The global baby bath and shower products market is experiencing robust growth, driven by increasing parental concerns about infant hygiene and the demand for safe, high-quality products. These products, including bath salts, tablets, capsules, shower gels, and bubble washes, are formulated with natural ingredients to ensure baby health and cleanliness while minimizing irritation. Manufacturers are prioritizing the elimination of potentially harmful ingredients, enhancing product safety and consumer trust. The market is propelled by rising birth rates, growing awareness of baby care, and the influence of trusted brands.

Market Drivers

Growing Parental Concerns for Hygiene

Increasing parental focus on infant hygiene is a primary driver of the baby bath and shower products market. Parents are prioritizing products that ensure their newborns’ health and safety, prompting manufacturers to adopt stringent measures to remove harmful ingredients from formulations. For example, initiatives like Johnson & Johnson’s ‘NO MORE TEARS’ product line, designed to eliminate irritants in shampoos and soaps, are enhancing consumer confidence and driving market growth. This focus on safety and hygiene is aligning with broader trends in the baby care industry, boosting demand for gentle, effective products.Rising Birth Rates

The anticipated increase in global birth rates is a significant growth factor. According to the United Nations Department of Economic and Social Affairs, Africa is expected to see a 24% increase in birth rates from 2019 to 2030, while Asia-Pacific is projected to experience a 10% rise. These demographic trends are driving demand for baby bath and shower products, as growing populations necessitate more hygiene solutions. The surge in births, particularly in emerging markets, is creating opportunities for manufacturers to expand their market presence.Trusted Brands and Quality Assurance

Trusted brand names play a pivotal role in driving purchase decisions, as parents prioritize quality and safety in baby care products. Established brands that guarantee high-quality, irritation-free formulations are attracting a growing customer base, supporting market expansion. The emphasis on premium products, such as specialized shampoos and soaps, enhances consumer trust and encourages market growth by meeting the demand for reliable, safe baby care solutions.Geographical Outlook

North America

North America is expected to experience significant growth in the baby bath and shower products market during the forecast period, driven by high consumer spending on baby care products in the United States. The U.S. is the largest market for these products, fueled by the penetration of leading manufacturers offering premium shampoos and soaps. Rising disposable incomes, coupled with high awareness of baby care and strong purchasing power, are key factors propelling market growth in the region. The focus on innovative, safe products further supports North America’s market dominance.Asia-Pacific

The Asia-Pacific region is poised for notable growth, driven by a projected 10% increase in birth rates through 2030. Countries like China and India, with large and growing populations, are seeing rising demand for baby bath and shower products. Increasing awareness of infant hygiene and improving economic conditions are encouraging parents to invest in high-quality products, boosting market expansion. The region’s focus on accessible, safe baby care solutions positions it as a key growth hub.Africa

Africa is expected to see significant market potential due to a projected 24% increase in birth rates through 2030. The growing population and rising awareness of baby hygiene are driving demand for bath and shower products. As manufacturers target emerging markets with affordable, safe formulations, Africa is becoming an important region for market growth, supported by increasing parental focus on infant health.Market Trends

The baby bath and shower products market is characterized by a focus on safety and natural ingredients, with manufacturers eliminating harmful substances to meet parental demands. The rise in birth rates globally is driving demand for premium, irritation-free products like shampoos and soaps. Trusted brands are leveraging quality assurance to attract consumers, while innovations in gentle formulations enhance market appeal. The market also benefits from growing awareness of infant hygiene and increasing disposable incomes, particularly in emerging regions like Asia-Pacific and Africa.The baby bath and shower products market is on a strong growth trajectory, driven by parental concerns for hygiene, rising birth rates, and the influence of trusted brands. North America leads with high consumer spending and awareness, while Asia-Pacific and Africa are poised for growth due to demographic trends and increasing hygiene focus. The emphasis on safe, natural formulations and premium products is shaping market dynamics. As global populations grow and parents prioritize infant health, the market is well-positioned for sustained expansion during the forecast period.

Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decisions to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use these reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive IntelligenceReport Coverage:

- Historical data from 2022 to 2024 & forecast data from 2025 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others.

The Baby Bath and Shower Products Market is segmented and analyzed as:

By Product Type

- Bath Soaps

- Shower Gels & Body Wash

- Bubble Baths & Foams

- Bath Oils & Lotions

- Others

By Form

- Solid

- Liquid

- Gel

- Foam/Aerosol

- Others

By Distribution Channel

- Online

- Offline

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Others

Table of Contents

Companies Mentioned

- Johnson & Johnson

- Procter & Gamble (P&G)

- Unilever

- Kimberly‑Clark Corporation

- L’Oréal S.A.

- Avon Products

- The Honest Company

- Sebapharma GmbH & Co. KG

- Mustela

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 152 |

| Published | August 2025 |

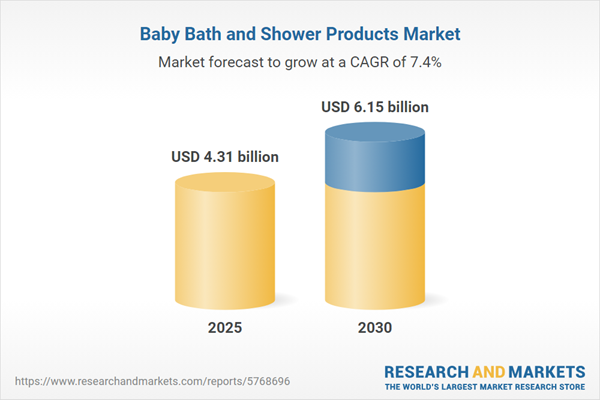

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 4.31 billion |

| Forecasted Market Value ( USD | $ 6.15 billion |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |