Global Metal Cans Market Analysis:

Major Market Drivers: The increasing consumption of processed and packed food, the growing infrastructure development, and the escalating demand for alcoholic and non-alcoholic beverages represent some of the primary factors stimulating the market growth.Key Market Trends: The emerging trend of utilizing eco-friendly cans, on account of the rising consumer environmental concerns, is bolstering the global market. Besides this, the introduction of easy open-lid cans is also acting as another significant growth-inducing factor.

Geographical Trends: According to the metal cans market outlook, North America acquires the dominant share in the global market, owing to the expanding food and beverage (F&B) industry, changing consumer preferences, and the growing demand for energy drinks. Furthermore, continuous advancements in the packaging industry will continue to catalyze the regional market in the coming years.

Competitive Landscape: Some of the major market players in the metal cans industry include Amcor plc, Ardagh Group S.A., Ball Corporation, CPMC Holdings Limited, Crown Holdings Inc., Hindustan Tin Works Ltd., Independent Can Company, Kian Joo Can Factory Berhad (Can-One Berhad), Mauser Packaging Solutions, Silgan Containers LLC (Silgan Holdings Inc.), Sonoco Products Company, and Toyo Seikan Group Holdings Ltd., among many others.

Challenges and Opportunities: The increasing availability of alternative materials, the rising environmental concerns, and the inflating need for cost-effective and sustainable packaging solutions are some key challenges hindering the global market. However, the growing focus on health and wellness presents opportunities for metal cans, particularly in the beverage market. Consumers are seeking healthier beverage options, and metal cans can be used to package products like sparkling water, energy drinks, and functional beverages. This, in turn, is expected to drive the global market over the forecast period.

Global Metal Cans Market Trends:

Growing Demand for Packaged and Processed Food

The escalating usage of packaged and processed food products, as they offer convenience to consumers, especially in today's fast-paced lifestyles, is one of the key factors stimulating the metal cans market growth. For instance, according to a recent report published by the United States Department of Agriculture (USDA), the food processing industry in India contributes to 13% of the country’s total GDP. Moreover, the Prime Minister of India, along with the Union Cabinet, approved the Production-Linked Incentive (PLI) scheme in food products to enhance the manufacturing capabilities and elevate the exports.Metal cans are an ideal packaging solution for a wide range of processed foods, including fruits, vegetables, soups, sauces, and ready-to-eat meals. They provide shelf-stable storage, easy opening, and portion control, making them a convenient choice for consumers. Moreover, metal cans offer a secure and hygienic packaging option for processed food products, protecting them from contamination and tampering during storage and transportation. Besides this, the growing demand for beverages is also creating a positive outlook in the metal cans market. For example, the revenue of Coca-Cola, one of the major key players in the beverage industry, grew 7% in the fourth quarter of 2023.

Increasing Focus on Recycling

Metals can be easily recycled without compromising on the quality. Apart from this, the elevating environmental concerns, along with surging awareness among consumers to mitigate disposal in landfills, are driving the metal cans market demand. One of the key metal cans market recent developments include extensive investment in recycling infrastructures and technologies. Furthermore, government and regulatory bodies are also taking significant initiatives and imposing stricter regulations and targets for recycling and waste reduction. For instance, in October 2023, Budweiser Brewing Co APAC Ltd, the largest beer company in the Asia Pacific, launched ""Can-to-Can"" recycling initiative in China.The program aimed to boost the percentage of recycled aluminium cans. Many companies are also setting sustainability goals, including targets for using recycled materials in their packaging. This has led to an increased demand for recycled metal. Moreover, the concept of the circular economy, which aims to minimize waste and maximize resource efficiency, is propelling the demand for recycling. For example, an analysis of the most popular beverage packaging substrates conducted recently by the Energy and Resources Institute (TERI), the first of its type in India, revealed that aluminium cans support a fully circular economy and that most of them have the lowest Global Warming Potential (GWP).

Rising Usage of Alcoholic and Non-Alcoholic Beverages

The elevating adoption of metal cans in the food and beverage (F&B) industry as a packaging solution for storing various products, including iced teas, energy drinks, alcoholic beverages, sodas, carbonated soft drinks, etc., represents one of the key factors propelling the metal cans market revenue. Additionally, the rising consumption of both alcoholic and non-alcoholic beverages like beer and fizzy drinks in regions, including Europe, is also acting as a significant growth-inducing factor. For instance, according to the Barth-Haas Group, Germany was the top beer producer in Europe in 2021. More than 85 million hl of beer were produced in Germany, more than twice as much as in the UK. Moreover, the rising environmental concern is augmenting the demand for eco-friendly cans.Metal Cans Industry Segmentation:

This report provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on material type, fabrication, and can type.Breakup by Material Type:

- Aluminium

- Steel

- Tin

Currently, aluminium accounts for the largest market share

The report has provided a detailed breakup and analysis of the market based on the material type. This includes aluminium, steel, and tin. According to the report, aluminium accounts for the largest market share.The growth of this segmentation is attributed to the increasing investment by key players to set up new manufacturing infrastructures to fulfill increasing orders and tackle the shortage of aluminium cans. For example, in September 2021, the Ball Corporation started the construction of a new aluminium beverage packaging plant in Nevada, United States. The production of this multi-line factory was started in late 2022. Apart from this, the rising awareness among consumers towards the advantages associated with aluminium packaging in terms of sustainability and ease of recycling without affecting quality or energy efficiency will continue to propel the global market in this segmentation.

Breakup by Fabrication:

- Two Piece Metal Can

- Three Piece Metal Can

Two piece metal can currently holds the majority of the total market share

The report has provided a detailed breakup and analysis of the market based on the fabrication. This includes two piece metal can and three piece metal can. According to the report, two piece metal can accounts for the majority of the global market share.Two-piece cans are gaining extensive traction, owing to the rising number of businesses, such as Kian Joo Can Factory and Berhad, that offer two-piece DWI steel cans to package processed foods, evaporated milk, and sweetened condensed milk safely. These cans are used in various applications, which is further contributing to the growth of the market in this segment.

Breakup by Can Type:

- Food

- Vegetable

- Fruits

- Pet Food

- Others

- Beverages

- Alcoholic Beverage

- Non-Alcoholic Beverage

- Aerosols

- Paints and Varnishes

- Cosmetic and Personal Care

- Pharmaceuticals

- Others

- Others

Currently, beverages exhibit a clear dominance in the market

The report has provided a detailed breakup and analysis of the market based on the can type. This includes food (vegetable, fruits, pet food and others), beverages (alcoholic beverage and non-alcoholic beverage), aerosols (paints and varnishes, cosmetic and personal care, pharmaceuticals, and others), and others. According to the report, beverages account for the majority of the global market share.The capacity of metal cans to contain beverages without leaking, spoiling, or contaminating them is primarily augmenting the market growth in this segmentation. Besides this, the growing demand for carbonated beverages, particularly among the younger demographic, is also acting as another significant growth-inducing factor. In addition, the beverage market is further divided into alcoholic and non-alcoholic. The growing demand for alcoholic beverages among the millennial population and the rising disposable income levels are projected to augment the global market in this segmentation over the forecasted period.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America currently dominates the global market

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America currently dominates the global market.The North America metal cans market is primarily driven by the highly developed infrastructure, and subsequent recycling industry. The region's growth is also catalyzed, owing to the presence of significant market players. Along with their increased profitability, the ongoing strategic efforts of these manufacturers to produce sustainable packaging solutions are also positively influencing the regional market. Additionally, the escalating demand for canned food in countries, including Canada, will continue to drive the metal cans market in North America over the forecasted period.

Leading Key Players in the Metal Cans Industry:

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided.Some of the key players in the market include:

- Amcor plc

- Ardagh Group S.A.

- Ball Corporation

- CPMC Holdings Limited

- Crown Holdings Inc.

- Hindustan Tin Works Ltd.

- Independent Can Company

- Kian Joo Can Factory Berhad (Can-One Berhad)

- Mauser Packaging Solutions

- Silgan Containers LLC (Silgan Holdings Inc.)

- Sonoco Products Company and Toyo Seikan Group Holdings Ltd.

Key Questions Answered in This Report:

- What are metal cans?

- How big is the metal cans market?

- What is the expected growth rate of the global metal cans market during 2025-2033?

- Which segment accounted for the largest metal cans market share?

- What are the factors driving the metal cans market?

- What is the leading segment of the global metal cans market based on the material type?

- What is the leading segment of the global metal cans market based on fabrication?

- What is the leading segment of the global metal cans market based on can type?

- What are the key regions in the global metal cans market?

- Who are the key players/companies in the global metal cans market?

Table of Contents

Companies Mentioned

- Amcor plc

- Ardagh Group S.A.

- Ball Corporation

- CPMC Holdings Limited

- Crown Holdings Inc.

- Hindustan Tin Works Ltd.

- Independent Can Company

- Kian Joo Can Factory Berhad (Can-One Berhad)

- Mauser Packaging Solutions

- Silgan Containers LLC (Silgan Holdings Inc.)

- Sonoco Products Company

- Toyo Seikan Group Holdings Ltd.

Table Information

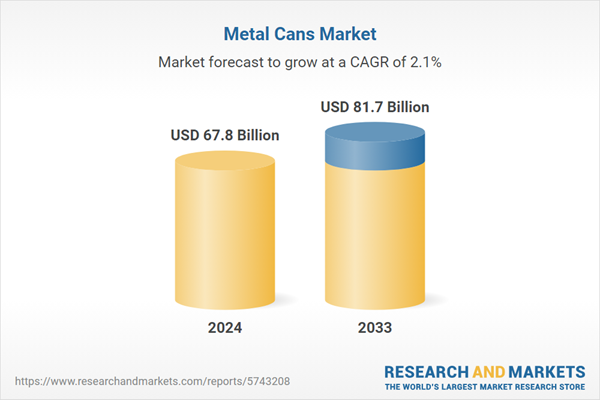

| Report Attribute | Details |

|---|---|

| No. of Pages | 144 |

| Published | April 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 67.8 Billion |

| Forecasted Market Value ( USD | $ 81.7 Billion |

| Compound Annual Growth Rate | 2.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |