of 10,000 hours. With a compact emitter size of 80μm width, they ensure efficient coupling of laser beams to optical fibers, reducing power consumption and extending equipment life.

- Sep-2023: Ams-OSRAM AG has partnered with TriLite Technologies GmbH, known for designing and constructing the world's tiniest projection displays. In this collaboration, Ams-OSRAM will supply its pre-assembled RGB laser diodes to TriLite's Trixel® 3 laser beam scanner (LBS), recognised as the world's smallest projection display. By joining TriLite's growing ecosystem of manufacturing partners, Ams-OSRAM contributes its renowned expertise and cutting-edge laser diode technology, enhancing TriLite's vision for the future of AR smart glasses.

- Jul-2023: Lumentum Holdings Inc. has finalised the acquisition of Cloud Light Technology Limited, a firm specialising in the design, marketing, and manufacturing of optical fibre transceivers and sensors. Through this acquisition, Lumentum intends to enhance its portfolio by integrating Cloud Light's high-speed optical transceiver products and bolstering its supply chain security.

List of Key Companies Profiled

- Coherent Corp.

- IPG Photonics Corporation

- Jenoptik AG

- Lumentum Holdings, Inc.

- MKS Instruments, Inc.

- ams-OSRAM AG

- Rohm Semiconductors Co., Ltd.

- Sharp Corporation

- Ushio, Inc.

- Hamamatsu Photonics K.K.

Market Report Segmentation

By Wavelength- Infrared

- Red

- Blue & Green

- Blue Violet

- Ultraviolet

- Distributed Feedback

- Separate Confinement Heterostructure

- Double Hetero Structure

- Quantum Well & Cascade

- VCSEL & VECSEL

- Gallium Arsenide (GaAs)

- Gallium Aluminum Arsenide (GaAIAs)

- Gallium Nitride (GaN) & Indium Gallium Nitride (InGaN)

- Gallium Indium Arsenic Antimony (GaInAsSb)

- Aluminum Gallium Indium Phosphide (AIGaInP)

- Others

- Consumer Electronics

- Telecommunication

- Industrial & Automotive

- Medical & Healthcare

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Coherent Corp.

- IPG Photonics Corporation

- Jenoptik AG

- Lumentum Holdings, Inc.

- MKS Instruments, Inc.

- ams-OSRAM AG

- Rohm Semiconductors Co., Ltd.

- Sharp Corporation

- Ushio, Inc.

- Hamamatsu Photonics K.K.