This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

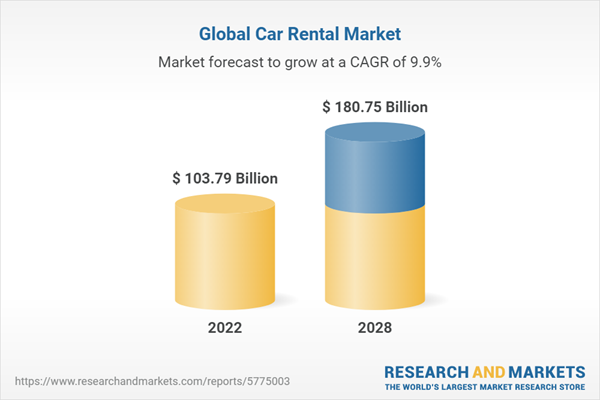

According to the research report, “Global Car Rental Market Outlook, 2028” published by Bonafide Research, the market stood at USD 103.79 Billion market size in 2022 which is expected to reach USD 180.75 Billion by 2028. With that, the market is projected to grow with 9.87% CAGR for 2023-28. A significant rise in the number of people taking business and leisure trips across the globe is driving the demand for car rental services, thereby propelling the industry’s growth. Rising internet penetration across developing as well as developed countries have further helped companies in the market capture a larger customer base with the help of dedicated mobile apps for the convenience of customers. There has been a significant increase in global travel across the world over the last decade. Global commuters are increasingly demanding familiar, reliable, and high-quality travel services during their travel. Some of the key car rental operators are attempting to leverage this trend by expanding their brand and distribution platforms on a global level. The implementation of an integrated global car rental system is anticipated to enable these operators to manage their geographically dispersed business operations.

According to the report the market is segmented into major five regions including North America, Europe, Asia-Pacific, South America and Middle East & Africa. Among them, North America region is leading the market with more than 37% market share in 2022 with the United States being the largest market. The USA is contributing for almost 30% of the market in 2022 followed by China. The presence of some of the leading car rental operators in this region, such as Avis Budget Group and Enterprise Rent-a-Car, is anticipated to provide lucrative growth opportunities. Additionally, the region includes numerous popular tourist destinations that attract a large number of travellers that require car rental services, ultimately boosting the market growth. On the other hand, the Asia-Pacific car rental market is expected to register the highest CAGR of more than 12% from 2023 to 2028. Rising disposable incomes of consumers and steadily growing economies, and rising expenditure on business travel are expected to impact the regional market growth favourably. The markets in China and India are expected to grow exponentially over the forecast period. Government bans on car purchases in certain parts of China, in an attempt to address the rising issues of pollution and traffic, are anticipated to encourage people to opt for car rental services.

Based on car type, the market is segregated into luxury cars, executive cars, economy cars, sports utility vehicle (SUV) car, and multi utility vehicle (SUV) car. Among them, the economy cars segment accounted for the largest share in 2022 and is expected to retain its dominance over the forecast period. Some of the prime factors driving the growth of this segment are the compact nature and cost-effectiveness of these cars. As a result, economy cars are increasingly preferred for airport and intra-city travel. As for the executive cars segment, it is anticipated to register a CAGR of over 10% from 2023 to 2028. The increasing number of business travellers across the globe, specifically in developing countries, is one of the prime factors boosting the growth of the segment. Additionally, these vehicles offer customers a combination of premium features at reasonable pricing, accelerating their demand among corporate travellers. However, sports utility vehicle (SUV) car segment is projected to grow with higher CAGR compared to other car types.

Technology is a critical component expected to boost the market over the forecast period. Increased adoption of information technology is transforming the industry and enabling operators to deliver improved services to their customers. This includes the utilization of optimized corporate and customer information management and the development of convenient internet booking applications. For instance, the order online or pick-up model is at the forefront of identifying applications for beacons and near-field communications (NFC). Newer players, like Zipcar and BlaBlaCar, are benefiting from using innovative business models such as car-sharing and adopting technologies such as telematics. Uber and Lyft are using mobile technologies and devices to better meet consumers’ personal transportation needs. These initiatives are contributing to the disruption of the car rental industry. Industry players such as Sixt SE, Uber, and Avis have launched their mobile apps through which customers can easily choose vehicles from a portfolio and carry out bookings. Based on these factors, online booking method for car rental market is projected to dominate the market during the upcoming timeframe.

Most tourists prefer the online reservation technique for a rental car. As per the car rental industry overview, booking online serves a variety of purposes, such as, verifying the renter's documents, the information about the car, the ability to drop at and pick up from a certain location, e-signed contracts, cashless transaction, and much more. Online booking also enables vehicle booking from faraway places, without the need to be physically present at the site, which is propelling the industry forward. The rental car market tends to vary significantly between regions and urban and suburban areas, increasing the importance of rental car market research. Moreover, the business of car rental service is quite profitable, where venture capitalists and angel investors are funding the start-ups to start their own car rental services. The start-ups such as Turo, Getaround, Zoomcar, Zipcar, Socar, and Kovi are the new market players in the car rental market.

An emerging trend in the travel and tourism industry is the evolution of ’bleisure’. This relatively new term describes a combination of leisure travel with a business trip and is gaining popularity across the globe. Bringing the family on corporate trips is becoming more acceptable since companies follow this trend to aid employee retention and alleviate some of the key road warriors’ stress. This incentive is increasingly appealing to recruits as younger employees are generally becoming business travellers. This concept is particularly advantageous for international trips where employees can get acquainted with locations, especially essential business details. Based on the application type, the business segment is anticipated to hold the largest share globally over the forecast period. Most private enterprises and government corporations have been renting luxury cars for their top executives for many years. The corporations update the cars to be rented to the personnel based on their designation and annual advancement. It also facilitates the firm to not add fixed assets and inventory cost of these luxury cars while facilitating the executives to use these luxurious cars while going for meetings and client visits. As a result, current luxury car rental market trends are expected to drive the market expansion over the forecast period. On the other hand, consumers desire access to luxury cars rather than buying and owning them, and they prefer to pay for the privilege of momentarily using them. These factors are expected to drive the growth of the leisure segment during the forecast period.

Based on the end user segmentation, the market is anticipated to be dominated by self-driven rental cars with more than half of the market share by 2028. However, chauffeur-driven segment is growing with highest CAGR for 2023-28. Furthermore, based on the rental length the market is divided into two major parts including short term and long term. Among them, short term segment is leading the market with around 65% share in 2022. The implementation of favourable government policies, along with the increasing awareness regarding environment conservation, is acting as another growth-inducing factor. Governments of both the developed and emerging economies are emphasizing on minimizing their vehicular emissions and promoting car rental services as one of the most economical modes of transportation. Enterprise Rent-A-Car, Hertz Group AG, Avis Budget Group Inc., Uber, Europcar Mobility Group S.A., Redcap Tour, ANI technologies Pvt. limited, and Sixt AG are the major car rental service providers in the global car rental industry. Hiyacar, eZhire, Assar Vehicle, Cartrast, Clonded, Stealth are some of the Start-ups for car rental market across the globe.

Looking forward, the car rental industry will embrace a new era with technological innovations blooming in the next decade. In search of new business opportunities, industry leaders are actively exploring new technologies across the auto value chain, such as Autonomous Driving (AD) and smart Electric Vehicles (EVs). For example, several car rental companies, particularly Hertz, have started to employ EVs and invest in electrification. The industry is believed to be stepping into a new stage when technological innovation is the key. The surging adoption of EVs by service providers is a key market trend in the car rental industry. Governments of numerous countries are implementing policies and regulations to support the deployment of EVs for car rental services. Additionally, the companies are taking initiatives to incorporate these new-energy vehicles into their fleet. For instance, Sixt SE provides electric cars, such as Tesla Model X, Tesla Model S, BMW i3, and BMW i8, for renting purposes. The market is highly fragmented with the presence of a large number of organized and unorganized players. However, the growing necessity to switch from the unorganized to the organized sector has led to the emergence of the digital or online car rental system, which is further expanding the growth opportunities for the emerging and existing players in the market.

Most Popular Airport for Car Rental

Heathrow Airport, Gatwick Airport, Edinburgh Airport, Mallorca Airport, Malaga Airport, Alicante Airport, Barcelona Airport, Dublin Airport, Los Angeles Airport, San Francisco Airport, Orlando Airport, Miami Airport, Las Vegas Airport, Sydney Airport and Dubai Airport

Car Rental Market Start-Ups:

- Getaround is an app-based peer-to-peer car sharing platform. The platform enables car owners to rent their cars to a community of drivers using their smartphones. Drivers can find the car using the app and reserve it through the app for using the car. Their app is available for iOS & Android devices.

- Zipcar is a membership-based car-sharing company that provides automobiles rentals to its members billable on an hourly or daily basis. Members are able to view vehicle availability and reserve a self-service car via the internet, iPhone app or telephone in increments as short as one hour and pay only for the time they reserve. Zipcar vehicles report their positions to a control centre using in-car technology.

- Zoomcar is an app-based self-driving car rental platform. Users can book available cars on the platform by uploading their driving license, security deposit & more. Users can also access 7 get the keys by using the mobile app. Users can make short or long trips. At the end of the ride, users have to leave the vehicle at the designated location or parking space.

Recent Developments:

- In February 2022, In February 2022, UFODrive raised 19 million US dollars in its Series A funding round. The main investors are car rental company Hertz and the private equity firm Certares. Hertz plans to use UFODrive’s digital rental and fleet management technology to operate its global electric car fleet.

- In February 2022, Udrive, the UAE’s homegrown brand providing a pay-per-minute car rental service, completed another strong funding round with investments of USD 5 million from Cultiv8 and Oman Holding International. The investment will support Udrive for the upcoming expansion in the region and enhancements of its technology.

- July 2022 - Ikenna Ordor’s luxury car rental brand ‘Starr Luxury’, announced its expansion in the U.S. It announced its start of operation in major cities such as Los Angeles, Miami, Houston, Atlanta, and Austin. Starr Luxury is known for being one of the few companies of its kind in the world to have collaboration with five-star hotels.

- July 2022 - Uber’s premium electric car service Uber Comfort Electric announced its expansion in more U.S. cities, including Las Vegas, Portland, Seattle, Denver, Baltimore, Austin, and Philadelphia.

- In November 2021, Hertz rentals partnered with Tesla Motors to supply 100,000 Model 3S by 2022, and half of these vehicles are expected to be rented out to Uber drivers.

- In April 2021, GoAir partnered with Eco Europcar and launched car rental services across 100 cities in India, including 25 airports. Through Eco Europcar, GoAirwill is offering Chauffeur-driven cars from mid to luxury car segments.

- In February 2021, Theeb Rent a Car, a Saudi-based car rental firm, expanded its car rental fleet in the Kingdom. The company's expansion strategy is to modernize and develop its fleet to offer different car brands and models to its customers.

Partnerships, Collaborations and Agreements

- The Hertz Corporation, in collaboration with CLEAR, debuted the Hertz Fast Lane online platform in December 2018. For the convenience of clients, this platform leverages biometrics to carry out and speed up the complete vehicle rental procedure.

- Enterprise Rent-A-Automobile established a partnership with Premier Group in January 2019 to extend its car rental service offering in Egypt.

- The startup announced a partnership with the University of Delaware in December 2018 to provide on-demand transportation services on campus.

- September 2021 - Corsa HQ, an exotic car rental company, partnered with RitzCarlton in Orlando, Grande Lakes. Guests can rent luxury automobiles from the Corsa HQ portfolio during their stay, including Lamborghini, Rolls-Royce, Ferrari, and Bentley. A Ritz-Carlton gift card worth USD 50 is included with premium SUV rentals and a USD 100 gift card is included with exotic luxury rentals.

Mergers and Acquisitions

- Enterprise Holdings Inc. bought Discount Vehicle and Truck Rentals, a renowned Canadian car and truck rental firm with customers all throughout the country, in September 2020. Enterprise Holding Inc. will be able to grow its fleet size and service offerings in Canada as a result of the acquisition. Discount Car and Truck Rentals’ sites in Canada and Quebec will be acquired by the corporation.

- Hertz Global Holdings, Inc. - and General Motors Co. announced an agreement according to which Hertz to order 175,000 Chevrolet, Buick, GMC, Cadillac and BrightDrop electric vehicles in the upcoming 5 years.

Product Launches and Product Expansions

- Fox Rent A Car - announced the opening of its first US dual-branded location at Houston Hobby Airport in Texas. The dual-branded location will be the twenty-second corporate location in the US for Fox Rent A Car and the first official Europcar corporate location in the US.

- Sixt SE introduced a mobility app in March 2019 to provide users with services like vehicle rental, sharing, and cab hailing.

- In May 2021, Uber launched a new car rental service called Uber Rent in partnership with the Dublin-based car rental company CarTrawler. The partnership will see CarTrawler run Uber's car rental technology, which is being rolled out across the United States.

Covid-19 Impacts:

The COVID-19 pandemic-induced lockdown and economic crisis significantly impacted various manufacturers' financials in 2020. The COVID-19 crisis caused market uncertainty, supply chain disruption, panic among customer segments, and business decline. However, the market only recovered after the lockdown was lifted in most countries and government affairs resumed normally. Due to lockdowns, as a measure to control the spread of the virus, rental car companies were obliged to go into survival mode, selling off as many cars as they could. Furthermore, significant corporations, such as Hertz (the parent company of Thrifty and Dollar car rental brands) and Advantage Rent a Car, and Europcar, declared bankruptcy in 2020. However, it came out of bankruptcy by June 2021. The restrictions have been lifted across the world and the car rental market started recovering by end of 2021 owing to consumer inclination for rental services across major countries in the North American and European region.Major Companies present in the market:

Avis Budget Group Inc, Hertz Global Holdings Inc, Enterprise Holdings Inc, Sixt SE, Fast Rent a Car (Emirates National Group), Bettercar Rental LLC, Europcar Mobility Group, TT Car Transit, Renault Eurodrive, Al-Futtaim Vehicle Rentals Company LLC, Carzonrent India Private Limited (CIPL), Eco Rent A Car, Localiza Rent a Car SA, Uber Technologies, Inc, Budget Rent A Car System, Inc, Ola Cabs.Considered in this report

- Geography: Global

- Historic year: 2017

- Base year: 2022

- Estimated year: 2023

- Forecast year: 2028

Aspects covered in this report

- Global Car Rental market with its value and forecast along with its segments

- Region-wise Car Rental market analysis

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

Regions & Countries covered in the report:

- North America (United States, Canada, Mexico)

- Europe (Germany, United Kingdom, France, Spain, Italy, Russia)

- Asia-Pacific (China, Japan, India, Australia, South Korea)

- South America (Brazil)

- Middle-East & Africa (UAE, Saudi Arabia, South Africa)

By Car Type:

- Luxury car

- Executive car

- Economy car

- Sports utility vehicle (SUV) car

- Multi utility vehicle (MUV) car

By Application Type:

- Leisure/Tourism

- Business

By End User:

- Self-driven

- Chauffeur-driven

By Booking Type:

- Offline

- Online

By Rental Length:

- Short Term

- Long Term

The approach of the report:

This report consists of a combined approach of primary as well as secondary research. Initially, secondary research was used to get an understanding of the market and list out the companies that are present in the market. The secondary research consists of third-party sources such as press releases, and annual reports of companies, analyzing the government-generated reports and databases. After gathering the data from secondary sources primary research was conducted by making telephonic interviews with the leading players about how the market is functioning and then conducting trade calls with dealers and distributors of the market. Post this the publisher has started doing primary calls to consumers by equally segmenting consumers into regional aspects, tier aspects, age groups, and gender. Once the publisher has primary data with us we started verifying the details obtained from secondary sources.Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations & organizations related to the Car Rental industry, government bodies, and other stakeholders to align their market-centric strategies. In addition to marketing & presentations, it will also increase competitive knowledge about the industry.Table of Contents

1. Executive Summary2. Market Dynamics

2.1. Market Drivers

2.2. Challenges

2.3. Opportunity

2.4. Restraints

2.5. Market Trends

2.6. Covid-19 Effect

2.7. Supply chain Analysis

2.8. Policy & Regulatory Framework

2.9. Industry Experts Views

3. Research Methodology

3.1. Secondary Research

3.2. Primary Data Collection

3.3. Market Formation & Validation

3.4. Report Writing, Quality Check & Delivery

4. Market Structure

4.1. Market Considerate

4.2. Assumptions

4.3. Limitations

4.4. Abbreviations

4.5. Sources

4.6. Definitions

5. Economic /Demographic Snapshot

6. Competitive Landscape

6.1. Competitive Dashboard

6.2. Business Strategies Adopted by Key Players

6.3. Key Players Market Share Insights and Analysis, 2022

6.4. Key Players Market Positioning Matrix

6.5. Consolidated SWOT Analysis of Key Players

6.6. Porter's Five Forces

7. Global Car Rental Market Outlook

7.1. Market Size By Value

7.2. Market Size and Forecast, By Geography

7.3. Market Size and Forecast, By Car Type

7.4. Market Size and Forecast, By Application Type

7.5. Market Size and Forecast, By End User

7.6. Market Size and Forecast, By Booking Type

7.7. Market Size and Forecast, By Rental Length

8. North America Car Rental Market Outlook

8.1. Market Size By Value

8.2. Market Share By Country

8.3. Market Size and Forecast By Car Type

8.4. Market Size and Forecast By Application Type

8.5. US Car Rental Market Outlook

8.5.1. Market Size By Value

8.5.2. Market Size and Forecast By Car Type

8.5.3. Market Size and Forecast By Application Type

8.6. Canada Car Rental Market Outlook

8.6.1. Market Size By Value

8.6.2. Market Size and Forecast By Car Type

8.6.3. Market Size and Forecast By Application Type

8.7. Mexico Car Rental Market Outlook

8.7.1. Market Size By Value

8.7.2. Market Size and Forecast By Car Type

8.7.3. Market Size and Forecast By Application Type

9. Europe Car Rental Market Outlook

9.1. Market Size By Value

9.2. Market Share By Country

9.3. Market Size and Forecast By Car Type

9.4. Market Size and Forecast By Application Type

9.5. Germany Car Rental Market Outlook

9.5.1. Market Size By Value

9.5.2. Market Size and Forecast By Car Type

9.5.3. Market Size and Forecast By Application Type

9.6. UK Car Rental Market Outlook

9.6.1. Market Size By Value

9.6.2. Market Size and Forecast By Car Type

9.6.3. Market Size and Forecast By Application Type

9.7. France Car Rental Market Outlook

9.7.1. Market Size By Value

9.7.2. Market Size and Forecast By Car Type

9.7.3. Market Size and Forecast By Application Type

9.8. Italy Car Rental Market Outlook

9.8.1. Market Size By Value

9.8.2. Market Size and Forecast By Car Type

9.8.3. Market Size and Forecast By Application Type

9.9. Spain Car Rental Market Outlook

9.9.1. Market Size By Value

9.9.2. Market Size and Forecast By Car Type

9.9.3. Market Size and Forecast By Application Type

9.10. Russia Car Rental Market Outlook

9.10.1. Market Size By Value

9.10.2. Market Size and Forecast By Car Type

9.10.3. Market Size and Forecast By Application Type

10. Asia-Pacific Car Rental Market Outlook

10.1. Market Size By Value

10.2. Market Share By Country

10.3. Market Size and Forecast By Car Type

10.4. Market Size and Forecast By Application Type

10.5. China Car Rental Market Outlook

10.5.1. Market Size By Value

10.5.2. Market Size and Forecast By Car Type

10.5.3. Market Size and Forecast By Application Type

10.6. Japan Car Rental Market Outlook

10.6.1. Market Size By Value

10.6.2. Market Size and Forecast By Car Type

10.6.3. Market Size and Forecast By Application Type

10.7. India Car Rental Market Outlook

10.7.1. Market Size By Value

10.7.2. Market Size and Forecast By Car Type

10.7.3. Market Size and Forecast By Application Type

10.8. Australia Car Rental Market Outlook

10.8.1. Market Size By Value

10.8.2. Market Size and Forecast By Car Type

10.8.3. Market Size and Forecast By Application Type

10.9. South Korea Car Rental Market Outlook

10.9.1. Market Size By Value

10.9.2. Market Size and Forecast By Car Type

10.9.3. Market Size and Forecast By Application Type

11. South America, Middle East & Africa Car Rental Market Outlook

11.1. Market Size By Value

11.2. Market Share By Country

11.3. Market Size and Forecast By Car Type

11.4. Market Size and Forecast By Application Type

11.5. Brazil Car Rental Market Outlook

11.5.1. Market Size By Value

11.5.2. Market Size and Forecast By Car Type

11.5.3. Market Size and Forecast By Application Type

11.6. UAE Car Rental Market Outlook

11.6.1. Market Size By Value

11.6.2. Market Size and Forecast By Car Type

11.6.3. Market Size and Forecast By Application Type

11.7. Saudi Arabia Car Rental Market Outlook

11.7.1. Market Size By Value

11.7.2. Market Size and Forecast By Car Type

11.7.3. Market Size and Forecast By Application Type

11.8. South Africa Car Rental Market Outlook

11.8.1. Market Size By Value

11.8.2. Market Size and Forecast By Car Type

11.8.3. Market Size and Forecast By Application Type

12. Company Profile

12.1. Avis Budget Group Inc

12.1.1. Company Snapshot

12.1.2. Company Overview

12.1.3. Financial Highlights

12.1.4. Geographic Insights

12.1.5. Business Segment & Performance

12.1.6. Product Portfolio

12.1.7. Key Executives

12.1.8. Strategic Moves & Developments

12.2. Hertz Global Holdings Inc

12.3. Enterprise Holdings Inc

12.4. Sixt SE

12.5. Fast Rent a Car

12.6. Bettercar Rental LLC

12.7. Europcar Mobility Group

12.8. TT Car Transit

12.9. Renault Eurodrive

12.10. Al-Futtaim Vehicle Rentals Company LLC

12.11. Carzonrent India Private Limited

12.12. Eco Rent A Car

12.13. Localiza Rent a Car SA

12.14. Uber Technologies, Inc

12.15. Budget Rent A Car System, Inc

12.16. Ola Cabs

13. Strategic Recommendations

14. Annexure

14.1. FAQ`s

14.2. Notes

14.3. Related Reports

15. Disclaimer

List of Figures

Figure 1: Global Car Rental Market Size (USD Billion) By Region, 2022 & 2028

Figure 2: Market attractiveness Index, By Region 2028

Figure 3: Market attractiveness Index, By Segment 2028

Figure 4: Competitive Dashboard of top 5 players, 2022

Figure 5: Market Share insights of key players, 2022

Figure 6: Porter's Five Forces of Global Car Rental Market

Figure 7: Global Car Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 8: Global Car Rental Market Share By Region (2022)

Figure 9: North America Car Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 10: North America Car Rental Market Share By Country (2022)

Figure 11: US Car Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 12: Canada Car Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 13: Mexico Car Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 14: Europe Car Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 15: Europe Car Rental Market Share By Country (2022)

Figure 16: Germany Car Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 17: UK Car Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 18: France Car Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 19: Italy Car Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 20: Spain Car Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 21: Russia Car Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 22: Asia-Pacific Car Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 23: Asia-Pacific Car Rental Market Share By Country (2022)

Figure 24: China Car Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 25: Japan Car Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 26: India Car Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 27: Australia Car Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 28: South Korea Car Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 29: South America, Middle East & Africa Car Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 30: South America, Middle East & Africa Car Rental Market Share By Country (2022)

Figure 31: Brazil Car Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 32: UAE Car Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 33: Saudi Arabia Car Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 34: South Africa Car Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

List of Table

Table 1: Global Car Rental Market Snapshot, By Segmentation (2022 & 2028) (in USD Billion)

Table 2: Influencing Factors for Global Car Rental Market, 2022

Table 3: Top 10 Counties Economic Snapshot 2020

Table 4: Economic Snapshot of Other Prominent Countries 2020

Table 5: Average Exchange Rates for Converting Foreign Currencies into U.S. Dollars

Table 6: Global Car Rental Market Size and Forecast, By Geography (2017 to 2028F) (In USD Billion)

Table 7: Global Car Rental Market Size and Forecast, By Car Type (2017 to 2028F) (In USD Billion)

Table 8: Global Car Rental Market Size and Forecast, By Application Type (2017 to 2028F) (In USD Billion)

Table 9: Global Car Rental Market Size and Forecast, By End User (2017 to 2028F) (In USD Billion)

Table 10: Global Car Rental Market Size and Forecast, By Booking Type (2017 to 2028F) (In USD Billion)

Table 11: Global Car Rental Market Size and Forecast, By Rental Length (2017 to 2028F) (In USD Billion)

Table 12: North America Car Rental Market Size and Forecast By Car Type (2017 to 2028F) (In USD Billion)

Table 13: North America Car Rental Market Size and Forecast By Application Type (2017 to 2028F) (In USD Billion)

Table 14: US Car Rental Market Size and Forecast By Car Type (2017, 2022 & 2028F)

Table 15: US Car Rental Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 16: Canada Car Rental Market Size and Forecast By Car Type (2017, 2022 & 2028F)

Table 17: Canada Car Rental Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 18: Mexico Car Rental Market Size and Forecast By Car Type (2017, 2022 & 2028F)

Table 19: Mexico Car Rental Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 20: Europe Car Rental Market Size and Forecast By Car Type (2017 to 2028F) (In USD Billion)

Table 21: Europe Car Rental Market Size and Forecast By Application Type (2017 to 2028F) (In USD Billion)

Table 22: Germany Car Rental Market Size and Forecast By Car Type (2017, 2022 & 2028F)

Table 23: Germany Car Rental Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 24: UK Car Rental Market Size and Forecast By Car Type (2017, 2022 & 2028F)

Table 25: UK Car Rental Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 26: France Car Rental Market Size and Forecast By Car Type (2017, 2022 & 2028F)

Table 27: France Car Rental Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 28: Italy Car Rental Market Size and Forecast By Car Type (2017, 2022 & 2028F)

Table 29: Italy Car Rental Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 30: Spain Car Rental Market Size and Forecast By Car Type (2017, 2022 & 2028F)

Table 31: Spain Car Rental Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 32: Russia Car Rental Market Size and Forecast By Car Type (2017, 2022 & 2028F)

Table 33: Russia Car Rental Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 34: Asia-Pacific Car Rental Market Size and Forecast By Car Type (2017 to 2028F) (In USD Billion)

Table 35: Asia-Pacific Car Rental Market Size and Forecast By Application Type (2017 to 2028F) (In USD Billion)

Table 36: China Car Rental Market Size and Forecast By Car Type (2017, 2022 & 2028F)

Table 37: China Car Rental Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 38: Japan Car Rental Market Size and Forecast By Car Type (2017, 2022 & 2028F)

Table 39: Japan Car Rental Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 40: India Car Rental Market Size and Forecast By Car Type (2017, 2022 & 2028F)

Table 41: India Car Rental Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 42: Australia Car Rental Market Size and Forecast By Car Type (2017, 2022 & 2028F)

Table 43: Australia Car Rental Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 44: South Korea Car Rental Market Size and Forecast By Car Type (2017, 2022 & 2028F)

Table 45: South Korea Car Rental Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 46: South America, Middle East & Africa Car Rental Market Size and Forecast By Car Type (2017 to 2028F) (In USD Billion)

Table 47: South America, Middle East & Africa Car Rental Market Size and Forecast By Application Type (2017 to 2028F) (In USD Billion)

Table 48: Brazil Car Rental Market Size and Forecast By Car Type (2017, 2022 & 2028F)

Table 49: Brazil Car Rental Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 50: UAE Car Rental Market Size and Forecast By Car Type (2017, 2022 & 2028F)

Table 51: UAE Car Rental Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 52: Saudi Arabia Car Rental Market Size and Forecast By Car Type (2017, 2022 & 2028F)

Table 53: Saudi Arabia Car Rental Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 54: South Africa Car Rental Market Size and Forecast By Car Type (2017, 2022 & 2028F)

Table 55: South Africa Car Rental Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 124 |

| Published | January 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( $ | $ 103.79 Billion |

| Forecasted Market Value ( $ | $ 180.75 Billion |

| Compound Annual Growth Rate | 9.8% |

| Regions Covered | Global |