Cardiac prosthetic devices refer to artificial devices or implants designed to replace or assist the normal functioning of the heart. They are used in the treatment of various heart conditions, such as heart failure, valve disorders, or congenital heart defects. They can be broadly categorized into two types, artificial heart valves and mechanical circulatory support devices. Artificial heart valves are used to replace damaged or diseased heart valves, restoring normal blood flow through the heart. On the other hand, mechanical circulatory support devices are used to assist or replace the pumping function of the heart, often employed as a bridge to transplantation or as a long-term solution for patients ineligible for heart transplantation. Additionally, they are manufactured of biocompatible materials and are meticulously designed to replicate the structure and function of the heart, thereby improving the patient's cardiac function and quality of life.

The industry is driven by the aging global population. As the population continues to age, the incidence of cardiovascular diseases increases, leading to a higher demand for cardiac prosthetic devices. Additionally, continual advancements in medical technology and surgical techniques have improved the survival rates of patients with cardiovascular diseases, this is creating a larger patient pool for these devices. Along with this, the increasing awareness about cardiovascular health and the availability of treatment options among the masses is fueling the product demand. Also, patients are seeking timely interventions, including the use of cardiac prosthetic devices, to improve their quality of life and prolong survival, which is positively influencing the market. Other factors, including continual developments in the healthcare sector and extensive research and development (R&D) activities conducted by key players, are also positively influencing the market.

Cardiac Prosthetic Devices Market Trends/Drivers:

Increasing Prevalence of Cardiovascular Diseases and their Awareness

Cardiovascular diseases, including coronary artery disease, heart failure, and valvular heart diseases, are significant contributors to morbidity and mortality across the globe. Additionally, the increasing awareness about heart diseases, preventive measures, and the availability of treatment options has led to earlier detection and diagnosis of cardiovascular conditions. Improved diagnostic capabilities, including advanced imaging techniques, such as echocardiography and cardiac MRI, facilitate accurate diagnosis and identification of patients who may benefit from cardiac prosthetic devices. The combination of public awareness and the rising prevalence of numerous diseases has led to an increasing product demand. As more individuals are diagnosed with CVDs at an earlier stage, there is a growing pool of patients who could benefit from interventions involving cardiac prosthetics.The Implementation of Favorable Reimbursement Policies

Reimbursement plays a vital role in the adoption of cardiac prosthetic devices. Favorable reimbursement policies offered by government healthcare systems and private insurance providers incentivize healthcare providers to offer these devices and procedures to their patients. This creates a conducive environment for market growth, as it reduces financial barriers for patients and promotes the use of cardiac prosthetic devices. In addition, the rising disease burden, and advances in medical technology are increasing healthcare expenditure across the globe. This higher healthcare spending is contributing to the affordability and accessibility of cardiac prosthetic devices, making them more widely available to patients in need. Besides this, market players are establishing partnerships, collaborations, and distribution networks, which are acting as another growth-inducing factor.Continual Technological Innovations in Cardiac Surgery Techniques and Devices

Continuous advancements in cardiac surgical techniques, such as minimally invasive procedures, robotic-assisted surgeries, and transcatheter interventions, have expanded the scope of treating various cardiac conditions. These advancements have increased product utilization, including heart valves, ventricular assist devices (VADs), and pacemakers, as they play a crucial role in these procedures. Rapid advancements in technology have revolutionized the design and functionality of cardiac prosthetic devices. For instance, the development of transcatheter heart valves has enabled less invasive valve replacement procedures, reducing patient trauma and recovery time. Additionally, the integration of wireless connectivity, remote monitoring capabilities, and advanced sensors in pacemakers and implantable cardioverter-defibrillators (ICDs) has improved patient care and outcomes, creating a positive market outlook.Cardiac Prosthetic Devices Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global cardiac prosthetic devices report, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on product type and end-user.Breakup by Product Type:

- Valves

- Mechanical Valve

- Tissue Valve

- Stented Tissue Valve

- Stentless Tissue Valve

- Transcatheter Valve

- Pacemakers

- Implantable Pacemakers

- Single-Chamber Battery Pacemaker

- Dual-Chamber Battery Pacemaker

- Triple-Chamber Battery Pacemaker

- External Pacemakers

- Others

Valves dominate the market

The report has provided a detailed breakup and analysis of the market based on the product type. This includes valves (mechanical valve, tissue valve, stented tissue valve, stentless tissue valve, and transcatheter valve), pacemakers, implantable pacemakers (single-chamber battery pacemaker, dual-chamber battery pacemaker, and triple-chamber battery pacemaker), external pacemakers, and others. According to the report, valves represented the largest segment.Continual technological advancements in valve design and materials have improved the durability, functionality, and overall performance of devices, leading to greater acceptance and adoption. Additionally, the increasing focus on minimally invasive procedures and the development of transcatheter heart valve replacement techniques are positively influencing the demand for valve products.

Additionally, continuous advancements in medical technology have led to the development of innovative pacemaker devices with improved features and functionalities, including wireless connectivity and remote monitoring capabilities, which further drive market growth. Moreover, the rising prevalence of lifestyle-related diseases, such as obesity and diabetes, which are risk factors for heart ailments, is fueling the demand for pacemakers across the globe.

Breakup by End-User:

- Hospitals, Clinics and Cardiac Centers

- Ambulatory Surgical Centers

- Others

Hospitals, clinics and cardiac centers hold the largest share in the market

A detailed breakup and analysis of the market based on the end-user has also been provided in the report. This includes hospitals, clinics and cardiac centers, ambulatory surgical centers, and others. According to the report, hospitals, clinics, and cardiac centers accounted for the largest market share.The increasing usage of these devices in hospitals, clinics, and cardiac centers can be attributed to the continual advancements in medical technology and surgical techniques. The continuous development of innovative devices, such as artificial heart valves and implantable pacemakers, enables healthcare providers to offer improved treatment options to patients. Furthermore, various government initiatives and healthcare reforms aimed at enhancing cardiovascular care and improving patient outcomes also serve as major market drivers for the end-users in the industry.

On the contrary, ambulatory surgical centers (ASCs) as end-users in the cardiac offer numerous advantages, such as cost-effectiveness, convenience, and reduced hospital stays, which are particularly appealing to patients seeking cardiac procedures. These centers provide a suitable environment for minimally invasive surgeries and outpatient treatments, aligning with the growing trend towards value-based healthcare. Additionally, advancements in technology have made it feasible to perform complex cardiac procedures in ASCs, further fueling the market demand in this segment over the forecast period.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance, accounting for the largest the cardiac prosthetic devices market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa.The market in North America is driven by the increasing prevalence of cardiovascular diseases and the growing aging population. As heart-related conditions become more common, the need for devices such as heart valves, pacemakers, and implantable defibrillators is growing. Additionally, the healthcare system across the region focuses on quality healthcare delivery and reimbursement support for medical devices also plays a significant role in the growth of the market. Moreover, research and development efforts aimed at developing innovative and minimally invasive prosthetic devices are significantly supporting the market.

On the contrary, Asia Pacific is estimated to expand further in this domain in the coming years due to the aging population and changing lifestyles. In confluence with this, advancements in healthcare infrastructure and the rising disposable income in several countries within the Asia Pacific region have improved access to medical treatments and increased affordability. Furthermore, ongoing technological advancements and innovations in the field are driving the market in Asia Pacific.

Competitive Landscape:

The market is experiencing significant growth due to the continual advancements in medical technology and surgical procedures leading to the development of innovative and more efficient devices. Additionally, the integration of digital health technologies is creating opportunities for companies to offer remote monitoring solutions and personalized healthcare services, enhancing patient outcomes and increasing the overall value proposition of their products. Also, numerous companies are developing tailored solutions to address specific patient needs, this is gaining prominence across the globe. Moreover, the development of 3D printing technology has further facilitated the production of patient-specific devices, allowing for better fit and improved functionality. Additionally, top companies are investing in research and development to create customizable solutions and collaborate with healthcare professionals to understand patient requirements, which is influencing the market.The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Abbott Laboratories

- Biotronik

- Boston Scientific Corporation

- Edwards Lifesciences Corporation

- Lepu Medical Technology Co. Ltd.

- Medtronic Inc.

- Meril Life Sciences Pvt. Ltd.

- Siemens Healthcare GmbH

- Sorin Group

- St. Jude Medical Inc.

Key Questions Answered in This Report:

- How has the global cardiac prosthetic devices market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global cardiac prosthetic devices market?

- What is the impact of each driver, restraint, and opportunity on the global cardiac prosthetic devices market?

- What are the key regional markets?

- Which countries represent the most attractive cardiac prosthetic devices market?

- What is the breakup of the market based on the product type?

- Which is the most attractive product type in the cardiac prosthetic devices market?

- What is the breakup of the market based on the end-user?

- Which is the most attractive end-user in the cardiac prosthetic devices market?

- What is the competitive structure of the global cardiac prosthetic devices market?

- Who are the key players/companies in the global cardiac prosthetic devices market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Cardiac Prosthetic Devices Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Forecast

6 Market Breakup by Product Type

6.1 Valves

6.1.1 Market Trends

6.1.2 Major Types

6.1.2.1 Mechanical Valve

6.1.2.2 Tissue Valve

6.1.2.3 Stented Tissue Valve

6.1.2.4 Stentless Tissue Valve

6.1.2.5 Transcatheter Valve

6.1.3 Market Forecast

6.2 Pacemakers

6.2.1 Market Trends

6.2.2 Market Forecast

6.3 Implantable Pacemakers

6.3.1 Market Trends

6.3.2 Major Types

6.3.2.1 Single-Chamber Battery Pacemaker

6.3.2.2 Dual-Chamber Battery Pacemaker

6.3.2.3 Triple-Chamber Battery Pacemaker

6.3.3 Market Forecast

6.4 External Pacemakers

6.4.1 Market Trends

6.4.2 Market Forecast

6.5 Others

6.5.1 Market Trends

6.5.2 Market Forecast

7 Market Breakup by End-User

7.1 Hospitals, Clinics and Cardiac Centers

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Ambulatory Surgical Centers

7.2.1 Market Trends

7.2.2 Market Forecast

7.3 Others

7.3.1 Market Trends

7.3.2 Market Forecast

8 Market Breakup by Region

8.1 North America

8.1.1 United States

8.1.1.1 Market Trends

8.1.1.2 Market Forecast

8.1.2 Canada

8.1.2.1 Market Trends

8.1.2.2 Market Forecast

8.2 Asia Pacific

8.2.1 China

8.2.1.1 Market Trends

8.2.1.2 Market Forecast

8.2.2 Japan

8.2.2.1 Market Trends

8.2.2.2 Market Forecast

8.2.3 India

8.2.3.1 Market Trends

8.2.3.2 Market Forecast

8.2.4 South Korea

8.2.4.1 Market Trends

8.2.4.2 Market Forecast

8.2.5 Australia

8.2.5.1 Market Trends

8.2.5.2 Market Forecast

8.2.6 Indonesia

8.2.6.1 Market Trends

8.2.6.2 Market Forecast

8.2.7 Others

8.2.7.1 Market Trends

8.2.7.2 Market Forecast

8.3 Europe

8.3.1 Germany

8.3.1.1 Market Trends

8.3.1.2 Market Forecast

8.3.2 France

8.3.2.1 Market Trends

8.3.2.2 Market Forecast

8.3.3 United Kingdom

8.3.3.1 Market Trends

8.3.3.2 Market Forecast

8.3.4 Italy

8.3.4.1 Market Trends

8.3.4.2 Market Forecast

8.3.5 Spain

8.3.5.1 Market Trends

8.3.5.2 Market Forecast

8.3.6 Russia

8.3.6.1 Market Trends

8.3.6.2 Market Forecast

8.3.7 Others

8.3.7.1 Market Trends

8.3.7.2 Market Forecast

8.4 Latin America

8.4.1 Brazil

8.4.1.1 Market Trends

8.4.1.2 Market Forecast

8.4.2 Mexico

8.4.2.1 Market Trends

8.4.2.2 Market Forecast

8.4.3 Others

8.4.3.1 Market Trends

8.4.3.2 Market Forecast

8.5 Middle East and Africa

8.5.1 Market Trends

8.5.2 Market Breakup by Country

8.5.3 Market Forecast

9 SWOT Analysis

9.1 Overview

9.2 Strengths

9.3 Weaknesses

9.4 Opportunities

9.5 Threats

10 Value Chain Analysis

11 Porters Five Forces Analysis

11.1 Overview

11.2 Bargaining Power of Buyers

11.3 Bargaining Power of Suppliers

11.4 Degree of Competition

11.5 Threat of New Entrants

11.6 Threat of Substitutes

12 Price Analysis

13 Competitive Landscape

13.1 Market Structure

13.2 Key Players

13.3 Profiles of Key Players

13.3.1 Abbott Laboratories

13.3.1.1 Company Overview

13.3.1.2 Product Portfolio

13.3.2 Biotronik

13.3.2.1 Company Overview

13.3.2.2 Product Portfolio

13.3.3 Boston Scientific Corporation

13.3.3.1 Company Overview

13.3.3.2 Product Portfolio

13.3.4 Edwards Lifesciences Corporation

13.3.4.1 Company Overview

13.3.4.2 Product Portfolio

13.3.5 Lepu Medical Technology Co. Ltd.

13.3.5.1 Company Overview

13.3.5.2 Product Portfolio

13.3.6 Medtronic Inc.

13.3.6.1 Company Overview

13.3.6.2 Product Portfolio

13.3.7 Meril Life Sciences Pvt. Ltd.

13.3.7.1 Company Overview

13.3.7.2 Product Portfolio

13.3.8 Siemens Healthcare GmbH

13.3.8.1 Company Overview

13.3.8.2 Product Portfolio

13.3.9 Sorin Group

13.3.9.1 Company Overview

13.3.9.2 Product Portfolio

13.3.10 St. Jude Medical Inc.

13.3.10.1 Company Overview

13.3.10.2 Product Portfolio

List of Figures

Figure 1: Global: Cardiac Prosthetic Devices Market: Major Drivers and Challenges

Figure 2: Global: Cardiac Prosthetic Devices Market: Sales Value (in Billion USD), 2019-2024

Figure 3: Global: Cardiac Prosthetic Devices Market: Breakup by Product Type (in %), 2024

Figure 4: Global: Cardiac Prosthetic Devices Market: Breakup by End-User (in %), 2024

Figure 5: Global: Cardiac Prosthetic Devices Market: Breakup by Region (in %), 2024

Figure 6: Global: Cardiac Prosthetic Devices Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 7: Global: Cardiac Prosthetic Devices (Valves) Market: Sales Value (in Million USD), 2019 & 2024

Figure 8: Global: Cardiac Prosthetic Devices (Valves) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 9: Global: Cardiac Prosthetic Devices (Pacemakers) Market: Sales Value (in Million USD), 2019 & 2024

Figure 10: Global: Cardiac Prosthetic Devices (Pacemakers) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 11: Global: Cardiac Prosthetic Devices (Implantable Pacemakers) Market: Sales Value (in Million USD), 2019 & 2024

Figure 12: Global: Cardiac Prosthetic Devices (Implantable Pacemakers) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 13: Global: Cardiac Prosthetic Devices (External Pacemakers) Market: Sales Value (in Million USD), 2019 & 2024

Figure 14: Global: Cardiac Prosthetic Devices (External Pacemakers) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 15: Global: Cardiac Prosthetic Devices (Others) Market: Sales Value (in Million USD), 2019 & 2024

Figure 16: Global: Cardiac Prosthetic Devices (Others) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 17: Global: Cardiac Prosthetic Devices (Hospitals, Clinics and Cardiac Centers) Market: Sales Value (in Million USD), 2019 & 2024

Figure 18: Global: Cardiac Prosthetic Devices (Hospitals, Clinics and Cardiac Centers) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 19: Global: Cardiac Prosthetic Devices (Ambulatory Surgical Centers) Market: Sales Value (in Million USD), 2019 & 2024

Figure 20: Global: Cardiac Prosthetic Devices (Ambulatory Surgical Centers) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 21: Global: Cardiac Prosthetic Devices (Others) Market: Sales Value (in Million USD), 2019 & 2024

Figure 22: Global: Cardiac Prosthetic Devices (Others) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 23: North America: Cardiac Prosthetic Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 24: North America: Cardiac Prosthetic Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 25: United States: Cardiac Prosthetic Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 26: United States: Cardiac Prosthetic Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 27: Canada: Cardiac Prosthetic Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 28: Canada: Cardiac Prosthetic Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 29: Asia Pacific: Cardiac Prosthetic Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 30: Asia Pacific: Cardiac Prosthetic Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 31: China: Cardiac Prosthetic Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 32: China: Cardiac Prosthetic Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 33: Japan: Cardiac Prosthetic Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 34: Japan: Cardiac Prosthetic Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 35: India: Cardiac Prosthetic Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 36: India: Cardiac Prosthetic Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 37: South Korea: Cardiac Prosthetic Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 38: South Korea: Cardiac Prosthetic Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 39: Australia: Cardiac Prosthetic Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 40: Australia: Cardiac Prosthetic Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 41: Indonesia: Cardiac Prosthetic Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 42: Indonesia: Cardiac Prosthetic Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 43: Others: Cardiac Prosthetic Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 44: Others: Cardiac Prosthetic Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 45: Europe: Cardiac Prosthetic Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 46: Europe: Cardiac Prosthetic Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 47: Germany: Cardiac Prosthetic Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 48: Germany: Cardiac Prosthetic Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 49: France: Cardiac Prosthetic Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 50: France: Cardiac Prosthetic Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 51: United Kingdom: Cardiac Prosthetic Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 52: United Kingdom: Cardiac Prosthetic Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 53: Italy: Cardiac Prosthetic Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 54: Italy: Cardiac Prosthetic Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 55: Spain: Cardiac Prosthetic Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 56: Spain: Cardiac Prosthetic Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 57: Russia: Cardiac Prosthetic Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 58: Russia: Cardiac Prosthetic Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 59: Others: Cardiac Prosthetic Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 60: Others: Cardiac Prosthetic Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 61: Latin America: Cardiac Prosthetic Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 62: Latin America: Cardiac Prosthetic Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 63: Brazil: Cardiac Prosthetic Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 64: Brazil: Cardiac Prosthetic Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 65: Mexico: Cardiac Prosthetic Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 66: Mexico: Cardiac Prosthetic Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 67: Others: Cardiac Prosthetic Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 68: Others: Cardiac Prosthetic Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 69: Middle East and Africa: Cardiac Prosthetic Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 70: Middle East and Africa: Cardiac Prosthetic Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 71: Global: Cardiac Prosthetic Devices Industry: SWOT Analysis

Figure 72: Global: Cardiac Prosthetic Devices Industry: Value Chain Analysis

Figure 73: Global: Cardiac Prosthetic Devices Industry: Porter’s Five Forces Analysis

List of Tables

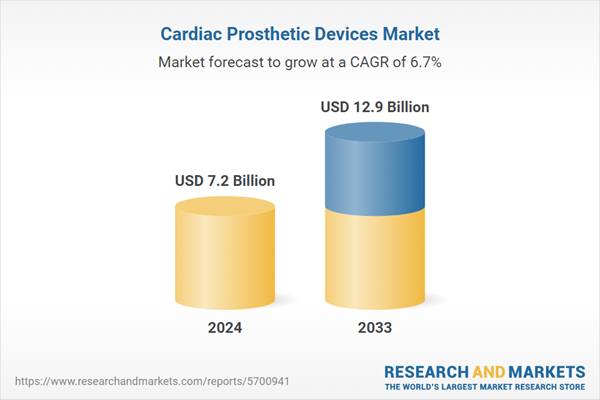

Table 1: Global: Cardiac Prosthetic Devices Market: Key Industry Highlights, 2024 and 2033

Table 2: Global: Cardiac Prosthetic Devices Market Forecast: Breakup by Product Type (in Million USD), 2025-2033

Table 3: Global: Cardiac Prosthetic Devices Market Forecast: Breakup by End-User (in Million USD), 2025-2033

Table 4: Global: Cardiac Prosthetic Devices Market Forecast: Breakup by Region (in Million USD), 2025-2033

Table 5: Global: Cardiac Prosthetic Devices Market: Competitive Structure

Table 6: Global: Cardiac Prosthetic Devices Market: Key Players

Companies Mentioned

- Abbott Laboratories

- Biotronik

- Boston Scientific Corporation

- Edwards Lifesciences Corporation

- Lepu Medical Technology Co. Ltd.

- Medtronic Inc.

- Meril Life Sciences Pvt. Ltd.

- Siemens Healthcare GmbH

- Sorin Group and St. Jude Medical Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 149 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 7.2 Billion |

| Forecasted Market Value ( USD | $ 12.9 Billion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |