The Spanish insurance sector to remain strongly capitalized in 2022. It is one of the best-capitalized in Europe. According to the Spanish regulator Direccion General de Seguros y Fondos de Pensiones (DGSFP), the sector Solvency II solvency capital requirements coverage ratio was a very strong 239% in end-2020. Own funds of the sector consist almost entirely of unrestricted Tier 1 capital. Regulatory capital adequacy levels to remain stable in 2022, supported by stable earnings generation.

The overall profitability of the sector is to remain strong in a few years, supported by stable non-life insurance earnings, while life profitability is likely to remain pressured and more volatile. The sector’s return on equity (ROE) remained strong and resilient at 12% in 2020 despite the COVID-19 pandemic, supported by a stronger contribution from non-life businesses, which benefitted from an overall lower claims frequency. This was in line with the sector’s 10-year average ROE of 12%, one of the strongest levels in Europe.

Life Insurers in Spain have been grappling with a combination of cost, regulatory, and interest rate challenges for much of the past decade. The COVID-19 pandemic has accelerated those challenges by adding pressure on life insurers’ costs, solvency, and investment yield, forcing necessary investments in digitalization. Now the challenge for incumbents is to learn from these developments so they can be better prepared for the future and avoid becoming trapped in a downward spiral.

In Spain, life insurance premiums grew 8%, showing an improvement in 2021 but still far below 2019. The growth in unit-linked premiums outpaced that in guaranteed premiums. premiums grew 5% in 2021 and rising medical expenses were the driver. Property claims rose 7% in Spain, compared to 2020, mainly due to extreme weather events, the most striking being snowstorm Filomena, which cost insurers more than EUR 200 million (USD 212.3 million). Natcat losses are usually covered by the public Consorcio de Compensacion de Seguros, but some events, such as snowstorms, are covered by private insurers. A volcanic eruption on the island of La Palma caused severe damage and over EUR 90 million (USD 95.5 million) was paid in compensation by the Consorcio. In 2021, significant insured losses were also recorded in agriculture.

In 2021, the leading insurance company by volume of premiums in the non-life sector in Spain was Mutua Madrileña headquartered in Madrid, Mutua Madrileña reached non-life premiums worth over EUR 5.5 billion (USD 5.8 billion) that year. This was closely followed by Mapfre, which had a non-life premium volume of approximately EUR 5.3 (USD 5.6 billion) billion. The third-place ranking is completed by Allianz, which reached non-life premiums valued at almost EUR 2.5 billion (USD 2.65 billion) in 2021.

Spain Life & Non-Life Insurance Market Trends

Increasing in Fintech and InsureTech Adoption in Spain is Expected to Drive the Market

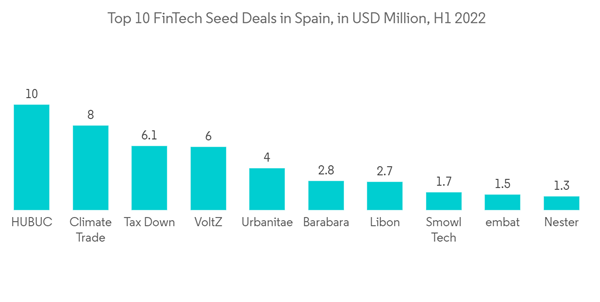

The rise of fintech, changing consumer behavior, and advanced technologies are disrupting the insurance industry. Additionally, insurtechs and technology startups continue to redefine customer experience through innovations such as risk-free underwriting, on-the-spot purchasing, activation, and claims processing.Spain’s FinTechs have increased six-fold since 2015, making Spain the sixth-largest global market in terms of Fintechs per capita. They have also benefitted from over EUR 600 million (USD 636.9 billion) invested between 2020-2021, putting them in a great position to build on their existing ecosystem.

FinTechs are also about to benefit from the country’s new Startups Law which is aimed at the unique needs of the country’s small FinTechs. Startups Law aims to make Spain a more entrepreneurial country, attractive to international investors and talented innovators. With this considered, the law can be seen as very good news for Spain’s FinTech startups.

Innsomnia is the biggest Insurtech Club in Spain. Innsomnia's Fintech and Insurtech Galaxy consists of more than 1,000 startups that have developed an average of 3.5 fintech and insurtech products already tested in the market. It is the largest insurtech community in Spain.

Rising General Liability Insurance in Spain is Driving the Market Growth

In Spain, there are 3 types of business liability insurance: General Liability, Professional Liability, and Liability for directors and managers. general liability insurance is for regular companies and their staff. It is essential and often mandatory for companies. This covers all employees for damage to third parties. There is a special “Comercio” insurance for offices and small buildings that includes the liability. This only provides coverage within the 4 walls of the property.Demand for General liability insurance has been growing for the past 5 years. In 2020, the total claims paid on the general liability insurance market amounted to more than EUR 652 million (USD 692.1 million) up 10% from the previous year.

Spain Life & Non-Life Insurance Market Competitor Analysis

The report covers the major players operating in the life and non-life insurance market in Spain. The market fragmented, and insurance penetration is low in the country. Insurtech's adoption is increasing, and many insurtech companies have raised funds. As a result, the adoption of insurtech in health insurance is higher in the country. The market is expected to grow in the forecast period due to several factors. Companies including, CA Life Insurance Experts Compania De Seguro Y Reaseguros SA., AXA Seguros Generalas Sociedad Anonima De Seguros Y Reaseguros, MAPFRE Espana Compania De Seguros Y Reaseguros SA, Linea Directa Aseguradora Sociedad Anonima Compania De Seguros Y Reaseguros, and Allianz Compania De Sseguros Y Reaseguros SA, among others have been profiled in the report.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- CA LIFE INSURANCE EXPERTS COMPAÑIA DE SEGUROS Y REASEGUROS SA.

- AXA SEGUROS GENERALES SOCIEDAD ANONIMA DE SEGUROS Y REASEGUROS

- MAPFRE ESPAÑA COMPAÑIA DE SEGUROS Y REASEGUROS SA

- LINEA DIRECTA ASEGURADORA SOCIEDAD ANONIMA COMPAÑIA DE SEGUROS Y REASEGUROS

- ALLIANZ COMPAÑIA DE SEGUROS Y REASEGUROS SA

- REALE SEGUROS GENERALES SA

- MUTUA MADRILEÑA AUTOMOVILISTA, SOCIEDAD DE SEGUROS A PRIMA FIJA

- FIATC MUTUA DE SEGUROS Y REASEGUROS.

- MERIDIANO SA COMPAÑIA ESPAÑOLA DE SEGUROS

- LIBERTY SEGUROS COMPAÑIA DE SEGUROS Y REASEGUROS, SA