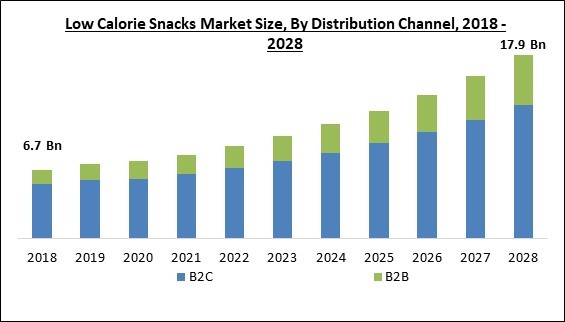

The Global Low Calorie Snacks Market size is expected to reach $17.9 billion by 2028, rising at a market growth of 12.1% CAGR during the forecast period.

As consumers continue to seek methods to reconcile nutrient-dense, healthful, and purposeful snacking with the need for emotionally rewarding and indulgent snacks, especially when snacks are of better quality, low-calorie snack foods are taking on increasingly specific responsibilities. Low-calorie snacks with natural, unprocessed components can provide several health advantages without negatively harming the body.

Increased demand and consumption of snack foods in various economies have considerably spurred the market expansion for low-calorie snacks. Increasing disposable income and shifting lifestyle and dietary preferences, the fast expansion of big retail chains, such as hypermarkets and supermarkets, an increase in the preference for ready-made and convenient food products, and an increase in people's spending power are contributing to developing the snacking sector. Furthermore, an increase in the demand for organic and conventional snack foods increases the demand for low-calorie snacks, which is accelerating the market growth for low-calorie snacks.

Over time, a greater appreciation for the significance of eating has emerged. This is attributable to the sharp increase in chronic health conditions. Consumers have embraced particular diet regimens to fight health issues and even altered their lifestyles to remain healthy. The usage of low-calorie snack foods is a noticeable trend that matches this requirement. Low-calorie snacks are popular since they do not include additives and give significantly fewer calories than are required to maintain a healthy weight.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Ingredion Incorporated, The Kraft Heinz Company, The Hain Celestial Group, Inc., Conagra Brands, Inc., Nestle S.A., Archer-Daniels-Midland Company, General Mills, Inc., Danone, S.A., Mondelez International, Inc., and Cargill, Corporation.

As consumers continue to seek methods to reconcile nutrient-dense, healthful, and purposeful snacking with the need for emotionally rewarding and indulgent snacks, especially when snacks are of better quality, low-calorie snack foods are taking on increasingly specific responsibilities. Low-calorie snacks with natural, unprocessed components can provide several health advantages without negatively harming the body.

Increased demand and consumption of snack foods in various economies have considerably spurred the market expansion for low-calorie snacks. Increasing disposable income and shifting lifestyle and dietary preferences, the fast expansion of big retail chains, such as hypermarkets and supermarkets, an increase in the preference for ready-made and convenient food products, and an increase in people's spending power are contributing to developing the snacking sector. Furthermore, an increase in the demand for organic and conventional snack foods increases the demand for low-calorie snacks, which is accelerating the market growth for low-calorie snacks.

Over time, a greater appreciation for the significance of eating has emerged. This is attributable to the sharp increase in chronic health conditions. Consumers have embraced particular diet regimens to fight health issues and even altered their lifestyles to remain healthy. The usage of low-calorie snack foods is a noticeable trend that matches this requirement. Low-calorie snacks are popular since they do not include additives and give significantly fewer calories than are required to maintain a healthy weight.

COVID-19 Impact Analysis

As consumers seek a balanced diet, the industry is experiencing a rise in demand for available snacks, minimally-processed foods, and low-calorie diets. Low-calorie foods are considered a treasury of plant-based nutrients, such as protein, vitamins A, B, and C, minerals, and dietary fiber. Experts on health advocate a low-calorie diet containing at least two cups of veggies. Hence, after the slight slowdown at the start of the pandemic due to the shutdown of many food processing factories, the rising demand for healthy foods is expected to push the low-calorie snacks market significantly during and after the pandemic.Market Growth Factors

The growing demand for healthy and convenient food

Convenient food has established itself as a dependable source of nutrition for customers who work in the business sector. This increases the market penetration of these products. As low-calorie snacks are also considered convenience meals, their industry will gain from the growth and popularity of convenience foods. Also, due to the good qualities of low-calorie organic snacking products and the rising consumer awareness of health and fitness, the market for low calorie snacks is expected to propel.The increasing demand for low calorie bakery products with extended shelf life

Texture variations and taste combinations are vital to expanding the market for low-calorie snack foods. The key drivers of the rising demand for low-calorie snack foods are the rising need for novel flavors and innovative twists on existing favorites. Producers use packaging strategies that highlight the food's clean labeling, non-GMO status, and certification to assist potential buyers in choosing if the product is suitable for them. Hence, the increased shelf life of many products and the high consumption of healthy and low-calorie bakery products will boost the low-calorie snacks market growth.Market Restraining Factor

Low product demand in various regions

Individuals must consume more calories daily than they expend. Eating calorie- and nutrient-dense snacks between meals increases energy consumption without feeling satiated. As specific ingredients are required for most low-calorie and healthy foods, their prices are much greater than those of other convenience foods. This is the fundamental disadvantage of a low-calorie diet. A huge number of consumers are opting for snacks that are high in calories to maintain weight and various other reasons, are anticipated to restrict the market growth.Type Outlook

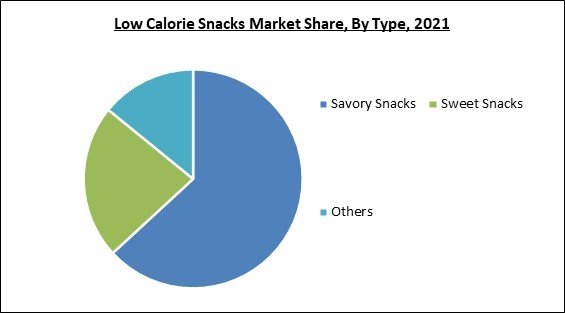

Based on type, the low-calorie snacks market is segmented into sweet snacks, savory snacks, and others. The sweet snacks segment acquired a significant revenue share in the low-calorie snacks market in 2021. This is owing to improved health awareness, and customers' preference for sweet delights such as cakes, pastries, ice cream, and muffins is increasing. There is a vast availability of several low-calorie, fat-free, and cholesterol-free products.Packaging Type Outlook

On the basis of packaging type, the low-calorie snacks market is divided into pouches, can, and jars & others. The cans segment procured a promising growth rate in the low-calorie snacks market in 2021. This is owing to the fact that can packaging manufacturers establish a new benchmark for R&D by focusing on cost-effective production sites and proximity supplies. In addition, focus on high-quality goods, changes in consumer lifestyles, and increased disposable income are the primary factors that will propel the segment's expansion during the projected period.Distribution Channel Outlook

By distribution channel, the low-calorie snacks market is classified into B2B and B2C. The B2C segment witnessed the largest revenue share in the low-calorie snacks market in 2021. This is because these channels offer a variety of products and frequently serve as a one-stop shop for all daily needs. The urban and semi-urban populous prefers B2C due to the items' accessibility. One of the developments in the low-calorie snack industry is a rise in the number of outlets operated by major companies.Nature Outlook

Based on the nature, the low-calorie snacks market is bifurcated into organic and conventional. The conventional segment led the low-calorie snacks market by generating the maximum revenue share in 2021. This is because the conventional category has grown in popularity due to the rise in the level of life and the awareness of the advantages of low-calorie snack items, such as their high content of antioxidants. In addition, increasing disposable income, altering taste preferences, and introducing new flavors with more nutritious components is further aiding the segment's growth in the projected period.Regional Outlook

Region-wise, the low-calorie snacks market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Europe region generated the highest revenue share in the low-calorie snacks market in 2021. This is because the region's retail channels are well-developed and extensive. The industry for organic snacks is the largest in the area. Due to the growth in internet penetration and the availability of online meal delivery, the market for low calorie snacks has expanded dramatically.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Ingredion Incorporated, The Kraft Heinz Company, The Hain Celestial Group, Inc., Conagra Brands, Inc., Nestle S.A., Archer-Daniels-Midland Company, General Mills, Inc., Danone, S.A., Mondelez International, Inc., and Cargill, Corporation.

Recent Strategies Deployed in Low Calorie Snacks Market

- Mar-2023: Cargill partnered with CUBIQ FOODS; a company engaged in transforming nutrition. This partnership would enable Cargill to deliver CUBIQ’s innovative fats to customers engaged in the development of plant-based foods and may finally make them healthier than those made of tropical oils or animal fats.

- Nov-2022: Healthy Choice®, a brand of Conagra Brands, Inc., released Healthy Choice® Zero, meals which are ALL IN one flour without any added sugar. The launch consists of three delicious flavors which include Verde Chicken, Sesame Chicken, and Basil Chicken which consists of cauliflower rice and zucchini noodles.

- Jan-2022: The Hain Celestial Group, Inc. took over the Parmcrisps and Thinsters brands from Clearlake Capital Group LP, a private equity company. With this acquisition, The Hain Celestial Group becomes a bigger player across US and Canada in snack segments.

- Mar-2021: Ingredion Incorporated announced a partnership with Amyris, Inc., a leading synthetic biotechnology company. This partnership positions Ingredion well to meet its customers' increasing need for quality ingredients that would propel transformational change in the food industry.

- Jul-2020: Ingredion Incorporated completed the acquisition of PureCircle Limited, a producer and innovator of plant-based stevia sweeteners and flavors for the food and beverage industry. This acquisition places Ingredion to provide plant-based, low-calorie sugar alternatives addressing the worldwide megatrend in the food and beverage industry to decrease sugar in consumers' diets.

- Apr-2020: Ingredion EMEA unveiled ERYSTA® Erythritol, the company's first polol sweetener. The Product allows manufacturers to decrease or replace sugar to achieve nutrition-related claims, including calorie-reduced or no added sugar.

- Oct-2019: Kraft Heinz came into partnership with the UFC Performance Institute, a provider of global resources to UFC athletes and coaches. This partnership would aim to bring a protein-rich snack, targeted at active consumers looking to fuel workouts.

- Mar-2019: Ingredion announced the launch of NOVATION® Indulge 2920 starch, a corn-based starch. The product would support lower-calorie and lower-fat products and the production of foods with healthier profiles. Moreover, the NOVATION® Indulge 2920 starch allows food producers to enhance mouthfeel by providing the same functionality as a modified starch as well as replacing or decreasing ingredients including oil and fat.

- Mar-2018: Cargill introduced EverSweet, a zero-calorie, next-generation sweetener. The product is made primarily with two sweet compounds found in the Reb M, Stevia leaf and Reb D. Additionally, this launch aimed to create lower calorie products that taste great and are cost-efficient.

Scope of the Study

By Distribution Channel

- B2C

- Hypermarket/supermarket

- Specialty Stores

- Online Sales

- Others

- B2B

By Type

- Savory Snacks

- Sweet Snacks

- Others

By Packaging Type

- Pouches

- Can

- Jar & Others

By Nature

- Conventional

- Organic

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Ingredion Incorporated

- The Kraft Heinz Company

- The Hain Celestial Group, Inc.

- Conagra Brands, Inc.

- Nestle S.A.

- Archer-Daniels-Midland Company

- General Mills, Inc.

- Danone, S.A.

- Mondelez International, Inc.

- Cargill, Corporation

Unique Offerings

- Exhaustive coverage

- The highest number of market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Chapter 1. Market Scope & Methodology

Chapter 2. Market Overview

Chapter 4. Global Low Calorie Snacks Market by Distribution Channel

Chapter 5. Global Low Calorie Snacks Market by Type

Chapter 6. Global Low Calorie Snacks Market by Packaging Type

Chapter 7. Global Low Calorie Snacks Market by Nature

Chapter 8. Global Low Calorie Snacks Market by Region

Chapter 9. Company Profiles

Companies Mentioned

- Ingredion Incorporated

- The Kraft Heinz Company

- The Hain Celestial Group, Inc.

- Conagra Brands, Inc.

- Nestle S.A.

- Archer-Daniels-Midland Company

- General Mills, Inc.

- Danone, S.A.

- Mondelez International, Inc.

- Cargill, Corporation