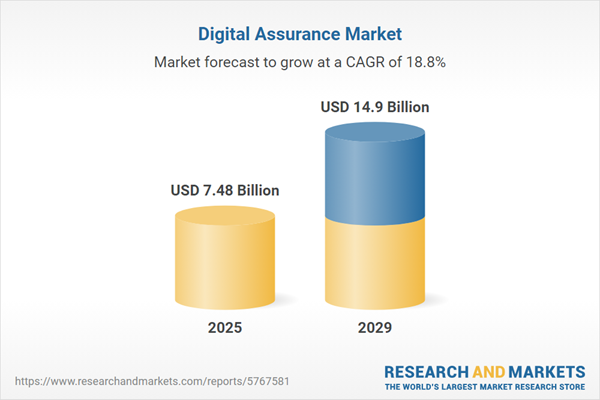

The digital assurance market size is expected to see rapid growth in the next few years. It will grow to $14.9 billion in 2029 at a compound annual growth rate (CAGR) of 18.8%. The growth in the forecast period can be attributed to resilience and chaos engineering, demand for cognitive testing and predictive analytics, shift from quality assurance to quality engineering, integration of iot and edge computing, focus on performance engineering, globalization of development and testing efforts. Major trends in the forecast period include blockchain testing, predictive analytics for testing, agile and DevOps transformation, ai-driven testing and test automation, shift-left testing practices, focus on customer experience testing.

The growing digital transformation initiatives by IT companies will propel the digital assurance market. Digital transformation is employing digital technology to develop new or adapt current business processes, culture, and customer experiences to suit changing business and market requirements. It is being applied in almost every organization owing to the growing need for digitalization. Digital assurance is a quality assurance process that ensures smooth interactions between various components of the digital ecosystem and networks, proving crucial for companies undergoing digital transformation. According to the World Economic Forum, digital transformation will add $100 trillion to the global economy by 2025. Thus, growing digital transformation initiatives by IT companies drive the digital assurance market growth.

Increased cybersecurity concerns are significantly driving the growth of the digital assurance market. Cybersecurity concerns refer to the worries, issues, and challenges related to the protection and defense of computer systems, networks, data, and digital assets from unauthorized access, attacks, damage, or theft. The rising number of cyber threats and data breaches increases the need to ensure the security of digital assets and data. Digital assurance plays a pivotal role in evaluating the security of digital systems and applications. For instance, in 2022, according to Packetlabs, a Canada based Computer security service company, 79% of financial CISOs have reported that threat actors are utilizing more sophisticated cyberattacks annually. Thus, increased cybersecurity concerns drive the digital assurance market growth.

Technological innovation is a significant trend in the digital assurance market. Automation and artificial intelligence are being utilized in API to enhance efficiency. API testing can greatly benefit from the integration of automation and artificial intelligence. Incorporating intelligence presents an excellent opportunity to improve automated testing in alignment with business logic. For example, in 2023, EY Assurance, a UK-based assurance service provider, launched over 25 new capabilities, including embedded AI technologies, aimed at enhancing audit and assurance processes. Additionally, the company introduced a global Artificial Intelligence Assurance framework to help EY professionals deliver cutting-edge assurance services with an emphasis on AI integration and risk management. These advancements are intended to improve the quality and efficiency of assurance services while aiding organizations in their digital transformation initiatives.

Major companies operating in the digital assurance are focused on strategic partnerships to expand their offerings in the market. Strategic partnerships refer to a process in which companies leverage each other's strengths and resources to achieve mutual benefits and success. For instance, in September 2023, NewVision Software, a US-based information technology consulting and services company offering digital assurance solutions, partnered with LambdaTest, a US-based AI-powered unified enterprise test execution cloud platform, to improve their client’s digital experiences. NewVision Software can assist customers enhance their digital experiences by ensuring that their websites or web apps are compatible with various operating systems and browsers by utilizing LambdaTest's testing platform solutions.

In February 2022, ProArch, a US-based cloud consulting, data, cybersecurity, and product engineering company, acquired Enhops for an undisclosed amount. Through this acquisition, ProArch will be able to increase its software and quality assurance capabilities, as well as its product engineering practice, and 120 Enhops personnel will join the ProArch team to strengthen its quality assurance capability. Enhops is a US-based software testing and quality assurance company.

Major companies operating in the digital assurance market include Capgemini SE, DXC Technology Company, Accenture PLC, Cognizant Technology Solutions Corporation, Cigniti Technologies, Hexaware technologies Ltd., The International Business Machines Corporation, Infosys Limited, Maveric Systems, Micro Focus International plc, Mindtree Limited, NTT Data Corporation, Qualitest Group, SQS Software Quality Systems AG, Tata Consultancy Services Limited (TCS), Tech Mahindra Limited, Wipro Limited, Atos SE, HCL Technologies Limited, Happiest Minds Technologies Private Limited, Infostretch Corporation, Katalon LLC, Larsen & Toubro Infotech Limited (LTI), Mphasis Limited, Nagarro SE, Nihilent Limited, Persistent Systems Limited, QASource Inc., Softura Inc., Techwave Consulting Inc.

The digital assurance refers to a collection of quality assurance procedures designed to assure seamless interactions among several components of digital ecosystems, which include networked people, processes, and objects spanning the social, mobile, analytics, and cloud platforms.

The testing’s offered under digital assurance include network testing, application programming interface testing, functional testing, usability testing, security testing, and performance testing. The network testing solutions and services refer to the process of evaluating and testing the network to find flaws and performance issues, evaluate big network modifications, and measure network performance. They are performed in different digital segments ranging from social media, mobile, analytics and cloud. They are used by different industries ranging from government and defense, manufacturing, BFSI, energy and utilities, IT and Telecommunications, and others.

The digital assurance market research report is one of a series of new reports that provides digital assurance market statistics, including digital assurance industry global market size, regional shares, competitors with a digital assurance market share, detailed digital assurance market segments, market trends and opportunities, and any further data you may need to thrive in the digital assurance industry. This digital assurance market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

North America was the largest region in the digital assurance market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the digital assurance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

The countries covered in the digital assurance market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Canada, Spain.

The digital assurance market includes revenues earned by entities by providing agile/DevOps testing services. AI in testing, microservice testing services, business resilience testing, cloud testing services. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Digital Assurance Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on digital assurance market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for digital assurance ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The digital assurance market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Testing Type: Network Testing; Application Programming Interface Testing; Functional Testing; Usability Testing; Security Testing; Performance Testing2) By Technology: Social media; Mobile; Analytics; Cloud

3) By Vertical: Government and Defense; Manufacturing; Banking, Financial Services, and Insurance (BFSI); Energy and Utilities; IT and Telecommunications; Other Verticals

Subsegments:

1) By Network Testing: Network Performance Testing; Network Security Testing; Network Configuration Testing2) By Application Programming Interface (API) Testing: Functional API Testing; Load API Testing; Security API Testing

3) By Functional Testing: Smoke Testing; Sanity Testing; Regression Testing; User Acceptance Testing (UAT)

4) By Usability Testing: User Experience (UX) Testing; Accessibility Testing; A Or B Testing

5) By Security Testing: Vulnerability Scanning; Penetration Testing; Security Audits

6) By Performance Testing: Load Testing; Stress Testing; Endurance Testing; Scalability Testing

Key Companies Mentioned: Capgemini SE; DXC Technology Company; Accenture PLC; Cognizant Technology Solutions Corporation; Cigniti Technologies

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Capgemini SE

- DXC Technology Company

- Accenture PLC

- Cognizant Technology Solutions Corporation

- Cigniti Technologies

- Hexaware technologies Ltd.

- The International Business Machines Corporation

- Infosys Limited

- Maveric Systems

- Micro Focus International plc

- Mindtree Limited

- NTT Data Corporation

- Qualitest Group

- SQS Software Quality Systems AG

- Tata Consultancy Services Limited (TCS)

- Tech Mahindra Limited

- Wipro Limited

- Atos SE

- HCL Technologies Limited

- Happiest Minds Technologies Private Limited

- Infostretch Corporation

- Katalon LLC

- Larsen & Toubro Infotech Limited (LTI)

- Mphasis Limited

- Nagarro SE

- Nihilent Limited

- Persistent Systems Limited

- QASource Inc.

- Softura Inc.

- Techwave Consulting Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | January 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 7.48 Billion |

| Forecasted Market Value ( USD | $ 14.9 Billion |

| Compound Annual Growth Rate | 18.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |