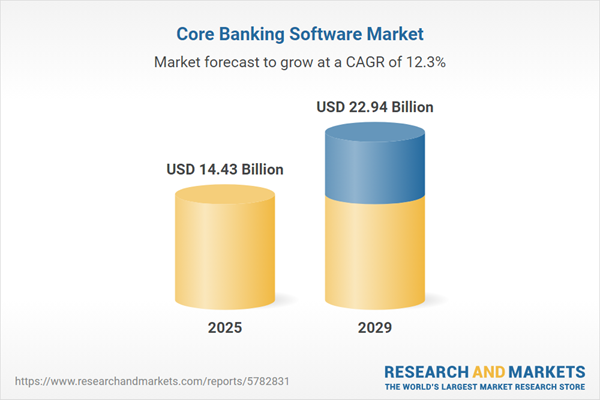

The core banking software market size is expected to see rapid growth in the next few years. It will grow to $22.94 billion in 2029 at a compound annual growth rate (CAGR) of 12.3%. The growth in the forecast period can be attributed to real-time payments, scalability, cost pressures, data security and privacy, real-time reporting, sustainable banking. Major trends in the forecast period include cloud adoption, data analytics and AI, cybersecurity, customer experience enhancement, blockchain integration, API economy, microservices architecture.

The core banking software market is poised for growth, driven by the increasing demand for digital banking solutions among the millennial and Gen Z populations. With a preference for digital banking over traditional methods, these demographics are shaping the demand for core banking software. A survey conducted by GoCardless in 2022 revealed that 56% of millennials and 54% of Gen Z individuals are willing to fully transition from traditional banking to peer-to-peer and social media apps for payments. This digital banking preference is a significant factor propelling the core banking software market forward.

The core banking software market is also set to benefit from the rising customer demand for mobile and net banking services. Mobile banking, allowing users to manage accounts through smartphones or tablets, and net banking, enabling online financial transactions, are gaining popularity. Core banking software plays a pivotal role in connecting these services with the regular operating channels of banks, ensuring seamless operations across channels. According to projections by MoneyTransfers.com in October 2023, the global number of online banking users, including mobile and internet banking, is expected to reach 3.6 billion by 2024. This growth underscores the increasing significance of online banking services, particularly in developing countries, driving the demand for core banking software.

Technological advancements are a prominent trend in the core banking software market, with major companies introducing innovative technologies like core banking chatbots based on artificial intelligence. In January 2022, Temenos, a Switzerland-based banking software company, introduced the first AI-driven buy-now-pay-later banking service. Deployed on the Temenos banking cloud, it leverages the rationalist capabilities of the core banking system, integrating industry best practices and providing reliable lending capabilities. This exemplifies the ongoing trend of integrating AI technologies into core banking solutions, enhancing the overall banking experience.

Furthermore, major companies in the core banking software market are actively integrating new and innovative technologies, such as core banking technology, to stay competitive. Core banking technology, also known as core banking systems (CBS), forms the backbone of modern banking operations, managing day-to-day transactions and activities. In February 2023, Arvest Bank, a US-based financial services company, launched a lending service utilizing Thought Machine's cloud-native core banking technology. This innovative application eliminates inefficiencies in the equipment finance market, exceeding $1 trillion in the United States. Arvest Bank's adoption of core banking technology reflects a strategic move to enhance its banking experience and introduce efficient financial products.

In the realm of strategic acquisitions, M2P Fintech, an India-based API infrastructure company, acquired BSG ITSOFT in February 2022. BSG ITSOFT, a provider of core banking solutions, serves over 250 cooperative banks and small finance banks. This acquisition aligns with M2P Fintech's vision to deliver next-generation banking solutions and payment stacks, reinforcing its position in the evolving landscape of digital banking services.

Major companies operating in the core banking software market are SAP SE, Capgemini SE, Infosys Limited, Oracle Corporation, Alkami Technology Inc., Avaloq Group AG, Computer Business Solutions Inc., eClerx Services Ltd., Fidelity National Information Services Inc., Finastra International Ltd., FinnOne Neo Customer Acquisition System, Fiserv Inc., HCL Technologies Ltd., Infrasoft Technologies Ltd., Intellect Design Arena Ltd., Jack Henry & Associates Inc., Mambu GmbH, NCR Corporation, Neptune Software Ltd., Newgen Software Technologies Ltd., Path Solutions India Pvt. Ltd., Virtusa Corporation, Profile Systems and Software S.A., Silverlake Axis Ltd., Sopra Banking Software Ltd., T24 Ltd., Tata Consultancy Services, Temenos AG, Virmati Software & Telecommunications Ltd.

North America was the largest region in the core banking software market in 2024. Asia Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the core banking software market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the core banking software market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Core banking software refers to software designed to encompass the essential day-to-day banking features, supporting the routine transactions within the banking industry.

The primary services offered by core banking software can be categorized into professional services and managed services. Professional services are on-demand services related to banking, including offerings such as real estate lending, loans, and business checking, aimed at providing specialized and professional assistance to customers. Various solutions are part of core banking software, covering areas like deposits, loans, enterprise customer solutions, and others. These solutions are deployed through both cloud-based and on-premises models, catering to end-users such as banks, financial institutions, and other entities in the banking sector.

The core banking software market research report is one of a series of new reports that provides core banking software market statistics, including core banking software industry global market size, regional shares, competitors with a core banking software market share, detailed core banking software market segments, market trends and opportunities, and any further data you may need to thrive in the core banking software industry. This core banking software market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The core banking software market includes revenues earned by entities through customer account management services, customer relationship management services, account opening services, and other services. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Core Banking Software Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on core banking software market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for core banking software? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The core banking software market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Service: Professional Service; Managed Service2) by Solution: Deposits; Loans; Enterprise Customer Solutions; Other Solutions

3) by Software Deployment: Cloud; on-Premise

4) by End-Use: Banks; Financial Institutions; Other End Users

Subsegments:

1) by Professional Service: Consulting Services; Implementation Services; Training and Support Services; Customization Services2) by Managed Service: Application Hosting; Infrastructure Management; Security Management; Data Backup and Recovery

Key Companies Mentioned: SAP SE; Capgemini SE; Infosys Limited; Oracle Corporation; Alkami Technology Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Core Banking Software market report include:- SAP SE

- Capgemini SE

- Infosys Limited

- Oracle Corporation

- Alkami Technology Inc.

- Avaloq Group AG

- Computer Business Solutions Inc.

- eClerx Services Ltd.

- Fidelity National Information Services Inc.

- Finastra International Ltd.

- FinnOne Neo Customer Acquisition System

- Fiserv Inc.

- HCL Technologies Ltd.

- Infrasoft Technologies Ltd.

- Intellect Design Arena Ltd.

- Jack Henry & Associates Inc.

- Mambu GmbH

- NCR Corporation

- Neptune Software Ltd.

- Newgen Software Technologies Ltd.

- Path Solutions India Pvt. Ltd.

- Virtusa Corporation

- Profile Systems and Software S.A.

- Silverlake Axis Ltd.

- Sopra Banking Software Ltd.

- T24 Ltd.

- Tata Consultancy Services

- Temenos AG

- Virmati Software & Telecommunications Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 14.43 Billion |

| Forecasted Market Value ( USD | $ 22.94 Billion |

| Compound Annual Growth Rate | 12.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |