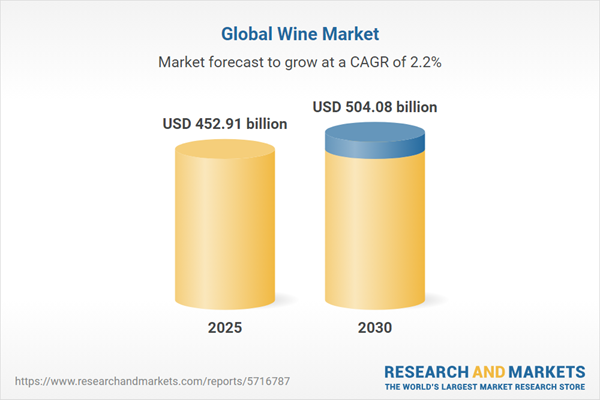

The global wine market is experiencing robust growth, driven by urban consumers increasing preference for exotic wines, rising health consciousness, and the expansion of e-commerce platforms. Key factors include evolving lifestyles, growing awareness of wine's health benefits, particularly red wine, and advancements in packaging technology. The market is further supported by the premiumization of wine products and the proliferation of eateries, lounges, and social clubs, particularly in developing economies. Despite challenges such as regulatory complexities and economic uncertainties, the market is poised for sustained expansion, with China emerging as a significant growth hub.

Market Drivers

The surge in demand for low-calorie, health-focused alcoholic beverages, especially red wine, is a primary growth driver. Red wine's benefits, such as supporting heart health and increasing blood antioxidants, align with rising consumer health consciousness and improved living standards. The growing prevalence of cardiovascular diseases further boosts demand for organic red wines, perceived as healthier alternatives. The emergence of e-commerce platforms is another key driver, offering convenient shopping experiences, prompt delivery, and diverse offerings. In industrialized regions like North America and Europe, online wine sales are projected to grow annually by approximately 15%, driven by technical advancements and expanded distribution networks. Manufacturers are leveraging partnerships and new e-commerce platforms to capture market share, while product innovation, including exotic flavors like Riesling and tropical fruit wines, caters to evolving consumer preferences.Market Segmentation

The market is segmented by wine type, distribution channel, and geography. Red wine dominates due to its health benefits, while white and other wines also contribute to market diversity. Distribution channels include online and offline, with e-commerce gaining traction for its accessibility and variety. Geographically, the market spans North America, South America, Europe, the Middle East and Africa, and Asia Pacific. China stands out as a key market, driven by rising disposable incomes, an expanding middle class, and a shift toward wine as a symbol of sophistication and healthier consumption. The Chinese government's investments in domestic vineyard cultivation and winemaking technology further bolster the market, enhancing the quality and recognition of local wines.Industry Analysis

Porter's Five Forces model evaluates competitive dynamics, analyzing supplier power, buyer influence, and market rivalry. An industry value chain analysis identifies key players in production, packaging, and distribution, highlighting their roles in driving innovation and market reach. The regulatory framework, including regional policies on grape sourcing and production standards, shapes market dynamics, particularly in key regions like the U.S. and China. These regulations ensure quality and sustainability, fostering consumer trust.Competitive Landscape

Key players, such as Pernod Ricard, are expanding through strategic collaborations to enhance their premium wine portfolios. The focus on acquisitions and product innovation, such as organic and exotic wine offerings, strengthens market positions. Companies are plotted in a vendor matrix as leaders, followers, challengers, or niche players based on their strategies and market presence.Challenges

Regulatory complexities, such as changes in grape crush district boundaries in regions like California, and economic uncertainties pose challenges. Additionally, ensuring consistent quality across diverse markets requires robust supply chain management.The global wine market is set for steady growth, driven by health-conscious consumer trends, e-commerce expansion, and premiumization. China's rising affluence and domestic wine production make it a pivotal market, while North America and Europe benefit from strong online sales growth. Continued innovation, regulatory support, and strategic partnerships will be critical for sustaining market momentum and meeting evolving consumer demands.

Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decisions to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive Intelligence.Report Coverage:

- Historical data from 2020 to 2024 & forecast data from 2025 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling: Strategies, Products, Financial Information, and Key Developments among others

Market Segmentation:

By Type

- Red

- White

- Others

By Distribution Channel

- Online

- Offline

By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

Table of Contents

Companies Mentioned

- E. & J. Gallo Winery

- Treasury Wine Estates Limited

- Accolade Wines

- The Wine Group

- Constellation Brands

- Maison Castel

- Casella Family Brands

- Concha y Toro

- Penfolds

- Davide Campari-Milano S.p.A.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | August 2025 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 452.91 billion |

| Forecasted Market Value ( USD | $ 504.08 billion |

| Compound Annual Growth Rate | 2.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |