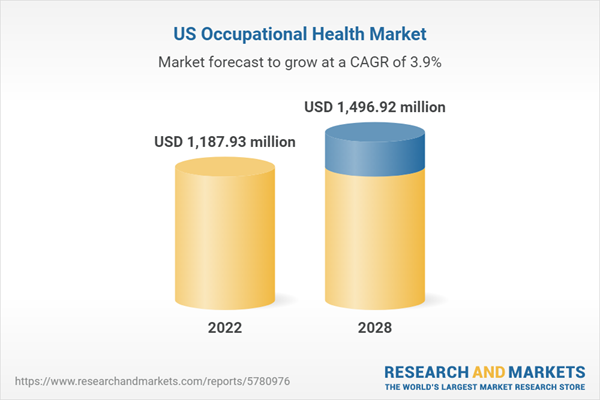

The US occupational health market size is expected to grow from US$ 1,187.93 million in 2022 to US$ 1,496.92 million by 2028; it is estimated to record a CAGR of 3.9% from 2022 to 2028. The market growth is attributed to high focus on employer-sponsored medical health coverage and accelerating adoption of workplace wellness programs. However, the health-associated risks at the workplace hamper the market's growth.

According to the CDC, workplace health models are an important stage in promoting physically and mentally healthy and protected work culture and rolling out disease prevention programs. For example, in the US, people working full time spend on average more than one-third of the day, five days per week, at their workplaces. Through an effective workplace health model, employers having the intention to offer safe and hazard-free workplaces will experience lucrative opportunities for promoting individual health by fostering a healthy environment for more than 159 million workers in the US. Additionally, the effective implementation of workplace health models reduces health risks by improving workers' quality of life. Also, maintaining a healthier workforce lowers direct costs such as insurance premiums and workers' compensation claims.

The CDC runs the Workplace Health Model promotion in the US. As a result, 46% of worksites in the US have been implementing workplace health programs that focus on physical activity, nutrition, and stress reduction. Additionally, the CDC has designed a Worksite Health “Scorecard” to assist employers in effectively implementing evidence-based interventions at their workplace. The initiative is also meant to help it select and implement suitable strategies for improving workers’ health. For instance, as per the CDC, ~156 million full-time workers in the US are spending the majority of their working hours at work, which further promotes the rollout of workplace health model programs to reach different population classes, which otherwise are not involved in any public health promotion programs, campaigns, and messages. For instance, ~50% of US worksites have implemented effective strategies for improving the social or physical environment by ~47.8%, indicating the progress made by US employers.

Robotics-led automation of tasks will bring a new diverse trend in the occupational health market. The availability of relatively inexpensive robots capable of performing in a shared environment with human workers has driven a new robotic era. For example, human workers are equipped with performance-enhancing robotic devices such as robotic exoskeletons and other capacity-enhancing prostheses. Collaborative robots are designed for direct interaction with humans, and these can be of three types - industrial, professional, and personal service robots. The implementation of robotics in workplace is likely to protect workers from exposure to hazardous substances, environments, and physical agents. For example, robotics is being deployed for handling radioactive materials and working in high-dust exposure environments, resulting in health and safety benefits, production efficiency, and quality improvements. Additionally, the incorporation of sensors has increased exponentially as countless remote wireless sensors are now employed for monitoring worksites and facilities. Similarly, risk assessment with new technologies quickly determines workers' safety and health issues. The Occupational Safety and Health Administration (OSHA) in the US Department of Labor has issued a mandatory national standard to curb the cases of lung cancer and chronic obstructive pulmonary disorders among workers by limiting their exposure to respirable crystalline silica.

Society for Human Resource Management (SHRM), Health Opportunities for People Everywhere (HOPE), and Kaiser Family Foundation (KFF) are among the primary and secondary sources referred to while preparing the report on the US occupational health market.

According to the CDC, workplace health models are an important stage in promoting physically and mentally healthy and protected work culture and rolling out disease prevention programs. For example, in the US, people working full time spend on average more than one-third of the day, five days per week, at their workplaces. Through an effective workplace health model, employers having the intention to offer safe and hazard-free workplaces will experience lucrative opportunities for promoting individual health by fostering a healthy environment for more than 159 million workers in the US. Additionally, the effective implementation of workplace health models reduces health risks by improving workers' quality of life. Also, maintaining a healthier workforce lowers direct costs such as insurance premiums and workers' compensation claims.

The CDC runs the Workplace Health Model promotion in the US. As a result, 46% of worksites in the US have been implementing workplace health programs that focus on physical activity, nutrition, and stress reduction. Additionally, the CDC has designed a Worksite Health “Scorecard” to assist employers in effectively implementing evidence-based interventions at their workplace. The initiative is also meant to help it select and implement suitable strategies for improving workers’ health. For instance, as per the CDC, ~156 million full-time workers in the US are spending the majority of their working hours at work, which further promotes the rollout of workplace health model programs to reach different population classes, which otherwise are not involved in any public health promotion programs, campaigns, and messages. For instance, ~50% of US worksites have implemented effective strategies for improving the social or physical environment by ~47.8%, indicating the progress made by US employers.

Robotics-led automation of tasks will bring a new diverse trend in the occupational health market. The availability of relatively inexpensive robots capable of performing in a shared environment with human workers has driven a new robotic era. For example, human workers are equipped with performance-enhancing robotic devices such as robotic exoskeletons and other capacity-enhancing prostheses. Collaborative robots are designed for direct interaction with humans, and these can be of three types - industrial, professional, and personal service robots. The implementation of robotics in workplace is likely to protect workers from exposure to hazardous substances, environments, and physical agents. For example, robotics is being deployed for handling radioactive materials and working in high-dust exposure environments, resulting in health and safety benefits, production efficiency, and quality improvements. Additionally, the incorporation of sensors has increased exponentially as countless remote wireless sensors are now employed for monitoring worksites and facilities. Similarly, risk assessment with new technologies quickly determines workers' safety and health issues. The Occupational Safety and Health Administration (OSHA) in the US Department of Labor has issued a mandatory national standard to curb the cases of lung cancer and chronic obstructive pulmonary disorders among workers by limiting their exposure to respirable crystalline silica.

Type-Based Insights

Based on type, the US occupational health market is bifurcated into physical wellbeing and social and mental wellbeing. In 2022, the physical wellbeing segment held a larger share of the market. However, the social and mental wellbeing segment is anticipated to register a higher CAGR during the forecast period. Physical wellbeing is not just the absence of disease. It includes behavioral choices to ensure health, avoid preventable diseases and conditions, and live in a balanced physical, mental and spiritual state. Physical health encompasses many aspects, such as, e.g., good nutrition, physical activity, good hygiene, and sufficient rest. Physical activity can improve mood, reduce stress and anxiety, and prevent mental health problems. Paying attention to physical wellbeing in the workplace is a great way to increase productivity. Physical activity in the workplace can improve employee health and save money. Employing workplace wellness programs encouraging physical activity can help create a healthier workforce, reducing healthcare costs for employers and employees.Society for Human Resource Management (SHRM), Health Opportunities for People Everywhere (HOPE), and Kaiser Family Foundation (KFF) are among the primary and secondary sources referred to while preparing the report on the US occupational health market.

Table of Contents

1. Introduction

3. Research Methodology

4. Occupational Health Market - Market Landscape

5. US Occupational Health Market - Key Market Dynamics

6. Occupational Health Market - US Analysis

7. US Occupational Health Market Revenue and Forecasts To 2028- by Offerings

8. US Occupational Health Market Revenue and Forecasts To 2028- by Category

9. US Occupational Health Market Revenue and Forecasts To 2028- by Employee Type

10. US Occupational Health Market Revenue and Forecasts To 2028- by Site Location

11. US Occupational Health Market Revenue and Forecasts To 2028- by Type

12. Impact of COVID-19 Pandemic on US Occupational Health Market

13. Occupational Health Market-Industry Landscape

14. Company Profiles

15. Appendix

List of Tables

List of Figures

Companies Mentioned

- Premise Health Holding Corp

- Occucare International LLC

- Examinetics Inc

- Concentra Inc

- Ascension Health Alliance

- Adventist Health System Sunbelt Healthcare Corp

- WorkCare Inc

- e3 Diagnostics Inc

- Icahn School of Medicine at Mount Sinai

- Workwell Occupational Medicine LLC.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 127 |

| Published | March 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 1187.93 million |

| Forecasted Market Value ( USD | $ 1496.92 million |

| Compound Annual Growth Rate | 3.9% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |