The growth in the market is being fueled extensively by the rising use of cloud technology in the banking industry. Cloud solutions are gaining traction among banks and other financial institutions because they can help cut down on operational expenditures as well as enhance scalability. These platforms enable banks to utilize advanced features and advancements in technology without having to incur massive funds as initial investments in infrastructure. Moreover, these platforms can also improve their agility, increase data protection, and lower the maintenance cost, with the transition of banks to the cloud, thereby enhancing resource allocation. In addition, cloud technology allows for easy integration with current systems, allowing third-party software providers to provide customized solutions. With more banks and financial institutions moving to the cloud, third-party banking software solutions are likely to witness greater demand, thereby influencing the overall market growth.

In the United States, the trends in the third-party banking software market are significantly driven by the continuous regulatory developments and changing competitive dynamics. In addition, the latest regulations, including those from the Consumer Financial Protection Bureau (CFPB), are compelling banks to give consumers simpler access to their financial information. It has been a major step in the evolution of open banking, which will make the competition among financial institutions grow and enable consumers to combine their banking services with new financial applications. In addition, this transition is encouraging an increasing number of financial institutions to pursue third-party software solutions that are able to support compliance with new data-sharing regulations and provide a seamless integration with third-party platforms.

Third-Party Banking Software Market Trends:

The banking, financial services, and insurance (BFSI) sector is experiencing significant growth, which is driving the expansion of the market. As of July 2024, there were 602 banks using UPI, with total digital transactions reaching 15.08 Billion, valued at Rs. 2,10,000 Crore, according to IBEF. This surge is largely attributed to the increasing adoption of digital platforms. Moreover, the integration of cloud-based applications into banking software is accelerating market development. Unlike traditional manual methods, there is a growing preference for automated accounting systems for managing finances and transactions. Consumers are also shifting toward digital platforms, using smartphones, laptops, and tablets to access accounts and conduct transactions. This transition is evident in the expected increase in digital banking users in the US, which is forecast to reach 216.8 Million by 2025, according to recent studies. Furthermore, advancements in technology, such as the incorporation of big data analytics into third-party banking software, are positively influencing the market. These analytics tools process vast data sets, supporting businesses in making data-driven decisions to boost profitability and identify emerging trends. With cybercrime costs projected to hit USD 10.5 Trillion by 2025, as per the World Economic Forum and Cybersecurity Ventures, the demand for secure, adaptable banking solutions is higher than ever. Additionally, the increasing focus on customer-centric banking and the demand for standardized processes will continue to propel market growth. These developments reflect the evolving third-party banking software market trends, pushing financial institutions to adopt innovative solutions.Strategic Acquisitions Driving Innovation in Banking Software

The third-party banking software market has seen a marked shift towards strategic acquisitions that drive both innovation and competitiveness. As financial institutions face increasing pressure to comply with regulatory requirements, enhance operational efficiency, and offer innovative digital solutions, the role of acquisitions becomes crucial. These acquisitions allow companies to integrate advanced technologies, providing more robust solutions for financial institutions. For example, in October 2024, Axway's acquisition of Sopra Banking Software (SBS) exemplified this trend, significantly boosting its capabilities in the open banking space. The integration of SBS’s advanced technology strengthened Axway’s platform, enabling it to meet the newly introduced CFPB regulations while also enhancing its ability to securely manage data. This development ensures financial institutions can provide faster, more efficient services while remaining compliant with stringent regulations. With enhanced API management and a more streamlined data architecture, Axway empowered its clients to unlock new business opportunities and improve revenue streams. The acquisition also positioned Axway as a market leader in providing flexible, scalable solutions, which cater to the evolving needs of modern banks. Through acquisitions like this, companies are setting themselves up to lead the way in transforming the banking industry, pushing for greater innovation, security, and customer-centric solutions across the market. These strategic moves are expected to drive the third-party banking software market growth, as more banks seek advanced, adaptable solutions.Rising Partnerships for Enhanced Customer Experience

Partnerships within the third-party banking software market are driving significant advancements in customer experience, marking a shift toward more collaborative and integrated solutions. As customer expectations evolve, financial institutions are focusing on partnerships to enhance service delivery and operational efficiency. These collaborations enable companies to combine their strengths and offer more comprehensive, user-friendly banking solutions. For instance, in May 2025, Tietoevry Banking entered a strategic partnership with Lokalbank to deliver a comprehensive, tailored banking platform for the Norwegian market. This partnership focused on providing a scalable, secure solution that integrates core banking services with mobile and online banking, payment systems, card services, and anti-financial crime tools. The partnership freed up resources for Lokalbank, allowing them to focus on customer advisory services and sales by streamlining operations and automating key processes. The platform’s modern digital interface further enhanced the customer experience by providing seamless access to services and improving engagement. The collaboration was designed to reduce operational complexity, enhance security, and simplify integration, which is vital for staying competitive in the digital-first banking world. This trend illustrates how strategic partnerships are becoming essential for delivering high-quality banking experiences, enabling financial institutions to meet market demands for speed, security, and customer-centric services.Third-Party Banking Software Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global third-party banking software market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, deployment type, application, and end user.Analysis by Product:

- Core Banking Software

- Multi-Channel Banking Software

- Business Intelligence Software

- Others

Analysis by Deployment Type:

- On-premises

- Cloud-based

Analysis by Application:

- Risk Management

- Information Security

- Business Intelligence

- Others

Analysis by End User:

- Commercial Banks

- Retail and Trading Banks

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Key Regional Takeaways:

United States Third-Party Banking Software Market Analysis

In 2024, the United States accounted for 90.60% of the third-party banking software market in North America, driven by multiple factors. The market in the United States is experiencing robust growth, driven by the country's high digital adoption rate and increasing demand for personalized financial services. The rapid expansion of fintech ecosystems is accelerating the integration of advanced software platforms for customer relationship management, transaction automation, and data analytics. According to recent reports, U.S. bank executives plan to increase IT and tech spending by at least 10% in 2025 to enhance security measures following multiple data breaches in 2024. This emphasis on cybersecurity and infrastructure fortification is propelling investments in third-party platforms equipped with advanced security protocols. Additionally, the growing reliance on open banking frameworks is encouraging financial institutions to adopt modular third-party solutions to enhance operational efficiency. The shift toward cloud-native architectures and API-based platforms is facilitating seamless upgrades and integration with emerging technologies. Moreover, the evolving regulatory environment is compelling for banks to deploy agile and scalable software solutions. As banks focus on building ecosystem partnerships and leveraging data-driven strategies, the market is expected to witness sustained growth in the coming years.Europe Third-Party Banking Software Market Analysis

The third-party banking software market in Europe is progressing steadily, fueled by the region’s commitment to digital transformation and sustainable finance practices. The implementation of unified financial data standards enhances cross-border interoperability, prompting financial institutions to embrace standardized third-party platforms. According to the European Investment Bank, the EIB Group signed nearly USD 96.6 Billion in new financing for over 900 projects in 2024, mobilizing around USD 380 Billion in investment and supporting approximately 5.8 Million jobs. These large-scale investments are accelerating digitization efforts, further boosting demand for scalable software solutions. Additionally, the widespread use of mobile banking and digital wallets is encouraging the adoption of user-centric software. There is a growing trend toward integrating ESG considerations within banking systems, driving demand for analytical tools offered by third-party providers. As financial players focus on agile innovation and open finance initiatives, vendors providing embedded services and modular solutions are gaining traction, shaping a promising outlook for the European market.Asia Pacific Third-Party Banking Software Market Analysis

The Asia Pacific third-party banking software market is witnessing dynamic growth, primarily driven by rapid urbanization and the expansion of digital ecosystems. The rising penetration of internet and mobile devices is accelerating the demand for mobile-first banking solutions offered by third-party vendors. As per the India Brand Equity Foundation, India’s fintech industry is currently valued at approximately USD 111 Billion and projected to reach USD 421 Billion by 2029, making it the third-largest fintech ecosystem globally. This significant growth trajectory is pushing financial institutions across the region to adopt agile software for serving digitally native consumers. The growing popularity of real-time payment platforms and multilingual digital onboarding tools is encouraging the deployment of scalable third-party systems. Additionally, the focus on financial inclusion is prompting banks to implement inclusive and localized solutions. As regional institutions modernize legacy systems and embrace predictive analytics and cloud-native tools, the third-party software market is expected to maintain strong momentum.Latin America Third-Party Banking Software Market Analysis

The Latin American third-party banking software market is expanding steadily, fueled by the growing digital engagement of consumers and the shift toward cashless economies. Financial institutions are increasingly adopting third-party solutions to automate processes and expand digital channels, especially in underserved areas. Reports state that over 70% of Brazilians now use digital banking services, while financial institutions are accelerating their adoption of technology-driven solutions. This digital shift is prompting greater investment in third-party platforms that enable real-time transactions and user-centric features. The demand for software supporting alternative credit assessments and gamified financial services is rising, aligned with goals of expanding financial access. With a growing appetite for fintech integration and scalable platforms, third-party software continues to emerge as a strategic enabler of financial modernization across the region.Middle East and Africa Third-Party Banking Software Market Analysis

The third-party banking software market in the Middle East and Africa is gaining momentum due to the increasing push for digital financial services and infrastructure modernization. The region’s young and tech-savvy population is driving demand for mobile-optimized banking experiences, encouraging adoption of agile third-party platforms. According to the publisher, the Saudi Arabian digital banking market was valued at USD 87.60 Million in 2024 and is projected to reach USD 278.19 Million by 2033, growing at a CAGR of 12.70%. This expansion highlights growing investment in software that supports scalable, cloud-based solutions with robust features like biometric authentication and AI analytics. As financial institutions embrace digital identity frameworks and expand into underbanked areas, the role of flexible and secure third-party platforms is becoming increasingly central to regional banking strategies.Competitive Landscape:

Companies in the third-party banking software market are adopting advanced strategies to meet evolving technological demands and manage diverse workflows. They are leveraging automation tools and creation platforms to streamline software development, reduce manual tasks, and ensure consistent quality across various formats. By optimizing integration with publishing, analytics, and collaboration systems, organizations are ensuring seamless operations from design to deployment. Additionally, they are enhancing real-time editing and feedback capabilities, enabling quick adjustments based on performance data. These initiatives improve efficiency, maintain brand consistency, and support data-driven decision-making, minimizing risks of outdated messaging or inefficient workflows across digital platforms.The report provides a comprehensive analysis of the competitive landscape in the third-party banking software market with detailed profiles of all major companies, including:

- Accenture

- Capgemini

- Deltek, IBM

- Infosys

- Microsoft Corporation

- NetSuite Inc.

- Oracle Corporation

- SAP SE

- Tata Consultancy Services

Key Questions Answered in This Report

1. How big is the third-party banking software market?2. What is the future outlook of third-party banking software market?

3. What are the key factors driving the third-party banking software market?

4. Which region accounts for the largest third-party banking software market share?

5. Which are the leading companies in the global third-party banking software market?

Table of Contents

Companies Mentioned

- Accenture

- Capgemini

- Deltek

- IBM

- Infosys

- Microsoft Corporation

- NetSuite Inc.

- Oracle Corporation

- SAP SE

- Tata Consultancy Services

Table Information

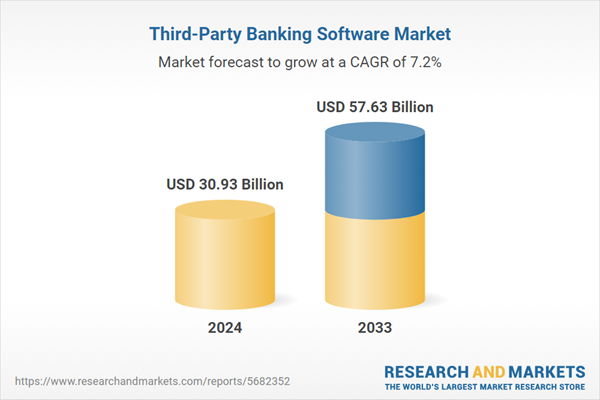

| Report Attribute | Details |

|---|---|

| No. of Pages | 147 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 30.93 Billion |

| Forecasted Market Value ( USD | $ 57.63 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |