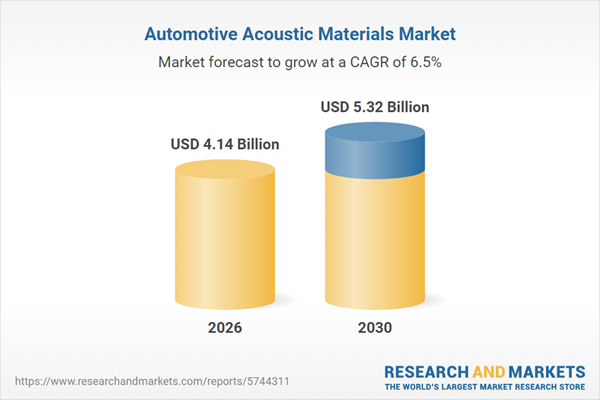

The automotive acoustic materials market size is expected to see strong growth in the next few years. It will grow to $5.32 billion in 2030 at a compound annual growth rate (CAGR) of 6.5%. The growth in the forecast period can be attributed to increasing adoption of AI-integrated acoustic systems, development of sustainable and lightweight materials, expansion in electric vehicle NVH solutions, integration with smart vehicle monitoring systems, growth in luxury and premium vehicle segments. Major trends in the forecast period include adoption of AI-driven nvh solutions, deployment of smart acoustic materials, integration of IoT-enabled noise monitoring, expansion of lightweight soundproofing technologies, implementation of automated in-car acoustic control.

The rising sales of electric vehicles are projected to fuel the growth of the automotive acoustic materials market going forward. Electric vehicles (EVs) are vehicles powered by electric motors using energy stored in rechargeable batteries rather than traditional internal combustion engines. The adoption of electric vehicles is accelerating due to increasing environmental concerns, as EVs produce zero tailpipe emissions, helping reduce air pollution and carbon footprint compared to gasoline-powered vehicles. Automotive acoustic materials assist electric vehicles in lowering interior noise levels through soundproofing and sound absorption. For instance, in January 2024, according to a report released by Kelley Blue Book, a US-based Cox Automotive company, 2023 saw a record 1.2 million car buyers in the United States choosing electric vehicles, representing 7.6% of the total U.S. vehicle market, an increase from 5.9% in 2022. Therefore, the growing sales of electric vehicles are supporting the expansion of the automotive acoustic materials market.

Major companies in the automotive acoustic materials sector are pursuing a strategic partnership strategy to offer comprehensive and integrated solutions. Strategic partnerships involve companies leveraging each other's strengths and resources for mutual benefit and success. For example, in July 2024, Brose, a manufacturing company, introduced an acoustic vehicle alerting system designed to enhance the safety of electric and hybrid vehicles, which are generally quieter than their internal combustion engine counterparts. This system emits audible warnings at low speeds to alert pedestrians and other road users of the vehicle's presence, thus minimizing the risk of accidents caused by insufficient sound. The Acoustic Vehicle Alerting System (AVAS) is required in many regions to ensure compliance with safety regulations, particularly as the automotive industry transitions towards electrification. The system can produce distinct sound designs across a broad frequency range, customized for various driving scenarios to enhance auditory awareness and vehicle recognition.

Autoneum Holding AG, a Switzerland-based automotive company, made a significant move in January 2023 by acquiring the automotive business from Borgers Group, a renowned Gemnat-based manufacturer of automotive acoustic and thermal management products, for an undisclosed amount. This acquisition was orchestrated to further bolster Autoneum's global market dominance in sustainable, lightweight solutions for vehicle acoustic and thermal management. The integration of Borgers Group's automotive business serves to reinforce Autoneum's position in the industry.

Major companies operating in the automotive acoustic materials market are Dow Chemical Company, 3M Acoustic Solutions, BASF SE, Covestro AG, Henkel Adhesives Technologies India Private Limited, LyondellBasell Industries Holdings B.V., Sumitomo Riko Co. Ltd., Sika AG, Huntsman International LLC, Johns Manville, Harman International, UFP Technologies Inc., Nihon Tokushu Toryo Co. Ltd., Owens Corning, DuPont Automotive, ThyssenKrupp Automotive AG, Alps Automotive Inc., American Showa Inc., ShanghAI Energy New Materials Technology Co. Ltd., Cangzhou Mingzhu Plastic Co., Teijin Limited, Nitto Denko Corporation.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

Tariffs are influencing the automotive acoustic materials market by increasing costs for imported polymer sheets, foams, fiberglass, and specialized textiles used in NVH management. Passenger cars, LCVs, and HCVs in regions such as Asia-Pacific, Europe, and North America are most affected due to reliance on imported acoustic materials. Nevertheless, tariffs are promoting domestic production, regional sourcing of raw materials, and development of energy-efficient and sustainable acoustic solutions, enhancing supply chain stability and adoption of advanced in-vehicle noise reduction technologies.

The automotive acoustic materials market research report is one of a series of new reports that provides automotive acoustic materials market statistics, including automotive acoustic materials industry global market size, regional shares, competitors with an automotive acoustic materials market share, detailed automotive acoustic materials market segments, market trends, and opportunities, and any further data you may need to thrive in the automotive acoustic materials industry. This automotive acoustic materials market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Automotive acoustic materials are specialized materials used in vehicles to manage and reduce noise, vibration, and harshness (NVH). These materials are designed to absorb, block, or dampen sound, improving the overall comfort and acoustic experience inside the vehicle. They play a crucial role in minimizing unwanted noise from the engine, tires, road, wind, and other external sources, while enhancing the sound quality of in-car entertainment systems.

Key materials in automotive acoustics include acrylonitrile butadiene styrene (ABS), fiberglass, polyvinyl chloride (PVC), polyurethane (PU) foam, polypropylene, and textiles. Acrylonitrile butadiene styrene, characterized by its opaqueness, amorphy, and thermoplastic nature, plays a crucial role. Various components like arch liners, dashboards, fenders, floor insulators, doors, headliners, bonnet liners, engine covers, trunk trims, parcel trays, and others contribute to the comprehensive utilization of these materials. Application areas span passenger cars, light commercial vehicles (LCVs), and heavy commercial vehicles (HCVs), addressing underbody and engine bay acoustics, interior cabin acoustics, exterior acoustics, and trunk panel acoustics.Asia-Pacific was the largest region in the automotive acoustic materials market share in 2025. The regions covered in the automotive acoustic materials market report are Asia-Pacific, South East Asia, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the automotive acoustic materials market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Taiwan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The automotive acoustic materials market consists of sales of vibration dampers, vibration damping sheets, barrier decouplers, PVC decouplers, cellulose panels, sound silencers, silk metal, and echo barriers. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Automotive Acoustic Materials Market Global Report 2026 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses automotive acoustic materials market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 16 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on end user analysis.

- Benchmark performance against key competitors based on market share, innovation, and brand strength.

- Evaluate the total addressable market (TAM) and market attractiveness scoring to measure market potential.

- Suitable for supporting your internal and external presentations with reliable high-quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for automotive acoustic materials? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The automotive acoustic materials market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, total addressable market (TAM), market attractiveness score (MAS), competitive landscape, market shares, company scoring matrix, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market. This section also examines key products and services offered in the market, evaluates brand-level differentiation, compares product features, and highlights major innovation and product development trends.

- The supply chain analysis section provides an overview of the entire value chain, including key raw materials, resources, and supplier analysis. It also provides a list competitor at each level of the supply chain.

- The updated trends and strategies section analyses the shape of the market as it evolves and highlights emerging technology trends such as digital transformation, automation, sustainability initiatives, and AI-driven innovation. It suggests how companies can leverage these advancements to strengthen their market position and achieve competitive differentiation.

- The regulatory and investment landscape section provides an overview of the key regulatory frameworks, regularity bodies, associations, and government policies influencing the market. It also examines major investment flows, incentives, and funding trends shaping industry growth and innovation.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- The total addressable market (TAM) analysis section defines and estimates the market potential compares it with the current market size, and provides strategic insights and growth opportunities based on this evaluation.

- The market attractiveness scoring section evaluates the market based on a quantitative scoring framework that considers growth potential, competitive dynamics, strategic fit, and risk profile. It also provides interpretive insights and strategic implications for decision-makers.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- Expanded geographical coverage includes Taiwan and Southeast Asia, reflecting recent supply chain realignments and manufacturing shifts in the region. This section analyzes how these markets are becoming increasingly important hubs in the global value chain.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The company scoring matrix section evaluates and ranks leading companies based on a multi-parameter framework that includes market share or revenues, product innovation, and brand recognition.

Scope

Markets Covered:

1) By Material Type: Acrylonitrile Butadiene Styrene (ABS); Fiberglass; Polyvinyl Chloride (PVC); Polyurethane (PU) Foam; Polypropylene; Textiles2) By Component: Arch Liner; Dash; Fender and Floor Insulator; Door; Head & Bonnet Liner; Engine Cover; Trunk Trim; Parcel Tray; Other Components

3) By Vehicle Type: Passenger Cars; LCV; HCV

4) By Application: Underbody and Engine Bay Acoustics; Interior Cabin Acoustics; Exterior Acoustics; Trunk Panel Acoustics

Subsegments:

1) By Acrylonitrile Butadiene Styrene (ABS): ABS Sheets; ABS Foam2) By Fiberglass: Fiberglass Mats; Fiberglass Panels

3) By Polyvinyl Chloride (PVC): Rigid PVC Sheets; Flexible PVC Sheets

4) By Polyurethane (PU) Foam: Rigid PU Foam; Flexible PU Foam

5) By Polypropylene: Polypropylene Sheets; Polypropylene Foam

6) By Textiles: Non-woven Textiles; Woven Textiles; Composite Textiles

Companies Mentioned: Dow Chemical Company; 3M Acoustic Solutions; BASF SE; Covestro AG; Henkel Adhesives Technologies India Private Limited; LyondellBasell Industries Holdings B.V.; Sumitomo Riko Co. Ltd.; Sika AG; Huntsman International LLC; Johns Manville; Harman International; UFP Technologies Inc.; Nihon Tokushu Toryo Co. Ltd.; Owens Corning; DuPont Automotive; ThyssenKrupp Automotive AG; Alps Automotive Inc.; American Showa Inc.; Shanghai Energy New Materials Technology Co. Ltd.; Cangzhou Mingzhu Plastic Co.; Teijin Limited; Nitto Denko Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Taiwan; Russia; South Korea; UK; USA; Canada; Italy; Spain.

Regions: Asia-Pacific; South East Asia; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: Word, PDF or Interactive Report + Excel Dashboard

Added Benefits:

- Bi-Annual Data Update

- Customisation

- Expert Consultant Support

Companies Mentioned

The companies featured in this Automotive Acoustic Materials market report include:- Dow Chemical Company

- 3M Acoustic Solutions

- BASF SE

- Covestro AG

- Henkel Adhesives Technologies India Private Limited

- LyondellBasell Industries Holdings B.V.

- Sumitomo Riko Co. Ltd.

- Sika AG

- Huntsman International LLC

- Johns Manville

- Harman International

- UFP Technologies Inc.

- Nihon Tokushu Toryo Co. Ltd.

- Owens Corning

- DuPont Automotive

- ThyssenKrupp Automotive AG

- Alps Automotive Inc.

- American Showa Inc.

- Shanghai Energy New Materials Technology Co. Ltd.

- Cangzhou Mingzhu Plastic Co.

- Teijin Limited

- Nitto Denko Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | January 2026 |

| Forecast Period | 2026 - 2030 |

| Estimated Market Value ( USD | $ 4.14 Billion |

| Forecasted Market Value ( USD | $ 5.32 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 23 |