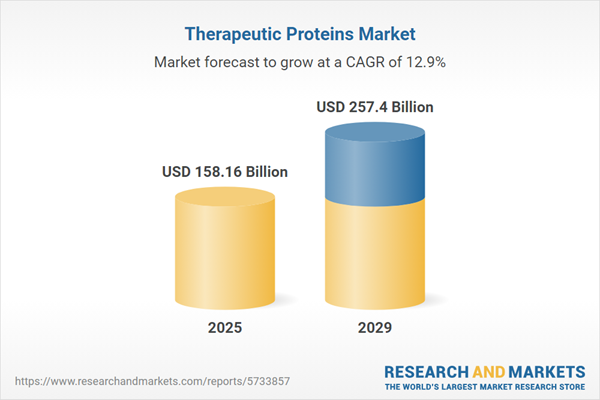

The therapeutic proteins market size has grown rapidly in recent years. It will grow from $140.96 billion in 2024 to $158.16 billion in 2025 at a compound annual growth rate (CAGR) of 12.2%. The growth in the historic period can be attributed to advances in protein engineering, expansion into chronic diseases, advent of immunotherapy, development of recombinant DNA technology, targeted cancer therapies.

The therapeutic proteins market size is expected to see rapid growth in the next few years. It will grow to $257.4 billion in 2029 at a compound annual growth rate (CAGR) of 12.9%. The growth in the forecast period can be attributed to regulatory adaptations, enhanced delivery systems, gene editing integration, biobetters development, immunotherapy evolution. Major trends in the forecast period include regulatory framework enhancements, improved delivery systems, biotechnology advancements, personalized medicine, monoclonal antibodies dominance.

Technological advancements in protein-based drug development are a driving force behind the therapeutic proteins market. Unlike as chemical synthesis, therapeutic proteins necessitate production through genetic engineering and recombinant DNA technology within living cells or organisms. Various protein-engineering platform technologies, such as glycoengineering, pegylation, Fc-fusion, albumin fusion, and albumin drug conjugation, play a pivotal role in enhancing production yield, product purity, circulating half-life, targeting, and functionality of therapeutic protein drugs. Belimumab, ipilimumab, taliglucerase alfa, albiglutide, and recombinant human coagulation factor IX are examples of therapeutic protein drugs developed using protein engineering technologies and FDA-approved in the past five years.

The rising incidence of chronic diseases, particularly diabetes, is anticipated to drive the growth of the therapeutic protein market in the coming years. Chronic diseases are defined as long-lasting ailments that hinder daily activities and necessitate ongoing medical care. Diabetes, a chronic condition characterized by insufficient insulin production or ineffective insulin usage, requires various protein therapeutics, including insulin and GLP-1 receptor agonists, to manage blood sugar levels. These treatments promote insulin release in response to high blood glucose levels and inhibit glucagon production, a hormone that elevates blood sugar. For example, in May 2024, the British Diabetic Association (Diabetes UK), a charity focused on patients, healthcare professionals, and research in the UK, reported that approximately 4.4 million individuals were diagnosed with diabetes as of 2022-23. Among these, about 8% had type 1 diabetes, while type 2 diabetes constituted around 90%, with the remaining 2% representing other, less common diabetes types. Consequently, the growing prevalence of chronic diseases like diabetes is fueling the expansion of the therapeutic protein market.

The growth of the therapeutic proteins market is expected to face a slowdown due to the increasing presence of biosimilar drugs on the global market. The expiration of patents for therapeutic proteins, including monoclonal antibodies, opens the door for biosimilars to enter the market. For instance, in October 2022, Amneal Pharmaceuticals, Inc., a US-based generics and specialty pharmaceutical company, introduced ALYMSY® (bevacizumab-maly) in the United States. While these biosimilars offer cost-effective alternatives to original biologics, their entry into the market leads to a decline in revenue and sales for the therapeutic proteins market.

The protein therapeutic segment is experiencing a surge in approvals for monoclonal antibody drugs. Monoclonal antibodies prove effective in treating chronic conditions such as cancer and immunological disorders. As a dominant and well-established product class in protein therapeutics, monoclonal antibodies offer enhanced safety and immunogenicity compared to their counterparts. Cell-based expression systems, such as the Chinese hamster ovary (CHO) mammalian cell expression system, have addressed previous challenges associated with antibody drugs, leading to increased monoclonal antibody productivity. Over the past five years, the FDA has greenlit 213 drugs, with 44 being monoclonal antibodies, including twelve for the treatment of cancer and immunological disorders.

Major companies in the market are strategically introducing media systems to gain a competitive edge. Specifically designed for optimizing the production of therapeutic monoclonal antibodies, these media systems enhance efficiency in therapeutic protein manufacturing. For instance, Lonza Group AG, a Switzerland-based pharmaceutical manufacturing company, launched the TheraPRO CHO (Chinese Hamster Ovary) Media System in July 2023. This new cell culture platform simplifies media preparation with a chemically specified, two-part production technique, offering full scalability and support from technical professionals with extensive troubleshooting knowledge.

Therapeutic proteins are pharmaceuticals that represent genetically modified versions of naturally occurring human proteins, created in a laboratory for medicinal purposes. These potent and rapidly acting medications have revolutionized the treatment of diseases due to their high efficacy in vivo.

Within the therapeutic proteins market, the primary product categories include insulin, fusion proteins, erythropoietin, interferon, human growth hormone, and follicle-stimulating hormone. Insulin, a peptide hormone produced by pancreatic beta cells, functions as a key anabolic hormone in individuals. It plays a crucial role in influencing fat, carbohydrate, and protein metabolism by enhancing glucose uptake from the blood into fat, liver, and skeletal muscle cells. These therapeutic proteins serve various functions, including enzymatic and regulatory activities, specialized targeting activities, vaccines, and protein diagnostics. They find applications in treating a wide range of conditions such as metabolic disorders, immunologic disorders, hematological disorders, cancer, hormonal disorders, genetic disorders, among others.

The therapeutic proteins market research report is one of a series of new reports that provides therapeutic proteins market statistics, including industry global market size, regional shares, competitors with a therapeutic proteins market share, detailed therapeutic proteins market segments, market trends and opportunities, and any further data you may need to thrive in the therapeutic proteins industry. The therapeutic proteins market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

In March 2024, Merck & Co. Inc., a US-based pharmaceutical firm, acquired Harpoon Therapeutics for $680 million. This acquisition aims to enhance Merck's oncology pipeline by incorporating a variety of innovative T-cell engagers, such as HPN328 (MK-6070). This investigational therapy specifically targets delta-like ligand 3 (DLL3) to improve T-cell engagement in the fight against cancer. Harpoon Therapeutics is a US-based developer of therapeutic proteins.

Major companies operating in the therapeutic proteins market include Pfizer Inc., Johnson & Johnson Services Inc., F. Hoffmann-La Roche Ltd., Merck & Co. Inc., AbbVie Inc., Novartis International AG, Sanofi S.A, Bristol Myers Squibb Co., AstraZeneca plc, Abbott Laboratories, GlaxoSmithKline plc, Eli Lilly and Company, Boehringer Ingelheim International GmbH, Amgen Inc., Novo Nordisk A/S, Baxter International Inc., Teva Pharmaceutical Industries Ltd., CSL Behring LLC, Chugai Pharmaceutical Co. Ltd., Biogen Inc., Kyowa Kirin Co. Ltd., Oramed Pharmaceuticals Inc., Sandoz International GmbH, Hualan Biological Engineering Inc., Genentech Inc., ProBiogen AG, Diasome Pharmaceuticals Inc., Generex Biotechnology Corp., GeneScience Pharmaceuticals Co. Ltd.

North America was the largest region in the therapeutic proteins market in 2024. The regions covered in the therapeutic proteins market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the therapeutic proteins market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The therapeutic proteins market consists of sales of antibody-based drugs, FC fusion proteins, and anticoagulants. Values in this market are "factory gate values," that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Therapeutic Proteins Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on therapeutic proteins market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for therapeutic proteins ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The therapeutic proteins market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product Type: Insulin; Fusion Protein; Erythropoietin; Interferon; Human Growth Hormone; Follicle Stimulating Hormone2) By Function: Enzymatic and Regulatory Activity; Special Targeting Activity; Vaccines; Protein Diagnostics

3) By Application: Metabolic Disorders; Immunologic Disorders; Hematological Disorders; Cancer; Hormonal Disorders; Genetic Disorders; Other Applications

Subsegments:

1) By Insulin: Rapid-Acting Insulin; Short-Acting Insulin; Intermediate-Acting Insulin; Long-Acting Insulin2) By Fusion Protein: Tnf-Alpha Inhibitors; Anti-Cd20 Fusion Proteins; Other Targeted Fusion Proteins

3) By Erythropoietin: Epoetin Alpha; Darbepoetin Alfa; Other Erythropoietin Variants

4) By Interferon: Interferon Alpha; Interferon Beta; Interferon Gamma

5) By Human Growth Hormone: Somatropin; Somatrem

6) By Follicle Stimulating Hormone: Follitropin Alpha; Follitropin Beta

Key Companies Mentioned: Pfizer Inc.; Johnson & Johnson Services Inc.; F. Hoffmann-La Roche Ltd.; Merck & Co. Inc.; AbbVie Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Therapeutic Proteins market report include:- Pfizer Inc.

- Johnson & Johnson Services Inc.

- F. Hoffmann-La Roche Ltd.

- Merck & Co. Inc.

- AbbVie Inc.

- Novartis International AG

- Sanofi S.A

- Bristol Myers Squibb Co.

- AstraZeneca plc

- Abbott Laboratories

- GlaxoSmithKline plc

- Eli Lilly and Company

- Boehringer Ingelheim International GmbH

- Amgen Inc.

- Novo Nordisk A/S

- Baxter International Inc.

- Teva Pharmaceutical Industries Ltd.

- CSL Behring LLC

- Chugai Pharmaceutical Co. Ltd.

- Biogen Inc.

- Kyowa Kirin Co. Ltd.

- Oramed Pharmaceuticals Inc.

- Sandoz International GmbH

- Hualan Biological Engineering Inc.

- Genentech Inc.

- ProBiogen AG

- Diasome Pharmaceuticals Inc.

- Generex Biotechnology Corp.

- GeneScience Pharmaceuticals Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 158.16 Billion |

| Forecasted Market Value ( USD | $ 257.4 Billion |

| Compound Annual Growth Rate | 12.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |