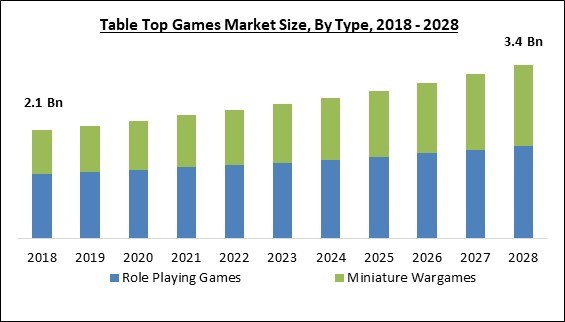

The Global Table Top Games Market size is expected to reach $3.4 billion by 2028, rising at a market growth of 5.2% CAGR during the forecast period.

Any game commonly played on a flat surface, primarily a table, is called a table top game. Table top games include, among others, miniature wargames, board games, dice games, role-playing games, pencil & paper games, card games, and tile-laying games. Tabletop games don't have a set minimum or a maximum number of players. For beginning and intermediate players, game publishers and businesses provide a variety of miniature war games and role-playing games.

A tabletop game is a general phrase that refers to various game kinds and styles often played on a flat surface. This typically implies that they are played on top of a table so players can sit around it and enjoy themselves. However, it is not necessary. More than anything, it is meant to indicate that the game can be contained wholly in a small, flat area.

Rarely do people get up and move around or run about. Nonetheless, some 'tabletop games'can need some of this. The complexity of tabletop games varies greatly. There is only a minimum level of complexity for games. Some tabletop games are so easy to learn that one can do it while the game is still in progress, whereas some would want much explanation and practice to comprehend completely.

The most common games are board and card games, and even within those categories, players may like numerous smaller subcategories. People typically play games to pass the time, keep their minds active, and foster social interaction with friends and family. Nowadays, so many games are available that anyone can easily select the one that best suits their needs. There are games for children and families, adult party games, games for couples, and even solo games.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Buffalo Games, LLC (Mason Wells), Mattel, Inc., Asmodee (Embracer Group AB), Hasbro, Inc., Grand Prix International, NSF Games (Nederlandse Spellenfabriek), Korea BoardGames Co., Ltd., Australian Design Group, Goliath Games LLC, and Ravensburger AG.

Any game commonly played on a flat surface, primarily a table, is called a table top game. Table top games include, among others, miniature wargames, board games, dice games, role-playing games, pencil & paper games, card games, and tile-laying games. Tabletop games don't have a set minimum or a maximum number of players. For beginning and intermediate players, game publishers and businesses provide a variety of miniature war games and role-playing games.

A tabletop game is a general phrase that refers to various game kinds and styles often played on a flat surface. This typically implies that they are played on top of a table so players can sit around it and enjoy themselves. However, it is not necessary. More than anything, it is meant to indicate that the game can be contained wholly in a small, flat area.

Rarely do people get up and move around or run about. Nonetheless, some 'tabletop games'can need some of this. The complexity of tabletop games varies greatly. There is only a minimum level of complexity for games. Some tabletop games are so easy to learn that one can do it while the game is still in progress, whereas some would want much explanation and practice to comprehend completely.

The most common games are board and card games, and even within those categories, players may like numerous smaller subcategories. People typically play games to pass the time, keep their minds active, and foster social interaction with friends and family. Nowadays, so many games are available that anyone can easily select the one that best suits their needs. There are games for children and families, adult party games, games for couples, and even solo games.

COVID-19 Impact Analysis

The COVID-19 outbreak has raised the demand for tabletop games. During the lockdown restrictions throughout the world, people stayed at home to prevent the spread of COVID-19, and during that time, tabletop games proved to be an effective option for keeping children and young adults busy. Thus, the breakout of COVID-19 has undoubtedly raised the demand for table top gaming, producing a long-lasting influence. The initial fall of the market due to the closure of many retail stores was overcome by the increased demands due to lockdowns, and the market saw a prominent expansion.Market Growth Factors

Table top games aids in mental growth of children

Researches revealed that compared to novices, board game players had increased grey matter in the nucleus accumbens and decreased grey matter in the amygdala. A part of the brain called the nucleus accumbens processes environmental inputs linked to pleasurable or unpleasant experiences. Its operation is based on the neurotransmitters serotonin and dopamine, which encourage inhibition and satiety. Increasing grey matter in the nucleus accumbens produces more enthusiastic and uplifting experiences. Stress reduction and an increase in serenity are caused by a decrease in grey matter in the amygdala.The growing popularity of online table top games

People could have fun with their friends and family during the COVID-19 lockdown by playing multiplayer board games without leaving their homes. On the other hand, the development of various board games on mobile phones has opened up many new possibilities for consumers to have fun and save themselves from boredom which came in handy during the pandemic. With the introduction of table top games for smartphones, many tournaments for these games were staged across numerous platforms with a sizable prize pool. The adoption of the table top games on online platforms has surged their popularity and propelled market growth.Market Restraining Factors

The adverse effect of the manufacturing of table top games on the environment

A significant amount of their carbon impact comes from shipping. The games are transported over great distances in shipping containers, aircraft, lorries, and vans before they arrive at various places. The game box's shrink wrap, which prevents wandering hands from swiping parts in nearby game stores, ensures the box won't open during shipping and disperse pieces, and maintains the game sparkling and scratch-free for future owners, is the major contributor to the pollution. Hence, the market growth is anticipated to get hampered due to its adverse effect on the environment.Application Outlook

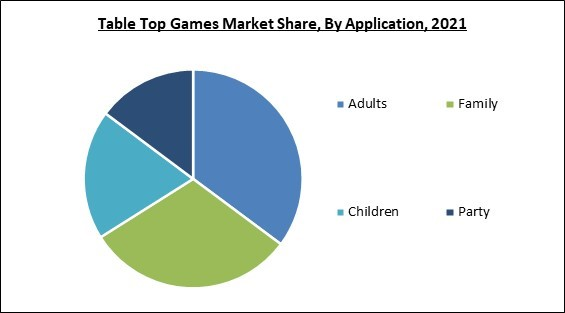

Based on application, the table top games market is segmented into children, adults, family and party. The adults segment held the highest revenue share in the table top games market in 2021. This is because, several traditional games, such as chess, test both creative and analytical mental processes, stimulating both sides of the brain. Even learning the rules and playing a new game will strengthen the player's brain. Many table players claim they play to relax and unwind. Many board games induce laughing, which stimulates endorphins. Furthermore, the simple act of having fun can promote serotonin, alleviate anxiety symptoms, and increase motivation in other aspects of life.Type Outlook

On the basis of type, the table top games market is divided into miniature wargames and role playing games. The role playing games segment witnessed the largest revenue share in the table top games market in 2021. The growth is attributed due to the presence of numerous varieties of RPGs in the market. RPGs' intricate storylines and character-building systems draw in a devoted following of gamers who construct distinctive characters and hone their skills to advance their characters.Distribution Channel Outlook

By distribution channel, the table top games market is classified into online and offline. The online segment garnered a prominent revenue share in the table top games market in 2021. This is because of the growing online presence and simple access to mobile gaming platforms. There is a rapid development of internet media and an increase in the working population throughout developing countries. Some of the key growth drivers for the industry for mobile gaming are the increasing online presence and the simple accessibility of these platforms.Regional Outlook

Region-wise, the table top games market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Europe region led the table top games market by generating the maximum revenue share in 2021. This is due to the fact that the tabletop games have a sizable market in Europe. In Europe, the number of millennials who play board games is rising noticeably. The region also produces miniature wargames. Europe's tabletop games industry has many businesses, including small and medium-sized firms (SMEs). SMEs, make up the majority of companies and are crucial to the economic structure of Europe, especially in the rural areas where most businesses are found.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Buffalo Games, LLC (Mason Wells), Mattel, Inc., Asmodee (Embracer Group AB), Hasbro, Inc., Grand Prix International, NSF Games (Nederlandse Spellenfabriek), Korea BoardGames Co., Ltd., Australian Design Group, Goliath Games LLC, and Ravensburger AG.

Strategies Deployed in Signals Table Top Games Market

Partnerships, Collaborations and Agreements:

- Apr-2023: Hasbro came into partnership with Panini America, a sports trading cards publisher, to introduce NBA Prizm Trading Cards to a new Board Game. Through this partnership, the power of the NBA trading card from Panini would be combined with Hasbro's iconic Monopoly to bring Monopoly Prizm, a new NBA trading card edition of the classic Monopoly game. With Monopoly Prizm, players would be able to trade and compete with NBA Prizm trading cards.

- Oct-2022: Hasbro extended its partnership with Renegade Game Studios, a creator and publisher of board games, to develop Gaming Classics. With this expansion, Renegade would bring new versions of the classic game Risk featuring Hasbro's well-known strategy games, delivering users a collection of the latest battles and themes for the Axis & Allies brand. The new editions would incorporate Power Rangers, Transformers, and G.I. JOE.

- Sep-2022: Asmodee entered into collaboration with Z-Man Games, a board game company, to launch Tabletop Game, namely, Challengers. Through this partnership, Z-Man Games would empower Asmodee in offering users an innovative Tabletop Game, Challengers, that would be a tournament of up to eight participants challenging one another at the same time in a strategic deck-building tournament.

- Jul-2022: Mattel, Inc. signed an agreement with SpaceX, an American spacecraft manufacturer, for developing and marketing products that encourage kids and collectors toward space exploration. With this agreement, Mattel would launch SpaceX-themed toys under its renowned Matchbox brand, for developing interest among kids in space exploration.

- Oct-2021: Mattel's UNO, came into partnership with Nike, an American multinational corporation engaged in footwear manufacturing and selling, to develop a product line encompassing the game's renowned colors, design components, and a unique 3-4 card design. Nike's footwear line would feature Nike's signature Zoom Freak 3, Air Force 1, and Offline with UNO colorways and Giannis’s design. With this partnership, UNO!, a mobile app, would combine the Giannis-branded UNO deck to utilize on iOS and Android devices, enabling players to use the 'force a turnover' rule and personalize their profiles with themed rewards.

Product Launches and Product Expansions:

- Jul-2022: Hasbro announced the launch of classic board games that would now be available in Tamil. The game board and action cards of the games namely, the Monopoly board game, and Monopoly Deal Card game would now also be provided with packaging, instructions, and elements in the Tamil language, empowering Hasbro to strengthen local sourcing and manufacturing in India.

- Feb-2022: Hasbro released a creative play and entertainment portfolio including My Little Pony, Peppa Pig, and Power Rangers entertainment games. The lineup would cover categories such as action, arts & crafts, fashion, sports action, etc. to provide engaging play and entertainment experiences to customers.

- Aug-2021: Mattel together with Etermax, a game developer, unveiled Trivia Crack-The Board Game. Trivia Crack is a highly interactive family game. With the introduction of Trivia Crack, Instagram users would be able to challenge their opponents for free, and that too from anywhere.

Acquisitions and Mergers:

- Mar-2023: Buffalo took over EastPoint Sports, a New Jersey-based company that specializes in offering yard games, to improve Buffalo's suite incorporating outdoor and indoor games. Through this acquisition, EastPoint's popular products would empower Buffalo in providing its customers with an enhanced suite of outdoor games such as tailgate and lawn games as well as indoor games including darts and air hockey.

- May-2022: Hasbro acquired Dungeons & Dragons (D&D), a tabletop role-playing game. With this acquisition, D&D expertise in delivering role-playing games focussing on offering engaging experiences to players would be leveraged by Wizards of the Coast, a subsidiary of Hasbro, Inc., in advancing its capabilities in providing a distinct ecosystem of innovative tabletop and digital games to intensify player engagement and satisfaction.

- Feb-2021: Asmodee completed the acquisition of Board Game Arena, an online platform for playing board games. With the support of Arena, Asmodee's suite of board games would be digitalized to offer Asmodee's customers powerful virtual tabletop games.

Scope of the Study

By Type

- Role Playing Games

- Miniature Wargames

By Distribution Channel

- Offline

- Online

By Application

- Adults

- Family

- Children

- Party

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Buffalo Games, LLC (Mason Wells)

- Mattel, Inc.

- Asmodee (Embracer Group AB)

- Hasbro, Inc.

- Grand Prix International

- NSF Games (Nederlandse Spellenfabriek)

- Korea BoardGames Co., Ltd.

- Australian Design Group

- Goliath Games LLC

- Ravensburger AG

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Chapter 1. Market Scope & Methodology

Chapter 2. Market Overview

Chapter 4. Global Table Top Games Market by Type

Chapter 5. Global Table Top Games Market by Distribution Channel

Chapter 6. Global Table Top Games Market by Application

Chapter 7. Global Table Top Games Market by Region

Chapter 8. Company Profiles

Companies Mentioned

- Buffalo Games, LLC (Mason Wells)

- Mattel, Inc.

- Asmodee (Embracer Group AB)

- Hasbro, Inc.

- Grand Prix International

- NSF Games (Nederlandse Spellenfabriek)

- Korea BoardGames Co., Ltd.

- Australian Design Group

- Goliath Games LLC

- Ravensburger AG