Speak directly to the analyst to clarify any post sales queries you may have.

KEY HIGHLIGHTS

- The growth in the organized manufacturing sector is anticipated to accelerate further the entry and expansion of multi-national companies (MNCs).

- Recycled polyester workwear is giving plastic waste a second purpose. Recycled polyester is made from 100% PET plastic bottles.

- Sustainable workwear is a significant step in decreasing waste; hence, most manufacturers participate in it.

- In the future, the demand and behavior of consumers are expected to become more complex, more technology-oriented, and more challenging to predict.

- New technologies such as mobile payment infrastructure and virtual fashion shows could help customize changes by reducing waste and extending the product lifecycle.

MARKET OPPORTUNITIES & DRIVERS

Increasing Product Innovation with Latest Technologies

The average workplace has experienced changes in the last few decades. The growth of the industrial workwear market is supported by the rising trends toward product and technological innovation. The demand for lighter workwear has risen due to the increasing focus on safety, durability, and comfortability. Hence, the industry players are incorporating better properties in their fabrics such as stretch & flex along with garment softness and breathability to improve the comfort of the wearer.Sustainable Workwear

Presently, the clothing industry is embracing recycled clothing from plastic bottles. Hence, manufacturers are committed to providing comfortable and sustainable workwear for the environment. Recycled polyester workwear is giving plastic waste a second purpose. Loop Workwear, a manufacturer in the industrial workwear market, is committed to providing corporate workwear that reflects its brand image and suits the working environment. It formed a range of workwear solutions that are all either compostable or biodegradable or produced from a 100% recycled substance.Stringent Regulatory Standards

Stringent regulations concerning industrial workwear have been practiced for many years in various countries to protect workers against injuries and other hazards at the workplace. In addition, several government regulations and instructions by local authorities in different countries have increased the demand for protective clothing worldwide, boosting the industrial workwear market growth.MARKET CHALLENGES

Lack of Enforcement of Stringent Safety Standards

The lack of enforcement of stringent safety standards across several countries globally is expected to hinder the growth of the industrial workwear market. Implications of safety standards differ from country to country. Similar safety situations might not exist in other regions, regardless of regulatory frameworks. Therefore, a lack of awareness about safety standards and the implementation of strict safety standards across numerous developing countries is expected to restrain the industrial workwear industry.SEGMENTATION ANALYSIS

INSIGHTS BY PRODUCT

The top wear segment accounts for most of the market, comprising 37.97% of the market share in 2021. The global industrial workwear market by product type includes T-shirts, jackets, vests, shirts, and others. Industrial workwear can protect from several hazards as well as provide security. The global top wears industrial workwear market was valued at USD 13.54 billion in 2021 and is expected to reach USD 20.25 billion by 2027, growing at a CAGR of 6.94% during the forecast period. In the construction sector, most project managers wear flannel shirts or polos. On top of that, jackets can be worn; however should be of the right length, not bulky, & easy to move around in. Several industry players are focusing on enhancing products offered by them based on chemical, temperature, electronic, ballistic, and fire resistance, which is expected to affect industry development positively.Segmentation by Product

- Top wear

- Bottom wear

- Footwear

- Headwear

- Others

INSIGHTS BY MATERIAL TYPE

The global industrial workwear market on the basics of material type segment is segmented into polyester, cotton, nylon, specialty fabric, and others. Under this, the polyester segment dominates the global industry and is valued at USD 15.98 billion. Polyester is a synthetic fabric that can be used to make industrial workwear. It is also known as PET, polyethylene terephthalate, or microfiber. The global polyester industrial workwear market is expected to reach USD 23.05 billion by 2027, growing at a CAGR of 6.30% during the forecast period. When these fibers have been made, they can be woven into materials and used to generate diverse products containing clothing and workwear.Segmentation by Material Type:

- Polyester

- Cotton

- Nylon

- Specialty Fabric

- Others

INSIGHTS BY END-USERS

The conduction segment is the largest segment under the end-users segment and is estimated to reach USD 13.95 billion by 2027. The construction industry is one of the most lucrative vertical applications on the market for industrial workwear. The developments in the industrial workwear industry, especially across APAC's developing economies, have undergone a dramatic shift due to the increasing construction market. The workwear in the construction sector includes jackets, t-shirts, craftsman trousers, and many more. Employees on the construction site tend to work in hazardous conditions, which require appropriate and effective workwear to ensure their safety at the workplace. As a result, rising construction activities worldwide would drive industrial workwear demand and improve industry growth.Segmentation by End-User:

- Construction

- Oil & Gas

- Manufacturing

- Chemicals

- Automotive

- Mining

- Others

GEOGRAPHICAL ANALYSIS

The APAC region dominates the global industrial workwear market and accounts for 44.02% of the industry share. Countries such as China and India are expected to lead the demand for the industrial workwear market in the APAC region during the forecast period and increase revenue by exporting and importing materials. Further, the Asia Pacific region is home to several industries, including manufacturing, services, automobiles, and electrical. This consequently increases the need for industrial workwear in the region. While Japan and South Korea are prominent manufacturers and exporters of electrical appliances and automobiles, Singapore dominates with its excellent construction facilities.The industrial workwear market in North America is 21.39% of the market share in 2021. The market is expected to witness growth at a healthier rate due to strict regulations and guidelines by the government and local authorities. However, the industry has seen some decline in industrial workwear used in manufacturing, construction, and mining, among others owing to the COVID-19 pandemic and the authoritative shutdown few regional industries, particularly in 2020 & 2021. However, the industry is expected to grow due to increased demand from healthcare, chemical, and a few other sectors during the forecast period.

Segmentation by Geography

- North America

- U.S.

- Canada

- Europe

- UK

- Italy

- France

- Spain

- Germany

- APAC

- China

- Australia

- Japan

- South Korea

- India

- Middle East & Africa

- GCC

- South Africa

- Latin America

- Brazil

- Mexico

- Argentina

COMPETITIVE LANDSCAPE

The industrial workwear market is highly fragmented, with many medium and large enterprises. The more prominent players are expected to dominate the global industrial workwear market with their high-volume product lines, which have helped offset the cost variations. The industry is characterized by the presence of diversified international and regional vendors. Further, as international players would increase their footprint in the industry, regional vendors are expected to face challenges concerning the large customer base and variety in clothing for global industrial sectors. The industry competition is projected to intensify further with an increase in product/service extensions and M&As.Key Vendors

- 3M

- Milwaukee Tool

- Carhartt

- Bulwark Protection

- Sellstrom

- NSA-National Safety Apparel

- Pyramex

- Ergodyne

- ERB Safety

- Cintas

- LH Workwear

- Delta Plus

- Ballyclare

- Bennett Safetywear

- Asatex

- Alexandra

- Sanctum Work Wear

- Wenaas

- DEWALT

- Mallory

- Global Glove and Safety

- Sioen

- Robert Bosch

- Makita

- MSA

- Hultafors Group

- Benchmark

- Kolossus

Some of the key developments in the global industrial workwear market are listed as follows:

- In May 2018, National Safety Apparel (NSA) Acquired Rubin Brothers, a Chicago-based safety clothing producer, including its Union Line brand.

- In November 2021, Sentinel Capital Partners, a private equity firm focused on the lower midmarket, invested in RefrigiWear (Dahlonega, GA, US), which makes protective industrial workwear for indoor and outdoor use in sub-freezing temperatures and inclement weather environments. RefrigiWear’s products include outerwear, coveralls, bibs, pants, and protective handwear and footwear.

- In December 2021, BaltCap invested in Weekend (Tormi, Estonia), an omnichannel platform for apparel and footwear. BaltCap is a private equity fund manager in the Baltic states.

KEY QUESTIONS ANSWERED:

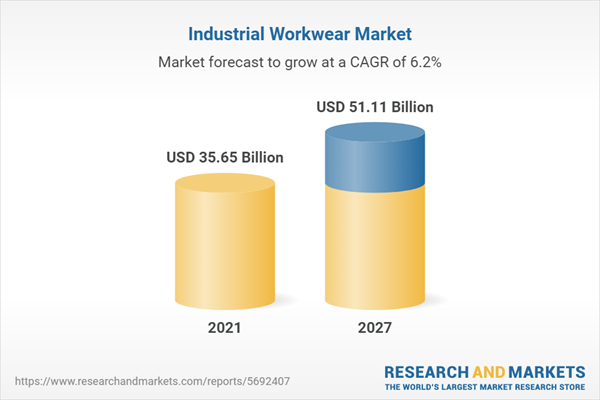

1. How big is the industrial workwear market?2. What is the projected market size of the global industrial workwear market by 2027?

3. What is the growth rate of the global industrial workwear market?

4. Which region dominates the global industrial workwear market?

5. What are the primary trends in the industrial workwear market?

6. Who are the key players in the global industrial workwear market?

Table of Contents

Companies Mentioned

- 3M

- Milwaukee Tool

- Carhartt

- Bulwark Protection

- Sellstrom

- NSA-National Safety Apparel

- Pyramex

- Ergodyne

- ERB Safety

- Cintas

- LH Workwear

- Delta Plus

- Ballyclare

- Bennett Safetywear

- Asatex

- Alexandra

- Sanctum Work Wear

- Wenaas

- DEWALT

- Mallory

- Global Glove and Safety

- Sioen

- Robert Bosch

- Makita

- MSA

- Hultafors Group

- Benchmark

- Kolossus

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 249 |

| Published | November 2022 |

| Forecast Period | 2021 - 2027 |

| Estimated Market Value ( USD | $ 35.65 Billion |

| Forecasted Market Value ( USD | $ 51.11 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 28 |