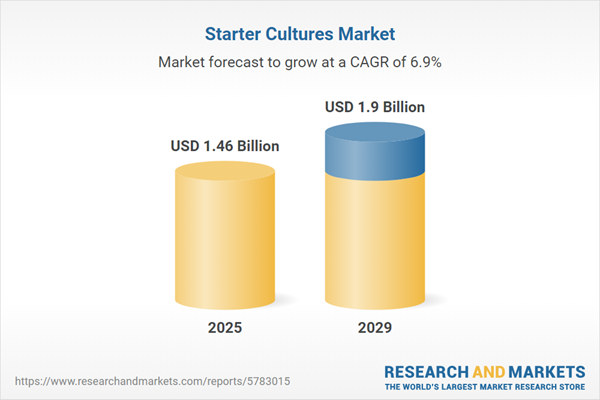

The starter cultures market size is expected to see strong growth in the next few years. It will grow to $1.9 billion in 2029 at a compound annual growth rate (CAGR) of 6.9%. The growth in the forecast period can be attributed to market expansion in emerging economies, increasing demand for probiotics, expanding fermented foods market, health and wellness trends, clean label and natural ingredients preference. Major trends in the forecast period include research and development initiatives, regulatory support and safety standards, globalization and cultural exchange, culinary experimentation and innovation, technological advancements.

The rising demand for dairy products is fueling the growth of the starter cultures market. Dairy products encompass any food items derived from milk and are linked to increasing consumer preferences for protein-rich foods and a growing awareness of their nutritional benefits. Starter cultures are essential for producing fermented dairy items like cheese, yogurt, and other dairy products, thereby driving the demand for dairy. For example, in April 2023, the USDA, a U.S.-based government agency, reported that cheese production (excluding cottage cheese) reached 14.1 billion pounds in 2022, a 2.2 percent increase from 2021. Consequently, the increased demand for dairy products is expected to propel the growth of the starter cultures market.

Growing consumer interest in probiotics and fermented products is significantly enhancing the growth of the starter culture market. Probiotics refer to living microorganisms that are consumed or applied to provide health benefits. This trend is attributed to heightened consumer awareness of the advantages of gut health, leading to greater interest in natural and functional foods that support digestion and immunity. Starter cultures are vital in producing probiotics, aiding in the development of fermented foods and beverages that offer a range of health benefits. For instance, the Good Food Institute Europe, a Belgium-based non-profit organization, reported that the number of companies focused on fermentation for alternative proteins rose to 136, marking a 12% increase compared to the total known companies in 2021. Thus, the growing consumer interest in probiotics and fermented products is set to drive the starter cultures market forward.

Leading companies in the starter culture market are concentrating on developing innovative cultures, including a new generation of starter cultures aimed at enhancing fermentation, improving flavors, and increasing the nutritional value of food products. These new generations of starter cultures consist of advanced microbial formulations engineered to optimize fermentation processes, enhance flavor development, and boost the health benefits of food items. For instance, in September 2023, dsm-firmenich, a Switzerland-based chemical manufacturing firm, launched Delvo Fresh Pioneer starter cultures. These innovative ingredients are specifically designed for producing mild yogurts, offering exceptional pH stability and consistency throughout their shelf life. They enable manufacturers to create creamy, delicious yogurts while minimizing post-acidification and maintaining optimal quality under various storage conditions.

Key players in the starter culture market are dedicated to developing shelf-stable starter cultures to enhance their offerings and advance further biochemical research. Shelf-stable cultures ensure that probiotics derived from them have a longer shelf life and improved pH profiles. For example, in September 2023, SIG, a Switzerland-based packaging company, partnered with AnaBio Technologies, an Ireland-based microencapsulation firm, to introduce long-life probiotic yogurt. This groundbreaking invention creates a new product category of probiotic beverages packaged in aseptic carton packs and spouted pouches, which remain shelf-stable for extended periods without refrigeration.

In March 2024, Roquette, a French food company, acquired IFF Pharma Solutions for an undisclosed amount. This acquisition aims to significantly strengthen Roquette's position in the pharmaceutical industry, particularly in the excipients market for oral dosage forms. IFF Pharma Solutions is a US-based pharmaceutical company specializing in sustainable cellulosics, seaweed extracts, ultrapure biopolymers, and specialized synthetic polymers.

Major companies operating in the starter cultures market are Chr. Hansen Holding A/S, Lallemand Inc., Koninklijke DSM N.V., Sacco System S.r.l., LB Bulgaricum AD, International Flavors & Fragrances Inc., Biochem Srl, Wyeast Laboratories Inc., Mad Millie Pty Ltd, Futura Ingredients AB, Angel Yeast Co. Ltd., Benebios Inc., Benny Impex, Mediterranea Biotecnologie Srl, Bioprox Healthcare SAS, Codex-ing Biotech Ingredients Inc., CSK Food Enrichment B.V., Danisco A/S, Lesaffre et Compagnie, DSM Food Specialties B.V., Abiasa Corporativo S.A. de C.V.

Europe was the largest region in the starter cultures market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the starter cultures market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the starter cultures market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

A starter culture refers to a preparation of living microorganisms, which may consist of a single type or a combination of two or more microorganisms. This culture imparts specific sensory and nutritional characteristics to foods, offers potential health benefits, and ensures safety when incorporated into fermented products. It aids in initiating fermentation and facilitates the desired and predictable changes in the production of various food items.

The primary microorganisms used in starter cultures include bacteria, yeast, and molds. Bacteria, such as Streptococcus cremoris and Leuconostoc citrovorum, are examples used in the fermentation of various dairy products in both industrial and domestic settings. Starter cultures can come in different compositions such as multi-strain mixtures, single strains, or blends of multiple strains. They are available in forms like freeze-dried or frozen and find applications in dairy products, meat and seafood, alcoholic beverages, and other food categories.

The starter cultures market research report is one of a series of new reports that provides starter cultures market statistics, including starter cultures industry global market size, regional shares, competitors with a starter cultures market share, detailed starter cultures market segments, market trends and opportunities, and any further data you may need to thrive in the starter cultures industry. This starter cultures market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The starter culture market includes revenues earned by entities by producing acid during manufacture and contributing to the ripening process. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Starter Cultures Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on starter cultures market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for starter cultures ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The starter cultures market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- the market characteristics section of the report defines and explains the market.

- the market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- the forecasts are made after considering the major factors currently impacting the market. These include:

- the forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- the regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- the competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- the trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Microorganism: Bacteria; Yeast; Molds2) by Composition: Multi-Strain Mix; Single Strain; Multi-Strain

3) by Form: Freeze-Dried; Frozen

4) by Application: Dairy and Dairy Products; Meat and Seafood; Alcoholic Beverages; Other Applications

Subsegments:

1) by Bacteria: Lactic Acid Bacteria (LAB); Non-Lactic Acid Bacteria2) by Yeast: Baker's Yeast; Brewer's Yeast; Other Yeasts

3) by Molds: Filamentous Fungi; Other Molds

Key Companies Mentioned: Chr. Hansen Holding a/S; Lallemand Inc.; Koninklijke DSM N.V.; Sacco System S.r.l.; LB Bulgaricum AD

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Starter Cultures market report include:- Chr. Hansen Holding A/S

- Lallemand Inc.

- Koninklijke DSM N.V.

- Sacco System S.r.l.

- LB Bulgaricum AD

- International Flavors & Fragrances Inc.

- Biochem Srl

- Wyeast Laboratories Inc.

- Mad Millie Pty Ltd

- Futura Ingredients AB

- Angel Yeast Co. Ltd.

- Benebios Inc.

- Benny Impex

- Mediterranea Biotecnologie Srl

- Bioprox Healthcare SAS

- Codex-ing Biotech Ingredients Inc.

- CSK Food Enrichment B.V.

- Danisco A/S

- Lesaffre et Compagnie

- DSM Food Specialties B.V.

- Abiasa Corporativo S.A. de C.V.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 1.46 Billion |

| Forecasted Market Value ( USD | $ 1.9 Billion |

| Compound Annual Growth Rate | 6.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 22 |