Rising Health Consciousness

The rising health consciousness among people is fueling the demand for smart bikes. Regular exercise using smart bikes helps people improve their cardio-respiratory capacity, thus, reducing the risk of cardiovascular disease. Cycling also helps in improving lungs and breathing capacity. People with chronic lung disease, asthma, or chronic obstructive pulmonary diseases (COPD) can improve their symptoms through physical activities, which smart bikes help increase. Now people are building a habit of working out regularly as it helps them to feel more confident, decreases stress and anxiety, reduces the risk of various diseases, has anti-depressive effects, and is highly efficient against bad cholesterol. Due to this, the demand for smart bikes has increased.Regular exercise on a smart bike is good for toning legs, thighs, buttocks, arms, and abdominal and back muscles. It also helps burn a lot of calories, thus, making it very effective for weight loss. For instance, 1 hour of exercise on a smart bike helps to burn 413 to 738 kcal, so to lose 1 kg weight, a person should exercise for 1 hour 3 times a week. Not just this, regular exercise using a smart bike also reduces the risk of type 2 diabetes as it helps lower blood glucose levels in diabetic people.

Physical activities, such as cycling, increase hormone secretion, such as endorphins and serotonin, which improve individuals' health and help regulate mood, stress, and anxiety. Regular cycling promotes good cholesterol and lowers bad cholesterol. It helps to reduce the risks and delay the symptoms of degenerative diseases, such as Parkinson's or Alzheimer's. The growing awareness regarding such benefits and different technological advantages of smart bikes has been promoting the market.

Smart bikes also give the feel of an actual ride with health benefits. When opting for different modes, riders feel like riding on a road or hills. The movement of the handle and seat make it more realistic for a rider when riding the bike in the above-mentioned mode. Advanced smart bike technologies help attract more customers and make the rider work more enthusiastically, thus helping them fight the above health issue. Thus, these advantages are fueling the demand for smart bikes, aiding the market growth.

Market Overview

The North America smart bike market is spread across the US, Canada, and Mexico. The market growth in this region is attributed to the rising awareness regarding health issues among North American offices. To help improve employees' health, employers have implemented corporate wellness programs in their organizations. This organizations are providing subscriptions to their employees which is providing the awareness about smart bike in the market, making it one of the primary factors driving the growth of the smart bike market in North America.Due to the subscription provided by the organizations to their employees, the visit to the gym is increasing. Because of this the demand for smart bike in gym are increasing thus boosting the market growth. According to Rand Corp. and the US Department of Health and Human Services, 80% of businesses with more than 50 employees are benefited from corporate wellness programs. It helped them reduce absenteeism and improve employee well-being. The program also positively impacts various aspects of a business's bottom line, such as its medical costs. For instance, Los Alamos National Laboratory implemented wellness programs that helped them to reduce their annual healthcare premium. Los Alamos's healthcare premium is stabilized at 2.5%, which is lower than the national average of 7%.

Many smart bike manufacturers have a significant presence in North America, such as Peloton Interactive, Inc.; Nautilus, Inc.; Echelon Fitness Multimedia LLC; Johnson Fitness; Mad Dogg Athletics; and Wahoo Fitness LLC. The development of smart bikes by these manufacturers is boosting the demand for smart bikes in the region even further. Manufacturers are also specifically launching products for wellness programs. For instance, in June 2021, Peloton Interactive, Inc. announced Peloton Corporate Wellness, connecting Peloton fitness products to businesses and organizations. Under this, the company will provide subsidized access to Peloton Digital and All Access Memberships to organizations.

North America Smart Bike Market Segmentation

The North America smart bike market is segmented into Connectivity, handle type, application, and country.- Based on connectivity, the market is sub segmented into Bluetooth andwi-fi. The Bluetooth segment held the larger market share in 2022.

- Based on handle type, the market is segmented into fixed handle type and moving handle type. The fixed handle type segment held a larger market share in 2022.

- Based on application, the market is segmented into residential and commercial. The residential segment held the larger market share in 2022.

- Based on country, the market is segmented into the US, Canada, and Mexico. The US dominated the market share in 2022.

Table of Contents

1. Introduction1.1 Study Scope

1.2 Research Report Guidance

1.3 Market Segmentation

1.3.1 North America Smart Bike Market - By Connectivity

1.3.2 North America Smart Bike Market - By Handle Type

1.3.3 North America Smart Bike Market - By Application

1.3.4 North America Smart Bike Market- By Country

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. North America Smart Bike Market Landscape

4.1 Market Overview

4.2 North America PEST Analysis

4.3 Ecosystem Analysis

4.4 Expert Opinion

5. North America Smart Bike Market - Key Market Dynamics

5.1 Market Drivers

5.1.1 Rising Health Consciousness

5.1.2 Technological Advancement in Smart Bikes

5.2 Market Restraints

5.2.1 High Initial Investment

5.3 Market Opportunities

5.3.1 Rising Interest in Smart Bikes in Developing Nations

5.4 Future Trends

5.4.1 Corporate Wellness Programs

5.5 Impact Analysis of Drivers and Restraints

6. Smart Bike Market - North America Analysis

6.1 North America Smart Bike Market Overview

6.2 North America Smart Bike Market - Revenue and Forecast to 2028 (US$ Million)

7. North America Smart Bike Market Analysis - By Connectivity

7.1 Overview

7.2 North America Smart Bike Market, By Connectivity (2021 and 2028)

7.3 Bluetooth

7.3.1 Overview

7.3.2 Bluetooth: North America Smart Bike Market - Revenue, and Forecast to 2028 (US$ Million)

7.4 Wi-Fi

7.4.1 Overview

7.4.2 Wi-Fi: North America Smart Bike Market - Revenue, and Forecast to 2028 (US$ Million)

8. North America Smart Bike Market Analysis - By Handle Type

8.1 Overview

8.2 North America Smart Bike Market Breakdown, By Handle Type, 2021 & 2028

8.3 Fixed Handle Type

8.3.1 Overview

8.3.2 Fixed Handle Type Market Revenue and Forecast to 2028 (US$ Million)

8.4 Moving Handle Type

8.4.1 Overview

8.4.2 Moving Handle Type Market Revenue and Forecast to 2028 (US$ Million)

9. North America Smart Bike Market Analysis - By Application

9.1 Overview

9.2 North America Smart Bike Market Breakdown, By Handle Type, 2021 & 2028

9.3 Residential

9.3.1 Overview

9.3.2 Residential Market Revenue and Forecast to 2028 (US$ Million)

9.4 Commercial

9.4.1 Overview

9.4.2 Commercial Market Revenue and Forecast to 2028 (US$ Million)

10. North America Smart Bike Market - Country Analysis

10.1 Overview

10.1.1 North America Smart Bike Market Breakdown, by Country

10.1.1.1 US Smart Bike Market, Revenue and Forecast to 2028

10.1.1.1.1 US Smart Bike Market Breakdown, By Connectivity

10.1.1.1.2 US Smart Bike Market Breakdown, By Handle Type

10.1.1.1.3 US Smart Bike Market Breakdown, By Application

10.1.1.2 Canada Smart Bike Market, Revenue and Forecast to 2028

10.1.1.2.1 Canada Smart Bike Market Breakdown, By Connectivity

10.1.1.2.2 Canada Smart Bike Market Breakdown, By Handle Type

10.1.1.2.3 Canada Smart Bike Market Breakdown, By Application

10.1.1.3 Mexico Smart Bike Market, Revenue and Forecast to 2028

10.1.1.3.1 Mexico Smart Bike Market Breakdown, By Connectivity

10.1.1.3.2 Mexico Smart Bike Market Breakdown, By Handle Type

10.1.1.3.3 Mexico Smart Bike Market Breakdown, By Application

11. Industry Landscape

11.1 Overview

11.2 Market Initiative

11.3 New Product Development

11.4 Mergers and Acquisitions

12. Company Profiles

12.1 Echelon Fitness Multimedia, LLC.

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.1.6 Key Developments

12.2 Garmin Ltd.

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Products and Services

12.2.4 Financial Overview

12.2.5 SWOT Analysis

12.2.6 Key Developments

12.3 Keiser Corporation

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Products and Services

12.3.4 Financial Overview

12.3.5 SWOT Analysis

12.3.6 Key Developments

12.4 Life Fitness

12.4.1 Key Facts

12.4.2 Business Description

12.4.3 Products and Services

12.4.4 Financial Overview

12.4.5 SWOT Analysis

12.4.6 Key Developments

12.5 Nautilus, Inc.

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Products and Services

12.5.4 Financial Overview

12.5.5 SWOT Analysis

12.5.6 Key Developments

12.6 Peloton Interactive, Inc.

12.6.1 Key Facts

12.6.2 Business Description

12.6.3 Products and Services

12.6.4 Financial Overview

12.6.5 SWOT Analysis

12.6.6 Key Developments

12.7 Wahoo Fitness

12.7.1 Key Facts

12.7.2 Business Description

12.7.3 Products and Services

12.7.4 Financial Overview

12.7.5 SWOT Analysis

12.7.6 Key Developments

12.8 Johnson Health Tech

12.8.1 Key Facts

12.8.2 Business Description

12.8.3 Products and Services

12.8.4 Financial Overview

12.8.5 SWOT Analysis

12.8.6 Key Developments

12.9 MAD DOGG ATHLETICS

12.9.1 Key Facts

12.9.2 Business Description

12.9.3 Products and Services

12.9.4 Financial Overview

12.9.5 SWOT Analysis

12.9.6 Key Developments

12.10 SOLE FITNESS

12.10.1 Key Facts

12.10.2 Business Description

12.10.3 Products and Services

12.10.4 Financial Overview

12.10.5 SWOT Analysis

12.10.6 Key Developments

13. Appendix

13.1 About the Publisher

13.2 Word Index

List of Tables

Table 1. North America Smart Bike Market - Revenue and Forecast to 2028 (US$ Million)

Table 2. North America Smart Bike Market, by Country - Revenue and Forecast to 2028 (US$ Million)

Table 3. US Smart Bike Market, by Connectivity - Revenue and Forecast to 2028 (US$ Million)

Table 4. US Smart Bike Market, By Handle Type - Revenue and Forecast to 2028 (US$ Million)

Table 5. US Smart Bike Market, by Application - Revenue and Forecast to 2028 (US$ Million)

Table 6. Canada Smart Bike Market, by Connectivity - Revenue and Forecast to 2028 (US$ Million)

Table 7. Canada Smart Bike Market, By Handle Type - Revenue and Forecast to 2028 (US$ Million)

Table 8. Canada Smart Bike Market, by Application - Revenue and Forecast to 2028 (US$ Million)

Table 9. Mexico Smart Bike Market, by Connectivity - Revenue and Forecast to 2028 (US$ Million)

Table 10. Mexico Smart Bike Market, By Handle Type - Revenue and Forecast to 2028 (US$ Million)

Table 11. Mexico Smart Bike Market, by Application - Revenue and Forecast to 2028 (US$ Million)

Table 12. List of Abbreviation

List of Figures

Figure 1. North America Smart Bike Market Segmentation

Figure 2. North America Smart Bike Market Segmentation - By Country

Figure 3. North America Smart Bike Market Overview

Figure 4. Bluetooth Segment Held the Largest Share of North America Smart Bike Market

Figure 5. Fixed Handle Type Segment Held the Largest Share of North America Smart Bike Market

Figure 6. Residential Segment Held the Largest Share of North America Smart Bike Market

Figure 7. US to Show Great Traction During Forecast Period

Figure 8. North America: PEST Analysis

Figure 9. Expert Opinion

Figure 10. North America Smart Bike Market Impact Analysis of Drivers and Restraints

Figure 11. North America Smart Bike Market - Revenue and Forecast to 2028 (US$ Million)

Figure 12. North America Smart Bike Market Revenue Share, By Connectivity (2021 and 2028)

Figure 13. Bluetooth: North America Smart Bike Market - Revenue, and Forecast to 2028 (US$ Million)

Figure 14. Wi-Fi: North America Smart Bike Market - Revenue, and Forecast to 2028 (US$ Million)

Figure 15. North America Smart Bike Market Breakdown, By Handle Type (2021 and 2028)

Figure 16. Fixed Handle Type Market Revenue and Forecast to 2028 (US$ Million)

Figure 17. Moving Handle Type Market Revenue and Forecast to 2028(US$ Million)

Figure 18. North America Smart Bike Market Breakdown, By Handle Type (2021 and 2028)

Figure 19. Residential Market Revenue and Forecast to 2028 (US$ Million)

Figure 20. Commercial Market Revenue and Forecast to 2028 (US$ Million)

Figure 21. North America Smart Bike Market, by Key Country Revenue (2021) (US$ Million)

Figure 22. North America Smart Bike Market Breakdown, by Country, 2021 & 2028 (%)

Figure 23. US Smart Bike Market, Revenue and Forecast to 2028 (US$ Million)

Figure 24. Canada Smart Bike Market, Revenue and Forecast to 2028 (US$ Million)

Figure 25. Mexico Smart Bike Market, Revenue and Forecast to 2028 (US$ Million)

Companies Mentioned

- Echelon Fitness Multimedia, LLC.

- Garmin Ltd.

- Johnson Health Tech

- Keiser Corporation

- Life Fitness

- MAD DOGG ATHLETICS

- Nautilus, Inc.

- Peloton Interactive, Inc.

- SOLE FITNESS

- Wahoo Fitness

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 121 |

| Published | December 2022 |

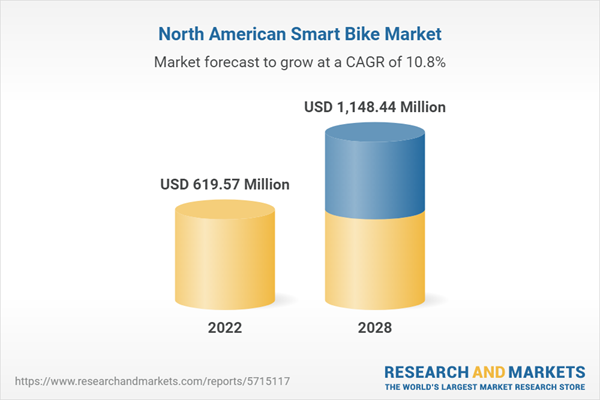

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 619.57 Million |

| Forecasted Market Value ( USD | $ 1148.44 Million |

| Compound Annual Growth Rate | 10.8% |

| Regions Covered | North America |

| No. of Companies Mentioned | 10 |