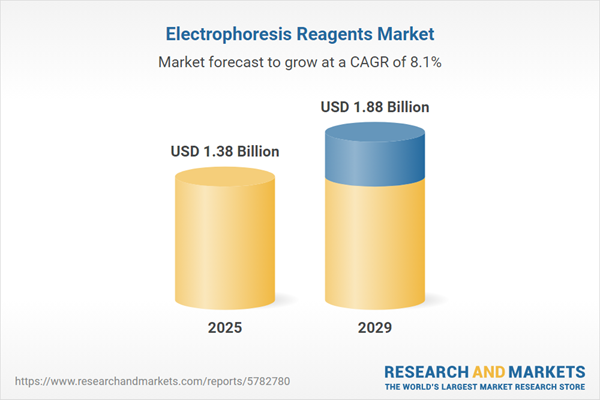

The electrophoresis reagents market size is expected to see strong growth in the next few years. It will grow to $1.88 billion in 2029 at a compound annual growth rate (CAGR) of 8.1%. The growth in the forecast period can be attributed to expansion of point-of-care testing, shift towards capillary electrophoresis, focus on sustainable reagent formulations, demand for high-throughput analysis, advancements in microfluidic electrophoresis. Major trends in the forecast period include technological advancements in electrophoresis techniques, adoption of next-generation sequencing (NGS), demand for high-throughput techniques, strategic collaborations and partnerships, integration of artificial intelligence (AI) in data analysis, customization and compatibility.

The rapidly growing geriatric population is anticipated to drive the expansion of the electrophoresis reagent market. The geriatric population refers to individuals aged 60 years and older within the total population. Hemoglobin electrophoresis, a test that assesses hemoglobin levels, is commonly utilized to diagnose anemia, sickle cell disease, and other hemoglobin-related disorders. For example, in January 2024, a report by the Pew Research Center, a US-based nonpartisan fact tank, indicated that the geriatric population is projected to increase from 0.2% in 2024 to 0.5% by 2054. As a result, the rising geriatric population is fueling the growth of the electrophoresis reagent market.

The growing demand in hospitals is expected to further propel the electrophoresis reagent market. Hospitals are large, specialized healthcare institutions that offer a broad range of medical services, treatment, and care for individuals who are ill or injured. Electrophoresis reagents play a vital role in diagnostics, research, and the detection and monitoring of various medical conditions within hospitals, contributing to advancements in patient care and medical knowledge. For instance, in August 2023, Interweave Textiles Limited, a UK-based textile manufacturing company, reported that there are 1,148 hospitals in the UK. Therefore, the increasing number of hospitals is driving the growth of the electrophoresis reagent market.

Innovation in product development has emerged as a notable trend reshaping the electrophoresis reagents market. Key companies within the sector are focused on creating novel products to maintain their market standing. For instance, in February 2022, Kemira Oyj, a Finland-based chemical industry company, introduced biomass-balanced polyacrylamide. This polymer, possessing similar technical properties to its conventional counterpart, finds utility in various industries such as energy, demanding paper applications, water treatment, and other water-intensive sectors.

Major companies in the electrophoresis reagents market are focusing on developing innovative products, such as ionic calixarene-based detergents/surfactants, to boost their revenues. An ionic calixarene-based detergent/surfactant is a specialized surfactant derived from calixarene compounds, known for its amphiphilic properties. For example, in September 2022, Amerigo Scientific, a US-based distribution company serving the biomedical and life science research sectors, introduced the CALX8 Reagent. CALX8 Reagent is an ionic calixarene-based detergent/surfactant specifically designed for membrane protein research. It contains three polar carboxylic groups and an octyl chain, making it highly effective in solubilizing and stabilizing membrane proteins while preserving their structural integrity. This reagent is particularly beneficial in various stages of membrane protein studies, including extraction, stabilization, isolation, and crystallization. This innovation aims to enhance life science research and applications by improving the efficiency of laboratory processes.

In September 2023, Agilent Technologies, a US-based provider of scientific instruments, software, services, and consumables for laboratories, partnered with the National Cancer Institute. This partnership aims to enhance the capabilities of Agilent's electrophoresis technology for cancer research. The collaboration seeks to leverage advanced electrophoresis techniques to improve the analysis of cancer biomarkers, which is essential for advancing diagnostic and treatment strategies. The National Cancer Institute is the principal federal agency in the United States dedicated to cancer research.

Major companies operating in the electrophoresis reagents market are Thermo Fisher Scientific Inc., Sigma-Aldrich Corporation, Bio-Rad Laboratories Inc., Agilent Technologies Inc., Lonza Group Ltd., Takara Bio Inc., Sebia Group, The Merck Group, Cytiva, Promega Corporation, Helena Laboratories Corporation, Randox Laboratories Limited, Qiagen NV, Hoefer Inc., VWR International GmbH, anamed Elektrophorese GmbH, Alfa Aesar, GenScript Corp., Zymo Research Corp., Omega Bio-tek Inc., Norgen Biotek Corp., Eurofins Genomics LLC.

North America was the largest region in the electrophoresis reagents market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the electrophoresis reagents market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the electrophoresis reagents market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Electrophoresis reagents are specifically formulated substances or mixtures designed to streamline the separation and analysis of samples during electrophoretic processes. They play a critical role in isolating biological molecules like proteins and DNA from cells, facilitating their examination and separation within electrophoresis.

The primary constituents of electrophoresis reagents comprise gels (such as polyacrylamide, starch, and agarose), buffers (like TAE buffer, TBE buffer, and others), dyes (including ETBR, SYBR, bromophenol blue, and similar compounds), and additional supporting reagents. Gels, synthesized through free-radical polymerization of bis-acrylamide and acrylamide, form the matrix for electrophoretic separation, particularly polyacrylamide gels utilized in protein separation via gel electrophoresis. Electrophoresis techniques, namely capillary electrophoresis and gel electrophoresis are employed for DNA and RNA analysis as well as protein analysis. End-users of these reagents span pharmaceutical and biotechnology companies, hospitals, diagnostic laboratories, academic and research institutions, and various other entities involved in molecular analysis and research.

The electrophoresis reagents market research report is one of a series of new reports that provides electrophoresis reagents market statistics, including electrophoresis reagents industry global market size, regional shares, competitors with an electrophoresis reagents market share, detailed electrophoresis reagents market segments, market trends and opportunities, and any further data you may need to thrive in the electrophoresis reagents industry. This electrophoresis reagents market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The electrophoresis reagents market consists of sales of electrophoresis reagents that are used for electrophoretic separation and sample analysis. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Electrophoresis Reagents Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on electrophoresis reagents market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for electrophoresis reagents? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The electrophoresis reagents market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Product: Gels (Polyacrylamide, Starch, and Agarose); Buffer (TAE Buffer, TBE Buffer, and Other Buffers); Dyes (ETBR, SYBR, Bromophenol Blue and Others); Other Reagents2) by Technique: Capillary Electrophoresis; Gel Electrophoresis

3) by Application: DNA and RNA Analysis; Protein Analysis

4) by End-User: Pharmaceutical and Biotechnology Companies; Hospitals and Diagnostic Laboratories; Academic and Research Institutions; Others End Users

Subsegments:

1) by Gels: Polyacrylamide Gels; Starch Gels; Agarose Gels2) by Buffers: TAE Buffer (Tris-Acetate-EDTA); TBE Buffer (Tris-Borate-EDTA); Other Buffers

3) by Dyes: Ethidium Bromide (ETBR); SYBR Green; Bromophenol Blue; Other Dyes

4) by Other Reagents: Sample Loading Dyes; Stabilizers; Enhancers

Key Companies Mentioned: Thermo Fisher Scientific Inc.; Sigma-Aldrich Corporation; Bio-Rad Laboratories Inc.; Agilent Technologies Inc.; Lonza Group Ltd.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Electrophoresis Reagents market report include:- Thermo Fisher Scientific Inc.

- Sigma-Aldrich Corporation

- Bio-Rad Laboratories Inc.

- Agilent Technologies Inc.

- Lonza Group Ltd.

- Takara Bio Inc.

- Sebia Group

- The Merck Group

- Cytiva

- Promega Corporation

- Helena Laboratories Corporation

- Randox Laboratories Limited

- Qiagen NV

- Hoefer Inc.

- VWR International GmbH

- anamed Elektrophorese GmbH

- Alfa Aesar

- GenScript Corp.

- Zymo Research Corp.

- Omega Bio-tek Inc.

- Norgen Biotek Corp.

- Eurofins Genomics LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 1.38 Billion |

| Forecasted Market Value ( USD | $ 1.88 Billion |

| Compound Annual Growth Rate | 8.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 23 |