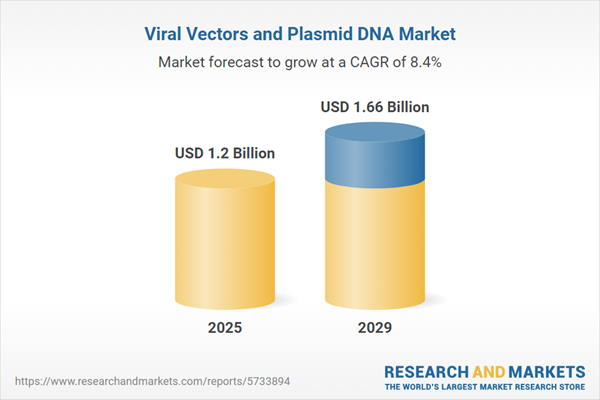

The viral vectors and plasmid dna market size has grown rapidly in recent years. It will grow from $1.05 billion in 2024 to $1.2 billion in 2025 at a compound annual growth rate (CAGR) of 14.8%. The growth in the historic period can be attributed to increasing prevalence of cancer, growing awareness of gene therapy, growing patient population, increased access to healthcare, growing demand for personalized medicine.

The viral vectors and plasmid dna market size is expected to see strong growth in the next few years. It will grow to $1.66 billion in 2029 at a compound annual growth rate (CAGR) of 8.4%. The growth in the forecast period can be attributed to emerging therapeutic applications, COVID-19 pandemic response, increased funding, global expansion. Major trends in the forecast period include advances in viral vector and plasmid DNA manufacturing technology, advances in gene editing, customized vectors, scalability and production efficiency, safety and quality standards, non-viral delivery methods, international collaboration.

The global surge in cancer cases is a significant driving force behind the growth of the viral vector and plasmid DNA market. Common cancer triggers like obesity, smoking, alcohol consumption, and poor dietary habits contribute to the majority of cancer diagnoses. As projected by the American Cancer Society in January 2022, the US will likely witness 1.9 million new cancer cases and approximately 609,360 cancer-related deaths in the same year. Globally, lung, prostate, bowel, and female breast cancers are the most prevalent, accounting for 43% of all new cancer cases. This rise in cancer incidence is anticipated to bolster the demand for viral vectors and plasmid DNA in the market.

The increasing prevalence of tuberculosis cases is also driving growth in the viral vector and plasmid DNA market. Tuberculosis, an infectious disease caused by bacteria, primarily affects the lungs but can extend to other body parts. Plasmid DNA vaccines, delivering microbial antigen-coding genes for tuberculosis, have shown promise in combating this disease. These vaccines can express specific antigens of Mycobacterium tuberculosis, the causative bacterium, through intramuscular injection. According to the Centers for Disease Control and Prevention's March 2023 report, the US witnessed a rise in tuberculosis cases from 7,874 in 2021 to 8,300 in 2022, emphasizing the driving force of tuberculosis cases in the growth of the viral vector and plasmid DNA market.

Companies in the viral vectors and plasmid DNA market are strategically launching viral vector assays to invigorate gene therapy research. Viral vectors, essential in delivering genetic material into cells, are complemented by viral vector assays, investigative procedures that analyze these vectors. For instance, in November 2022, PerkinElmer introduced 'ready-to-use' adeno-associated virus vectors (AAV) detection kits. These aids support researchers involved in gene therapy across diverse diseases by facilitating the quick and efficient characterization of viral vector particles, guiding safe and effective gene transfer decisions.

Major players in the viral vectors and plasmid DNA market are intensifying their efforts toward product innovation, notably helper plasmids, to gain a competitive edge. Helper plasmids, a form of plasmid DNA utilized in producing viral vectors like adeno-associated viral vectors (AAV), are pivotal in gene therapy. For instance, Charles River Laboratories International Inc. unveiled off-the-shelf pHelper in March 2023. This innovation streamlines the process of developing adeno-associated virus (AAV)-based gene therapy programs, minimizing complexities and expediting supply chains. pHelper, part of a comprehensive line of contract development and manufacturing organization (CDMO) offerings, serves to fortify viral vector packaging in cell and gene therapy endeavors, particularly in creating adeno-associated viral vectors essential for gene therapy.

In January 2023, Moderna Inc., a pharmaceutical and biotechnology company based in the US, finalized the acquisition of OriCiro Genomics for $85 million. This strategic acquisition aims to expedite Moderna's pipeline development by enhancing their capabilities in plasmid DNA synthesis and amplification, which serves as a crucial foundation for manufacturing messenger RNA (mRNA). OriCiro Genomics, a Japan-based genome technology company, specializes in developing and commercializing cell-free systems designed for assembling and amplifying circular DNA molecules, notably plasmids and viral vectors. This acquisition positions Moderna to strengthen its mRNA production processes with advanced tools provided by OriCiro Genomics.

Viral vectors are tools constructed from viral genomes adapted into plasmid-based technologies. They are modified for safety by removing specific essential genes and separating viral components. On the other hand, plasmid DNA refers to small, circular DNA molecules present in certain bacteria and other microorganisms. These plasmids are physically distinct from chromosomal DNA and can replicate independently.

The primary product types within the viral vectors & plasmid DNA domain include plasmid DNA and viral vectors. Plasmids are circular DNA molecules separate from a cell's chromosomal DNA, commonly found in bacterial and some eukaryotic cells. Plasmid genes often confer genetic advantages to bacteria, such as antibiotic resistance.

The viral vectors & plasmid DNA market research report is one of a series of new reports that provides viral vectors & plasmid DNA market statistics, including viral vectors & plasmid DNA industry global market size, regional shares, competitors with a viral vectors & plasmid DNA market share, detailed viral vectors & plasmid DNA market segments, market trends and opportunities, and any further data you may need to thrive in the viral vectors & plasmid DNA industry. This viral vectors & plasmid DNA market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

Major companies operating in the viral vectors and plasmid dna market include FUJIFILM Diosynth Biotechnologies, FinVector Vision Therapies, Lonza Group AG, Cobra Biologics and Pharmaceutical Services, Brammer Bio, Каnеkа Соrроrаtіоn, Cell and Gene Therapy Catapult, VGXI Inc., MassBiologics, Sanofi, Spark Therapeutics, UniQure NV, Thermo Fisher Scientific, VIROVEK, SIRION Biotech GmbH, ALDEVRON, Oxford BioMedica, PlasmidFactory GmbH & Co. KG, Biovian Oy, BioReliance Corporation, 4D Molecular Therapeutics, Renova Therapeutics, Shenzhen SiBiono GeneTech Co., Vigene Biosciences Inc., Novasep, Genzyme Corporation, Oxford Gene Technology, Richter-Helm, Муlаn NV, MolMed, Merck KGaA Inc., Catalent Inc., WuXi AppTec, GenScript Biotech Corporation, Eurogentec, Creative Biogene.

North America was the largest region in the viral vectors and plasmid DNA market in 2024. The Middle East is expected to be the fastest growing region in the global viral vectors & plasmid DNA market analysis. The regions covered in the viral vectors and plasmid dna market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, and Africa. The countries covered in the viral vectors and plasmid dna market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Spain, Canada.

The viral vectors and plasmid DNA market consists of sales of adeno-associated viral, adenoviral, lentiviral, and retroviral. Values in this market are factory gate values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Viral Vectors and Plasmid DNA Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on viral vectors and plasmid dna market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for viral vectors and plasmid dna ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The viral vectors and plasmid dna market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Plasmid DNA; Viral Vectors2) By Disease: Infectious Diseases; Genetic Disorders; Cancer; Other Diseases

3) By Application: Gene and Cancer Therapies; Viral Infections; Immunotherapy; Formulation Development; Other Applications

4) By End User: Research Institutes; Biopharmaceutical and Pharmaceutical Companies

Subsegments:

1) By Plasmid DNA: Research-Grade Plasmid DNA; Clinical-Grade Plasmid DNA; GMP (Good Manufacturing Practice) Plasmid DNA2) By Viral Vectors: Adenoviral Vectors; Lentiviral Vectors; AAV (Adeno-Associated Virus) Vectors; Retroviral Vectors; Vesicular Stomatitis Virus (VSV) Vectors

Key Companies Mentioned: FUJIFILM Diosynth Biotechnologies; FinVector Vision Therapies; Lonza Group AG; Cobra Biologics and Pharmaceutical Services; Brammer Bio

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Viral Vectors and Plasmid DNA market report include:- FUJIFILM Diosynth Biotechnologies

- FinVector Vision Therapies

- Lonza Group AG

- Cobra Biologics and Pharmaceutical Services

- Brammer Bio

- Каnеkа Соrроrаtіоn

- Cell and Gene Therapy Catapult

- VGXI Inc.

- MassBiologics

- Sanofi

- Spark Therapeutics

- UniQure NV

- Thermo Fisher Scientific

- VIROVEK

- SIRION Biotech GmbH

- ALDEVRON

- Oxford BioMedica

- PlasmidFactory GmbH & Co. KG

- Biovian Oy

- BioReliance Corporation

- 4D Molecular Therapeutics

- Renova Therapeutics

- Shenzhen SiBiono GeneTech Co.

- Vigene Biosciences Inc.

- Novasep

- Genzyme Corporation

- Oxford Gene Technology

- Richter-Helm

- Муlаn NV

- MolMed

- Merck KGaA Inc.

- Catalent Inc.

- WuXi AppTec

- GenScript Biotech Corporation

- Eurogentec

- Creative Biogene

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 1.2 Billion |

| Forecasted Market Value ( USD | $ 1.66 Billion |

| Compound Annual Growth Rate | 8.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 37 |