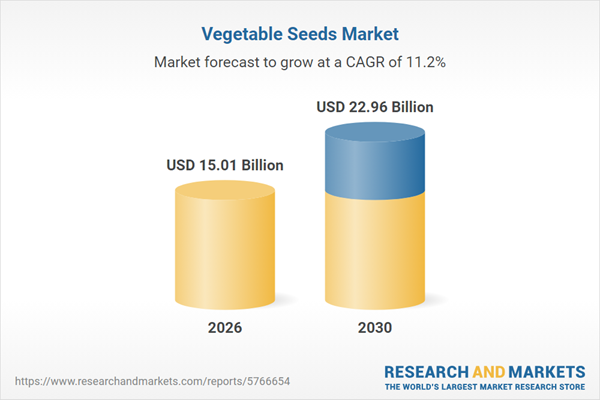

The vegetable seeds market size is expected to see rapid growth in the next few years. It will grow to $22.96 billion in 2030 at a compound annual growth rate (CAGR) of 11.2%. The growth in the forecast period can be attributed to rise in climate-resilient agriculture, increasing organic farming adoption, growth in protected cultivation systems, expansion of commercial vegetable production, demand for nutrient-rich vegetable varieties. Major trends in the forecast period include rising demand for heirloom and open-pollinated seeds, increasing adoption of disease-resistant vegetable seed varieties, growth in organic vegetable seed production, expansion of specialty and niche vegetable seed segments, increasing preference for climate-adapted seed varieties.

The rising demand for organic food products is expected to drive the growth of the vegetable seeds market in the coming years. Organic food refers to agricultural products grown and processed without synthetic fertilizers, pesticides, genetically modified organisms, or artificial additives, following environmentally sustainable and natural farming practices. This increasing demand is primarily fueled by growing consumer awareness of health and environmental sustainability, as individuals seek products that are perceived as safer, more nutritious, and less harmful to ecosystems, aligning personal well-being with ecological responsibility. Vegetable seeds play a crucial role in meeting this demand by enabling the cultivation of high-quality, chemical-free produce that adheres to organic standards and maintains the integrity of the organic food supply chain. For example, in December 2023, the United States Department of Agriculture, a US-based federal agency, reported that India produced 2.9 million metric tons of certified edible organic products for 2022-23. Thus, the growing demand for organic food is driving growth in the vegetable seeds market.

Major companies in the vegetable seeds market are focused on developing technological advancements, such as e-commerce platforms for vegetable seeds, to streamline purchasing, enhance accessibility, expand market reach, and improve customer engagement. An e-commerce platform for vegetable seeds serves as an online marketplace that facilitates the buying and selling of vegetable seeds. For example, in October 2024, Sakata, a Japan-based company, launched an e-commerce platform specifically for vegetable seeds, specializing in the development and production of vegetable and flower seeds. These platforms typically feature comprehensive product listings, search and filtering options, user accounts, a shopping cart for easy purchases, secure payment processing, customer reviews, educational resources, delivery options, customer support, and mobile compatibility, all designed to enhance the user experience and streamline the buying process.

In July 2023, Syngenta Vegetable Seeds, a Swiss agricultural technology company, completed the acquisition of Feltrin Sementes for an undisclosed sum. This acquisition marks a significant expansion of Syngenta's vegetable seed portfolio, extending its reach to growers across more than 40 countries. Feltrin Sementes, a Brazil-based vegetable seed company, specializes in serving smallholder growers and home gardeners. With a diverse offering of over 500 varieties across 50 crop segments, Feltrin Sementes enhances Syngenta's capacity to cater to a broader global market.

Major companies operating in the vegetable seeds market are BASF SE, Syngenta AG, JK Agri Genetics Limited, Bayer FMC Corporation, Groupe Limagrain Holding SA, Vilmorin & Cie SA, Rijk Zwaan Zaadteelt en Zaadhandel BV, Sakata Seed Corporation, Yuan Longping High-Tech Agriculture Co Ltd., Kaveri Seeds Company Pvt, De Enkhuizer Zaadwinkel, East-West Seed Company Ltd., W. Atlee Burpee & Co, Seedway LLC, Johnny's Selected Seeds, Stokes Seeds Inc., Bejo Zaden BV, Abbott & Cobb Inc., Harris Moran Seed Company, Advanta Seeds - UPL, Nuziveedu Seeds Limited, Emerald Seed Company, Territorial Seed Company, Takii & Co Ltd., Mahyco Private Limited, F.W. Sawatzky Ltd., Namdhari Seeds Pvt Ltd.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

Tariffs on imported seed varieties, packaging materials, and agricultural inputs have increased procurement costs and disrupted supply chains within the vegetable seed market, especially for hybrid and specialty seed categories sourced from regions such as Asia-Pacific and Europe. These tariffs most significantly affect commercial growers and large distributors that rely on cross-border seed movement. However, they may positively stimulate domestic seed breeding programs and local production capacity, reducing long-term import dependency and enhancing national seed security.

The vegetable seeds market research report is one of a series of new reports that provides vegetable seeds market statistics, including vegetable seeds industry global market size, regional shares, competitors with a vegetable seeds market share, detailed vegetable seeds market segments, market trends and opportunities, and any further data you may need to thrive in the vegetable seeds industry. This vegetable seeds market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Vegetable seeds are plant seeds cultivated for consumption and market distribution, forming part of the seed life cycle from flower to seedling, varying across different plants.

The primary categories of vegetable seeds include open-pollinated and hybrid varieties. Hybrid seeds result from intentional cross-pollination between different plant species, aiming to generate offspring with favorable traits from both parent plants. These seeds cover various crop types such as Solanaceae, root and bulb vegetables, cucurbits, brassicas, leafy greens, and others, available in genetically modified and conventional seed forms. Vegetable seeds are further classified into organic and inorganic variations.Asia-Pacific was the largest region in the vegetable seeds market in 2025. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the vegetable seeds market report are Asia-Pacific, South East Asia, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the vegetable seeds market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Taiwan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The vegetable seeds market consists of sales of lettuce, cabbage, turnip greens, and celery. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Vegetable Seeds Market Global Report 2026 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses vegetable seeds market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 16 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on end user analysis.

- Benchmark performance against key competitors based on market share, innovation, and brand strength.

- Evaluate the total addressable market (TAM) and market attractiveness scoring to measure market potential.

- Suitable for supporting your internal and external presentations with reliable high-quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for vegetable seeds? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The vegetable seeds market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, total addressable market (TAM), market attractiveness score (MAS), competitive landscape, market shares, company scoring matrix, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market. This section also examines key products and services offered in the market, evaluates brand-level differentiation, compares product features, and highlights major innovation and product development trends.

- The supply chain analysis section provides an overview of the entire value chain, including key raw materials, resources, and supplier analysis. It also provides a list competitor at each level of the supply chain.

- The updated trends and strategies section analyses the shape of the market as it evolves and highlights emerging technology trends such as digital transformation, automation, sustainability initiatives, and AI-driven innovation. It suggests how companies can leverage these advancements to strengthen their market position and achieve competitive differentiation.

- The regulatory and investment landscape section provides an overview of the key regulatory frameworks, regularity bodies, associations, and government policies influencing the market. It also examines major investment flows, incentives, and funding trends shaping industry growth and innovation.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- The total addressable market (TAM) analysis section defines and estimates the market potential compares it with the current market size, and provides strategic insights and growth opportunities based on this evaluation.

- The market attractiveness scoring section evaluates the market based on a quantitative scoring framework that considers growth potential, competitive dynamics, strategic fit, and risk profile. It also provides interpretive insights and strategic implications for decision-makers.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- Expanded geographical coverage includes Taiwan and Southeast Asia, reflecting recent supply chain realignments and manufacturing shifts in the region. This section analyzes how these markets are becoming increasingly important hubs in the global value chain.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The company scoring matrix section evaluates and ranks leading companies based on a multi-parameter framework that includes market share or revenues, product innovation, and brand recognition.

Scope

Markets Covered:

1) By Type: Open-Pollinated; Hybrids2) By Crop Type: Solanaceae; Roots And Bulb; Cucurbit; Brassica; Leafy; Other Crop Types

3) By Traits: Genetically Modified; Conventional

4) By Form: Inorganic; Organic

Subsegments:

1) By Open-Pollinated: Heirloom Seeds; Traditional Open-Pollinated Varieties2) By Hybrids: F1 Hybrids; Specialty Hybrids

Companies Mentioned: BASF SE; Syngenta AG; JK Agri Genetics Limited; Bayer FMC Corporation; Groupe Limagrain Holding SA; Vilmorin & Cie SA; Rijk Zwaan Zaadteelt en Zaadhandel BV; Sakata Seed Corporation; Yuan Longping High-Tech Agriculture Co Ltd.; Kaveri Seeds Company Pvt; De Enkhuizer Zaadwinkel; East-West Seed Company Ltd.; W. Atlee Burpee & Co; Seedway LLC; Johnny's Selected Seeds; Stokes Seeds Inc.; Bejo Zaden BV; Abbott & Cobb Inc.; Harris Moran Seed Company; Advanta Seeds - UPL; Nuziveedu Seeds Limited; Emerald Seed Company; Territorial Seed Company; Takii & Co Ltd.; Mahyco Private Limited; F.W. Sawatzky Ltd.; Namdhari Seeds Pvt Ltd.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Taiwan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; South East Asia; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: Word, PDF or Interactive Report + Excel Dashboard

Added Benefits:

- Bi-Annual Data Update

- Customisation

- Expert Consultant Support

Companies Mentioned

The companies featured in this Vegetable Seeds market report include:- BASF SE

- Syngenta AG

- JK Agri Genetics Limited

- Bayer FMC Corporation

- Groupe Limagrain Holding SA

- Vilmorin & Cie SA

- Rijk Zwaan Zaadteelt en Zaadhandel BV

- Sakata Seed Corporation

- Yuan Longping High-Tech Agriculture Co Ltd.

- Kaveri Seeds Company Pvt

- De Enkhuizer Zaadwinkel

- East-West Seed Company Ltd.

- W. Atlee Burpee & Co

- Seedway LLC

- Johnny's Selected Seeds

- Stokes Seeds Inc.

- Bejo Zaden BV

- Abbott & Cobb Inc.

- Harris Moran Seed Company

- Advanta Seeds - UPL

- Nuziveedu Seeds Limited

- Emerald Seed Company

- Territorial Seed Company

- Takii & Co Ltd.

- Mahyco Private Limited

- F.W. Sawatzky Ltd.

- Namdhari Seeds Pvt Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | January 2026 |

| Forecast Period | 2026 - 2030 |

| Estimated Market Value ( USD | $ 15.01 Billion |

| Forecasted Market Value ( USD | $ 22.96 Billion |

| Compound Annual Growth Rate | 11.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 28 |