Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Rapid Urbanization and Expansion of Commercial Infrastructure

India’s rapid urbanization has significantly accelerated the growth of the packaged air conditioners market. In 2024, India's urban population stands at 461 million, growing at 2.3% annually, with cities expected to contribute 75% of the nation's income by 2031. Tier-1 and tier-2 cities are witnessing a surge in commercial construction, including office complexes, IT parks, shopping malls, hospitals, educational institutions, and hotels.These large-scale establishments require centralized cooling solutions, making PACs a preferred choice over multiple split or window units due to their efficiency in handling large spaces. Additionally, the rise of organized retail, co-working spaces, and entertainment complexes further contributes to PAC demand. Urban migration has also increased residential-commercial mixed-use developments, where packaged air conditioners offer optimized cooling solutions, reducing installation complexity and operational costs. The increasing adoption of PACs in these urban hubs is strongly correlated with rising disposable incomes, enhanced lifestyle standards, and a growing focus on comfort and convenience.

Key Market Challenges

High Initial Investment and Cost Constraints

One of the primary challenges limiting the adoption of packaged air conditioners in India is their relatively high initial cost compared to conventional split or window AC units. PAC systems, which include centralized components, ducts, and installation infrastructure, require significant capital investment upfront. Small and medium enterprises (SMEs), retail outlets, and budget-conscious businesses often find it difficult to justify these expenditures, even when operational efficiency and long-term energy savings are considered. Additionally, imported PAC units attract higher costs due to taxes, tariffs, and shipping expenses, further discouraging widespread adoption. While energy-efficient models offer long-term cost benefits, the upfront investment remains a significant barrier, particularly in tier-2 and tier-3 cities where budget constraints are more pronounced. This cost sensitivity slows market penetration and limits growth among price-sensitive customer segments.Key Market Trends

Growing Adoption of Smart and IoT-Enabled PAC Systems

The Indian PAC market is witnessing a clear trend toward smart, IoT-enabled systems that allow remote monitoring, control, and automation. Modern PAC units are increasingly equipped with Wi-Fi connectivity, mobile app integration, and real-time performance monitoring, enabling facility managers to adjust cooling settings, schedule operations, and track energy consumption remotely. These intelligent systems also support predictive maintenance, alerting users about potential faults before they escalate into major issues, thereby reducing downtime and repair costs. With businesses and commercial spaces emphasizing operational efficiency and sustainability, smart PAC solutions are becoming increasingly attractive. This trend is particularly evident in urban centers and large enterprises, where the integration of digital technologies aligns with the broader push toward smart building management systems.Key Market Players

- Blue Star Limited

- Daikin Airconditioning India Private Limited

- Voltas Limited

- Carrier Airconditioning & Refrigeration Limited

- Trane Technologies India Private Limited

- Lennox India Technology Centre

- Toshiba India Private Limited

- Singhsons Refrigeration Private Limited

- Eakcon Systems Pvt. Ltd.

- LG Electronics India Pvt. Ltd.

Report Scope:

In this report, the India Packaged Air Conditioners Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Packaged Air Conditioners Market, By Type:

- Air Cooled

- Water Cooled

India Packaged Air Conditioners Market, By End User:

- Residential

- Commercial

India Packaged Air Conditioners Market, By Distribution Channel:

- Online

- Offline

India Packaged Air Conditioners Market, By Region:

- North

- South

- East

- West

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Packaged Air Conditioners Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Blue Star Limited

- Daikin Airconditioning India Private Limited

- Voltas Limited

- Carrier Airconditioning & Refrigeration Limited

- Trane Technologies India Private Limited

- Lennox India Technology Centre

- Toshiba India Private Limited

- Singhsons Refrigeration Private Limited

- Eakcon Systems Pvt. Ltd.

- LG Electronics India Pvt. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 70 |

| Published | September 2025 |

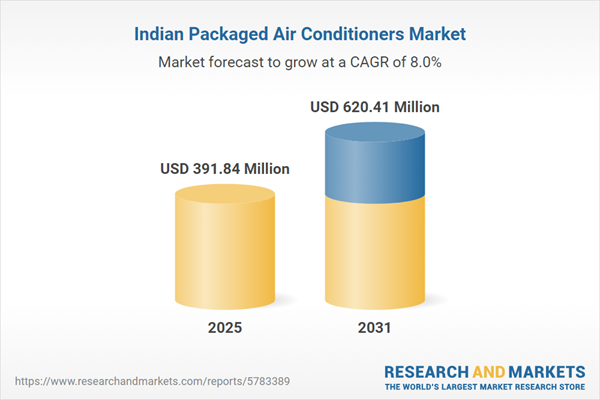

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 391.84 Million |

| Forecasted Market Value ( USD | $ 620.41 Million |

| Compound Annual Growth Rate | 7.9% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |