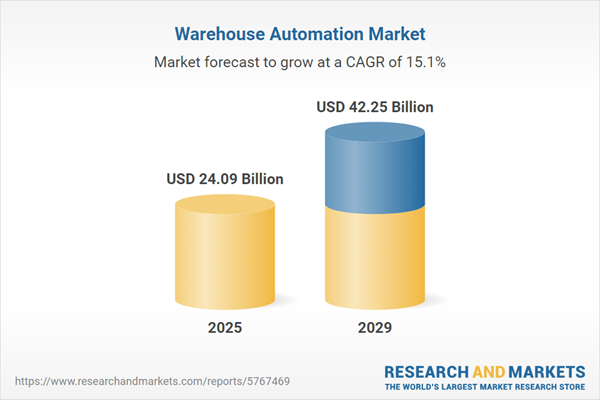

The warehouse automation market size is expected to see rapid growth in the next few years. It will grow to $42.25 billion in 2029 at a compound annual growth rate (CAGR) of 15.1%. The growth in the forecast period can be attributed to rise in same-day and on-demand delivery, sustainability and green warehousing, microfulfillment centers. Major trends in the forecast period include warehouse execution systems (WES), voice-activated and wearable technologies, automated palletizing and depalletizing systems, real-time monitoring and analytics, sustainable and green warehouse solutions.

The growth in e-commerce sales is set to drive the expansion of the warehouse automation market. As retailers face challenges in managing the rising volume of orders and the demands of last-mile delivery, warehouse automation is rapidly becoming a key advantage for those seeking to outpace their competitors, particularly in the competitive e-grocery sector. For example, in May 2024, the United States Census Bureau, a government agency, reported that e-commerce estimates for the first quarter of 2024 rose by 8.5 percent compared to the first quarter of 2023, while total retail sales increased by 2.8 percent during the same period. Consequently, the growth of the e-commerce sector is expected to significantly enhance the warehouse automation market in the upcoming forecast period.

The integration of robotics is anticipated to accelerate the growth of the warehouse management system market in the future. Robotics involves the technology focused on the design, construction, operation, and application of robots. Warehouse management systems improve efficiency in robot-operated warehouses by streamlining inventory tracking, order fulfillment, and overall logistics. For example, in September 2023, the World Robotics report published by the International Federation of Robotics, a professional non-profit organization based in Germany, indicated that there were 553,052 industrial robot installations in factories globally, reflecting a 5% year-on-year growth rate in 2022. Thus, the integration of robotics is significantly driving the warehouse management system market.

Investment in storage activities is a significant trend gaining traction in the warehouse automation market. Companies within this sector are increasingly allocating resources to storage facilities to enhance their product development initiatives and secure a competitive advantage by launching technologically advanced products with superior operational capabilities and performance. For instance, in July 2024, Mytra, a US-based warehouse robotics automation company, announced $78 million in funding to tackle physical storage challenges. The goal is to transform warehouse logistics through the introduction of a high-density, AI-driven automation solution for material storage and movement. This funding will facilitate the development of an adaptable 3D lattice system that optimizes space and improves efficiency by decreasing reliance on traditional conveyor systems. With its intelligent robotic system, Mytra aims to address the intricate issues related to 'material flow,' enabling businesses to adapt to changes in layout and demand without incurring excessive costs.

Leading companies in the warehouse automation market are prioritizing advanced solutions to deliver reliable services to their customers. For example, in September 2024, Stow Group, a Belgium-based warehouse automation provider, launched Movu Robotics. This new offering includes a range of innovative solutions designed to optimize warehouse operations. Movu Atlas increases pallet storage density, while Movu Escala facilitates bin transport. The Movu iFollow Autonomous Mobile Robot (AMR) assists operators in moving pallets, and Movu Eligo enhances order-picking accuracy. Collectively, these products create a plug-and-play automation ecosystem that improves handling and storage efficiency across various sectors.

In March 2023, Jungheinrich AG, a Germany-based sales financing company, acquired Storage Solutions, Inc. for an undisclosed amount. This acquisition aligns with Jungheinrich's strategy to strengthen its position in the material handling and warehouse solutions market. By leveraging Storage Solutions' expertise in customized storage solutions and warehouse space optimization, Jungheinrich aims to enhance its offerings. Storage Solutions, Inc. is a US-based provider specializing in warehouse automation solutions.

Major companies operating in the warehouse automation market include Viastore Systems Inc., ABB Ltd., Toyota Industries Corporation, Kion Group AG, Omron Corporation, Daifuku Co Ltd., Yaskawa Electric Corp Inc., KUKA Group, Schaefer Systems International Pvt Ltd., Honeywell Intelligrated Systems Inc., KNAPP Group, Vanderlande Industries BV, SSI Schaefer AG, Material Handling Systems Inc., WITRON Logistik + Informatik GmbH, Mecalux SA, Beumer Group, TGW Logistics Group, Swisslog Holding, Interroll Group, Bastian Solutions LLC, Kardex Group, Grenzebach Group, System Logistics SpA, Locus Robotics, Murata Machinery Ltd., Kardex Remstar LLC, Godrej Koerber Supply Chain Limited, Space Magnum Equipments Pvt Ltd., Fives Group.

North America was the largest region in the warehouse management system market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the warehouse automation market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the warehouse automation market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The warehouse automation refer to devices or systems used to streamline repetitive warehouse operations and make them less labor intensive to generate greater operational efficiencies. Warehouse automation is an integral part of supply chain optimization, as it reduces time, effort, and errors caused by manual or repetitive tasks. These automated systems are transforming operational facilities by increasing the speed of inventory movement, increasing storage density, reducing labor costs, and improving human safety inside the facility.

The main types of warehouse automation are conveyor/sortation systems, automated storage and retrieval systems (AS/RS), mobile robots, warehouse management systems (WMS), and automatic identification and data capture (AIDC). Sortation is the act of detecting individual objects on a conveyor system and routing them to the appropriate areas with the help of a variety of devices controlled by task-specific software. They are divided based on components in hardware and software that can perform activities such as inbound, picking, and outbound. There are various end users of warehouse automation, such as general merchandise, healthcare, FMCG/non-durable goods, and other end users.

The warehouse automation market research report is one of a series of new reports that provides warehouse automation market statistics, including warehouse automation system industry global market size, regional shares, competitors with a warehouse automation market share, detailed warehouse automation market segments, warehouse automation market trends and opportunities, and any further data you may need to thrive in the warehouse automation industry. This warehouse automation market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The warehouse management system market includes revenues earned by entities by providing services such as inbound logistics and outbound logistics tools for picking and packing processes, resource utilization, analytics, and others. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Warehouse Automation Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on warehouse automation market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for warehouse automation? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The warehouse automation market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Conveyor or Sortation Systems; Automated Storage and Retrieval Systems (AS or RS); Mobile Robots; Warehouse Management Systems (WMS); Automatic Identification and Data Capture (AIDC)2) By Component: Hardware; Software

3) By Function: Inbound; Picking; Outbound

4) By End User: General Merchandise; Healthcare; FMCG or Non-Durable Goods; Other End Users

Subsegments:

1) By Conveyor or Sortation Systems: Belt Conveyors; Roller Conveyors; Sortation Systems2) By Automated Storage and Retrieval Systems (AS or RS): Unit Load AS or RS; Mini-Load AS or RS; Automated Tote and Bin Systems

3) By Mobile Robots: Autonomous Mobile Robots (AMRs); Automated Guided Vehicles (AGVs)

4) By Warehouse Management Systems (WMS): Cloud-based WMS; on-premise WMS

5) By Automatic Identification and Data Capture (AIDC): Barcode Scanners; RFID Systems; Voice Recognition Systems

Key Companies Mentioned: Viastore Systems Inc.; ABB Ltd.; Toyota Industries Corporation; Kion Group AG; Omron Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Viastore Systems Inc.

- ABB Ltd.

- Toyota Industries Corporation

- Kion Group AG

- Omron Corporation

- Daifuku Co Ltd.

- Yaskawa Electric Corp Inc.

- KUKA Group

- Schaefer Systems International Pvt Ltd.

- Honeywell Intelligrated Systems Inc.

- KNAPP Group

- Vanderlande Industries BV

- SSI Schaefer AG

- Material Handling Systems Inc.

- WITRON Logistik + Informatik GmbH

- Mecalux SA

- Beumer Group

- TGW Logistics Group

- Swisslog Holding

- Interroll Group

- Bastian Solutions LLC

- Kardex Group

- Grenzebach Group

- System Logistics SpA

- Locus Robotics

- Murata Machinery Ltd.

- Kardex Remstar LLC

- Godrej Koerber Supply Chain Limited

- Space Magnum Equipments Pvt Ltd.

- Fives Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 24.09 Billion |

| Forecasted Market Value ( USD | $ 42.25 Billion |

| Compound Annual Growth Rate | 15.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |