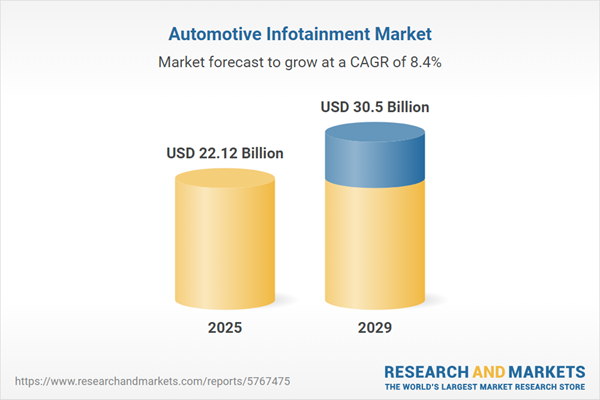

The automotive infotainment market size has grown strongly in recent years. It will grow from $20.88 billion in 2024 to $22.12 billion in 2025 at a compound annual growth rate (CAGR) of 5.9%. The growth in the historic period can be attributed to consumer demand for connectivity, integration of navigation systems, regulatory compliance, entertainment and comfort, rise of smartphones.

The automotive infotainment market size is expected to see strong growth in the next few years. It will grow to $30.5 billion in 2029 at a compound annual growth rate (CAGR) of 8.4%. The growth in the forecast period can be attributed to emergence of autonomous vehicles, electric vehicle infotainment enhancement, personalization and customization, subscription-based services, real-time updates and over-the-air updates. Major trends in the forecast period include integration of advanced connectivity, ai and machine learning integration, 5g connectivity, IoT integration, voice and gesture control.

The automotive infotainment market is poised for significant growth, primarily driven by the increasing adoption of connected cars equipped with enhanced infotainment systems. Consumers are gravitating towards connected vehicles featuring advanced infotainment, exemplified by Tata Motors achieving a milestone by integrating 500,000 vehicles onto its Connected Vehicle Platform (CVP), catering comprehensively to their commercial, passenger, and electric vehicle lineup. This surge in connected car adoption underscores the driving force behind the expansion of the automotive infotainment industry.

The increasing adoption of electric vehicles (EVs) is anticipated to drive the growth of the automotive infotainment market in the future. Electric vehicles are powered by electricity rather than traditional internal combustion engines (ICEs) that use gasoline or diesel. Automotive infotainment systems are utilized in electric vehicles to provide information, entertainment, and connectivity while also enhancing energy efficiency and range management. For instance, in March 2024, the International Energy Agency, a France-based intergovernmental organization, reported that approximately 14 million electric cars were registered worldwide in 2023, reflecting a 35% increase from the 10.5 million registered in 2022. Electric vehicles accounted for 18% of total car sales in 2023, rising from 14% in 2022. This growth indicates strong momentum in the EV market, with weekly registrations in 2023 surpassing 250,000. Battery electric vehicles constituted 70% of the total electric car stock in 2023. Thus, the growing adoption of electric vehicles is fueling the expansion of the automotive infotainment market.

A notable trend reshaping the automotive infotainment landscape is technological advancement, particularly evidenced by the introduction of Android-based in-car entertainment systems. Pioneer India Electronics Pvt. Ltd., an India-based provider of car equipment, unveiled Android-based infotainment systems tailored for car original equipment manufacturers in July 2023. These innovative systems promise a more intuitive and user-friendly experience for car owners, offering compatibility with various smartphone devices and streamlined access to favorite apps, music, and navigation services directly from the car's dashboard. Equipped with voice command support, these systems enhance safety and convenience, enabling drivers to manage entertainment and communication options while on the road more safely and conveniently. This integration of cutting-edge technology underpins the evolving landscape of automotive infotainment systems, catering to modern consumer preferences for connectivity and user experience.

Major companies in the automotive infotainment industry are embracing a strategic partnership approach to deliver integrated, innovative solutions that enhance in-car connectivity and user experiences. Strategic partnerships involve companies leveraging each other's strengths and resources to achieve mutual benefits and success. For example, in February 2024, L&T Technology Services, an India-based provider of digital engineering, development, and consultancy services, collaborated with Marelli, a Japan-based automotive technology company. This partnership introduces Marelli's Digital Twin solutions, marking a significant advancement in automotive software development and a reduction in prototype costs. This collaboration is driving remarkable efficiencies in automotive software development and shaping the future of automotive infotainment with L&T's advanced digital twin solutions.

In April 2022, Qualcomm, a U.S.-based global leader in semiconductor technology known for its innovative chips and wireless solutions, acquired Veoneer for $4.1 billion. This acquisition combined their complementary expertise to create a more formidable presence in the automotive technology market. As a result, Qualcomm expanded its capabilities in Advanced Driver Assistance Systems (ADAS) and autonomous driving, while Veoneer gained access to Qualcomm's advanced semiconductor technology. Veoneer, also a U.S.-based company, is a leading automotive technology firm that specializes in active safety systems. They develop and manufacture components such as radar, cameras, and software used in ADAS and autonomous driving technologies.

Major companies operating in the automotive infotainment market include Robert Bosch GmbH, HARMAN International, Mitsubishi Electric Corporation, DENSO CORPORATION, Visteon Corporation, Kenwood Corporation, Continental AG, Pioneer Corporation, Panasonic Corporation, Alpine Electronics, Delphi Automotive PLC, ALLGo Embedded Systems Pvt. Ltd., Aptiv PLC, Clarion Co. Ltd., Aisin Seiki Co. Ltd., Garmin Ltd., Pacific Industrial Co. Ltd., Fujitsu Ten Limited, Magnetic Marelli SpA, General Motors Company, Tesla Inc., Hyundai Mobis Co. Ltd., TomTom International BV, Sony Corporation, LG Electronics Inc., Blaupunkt GmbH, Qualcomm Incorporated, NXP Semiconductors N. V., Infineon Technologies AG, JVC Kenwood Corporation, Bose Corporation.

Automotive infotainment refers to a comprehensive hardware and software platform designed to deliver audio and video entertainment within vehicles. This multifaceted system integrates various entertainment features, including car radio broadcasting, video streaming, navigation services, and consolidated streaming services. Automotive infotainment is seamlessly incorporated into different vehicle components, such as the automotive instrument cluster, automotive display, telematics, digital cockpit controller, and smart device integration.

Several operating systems govern the functionality of automotive infotainment, with notable examples being QNX, Microsoft, and Linux. QNX, for instance, serves as a software stack adept at managing multimedia, speech integration, web apps, voice recognition, and navigation functions. Automotive infotainment systems come in different forms, including embedded, tethered, and integrated configurations. These systems cater to various vehicle types, spanning passenger cars, light commercial vehicles, and heavy commercial vehicles.

The automotive infotainment market research report is one of a series of new reports that provides automotive infotainment market statistics, including automotive infotainment industry global market size, regional shares, competitors with an automotive infotainment market share, detailed automotive infotainment market segments, market trends and opportunities, and any further data you may need to thrive in the automotive infotainment industry. This automotive infotainment market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Asia-Pacific was the largest region in the automotive infotainment market in 2024. The regions covered in the automotive infotainment market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

The countries covered in the automotive infotainment market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Canada, Spain.

The automotive infotainment market includes revenues earned by entities by providing hardware and software that can be used to display technologies to display multimedia and information content in automobiles for an enhanced in-vehicle experience. It provides navigation, audio/visual entertainment content management, rear-seat entertainment, connectivity with smartphones, and voice commands in vehicles. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Automotive Infotainment Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on automotive infotainment market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for automotive infotainment? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The automotive infotainment market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Operating System: QNX; Microsoft; Linux2) By Form: Embedded; Tethered; Integrated

3) By Vehicle Type: Passenger Car; Light Commercial Vehicle; Heavy Commercial Vehicle

Subsegments:

1) By QNX: QNX Neutrino RTOS; QNX Car Platform2) By Microsoft: Windows Embedded Automotive; Microsoft Azure Automotive Services

3) By Linux: Android Automotive OS; Automotive Grade Linux (AGL); Other Linux-based Systems

Key Companies Mentioned: Robert Bosch GmbH; HARMAN International; Mitsubishi Electric Corporation; DENSO CORPORATION; Visteon Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Automotive Infotainment market report include:- Robert Bosch GmbH

- HARMAN International

- Mitsubishi Electric Corporation

- DENSO CORPORATION

- Visteon Corporation

- Kenwood Corporation

- Continental AG

- Pioneer Corporation

- Panasonic Corporation

- Alpine Electronics

- Delphi Automotive PLC

- ALLGo Embedded Systems Pvt. Ltd.

- Aptiv PLC

- Clarion Co. Ltd.

- Aisin Seiki Co. Ltd.

- Garmin Ltd.

- Pacific Industrial Co. Ltd.

- Fujitsu Ten Limited

- Magnetic Marelli SpA

- General Motors Company

- Tesla Inc.

- Hyundai Mobis Co. Ltd.

- TomTom International BV

- Sony Corporation

- LG Electronics Inc.

- Blaupunkt GmbH

- Qualcomm Incorporated

- NXP Semiconductors N. V.

- Infineon Technologies AG

- JVC Kenwood Corporation

- Bose Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | January 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 22.12 Billion |

| Forecasted Market Value ( USD | $ 30.5 Billion |

| Compound Annual Growth Rate | 8.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 32 |