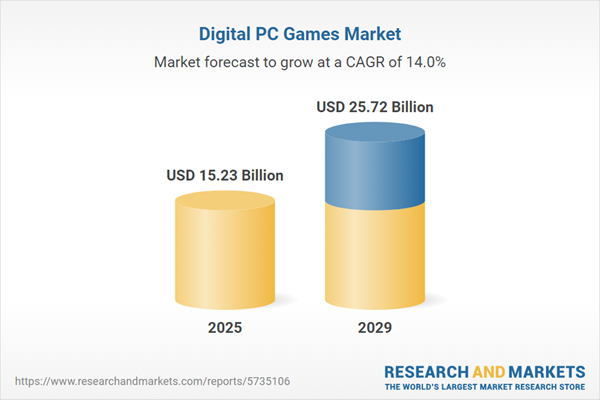

The digital pc games market size has grown rapidly in recent years. It will grow from $13.26 billion in 2024 to $15.23 billion in 2025 at a compound annual growth rate (CAGR) of 14.9%. The growth in the historic period can be attributed to digital distribution platforms, internet connectivity, convenience and accessibility, regular updates and patches.

The digital pc games market size is expected to see rapid growth in the next few years. It will grow to $25.72 billion in 2029 at a compound annual growth rate (CAGR) of 14%. The growth in the forecast period can be attributed to expanding library and backlogs, emerging markets, live services and microtransactions, cloud gaming. Major trends in the forecast period include digital distribution dominance, cloud gaming services, epic games store and competition, subscription services.

The digital PC game market is experiencing growth driven by the increasing demand for digital access to PC games. The convenience, cross-buying options, and easy storage offered by digital distribution are motivating players to opt for digital access to PC games. Gamers can access pre-loaded games when they pre-order them, ensuring immediate access upon their release. A survey conducted by GameIndustry.biz in collaboration with Ipsos revealed that 30% of respondents chose digital purchases due to lower prices, while 20% were enticed by discounts. Additionally, 15% preferred immediate access to games available on other platforms, and 7% opted for pre-ordering to gain access as soon as games hit the market. The rising demand for digital distribution is expected to drive the digital PC game market.

The growth of the digital PC game market is further fueled by the increasing number of online gamers. Online gamers engage in video games and interactive gaming experiences over the internet, benefiting from convenience, quick access, and potential multiplayer interactions. For instance, in August 2024, the Department for Business and Trade, a UK-based government agency, reported that in 2022, the Software and Computer Services sector, which includes video games, contributed £53.4 billion in gross value added to the UK economy, representing 43% of the total. As a result, the increasing number of online gamers is expected to drive demand in the digital PC games market.

A noteworthy trend in the digital PC game market is the emergence of cloud gaming. Cloud gaming is a disruptive platform where games are hosted on provider servers and then streamed to users, expanding access to premium games without the need for hardware upgrades. For instance, in September 2022, M1 Limited introduced Zolaz, a cloud gaming subscription service that allows customers to play games on any device at any time. Subscribers gain instant and unlimited access to over 400 high-quality PC and console titles, including those from AAA publishers. The cloud gaming subscription costs SGD 14.98 per month with no contract.

Major companies in the digital PC game market are exploring advanced distribution solutions, like Ultra Games, to expand their customer base and gain a competitive edge. Ultra Games is a blockchain-powered PC game store leveraging Web3 technology to introduce features like digital game reselling and enhanced developer revenue opportunities. For instance, Ultra Software Corporation unveiled Ultra Games in April 2023, aiming to reduce fees, create additional revenue streams for developers, establish true player ownership, and enhance community-building and engagement tools.

In October 2023, Microsoft, a U.S.-based IT corporation, acquired Activision Blizzard for $69 billion. This acquisition allows Microsoft to expand its gaming portfolio, enhance Xbox Game Pass, and strengthen its presence in mobile and cloud gaming. This strategic move positions Microsoft to better compete in the rapidly evolving gaming industry. Activision Blizzard, a U.S.-based video game company, is well-known for developing digital PC games.

A digital PC game is an interactive form of entertainment designed for one or multiple players, typically played with the aid of a personal computer.

The primary platforms for digital PC games include Windows, iOS, and other operating systems. iOS stands out as a mobile operating system specifically designed and developed for Apple Inc.'s hardware. Different game subscription models, such as premium and freemium, cater to a wide range of players, including social gamers, serious gamers, and core gamers.

The digital PC games market research report is one of a series of new reports that provides digital PC games market statistics, including digital PC games industry global market size, regional shares, competitors with a digital PC games market share, detailed digital PC games market segments, market trends and opportunities, and any further data you may need to thrive in the digital PC games industry. This digital PC games market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Major companies operating in the digital pc games market include Tencent Holdings Limited, Ubisoft Entertainment SA, King Digital Entertainment Limited, Activision Blizzard Inc., Zynga Inc., GungHo Online Entertainment Inc., Microsoft Corporation, Sony Corporation, Nintendo Co. Ltd., Electronic Arts Inc., Amazon Game Studios Inc., ArenaNet LLC, Behaviour Interactive Inc., Bethesda Softworks LLC, BioWare Corp., Bungie Inc., Capcom Co. Ltd., CD Projekt Red SA, Cloud Imperium Games Corporation, Cryptic Studios LLC, Daybreak Game Company LLC, Digital Extremes Ltd., Epic Games Inc., Firaxis Games Inc., Frontier Developments PLC, Gearbox Software LLC, Hi-Rez Studios LLC, id Software LLC, Infinity Ward Inc., Jagex Limited, Klei Entertainment Inc., Konami Digital Entertainment Co. Ltd., MachineGames Sweden AB, Mojang Studios AB, Naughty Dog LLC, NetEase Games, Niantic Inc., Ninja Theory Ltd., Obsidian Entertainment Inc., Phoenix Labs Inc., Psyonix Inc.

Asia-Pacific was the largest region in the digital PC games market in 2024. Asia-Pacific is expected to be the fastest-growing region in the digital PC games market report during the forecast period. The regions covered in the digital pc games market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the digital pc games market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Spain, Canada.

The digital PC games market includes revenues earned by entities by providing design, documentation, installation and support services, and producing and distributing digital video games which are played on a personal computer or laptop. The virtual environment provided by the digital PC games does not limit players by physical space or hands-on access but considers a wide range of cultural and media activities based on digital technologies. Digital PC games have integrated different features such as voice recognition, 3D gaming, GPS tracking and many more to provide players with real-life experiences. Values in this market are factory gate values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Digital PC Games Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on digital pc games market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for digital pc games ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The digital pc games market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Game Subscription Model: Premium; Freemium2) By Platform: Windows; IOS; Other Platforms

3) By Audience: Social Gamer; Serious Gamers; Core Gamers

Subsegments:

1) By Premium: One-Time Purchase; Pay-To-Play; Subscription-Based Premium Games (Access To a Full Game With Additional Content or Features)2) By Freemium: Free-To-Play (With in-Game Purchases); Freemium With Ads; in-App Purchases (Cosmetics, DLC); Free-To-Play With Premium Upgrades

Key Companies Mentioned: Tencent Holdings Limited; Ubisoft Entertainment SA; King Digital Entertainment Limited; Activision Blizzard Inc.; Zynga Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Digital PC Games market report include:- Tencent Holdings Limited

- Ubisoft Entertainment SA

- King Digital Entertainment Limited

- Activision Blizzard Inc.

- Zynga Inc.

- GungHo Online Entertainment Inc.

- Microsoft Corporation

- Sony Corporation

- Nintendo Co. Ltd.

- Electronic Arts Inc.

- Amazon Game Studios Inc.

- ArenaNet LLC

- Behaviour Interactive Inc.

- Bethesda Softworks LLC

- BioWare Corp.

- Bungie Inc.

- Capcom Co. Ltd.

- CD Projekt Red SA

- Cloud Imperium Games Corporation

- Cryptic Studios LLC

- Daybreak Game Company LLC

- Digital Extremes Ltd.

- Epic Games Inc.

- Firaxis Games Inc.

- Frontier Developments plc

- Gearbox Software LLC

- Hi-Rez Studios LLC

- id Software LLC

- Infinity Ward Inc.

- Jagex Limited

- Klei Entertainment Inc.

- Konami Digital Entertainment Co. Ltd.

- MachineGames Sweden AB

- Mojang Studios AB

- Naughty Dog LLC

- NetEase Games

- Niantic Inc.

- Ninja Theory Ltd.

- Obsidian Entertainment Inc.

- Phoenix Labs Inc.

- Psyonix Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 15.23 Billion |

| Forecasted Market Value ( USD | $ 25.72 Billion |

| Compound Annual Growth Rate | 14.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 42 |