Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

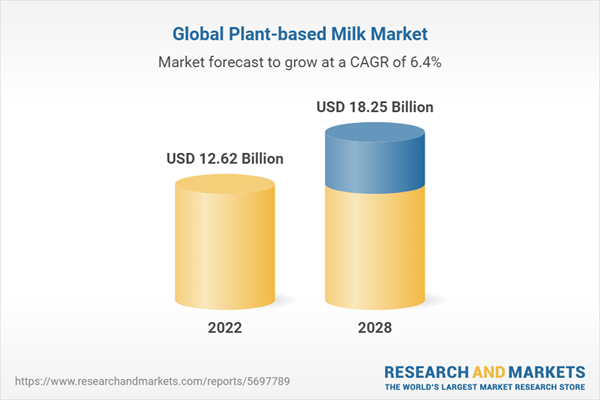

Overall, the plant-based milk market is a rapidly growing market with significant potential for growth in the coming years. This growth is being driven by a number of factors, including rising consumer awareness of the health and environmental benefits of plant-based milk, increasing availability of plant-based milk products, and growing vegan and vegetarian populations. Plant-based milk is becoming increasingly popular in foodservice applications. For example, many coffee shops now offer plant-based milk options for their lattes and cappuccinos. Plant-based milk companies are developing new and innovative products, such as plant-based yogurt, ice cream, and cheese. Plant-based milk is becoming more affordable and accessible, thanks to increased competition and economies of scale. The future of the plant-based milk market is bright. As consumers become more aware of the health and environmental benefits of plant-based milk, and as plant-based milk products become more affordable and accessible, the plant-based milk market is expected to continue to grow rapidly in the coming years.

The global plant-based milk market was experiencing significant growth due to various factors such as increased consumer awareness about health and sustainability, dietary preferences, and lactose intolerance. The plant-based milk market had expanded beyond traditional soy and almond milk to include a wide range of options such as oat milk, coconut milk, rice milk, hemp milk, and more. This diversity allowed consumers to choose products that suited their taste preferences and dietary needs. Growing health consciousness and concerns about lactose intolerance and allergies led many consumers to shift from dairy milk to plant-based alternatives, perceiving them as healthier options. Plant-based milks are often lower in saturated fat and cholesterol, and some are fortified with vitamins and minerals.

Key Market Drivers

Rising Health Consciousness Fuels the Global Plant-Based Milk Market Growth

In recent years, the global plant-based milk market has witnessed remarkable growth, driven by a significant shift in consumer preferences towards healthier and more sustainable dietary choices. This shift is closely linked to rising health consciousness among consumers, who are increasingly seeking alternatives to traditional dairy milk. In this comprehensive exploration, we delve into the profound impact of rising health consciousness on the global plant-based milk market, examining the key drivers, trends, and implications for the industry. The nexus between health consciousness and dietary choices cannot be overstated. As people become more aware of the impact of their food choices on their well-being, they are actively seeking ways to adopt healthier diets. Traditional dairy milk, once seen as a dietary staple, is now being scrutinized for its nutritional profile. The desire to reduce saturated fat, cholesterol, and calories from one's diet has led many to explore plant-based milk alternatives.One of the primary reasons behind the surge in plant-based milk consumption is the perceived health benefits. Many plant-based milks are naturally low in saturated fat and cholesterol, making them a desirable option for those concerned about heart health. Additionally, several varieties of plant-based milk are enriched with essential vitamins and minerals, such as calcium and vitamin D, making them comparable to or even surpassing the nutritional content of dairy milk. For instance, almond milk is known for being a good source of vitamin E and unsaturated fats, which can promote heart health. Soy milk is a complete protein source, making it a suitable option for individuals following vegetarian or vegan diets. Oat milk has gained popularity for its high fiber content, providing digestive benefits. These nutritional advantages align with the health-conscious consumer's desire for a well-rounded diet. Rising health consciousness is a powerful force driving the global plant-based milk market.

The Impact of New Product Launches on the Global Plant-Based Milk Market

The global plant-based milk market has witnessed remarkable growth in recent years, driven by a shift in consumer preferences towards healthier, sustainable, and ethical food choices. One of the key catalysts propelling this market forward is the continuous influx of new product launches. As consumers seek innovative and diverse alternatives to traditional dairy milk, manufacturers have responded with a wave of creativity, introducing an array of plant-based milk products that cater to various tastes and dietary needs. One of the primary ways in which new product launches have impacted the plant-based milk market is by offering consumers a wider range of options than ever before. Traditionally, soy and almond milk dominated the market, but today, consumers can choose from an extensive menu of plant-based milk alternatives, including oat milk, coconut milk, rice milk, hemp milk, and more. These innovations are designed to cater to different taste preferences and dietary requirements, ensuring that there is a plant-based milk option for everyone. For instance, Oat milk, in particular, gained immense popularity in recent years due to its creamy texture and ability to froth well, making it a favorite among coffee drinkers. This innovation has led to a surge in demand for oat milk products globally.The rise of veganism, vegetarianism, and flexitarianism (reducing animal product consumption) has significantly expanded the plant-based milk market. Plant-based milks are considered a staple in these diets, providing a dairy-free alternative that aligns with ethical and dietary choices. The introduction of new plant-based milk products represents a concerted effort by manufacturers to meet consumer demands for better taste, texture, and versatility. Innovation has been a driving force behind these product launches, with companies investing heavily in research and development. For instance, Flavored varieties, such as vanilla or chocolate almond milk, offer consumers a more indulgent experience. Barista-quality plant-based milks have been developed specifically for coffee shops, enabling consumers to enjoy their favorite coffee beverages without dairy.

In conclusion, new product launches have been a driving force in the global plant-based milk market, reshaping the industry and meeting the evolving demands of consumers. The introduction of diverse plant-based milk options fortified nutritional profiles, sustainable practices, and innovations in taste and texture have made these products increasingly appealing to a wide range of consumers.

Ease of Availability Driving Growth in the Global Plant-Based Milk Market

The global plant-based milk market has witnessed remarkable growth in recent years, and one of the key factors contributing to this expansion is the ease of availability of plant-based milk products. Consumers around the world are increasingly opting for plant-based milk over traditional dairy milk, and the availability of these products has played a pivotal role in shaping this trend. The shift towards plant-based milk has been a significant dietary trend over the past decade. It's no longer confined to niche markets or dietary preferences but has become mainstream. Plant-based milk options include almond, soy, oat, rice, coconut, hemp, and many more. This proliferation of choices caters to diverse tastes and dietary requirements, making it easier for consumers to find a product that suits their preferences. The availability of plant-based milk is evident on supermarket shelves. Major grocery store chains worldwide now stock a wide array of plant-based milk brands and varieties. Consumers can easily find these products in the dairy aisle or designated sections for plant-based alternatives. This placement increases visibility and accessibility, encouraging consumers to try these products.The digital age has ushered in a new era of convenience. Online retail platforms have become significant players in the plant-based milk market. Consumers can order their favorite plant-based milk products with a few clicks and have them delivered to their doorstep. Subscription services further enhance the ease of availability, allowing consumers to set up recurring deliveries, ensuring a constant supply of plant-based milk. The ease of availability of plant-based milk is not limited to a single region. This trend has gone global. Major players in the plant-based milk industry have expanded their distribution networks to reach consumers worldwide. For example, a brand that originated in Europe may now have a strong presence in North America, Asia, and other regions.

The global plant-based milk market has experienced remarkable growth, and the ease of availability has been a crucial factor in driving this expansion. The availability of plant-based milk in supermarkets, convenience stores, online retail platforms, food service establishments, and restaurants has made it accessible to consumers worldwide.

Key Market Challenges

High Prices

The global plant-based milk market has seen remarkable growth in recent years, driven by factors such as increased health consciousness, sustainability concerns, and dietary preferences. However, despite its growing popularity, one significant challenge that continues to persist in this market is the issue of high prices. Plant-based milk production often involves processes that can be cost-intensive. For example, almond milk production requires substantial water usage, and almond crops are susceptible to climate variations, which can impact yields. Oat milk production, on the other hand, involves the milling of oats and additional steps to extract the liquid. These processes contribute to the overall production costs. The cost of sourcing ingredients is a significant factor. High-quality nuts, grains, or legumes used in plant-based milk production can be expensive, particularly if they are sourced sustainably and ethically. Additionally, fluctuations in the prices of these raw materials can affect the final product's cost. Processing and manufacturing plant-based milk involve various steps, including grinding, soaking, blending, and, in some cases, fortification with vitamins and minerals. These processes require equipment and labor, adding to the overall cost.Competition and innovation in the plant-based milk market can also impact prices. While competition can drive innovation and improve efficiency, it can also lead to premium pricing for unique or specialized products. For example, specialty plant-based milk varieties, such as artisanal nut milk blends, tend to command higher prices. High prices can act as a barrier to entry for some consumers, particularly those with limited disposable income. While some consumers are willing to pay a premium for plant-based milk due to health or sustainability reasons, others may be deterred by the cost difference between plant-based and dairy milk. The challenge of high prices in the global plant-based milk market is a complex issue influenced by various factors, including production costs, sourcing, processing, and competition.

Competition from Conventional Dairy Brands

One of the most notable challenges in the plant-based milk market is the entry of established conventional dairy companies into the sector. These dairy giants, with their extensive resources, distribution networks, and brand recognition, have begun to diversify their product portfolios by introducing plant-based milk alternatives or acquiring existing plant-based milk brands. Conventional dairy brands benefit from decades, or even centuries, of brand recognition and consumer trust. When these companies enter the plant-based milk market, they often leverage their established reputations to gain a foothold. Consumers may be more inclined to try plant-based milk products from familiar names, which can pose a challenge to smaller, specialized plant-based brands.Conventional dairy companies have the resources to diversify their plant-based milk product lines quickly. They can introduce various flavors, formulations, and packaging options to cater to a broad range of consumer preferences. This ability to offer a wide selection of products can attract a larger customer base and make it more challenging for specialized plant-based brands to stand out. Competition from conventional dairy brands is a significant challenge in the global plant-based milk market. Established dairy companies leverage their brand recognition, distribution networks, and resources to enter the plant-based milk sector. This competition can make it difficult for specialized plant-based brands to gain market share, access distribution channels, and compete on pricing.

Key Market Trends

Diversification of Plant-Based Milk Varieties

One of the most prominent trends in the global plant-based milk market is the diversification of milk alternatives beyond traditional soy and almond milk. Consumers are now presented with a wide array of options, including oat, rice, coconut, hemp, and cashew milk, among others. This diversification caters to various dietary preferences, nutritional needs, and taste preferences. Oat milk has gained significant popularity in recent years, emerging as a strong contender in the plant-based milk market. This trend can be attributed to several factors. Firstly, oat milk has a naturally sweet flavor and creamy texture, making it a suitable replacement for dairy milk in coffee, lattes, and cereals. Secondly, it is often perceived as more sustainable than almond milk due to its lower water usage and smaller environmental footprint. Brands like Oatley have capitalized on this trend, leading to widespread availability of oat milk products. Another trend in plant-based milk diversification is the creation of specialized blends. Brands are combining various plant sources to create unique milk alternatives that offer a well-rounded nutritional profile. For instance, blends of almond and coconut or rice and pea protein aim to provide a balance of taste and nutrients.Health and Wellness Focus

Consumer awareness of health and wellness is a driving force behind the plant-based milk market. This trend encompasses several aspects, including lower saturated fat and cholesterol content, added vitamins and minerals, and reduced sugar levels in plant-based milk products. Many plant-based milk products are fortified with vitamins and minerals, such as calcium, vitamin D, and vitamin B12, to align with the nutritional profile of dairy milk. This fortification enhances the appeal of plant-based milk among health-conscious consumers, especially those who may be transitioning from dairy. Another health-oriented trend is the availability of low-sugar and unsweetened plant-based milk varieties. As consumers become more conscious of their sugar intake, manufacturers are responding with products that cater to this demand. Unsweetened almond, soy, and oat milk options have become increasingly prevalent on store shelves. To meet the needs of consumers looking to boost their protein intake, some plant-based milk brands offer protein-enriched versions. For instance, pea protein milk has gained popularity due to its higher protein content compared to almond or oat milk. These protein-rich options appeal to athletes, fitness enthusiasts, and individuals seeking plant-based protein sources.Retail Expansion and Convenience

The ease of availability of plant-based milk has played a pivotal role in its market growth. Retail expansion has been a key trend, making these products accessible to a broader consumer base. Plant-based milk products are now prominently featured in supermarkets, often placed alongside traditional dairy milk. This placement increases visibility and encourages consumers to explore plant-based options. Beyond supermarkets, convenience stores have embraced the trend of offering single-serving cartons of plant-based milk. This makes plant-based milk readily accessible, even when consumers are away from home, contributing to its convenience. The digital age has transformed the way consumers shop for plant-based milk. Online retail platforms and subscription services have gained traction, allowing consumers to order their preferred plant-based milk products with ease and have them delivered directly to their doorstep. This convenience factor appeals to busy individuals and those with specific dietary preferences.Segmental Insights

Type Insights

Based on type, the global plant-based milk market is mainly segmented into almond milk, soy milk, coconut milk, oat milk, rice milk, and others. According to projections, in 2022, the market for plant-based milk would be dominated by the almond milk category with market share of 29.99%. The leading position of this market sector is mainly related to elements including a rise in the number of customers switching to nut-based lactose-free milk, a change in consumer taste preferences, and an increase in general health & environmental concerns. It is anticipated that during the forecast period, this segment will increase. Due to soy-free and gluten-free products are becoming more and more popular, this market is expanding quickly.Regional Insights

Geographically, it is observed that Asia-Pacific would hold the greatest market share of 50.53% for plant-based milk in 2022. The significant market share of this region is primarily attributable to greater health consciousness, faster adoption of technical improvements in the F&B industry, and a larger demographic base of vegans and vegetarians. The western diet's rising popularity, the region's growing population, and more investment in the dairy substitutes industry are all major contributors to its rapid rise.Key Market Players

- Danone S.A.

- Hebei Yangyuan Zhihui Beverage Co., Ltd.

- Blue Diamond Growers

- Coconut Palm Group Co. Ltd.

- Oatly Group AB

- Califia Farms, LLC

- Earth’s Own Food Company Inc.

- The Hain Celestial Group, Inc.

- SunOpta, Inc.

- Ripple Foods PBC

- Australian Health and Nutrition Association Ltd

Report Scope

In this report, the Global Plant-Based Milk Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Plant-Based Milk Market, by Type

- Soy Milk

- Coconut Milk

- Almond Milk

- Oat Milk

- Others

Plant-Based Milk Market, by Category

- Flavored

- Non-Flavored

Plant-Based Milk Market, by Packaging

- Cartons

- Bottles

- Others

Plant-Based Milk Market, by Distribution Channel

- Convenience/Grocery Stores

- Supermarkets

- Online

- Others

Plant-Based Milk Market, by Region

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Plant-Based Milk Market.Available Customizations

The following customization option is available for the report based on your specific needs: Detailed analysis and profiling of additional market players (up to five).Table of Contents

Companies Mentioned

- Danone S.A.

- Hebei Yangyuan Zhihui Beverage Co., Ltd.

- Blue Diamond Growers

- Coconut Palm Group Co. Ltd.

- Oatly Group AB

- Califia Farms, LLC

- Earth’s Own Food Company Inc.

- The Hain Celestial Group, Inc.

- SunOpta, Inc.

- Ripple Foods PBC

- Australian Health and Nutrition Association Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 178 |

| Published | October 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 12.62 Billion |

| Forecasted Market Value ( USD | $ 18.25 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |