Speak directly to the analyst to clarify any post sales queries you may have.

Presently, there is a lot of hype about personalized nutrition, both in nutritional research and the food nutrients industry. The customized nutrition approach is based on personalized nutritional advice or dietary changes that can significantly improve health outcomes and reduce the risk of obesity, type II diabetes, and heart disease. Every individual has different requirements, some require tailored food for great hair, skin, and nails and others want food with the least environmental impact. Therefore, nutrition and personal diet are best suited to people’s personal health goals.

Key Winning Imperatives in the Global Personalized Nutrition Market

- Wellness is emerging as a priority for consumers, and innovations associated with personalized vitamins and DNA-based diets are transforming how they approach nutrition.

- The growing popularity of at-home diagnostics kits drives personalized nutrition as consumers look to comprehend their bodies and heritage better.

- Personalized nutrition is an emerging trend as consumers are willing to pay for customized nutrition.

MARKET TRENDS & OPPORTUNITIES

Personalized Shaping Food & Healthcare Industry

The nutraceuticals and functional foods markets have witnessed significant growth in recent years. Increasing demand for healthier lifestyles, specific food choices, and preventive health measures with tailored food and medicine industries are driving the growth of the global personalized nutrition market. Moreover, rising technological advancements and adopting healthier diet plans are supporting in shaping the food and healthcare industry.Growth Opportunities Through Collaborations And Strategic Partnerships

Personalized nutrition is an emerging trend as consumers are willing to pay for personalized nutrition. In a collaborative partnership, people and organizations from multiple sectors work together for a common purpose, a prominent strategy for community health improvement. The traditional approach of “one-size-fits-all is becoming less relevant as consumers expect customization of products.The R&D initiatives in personalized nutrition involve collaborative innovation as personalized nutrition requires technologies such as data tracking and collection to obtain individual health data. With these technologies, an individual’s health data could be obtained, and by vast data accumulation, the individual health database and standards could be established. Therefore, many players collaborate with material suppliers, scientific research institutions, medical institutions, and other stakeholders to build a personalized nutrition industry alliance and integrate R&D, production, and education.

Increasing Digital Healthcare

The rising awareness and impact of nutrition on health are constantly increasing. Digital technology enables the transmission of real-time data offered at greater convenience with less cost. Digital healthcare solutions help improve individual health and wellness and cover everything from wearable gadgets to ingestible sensors, from mobile health applications to artificial intelligence, which helps fulfill personal nutrition needs. Additionally, major technology organizations are driving the digital health revolution worldwide. For instance, Google has a stake in the health-tracking wearables market through health platforms such as Google Wear and Fit.SEGMENTATION INSIGHTS

INSIGHTS BY PRODUCT

The global personalized nutrition market is segmented into product categories such as dietary supplements & nutraceuticals, functional food & beverages, sports nutrigenomics, and digitalized DNA. Dietary supplements & nutraceuticals dominate the product segment and account for a 49.97% global market share. Dietary supplements include vitamins, minerals, herbs, amino acids, and enzymes. The supplements could include capsules, powders, tablets, liquids, gel caps, and soft gels. Supplements are a broad and diverse product category that supports good health and a supplement diet. Dietary supplements and nutraceuticals include minerals and vitamins such as zinc, selenium, vitamin C, and D. They are likely to be higher adopted by people as it helps in the proper functioning of the immune system. Also, dietary supplements benefit individuals at risk of respiratory viral infections and nutrient deficiency.Segmentation by Product

- Dietary Supplements & Nutraceuticals

- Functional Foods & Beverages

- Sports Nutrigenomics

- Digitized DNA

INSIGHTS BY FORM

The tablet is the largest form segment in the global personalized nutrition market and was valued at USD 3.15 billion in 2022. One of the multiple ways of consuming dietary supplements is through tablets. Priorly, drugs developed as painkillers were compressed into tablet form to allow measured doses and greater portability. The discovery of compounds such as vitamins, minerals, micronutrients, and other pigments has led to the advent of dietary supplements. Currently, tablets are available in several types, such as coated, uncoated, and chewable tablets, lozenges, time and sustained releases, and enteric-coated tablets. Presently, an aqueous coating solution is used to coat the tablets, making them safe, protective, and easy to swallow.Segmentation by Form

- Tablets

- Capsules

- Powders

- Liquids

- Others

INSIGHTS BY APPLICATION

The global personalized nutrition market is classified into the standard supplement, sports nutrition, and disease-based segments by applications. The standard supplement segment dominates the application segment and accounts for a market share of 47.16%. Standard supplements contain a minimum of one dietary ingredient, such as vitamins, minerals, herbs, botanicals, amino acids, or enzymes. Multivitamin is one of the common supplements that help prevent the intake of dozens of pills daily. Most common dietary supplements include calcium, fish oil, echinacea, ginseng, garlic, and vitamin D. Many chronic diseases, such as heart disease and type 2 diabetes, could be prevented with adequate nutrition. Also, it helps in strengthening the immune system as the immune system requires essential vitamins and minerals to function optimally. A wholesome and varied diet ensures proper immune system functioning and protects against illness and immunodeficiency issues.Segmentation by Application

- Standard Supplement

- Diseased-Based

- Sports Nutrition

INSIGHTS BY END-USER

The direct consumer is the largest end-user segment in the global personalized nutrition market and was valued at USD 3.49 billion in 2022. The segment growth is supported due to changes in consumers' preferences for high-nutrient products that help in enhancing health and lifestyle. The deficiency of nutrients has a long-lasting impact, which has been worrying people for a long time. Therefore, the personalized nutrition approach offers methods and solutions that help understand the problems and take steps accordingly. Therefore, the direct consumer segment is expected to lead the personalized nutrition market during the forecast period due to these factors.Segmentation by End-User

- Direct-to-consumers

- Wellness & Fitness Centers

- Hospitals & Clinics

- Institutions

- Others

GEOGRAPHICAL ANALYSIS

North America is the largest personalized nutrition market, accounting for 43.14% of the global market, and is expected to grow from USD 4.13 billion in 2022. The region's growth is majorly driven by increasing consumer awareness regarding health and eating patterns. Also, the region is witnessing a substantial increase in obesity rates. A hectic lifestyle has encouraged consumers to choose customized dietary supplements per their requirements. Moreover, rising disposable income has increased consumers' purchasing power, encouraging them to opt for personalized meal plans and related services.The personalized nutrition market in Europe was valued at USD 2.48 billion in 2022. The increasing trend of personalizing food to obtain a better diet, awareness of healthy foods, and promoting health and nutrition drive the growth of personalized nutrition in this region. The personalized approach regarding health and wellness helps in achieving specific goals in the specified time frame is gradually increasing. Personalized is an alternative approach that fits all the existing sizes and allows consumers to take control in maintaining a healthier diet.

APAC accounted for a share of 18.57% in the global personalized nutrition market and is one of the fastest-growing regions globally, with a forecasted CAGR of 20.62%. Factors driving the market's growth include increasing consumer awareness of health, a better understanding of adequate health and fitness, and the rising adoption of digital healthcare. In addition, due to the rising acceptance of personalized nutrition solutions and active measures, the regional market is expected to register the fastest growth. The market has witnessed growth due to significant changes in the lifestyle of people focusing on health and fitness. The market has grown despite the COVID-19 outbreak as consumers increasingly consume nutritional products to improve their immune systems.

Segmentation by Geography

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Norway

- Sweden

- Finland

- Denmark

- Belgium

- Switzerland

- Russia

- APAC

- China

- Japan

- South Korea

- Australia

- India

- Malaysia

- Singapore

- Indonesia

- Middle East & Africa

- South Africa

- Turkey

- Saudi Arabia

- UAE

- Israel

- Latin America

- Brazil

- Mexico

- Colombia

COMPETITIVE LANDSCAPE

The personalized nutrition market is highly competitive due to the presence of numerous players. Rapid technological improvements adversely impact market vendors as consumers expect continuous product upgrades. Presently, the market is dominated by vendors that have an international presence. Many international players are expected to expand their reach worldwide during the forecast period, especially in the fast-developing countries of the APAC region and Latin America, to enhance their market share.Some prominent personalized nutrition market players with a dominant presence include BASF SE, Herbalife Nutrition, DSM, Nutrigenomix, and Amway. Most major vendors are adopting innovative technologies to retain their market position. Nutrigenomix launched a 70-gene test for personalized nutrition in 2020. The expanded panel adds to the biohacking toolkit, which assists dietitians in making DNA-based dietary recommendations customized to specific requirements and goals.

Key Company Profiles

- Amway

- Herbalife Nutrition

- Nutrigenomix

- BASF SE

- DSM

Other Prominent Vendors

- Atlas Biomed

- DNAlysis

- Persona

- Bactolac Pharmaceutical

- Balchem

- Wellness Coaches

- DayTwo

- BiogeniQ

- mindbodygreen

- Helix & Gene

- Metagenics

- Baze

- GX Sciences

- Viome

- Zipongo

- Care/of

- DNAfit

- Vitagene

- InstaFit

- Segterra

- Nutrino

- Nourished

- Rootine

- Supp Nutrition

KEY QUESTIONS ANSWERED

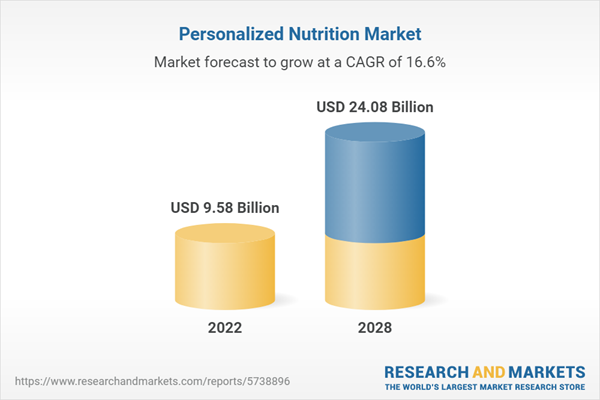

- How big is the global personalized nutrition market?

- What is the growth rate of the personalized nutrition market?

- Who are the key players in the global personalized nutrition market?

- What are the key driving factors in the personalized nutrition market?

- Which region dominates the global personalized nutrition market share?

Table of Contents

1 Research Methodology2 Research Objectives

3 Research Process

4 Scope & Coverage

4.1 Market Definition

4.1.1 Inclusions

4.1.2 Exclusions

4.1.3 Market Estimation Caveats

4.2 Base Year

4.3 Scope of the Study

4.4 Market Segmentation

4.4.1 Market by Product

4.4.2 Market by Form

4.4.3 Market by Application

4.4.4 Market by End-User

4.4.5 Market Segmentation by Geography

5 Report Assumptions & Caveats

5.1 Key Caveats

5.2 Currency Conversion

5.3 Market Derivation

6 Premium Insights

6.1 Market Overview

6.1.1 Market Trends

6.1.2 Market Opportunities

6.1.3 Market Enablers

6.1.4 Market Challenges

6.2 Segment Overview

6.3 Competitive Landscape

7 Market at a Glance

8 Introduction

8.1 Overview

8.1.1 Measurement Tools

8.2 Opportunities & Solutions in the Personalized Nutrition Industry

8.3 Value Chain Analysis

8.4 Consumer Behaviour

9 Market Opportunities & Trends

9.1 Rising Technology Innovations and Advancements

9.2 Growth Opportunities Through Collaborations and Strategic Partnerships

9.3 Personalization Shaping the Food & Healthcare Industry

10 Market Growth Enablers

10.1 Rise in the Aging Population

10.2 Rising Health Awareness Among Consumers

10.3 Increasing Digital Healthcare

11 Market Restraints

11.1 Stringent Rules and Regulations

11.2 Costly Dietary Supplements and Nutrition Plans

11.3 Insufficiency of Data Standardization

12 Market Landscape

12.1 Market Overview

12.2 Market Size & Forecast

12.3 Five Forces Analysis

12.3.1 Threat of New Entrants

12.3.2 Bargaining Power of Suppliers

12.3.3 Bargaining Power of Buyers

12.3.4 Threat of Substitutes

12.3.5 Competitive Rivalry

13 Product

13.1 Market Snapshot & Growth Engine

13.2 Market Overview

13.3 Dietary Supplements & Nutraceuticals

13.3.1 Market Overview

13.3.2 Market Size & Forecast

13.3.3 Market by Geography

13.4 Functional Foods & Beverages

13.4.1 Market Overview

13.4.2 Market Size & Forecast

13.4.3 Market by Geography

13.5 Sports Nutrigenomics

13.5.1 Market Overview

13.5.2 Market Size & Forecast

13.5.3 Market by Geography

13.6 Digitalized Dna

13.6.1 Market Overview

13.6.2 Market Size & Forecast

13.6.3 Market by Geography

14 Form

14.1 Market Snapshot & Growth Engine

14.2 Market Overview

14.3 Tablets

14.3.1 Market Overview

14.3.2 Market Size & Forecast

14.3.3 Market by Geography

14.4 Capsules

14.4.1 Market Overview

14.4.2 Market Size & Forecast

14.4.3 Market by Geography

14.5 Powders

14.5.1 Market Overview

14.5.2 Market Size & Forecast

14.5.3 Market by Geography

14.6 Liquids

14.6.1 Market Overview

14.6.2 Market Size & Forecast

14.6.3 Market by Geography

14.7 Others

14.7.1 Market Overview

14.7.2 Market Size & Forecast

14.7.3 Market by Geography

15 Application

15.1 Market Snapshot & Growth Engine

15.2 Market Overview

15.3 Standard Supplements

15.3.1 Market Overview

15.3.2 Market Size & Forecast

15.3.3 Market by Geography

15.4 Disease-Based

15.4.1 Market Overview

15.4.2 Market Size & Forecast

15.4.3 Market by Geography

15.5 Sports Nutrition

15.5.1 Market Overview

15.5.2 Market Size & Forecast

15.5.3 Market by Geography

16 End-User

16.1 Market Snapshot & Growth Engine

16.2 Market Overview

16.3 Direct Consumers

16.3.1 Market Overview

16.3.2 Market Size & Forecast

16.3.3 Market by Geography

16.4 Wellness & Fitness Centers

16.4.1 Market Overview

16.4.2 Market Size & Forecast

16.4.3 Market by Geography

16.5 Hospitals & Clinics

16.5.1 Market Overview

16.5.2 Market Size & Forecast

16.5.3 Market by Geography

16.6 Institutions

16.6.1 Market Overview

16.6.2 Market Size & Forecast

16.6.3 Market by Geography

16.7 Others

16.7.1 Market Overview

16.7.2 Market Size & Forecast

16.7.3 Market by Geography

17 Geography

17.1 Market Snapshot & Growth Engine

17.2 Geographic Overview

18 North America

18.1 Market Overview

18.2 Market Size & Forecast

18.3 Product

18.3.1 Market Size & Forecast

18.4 Form

18.4.1 Market Size & Forecast

18.5 Application

18.5.1 Market Size & Forecast

18.6 End-User

18.6.1 Market Size & Forecast

18.7 Key Countries

18.7.1 Us: Market Size & Forecast

18.7.2 Canada: Market Size & Forecast

19 Europe

19.1 Market Overview

19.2 Market Size & Forecast

19.3 Product

19.3.1 Market Size & Forecast

19.4 Form

19.4.1 Market Size & Forecast

19.5 Application

19.5.1 Market Size & Forecast

19.6 End-User

19.6.1 Market Size & Forecast

19.7 Key Countries

19.7.1 Germany: Market Size & Forecast

19.7.2 France: Market Size & Forecast

19.7.3 Uk: Market Size & Forecast

19.7.4 Italy: Market Size & Forecast

19.7.5 Spain: Market Size & Forecast

19.7.6 Norway: Market Size & Forecast

19.7.7 Sweden: Market Size & Forecast

19.7.8 Finland: Market Size & Forecast

19.7.9 Denmark: Market Size & Forecast

19.7.10 Belgium: Market Size & Forecast

19.7.11 Switzerland: Market Size & Forecast

19.7.12 Russia: Market Size & Forecast

20 Apac

20.1 Market Overview

20.2 Market Size & Forecast

20.3 Product

20.3.1 Market Size & Forecast

20.4 Form

20.4.1 Market Size & Forecast

20.5 Application

20.5.1 Market Size & Forecast

20.6 End-User

20.6.1 Market Size & Forecast

20.7 Key Countries

20.7.1 China: Market Size & Forecast

20.7.2 Japan: Market Size & Forecast

20.7.3 South Korea: Market Size & Forecast

20.7.4 Australia: Market Size & Forecast

20.7.5 India: Market Size & Forecast

20.7.6 Singapore: Market Size & Forecast

20.7.7 Indonesia: Market Size & Forecast

20.7.8 Malaysia: Market Size & Forecast

21 Middle East & Africa

21.1 Market Overview

21.2 Market Size & Forecast

21.3 Product

21.3.1 Market Size & Forecast

21.4 Form

21.4.1 Market Size & Forecast

21.5 Application

21.5.1 Market Size & Forecast

21.6 End-User

21.6.1 Market Size & Forecast

21.7 Key Countries

21.7.1 South Africa: Market Size & Forecast

21.7.2 Turkey: Market Size & Forecast

21.7.3 Saudi Arabia: Market Size & Forecast

21.7.4 Uae: Market Size & Forecast

21.7.5 Israel: Market Size & Forecast

22 Latin America

22.1 Market Overview

22.2 Market Size & Forecast

22.3 Product

22.3.1 Market Size & Forecast

22.4 Form

22.4.1 Market Size & Forecast

22.5 Application

22.5.1 Market Size & Forecast

22.6 End-User

22.6.1 Market Size & Forecast

22.7 Key Countries

22.7.1 Brazil: Market Size & Forecast

22.7.2 Mexico: Market Size & Forecast

22.7.3 Colombia: Market Size & Forecast

23 Competitive Landscape

23.1 Competition Overview

24 Key Company Profiles

24.1 Amway

24.1.1 Business Overview

24.1.2 Product Offerings

24.1.3 Key Strategies

24.1.4 Key Strengths

24.1.5 Key Opportunities

24.2 Herbalife Nutrition

24.2.1 Business Overview

24.2.2 Product Offerings

24.2.3 Key Strategies

24.2.4 Key Strengths

24.2.5 Key Opportunities

24.3 Nutrigenomix

24.3.1 Business Overview

24.3.2 Product Offerings

24.3.3 Key Strategies

24.3.4 Key Strengths

24.3.5 Key Opportunities

24.4 Basf

24.4.1 Business Overview

24.4.2 Product Offerings

24.4.3 Key Strategies

24.4.4 Key Strengths

24.4.5 Key Opportunities

24.5 Dsm

24.5.1 Business Overview

24.5.2 Product Offerings

24.5.3 Key Strategies

24.5.4 Key Strengths

24.5.5 Key Opportunities

25 Other Prominent Vendors

25.1 Atlas Biomed

25.1.1 Business Overview

25.1.2 Product Offerings

25.2 Dnalysis

25.2.1 Business Overview

25.2.2 Product Offerings

25.3 Persona

25.3.1 Business Overview

25.3.2 Product Offerings

25.4 Bactolac Pharmaceutical

25.4.1 Business Overview

25.4.2 Product Offerings

25.5 Balchem

25.5.1 Business Overview

25.5.2 Product Offerings

25.6 Wellness Coaches

25.6.1 Business Overview

25.6.2 Product Offerings

25.7 Daytwo

25.7.1 Business Overview

25.7.2 Product Offerings

25.8 Biogeniq

25.8.1 Business Overview

25.8.2 Product Offerings

25.9 Mindbodygreen

25.9.1 Business Overview

25.9.2 Product Offerings

25.10 Helix & Gene

25.10.1 Business Overview

25.10.2 Product Offerings

25.11 Metagenics

25.11.1 Business Overview

25.11.2 Product Offerings

25.12 Baze

25.12.1 Business Overview

25.12.2 Product Offerings

25.13 Gx Sciences

25.13.1 Business Overview

25.13.2 Product Offerings

25.14 Viome

25.14.1 Business Overview

25.14.2 Product Offerings

25.15 Zipongo

25.15.1 Business Overview

25.15.2 Product Offerings

25.16 Care/Of

25.16.1 Business Overview

25.16.2 Product Offerings

25.17 Dnafit

25.17.1 Business Overview

25.17.2 Product Offerings

25.18 Vitagene

25.18.1 Business Overview

25.18.2 Product Offerings

25.19 Instafit

25.19.1 Business Overview

25.19.2 Product Offerings

25.20 Segterra

25.20.1 Business Overview

25.20.2 Product Offerings

25.21 Nutrino

25.21.1 Business Overview

25.21.2 Product Offerings

25.22 Nourished

25.22.1 Business Overview

25.22.2 Product Offerings

25.23 Rootine

25.23.1 Business Overview

25.23.2 Product Offerings

25.24 Supp Nutrition

25.24.1 Business Overview

25.24.2 Product Offerings

26 Report Summary

26.1 Key Takeaways

26.2 Strategic Recommendations

27 Quantitative Summary

27.1 Product

27.2 Form

27.3 Application

27.4 End-User

27.5 Market by Geography

27.6 North America

27.6.1 Product

27.6.2 Form

27.6.3 Application

27.6.4 End-User

27.7 Europe

27.7.1 Product

27.7.2 Form

27.7.3 Application

27.7.4 End-User

27.8 Apac

27.8.1 Product

27.8.2 Form

27.8.3 Application

27.8.4 End-User

27.9 Middle East & Africa

27.9.1 Product

27.9.2 Form

27.9.3 Application

27.9.4 End-User

27.10 Latin America

27.10.1 Product

27.10.2 Form

27.10.3 Application

27.10.4 End-User

28 Appendix

28.1 Abbreviations

Companies Mentioned

- Amway

- Herbalife Nutrition

- Nutrigenomix

- BASF SE

- DSM

- Atlas Biomed

- DNAlysis

- Persona

- Bactolac Pharmaceutical

- Balchem

- Wellness Coaches

- DayTwo

- BiogeniQ

- mindbodygreen

- Helix & Gene

- Metagenics

- Baze

- GX Sciences

- Viome

- Zipongo

- Care/of

- DNAfit

- Vitagene

- InstaFit

- Segterra

- Nutrino

- Nourished

- Rootine

- Supp Nutrition

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 274 |

| Published | February 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 9.58 Billion |

| Forecasted Market Value ( USD | $ 24.08 Billion |

| Compound Annual Growth Rate | 16.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 29 |