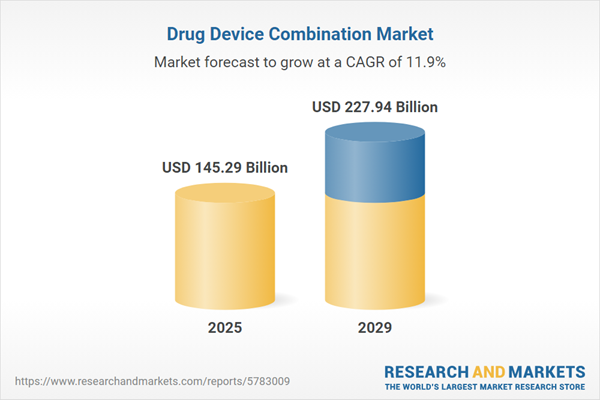

The drug device combination market size is expected to see rapid growth in the next few years. It will grow to $227.94 billion in 2029 at a compound annual growth rate (CAGR) of 11.9%. The growth in the forecast period can be attributed to patient empowerment and engagement, healthcare digitalization, global market expansion, emergence of novel therapies, value-based healthcare. Major trends in the forecast period include therapeutic advancements, complex disease management, patient-centric care, technological innovations, and regulatory support.

The drug-device combination market is witnessing substantial growth driven by the increasing prevalence of chronic diseases. Chronic diseases, persisting for a year or longer and requiring ongoing medical care, include conditions like heart disease and diabetes. Drug-device combinations, encompassing therapeutic and diagnostic products, play a pivotal role in effectively treating individuals with chronic diseases. As per the World Health Organization's report, the global incidence of diabetes surpassed 420 million in 2022, with projections indicating a rise to 578 million by 2030 and 700 million by 2045. This escalating prevalence underscores the critical role of drug-device combinations in managing chronic diseases, thereby propelling the growth of the market.

An increase in casualties due to accidents is anticipated to drive the growth of the drug-device combination market in the future. Accidents refer to unexpected events or unplanned incidents that result in unintended harm, damage, injury, or loss, often arising from a mix of factors such as human error, negligence, environmental conditions, or mechanical failure. Drug-device combinations are essential in managing and preventing accidents by providing targeted medical interventions and improving patient safety. For example, in May 2024, Transport Canada, a government agency in Canada, reported that motor vehicle fatalities reached 1,931 in 2022, representing a 6% increase from the previous year's total of 1,821, and marking the second highest figure recorded in the past decade. Consequently, the rise in casualties resulting from accidents is fueling the drug-device combination market.

Major companies in the drug combination device market are developing innovative products like Trelegy Ellipta to maintain their market position. Trelegy Ellipta is an inhaler designed to deliver a specific dosage of medication directly to the lungs and is recognized as the first single-inhaler triple therapy. For example, in April 2022, GSK, a UK-based pharmaceutical and biotechnology company, introduced Trelegy Ellipta. This inhaler is a compact and portable device used to treat chronic obstructive pulmonary disease (COPD) and asthma. Ellipta inhalers can accommodate up to three different types of drugs in foil packaging for combination therapy. Trelegy Ellipta is a drug combination device that features three active ingredients: fluticasone furoate, umeclidinium, and vilanterol. It enhances patient management of respiratory conditions through its integrated delivery system.

Major companies in the drug-device combination market are introducing innovative products such as the G-Lasta Subcutaneous Injection 3.6 mg BodyPod to simplify the administration process. The G-Lasta Subcutaneous Injection 3.6 mg BodyPod is a drug-device combination that includes an automated injection device and G-Lasta (pegfilgrastim), a medication given to patients undergoing chemotherapy to reduce the occurrence of febrile neutropenia. For instance, in December 2022, Terumo Corporation, a Japan-based medical device company, collaborated with Kyowa Kirin, a Japan-based pharmaceutical company, to launch the G-Lasta Subcutaneous Injection 3.6 mg BodyPod. G-Lasta is utilized during chemotherapy to decrease the incidence of febrile neutropenia. The automated injection device is connected at the hospital on the day of chemotherapy and automatically administers the drug approximately 27 hours later. This feature eliminates the need for an extra outpatient visit, thereby easing the burden on patients.

In May 2023, Closed Loop Medicine Ltd, a UK-based TechBio company focused on developing combination prescription drug and software therapy products, formed a partnership with Pharmanovia. Through this collaboration, Closed Loop Medicine Ltd. aims to advance precision medicine strategies that utilize genetic and molecular profiling to determine the most effective drug combinations for individual patients. Pharmanovia is a pharmaceutical company based in the UK.

Major companies operating in the drug device combination market are The 3M Company, Abbott India Ltd., Biotronik SE & Co. KG, Boston Scientific Corporation, Medtronic PLC, Ypsomed Holding AG, Micron Biomedical Inc., MetP Pharma AG, Sonceboz SA, Lepu Medical Technology (Beijing) Co. Ltd., Eitan Medical Ltd., Vaxess Technologies Inc., Subcuject Aps, Allergan PLC, Terumo Corporation, Stryker Corporation, Becton Dickinson and Company, Zimmer Biomet Holdings Inc., MediPrint Ophthalmics, Arrow International Inc., Alcon Inc., W. L. Gore & Associates Inc., Cook Medical LLC, Pinnacle Biologics Inc.

North America was the largest region in the drug-device combination market share in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the drug device combination market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the drug device combination market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Drug-device combinations refer to therapeutic and diagnostic products that combine a medical device with a drug, facilitating localized drug administration, precise drug targeting, and personalized therapy. These combinations create a unified entity, physically and chemically, packaged together in a single package. Drug-device combinations play a crucial role in clinical development, enabling the delivery of drugs to specific locations in the body.

The primary types of drug-device combination products include auto-injectors, microneedle patches, digital pills, smart inhalers, drug delivery hydrogels, drug-eluting lenses, and other products. These products find applications in various medical fields such as orthopedic diseases, respiratory diseases, diabetes, oncology, cardiovascular diseases, among others. The end users of drug-device combination products include clinics, hospitals, home care settings, ambulatory care centers, and others. These products are distributed through direct tenders, retail sales, and other distribution channels.

The drug-device combination market research report is one of a series of new reports that provides drug-device combination market statistics, including drug-device combination industry global market size, regional shares, competitors with an drug-device combination market share, detailed drug-device combination market segments, market trends and opportunities, and any further data you may need to thrive in the drug-device combination industry. This drug-device combination market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The drug-device combination market consists of sales of catheter and advanced wound care products. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Drug Device Combination Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on drug device combination market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for drug device combination? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The drug device combination market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Product: Auto-Injector; Microneedle Patch; Digital Pill; Smart Inhaler; Drug Delivery Hydrogels; Drug-Eluting Lens; Other Products2) by Distribution Channel: Direct Tender; Retails Sales; Other Distribution Channels

3) by Application: Orthopedic Diseases; Respiratory Diseases; Diabetes; Oncology; Cardiovascular Diseases; Other Applications

4) by End User: Clinics; Hospitals; Home Care Settings; Ambulatory Care Centers; Other End Users

Subsegments:

1) by Auto-Injector: Pre-Filled Auto-Injectors; Reusable Auto-Injectors2) by Microneedle Patch: Dissolving Microneedle Patches; Coated Microneedle Patches

3) by Digital Pill: Ingestible Sensors; Smart Capsules

4) by Smart Inhaler: Metered-Dose Inhalers (MDIs); Dry Powder Inhalers (DPIs)

5) by Drug Delivery Hydrogels: Injectable Hydrogels; Topical Hydrogels

6) by Drug-Eluting Lens: Contact Lenses; Intraocular Lenses

7) by Other Products: Transdermal Patches; Implantable Drug Delivery Systems

Key Companies Mentioned: the 3M Company; Abbott India Ltd.; Biotronik SE & Co. KG; Boston Scientific Corporation; Medtronic PLC

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Drug Device Combination market report include:- The 3M Company

- Abbott India Ltd.

- Biotronik SE & Co. KG

- Boston Scientific Corporation

- Medtronic PLC

- Ypsomed Holding AG

- Micron Biomedical Inc.

- MetP Pharma AG

- Sonceboz SA

- Lepu Medical Technology (Beijing) Co. Ltd.

- Eitan Medical Ltd.

- Vaxess Technologies Inc.

- Subcuject Aps

- Allergan PLC

- Terumo Corporation

- Stryker Corporation

- Becton Dickinson and Company

- Zimmer Biomet Holdings Inc.

- MediPrint Ophthalmics

- Arrow International Inc.

- Alcon Inc.

- W. L. Gore & Associates Inc.

- Cook Medical LLC

- Pinnacle Biologics Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 145.29 Billion |

| Forecasted Market Value ( USD | $ 227.94 Billion |

| Compound Annual Growth Rate | 11.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |