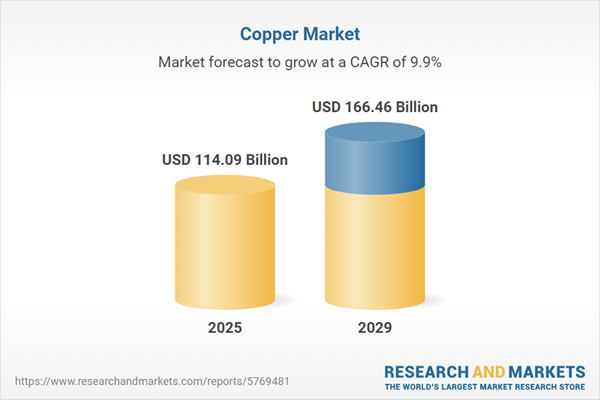

The copper market size is expected to see strong growth in the next few years. It will grow to $166.46 billion in 2029 at a compound annual growth rate (CAGR) of 9.9%. The growth in the forecast period can be attributed to renewable energy transition, electric vehicles (EVs) demand, urbanization and construction growth, 5G network expansion, global economic recovery. Major trends in the forecast period include copper in antimicrobial applications, supply chain resilience and diversification, copper recycling initiatives, copper alloy innovations, copper price volatility and market speculation.

The forecast of 9.9% growth over the next five years reflects a slight reduction of 0.1% from the previous projection. This reduction is primarily due to the impact of tariffs between the US and other countries. Tariff pressures on copper ore and refined copper imports can drive up costs in electric vehicle (EV) and construction wiring supply chains. The effect will also be felt more widely due to reciprocal tariffs and the negative effect on the global economy and trade due to increased trade tensions and restrictions.

The surge in the copper market is attributed to the increasing number of construction projects in rapidly developing nations such as China and India, driven by population growth and infrastructure demands. Population, denoting the total number of inhabitants in a country or region, plays a crucial role in this trend. Copper minerals and ores are present in both igneous and sedimentary rocks. As of June 2022, with China's population reaching 1,450,341,718, the expanding populace is a key factor propelling the growth of the copper market.

The increasing popularity of electric vehicles (EVs) is projected to drive the growth of the copper market in the future. EVs are powered by one or more electric motors, using electricity as their primary energy source. Copper plays a crucial role in electric vehicles, contributing to enhanced performance, efficiency, sustainability, effective energy storage, charging infrastructure, durability and reliability, weight reduction, and minimal energy loss during electric power transmission within the vehicle. For example, in March 2024, the Electric Vehicle Council, an Australia-based organization representing the electric vehicle industry, reported that 98,436 new EVs were sold in 2023. This represents more than a twofold increase in EV purchases compared to 2022, resulting in over 180,000 electric vehicles on Australian roads. Consequently, the growing popularity of electric vehicles is propelling the expansion of the copper market.

Major companies in the copper market are increasingly adopting a strategic partnership approach to enhance technology integration and broaden their market reach. A strategic partnership generally involves a collaborative relationship between two or more organizations, allowing them to combine their resources, expertise, and efforts to achieve shared goals. For example, in October 2024, Schneider Electric, a France-based energy management and automation firm, partnered with Glencore plc, a Switzerland-based commodity trading and mining company, to transform its copper supply chain and promote decarbonization initiatives. Through this collaboration, Schneider directly sources responsibly sourced, recyclable copper from Glencore, distributing it to its European factories. This partnership also allows Glencore to implement sustainable procurement practices for low-carbon capital equipment, in line with Schneider’s Zero Carbon Project. Additionally, Schneider assists Glencore by enhancing energy reporting systems, which include fuel-switching options and improvements in energy efficiency.

Innovations in the copper market include the development of recycled copper tubes by major companies aiming to gain a competitive advantage. Recycled copper tubes, sourced from post-industrial materials rather than newly mined copper ore, offer a sustainable alternative. For example, in March 2023, Germany-based Wieland-Werke AG introduced 'Cuprolife,' a sustainable option for the building sector. Utilizing a mass balance technique, Cuprolife tubes, constructed entirely of pure copper Cu-DHP, are flexible, easy to install, and suitable for applications such as solar systems, heating, gas, liquid gas, heating oil/biofuel oil B10, and household hot and cold water delivery. This environmentally conscious innovation aims to mitigate the adverse environmental effects of copper manufacturing and promote sustainability in the industry.

Major companies operating in the copper market include Glencore plc, BHP Billiton, Rio Tinto Group, Vale S.A., Zijin Mining Group Co. Ltd., Tongling Nonferrous Metals Group Co. Ltd., Freeport-McMoRan Inc., Codelco, Norilsk Nickel, Grupo México, Teck Resources Ltd., Southern Copper Corporation, First Quantum Minerals Ltd., Antofagasta plc, Jiangxi Copper Co. Ltd., Lundin Mining Corporation, Kaz Minerals PLC, Hudbay Minerals Inc., Capstone Copper Corp., KGHM Polska Miedz S.A., Ero Copper Corp., Copper Mountain Mining Corporation, Sumitomo Metal Mining Co. Ltd., Boliden AB.

Asia-Pacific was the largest region in the copper ore mining market in 2024. The regions covered in the copper market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the copper market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Spain, Canada.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The rapid escalation of U.S. tariffs and the ensuing trade tensions in spring 2025 are heavily affecting the mining sector, especially in areas such as equipment acquisition, export flows, and supply chain stability. Increased tariffs on imported heavy machinery, drilling tools, and specialized parts have driven up both capital and operational expenditures, leading to delays in project development and reduced production efficiency. Simultaneously, retaliatory tariffs from major trading partners have diminished global demand for U.S. sourced minerals particularly critical resources like lithium, copper, and rare earth elements intensifying revenue challenges. These impacts are hitting mid-sized and niche mining companies the hardest due to their reliance on international markets. In response, the industry is focusing on building domestic equipment supply chains, scaling up mineral recycling programs, and lobbying for tariff relief to regain competitiveness and safeguard long-term resource availability.

The copper market research report is one of a series of new reports that provides copper market statistics, including copper industry global market size, regional shares, competitors with a copper market share, detailed copper market segments, market trends and opportunities, and any further data you may need to thrive in the copper industry. This copper global market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Copper ore mining is a intricate procedure involving the extraction of copper, starting with the mining of ore containing less than 1% copper and culminating in the production of cathodes. These cathodes consist of sheets with 99.99% pure copper, ultimately destined for the manufacturing of everyday items. The predominant forms of copper ores are copper oxide and copper sulphide.

The primary categories of copper ore mining are associated with the refining industry, metal processing industry, chemical industry, and various other types. The refining industry pertains to the production and distribution of oil and oil products. Mining methods include both underground mining and surface mining.

The copper ore mining market includes revenues earned by entities by building construction, transportation, electronics and consumer goods. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Copper Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on copper market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for copper? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The copper market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Refining Industry; Metal Processing Industry, Chemical Industry; and Other Types2) By Mining Type: Underground Mining; Surface Mining

Subsegments:

1) By Refining Industry: Primary Copper Refining; Secondary Copper Refining (Recycling)2) By Metal Processing Industry: Copper Casting; Copper Rolling and Extrusion; Copper Forging; Copper Drawing

3) By Chemical Industry: Copper Sulfate Production; Copper Chloride Production; Copper Oxide Production

4) By Other Types: Electrical Industry (Cables, Wires); Construction Industry (Copper-Based Alloys, Pipes, Fittings); Automotive Industry (Copper Components); Renewable Energy (Solar Panels, Wind Turbines)

Companies Mentioned: Glencore plc; BHP Billiton; Rio Tinto Group; Vale S.A.; Zijin Mining Group Co. Ltd.; Tongling Nonferrous Metals Group Co. Ltd.; Freeport-McMoRan Inc.; Codelco; Norilsk Nickel; Grupo México; Teck Resources Ltd.; Southern Copper Corporation; First Quantum Minerals Ltd.; Antofagasta plc; Jiangxi Copper Co. Ltd.; Lundin Mining Corporation; Kaz Minerals PLC; Hudbay Minerals Inc.; Capstone Copper Corp.; KGHM Polska Miedz S.A.; Ero Copper Corp.; Copper Mountain Mining Corporation; Sumitomo Metal Mining Co. Ltd.; Boliden AB

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Copper market report include:- Glencore plc

- BHP Billiton

- Rio Tinto Group

- Vale S.A.

- Zijin Mining Group Co. Ltd.

- Tongling Nonferrous Metals Group Co. Ltd.

- Freeport-McMoRan Inc.

- Codelco

- Norilsk Nickel

- Grupo México

- Teck Resources Ltd.

- Southern Copper Corporation

- First Quantum Minerals Ltd.

- Antofagasta plc

- Jiangxi Copper Co. Ltd.

- Lundin Mining Corporation

- Kaz Minerals PLC

- Hudbay Minerals Inc.

- Capstone Copper Corp.

- KGHM Polska Miedz S.A.

- Ero Copper Corp.

- Copper Mountain Mining Corporation

- Sumitomo Metal Mining Co. Ltd.

- Boliden AB

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | September 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 114.09 Billion |

| Forecasted Market Value ( USD | $ 166.46 Billion |

| Compound Annual Growth Rate | 9.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |