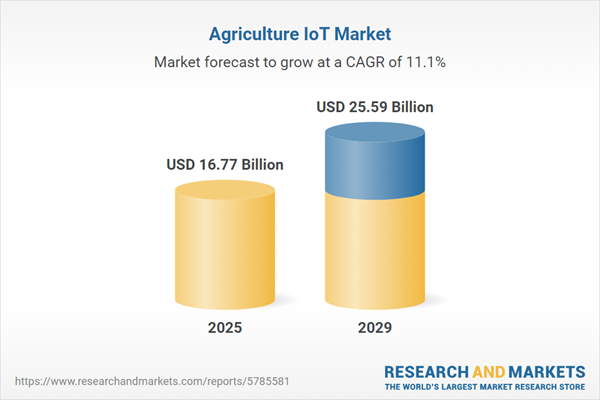

The agriculture iot market size is expected to see rapid growth in the next few years. It will grow to $25.59 billion in 2029 at a compound annual growth rate (CAGR) of 11.1%. The growth in the forecast period can be attributed to global expansion of precision agriculture, government regulations and standards, drones and UAVs integration, climate change mitigation, increasing adoption in developing regions, predictive analytics for disease management, customization for crop types, focus on sustainable agriculture. Major trends in the forecast period include sensor technology advancements, integration of ai and machine learning, farm management software, autonomous machinery and robotics, edge computing in agriculture, subscription-based IoT services, blockchain for transparency.

The surge in food demand is a primary catalyst propelling the expansion of the agriculture IoT sector. As the global population grows, the need for sustenance escalates, necessitating innovative approaches to bridge the supply-demand gap. IoT solutions have emerged as vital tools in aiding farmers to ensure abundant yields, financial viability, and environmental conservation. Forecasts by The Food and Agricultural Organization project a staggering 70% surge in global food production by 2050 to accommodate the anticipated population growth, expected to reach 9.6 billion. This surge in food demand significantly drives the growth trajectory of the agriculture IoT market.

The increasing crop production is anticipated to drive the growth of the agriculture IoT market in the future. Crop production involves the processes of growing, cultivating, and harvesting crops for various purposes, primarily for human consumption or animal feed. Agriculture IoT plays a vital role in crop production by enhancing efficiency, optimizing resource utilization, boosting productivity, and promoting sustainable and environmentally friendly farming practices. For example, in October 2023, the Press Information Bureau, an India-based nodal agency, reported that total food grain production in India was estimated at 3,296.87 Lakh tonnes for the 2022-23 period, reflecting an increase of 140.71 Lakh tonnes from the previous year (3,156.16 Lakh tonnes) and surpassing the five-year average. Consequently, the growth in crop production is fueling the expansion of the agriculture IoT market.

Major companies in the agriculture IoT market are concentrating on creating innovative products, such as IoT-based aftermarket devices, to improve crop monitoring and optimize resource management. These IoT-based aftermarket devices enhance existing agricultural equipment by facilitating real-time data collection and analysis, allowing farmers to monitor performance and optimize operations without needing to replace entire systems. For example, in 2023, Mahindra & Mahindra's agritech division, Krish-e, launched the Krish-e-Smart Kit for farm equipment. This kit offers several benefits for farmers and equipment owners, enhancing monitoring by providing real-time insights into tractor performance and usage, which leads to more efficient management and reduced downtime.

Leading entities within the agriculture IoT market are actively pursuing strategic partnerships as a core approach to harness the collective strengths of diverse companies, aiming to develop integrated solutions tailored to meet the evolving needs of the agriculture sector. These strategic collaborations involve a synergistic utilization of each other's resources and expertise to yield mutual advantages and foster joint success. A noteworthy instance of such collaboration occurred in July 2023 when CultYvate, an India-based agricultural service company, joined forces with Dhiway Networks Private Limited, a blockchain technology firm. This strategic alliance endeavors to revolutionize the agricultural sector's digital landscape by integrating Dhiway's sophisticated CORD blockchain technology with IoT data from CultYvate. This collaboration seeks to establish a robust foundation characterized by enhanced data security, transparency, and trust, thereby addressing critical challenges prevalent in the agricultural industry.

In September 2022, Telit Cinterion, a UK-based provider of Internet of Things (IoT) solutions and services, acquired Global IoT Module for an undisclosed amount. This acquisition aims to enhance Telit Cinterion's portfolio of IoT solutions by leveraging strengths in both hardware and software. Global IoT Module is a China-based technology company operating within the IoT sector.

Major companies operating in the agriculture iot market are Deere & Company, The Tetra Laval Group, Topcon Positioning Systems Inc., Trimble Inc., Raven Industries Inc., AgJunction Inc., Farmers Edge Inc., Field Group AS, AgEagle Aerial Systems, Komatsu Forest AB, InnovaSea Systems Inc., Steinsvik AS, Ponsse PLC, The Climate Corporation, OnFarm Systems Inc., SlantRange Inc., TELUS Agriculture Solutions Inc., Ag Leader Technology, Autonomous Solutions Inc., BouMatic Robotic B.V., Helium Systems Inc., Benchmark Labs Inc., Jala Corporation, Myriota Pty Ltd, Ketos Inc., FarmInsect Ltd., Orbital Insight Inc., M5Stack Technology Co. Ltd., KisanHub Ltd., Amber Agriculture Inc., Arable Labs Inc., Sencrop SAS.

North America was the largest region in the agriculture IoT market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the agriculture iot market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the agriculture iot market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Agriculture IoT (Internet of Things) involves the deployment of sensors, cameras, and various devices to transform every aspect and activity related to farming into actionable data. It plays a pivotal role in generating extensive datasets encompassing variables such as weather conditions, moisture levels, plant health, mineral status, chemical applications, insect presence, and more. These datasets empower big data engineers to extract insights about the farm at different levels of granularity through the utilization of software algorithms. Agriculture IoT enables farmers to leverage this data for informed decision-making regarding planting, irrigation, harvesting, and other agricultural practices.

The key components of agriculture IoT include hardware, software, and connectivity and services. Hardware in agriculture IoT refers to IoT-enabled tools that empower farmers to optimize labor and enhance productivity. This hardware comprises sensors for monitoring soil conditions, disease and pest indicators, hydration levels, light conditions, humidity and temperature controls, and other relevant factors. The hardware encompasses precision farming hardware, precision livestock hardware, precision aquaculture hardware, precision forestry hardware, smart greenhouse hardware, and other tools suitable for deployment in large, mid-sized, and small farms.

The agriculture IoT market research report is one of a series of new reports that provides agriculture IoT market statistics, including agriculture IoT industry global market size, regional shares, competitors with a agriculture IoT market share, detailed agriculture IoT market segments, market trends and opportunities, and any further data you may need to thrive in the agriculture IoT industry. This agriculture IoT market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The agriculture IoT market includes revenues earned by entities by greenhouse automation, crop management, cattle monitoring, and monitoring climate conditions. The market value includes the value of related goods sold by the service provider or included within the service offering. The agriculture IoT market also includes sales of weeding robots, machine navigation, harvesting robotics, material handling machines, and agriculture drones. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Agriculture IoT Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on agriculture iot market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for agriculture iot? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The agriculture iot market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Component type: Hardware; Software; Connectivity and Services2) by Farm Type: Large; Mid-Sized; Small Farms

Subsegments:

1) by Hardware: Sensors; Actuators; Drones; RFID Tags2) by Software: Data Analytics Platforms; Farm Management Software; Monitoring and Control Software

3) by Connectivity: Wireless Technologies; Cellular Networks; Satellite Communication

4) by Services: Consulting Services; Installation and Integration Services; Maintenance and Support Services

Key Companies Mentioned: Deere & Company; the Tetra Laval Group; Topcon Positioning Systems Inc.; Trimble Inc.; Raven Industries Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Agriculture IoT market report include:- Deere & Company

- The Tetra Laval Group

- Topcon Positioning Systems Inc.

- Trimble Inc.

- Raven Industries Inc.

- AgJunction Inc.

- Farmers Edge Inc.

- Field Group AS

- AgEagle Aerial Systems

- Komatsu Forest AB

- InnovaSea Systems Inc.

- Steinsvik AS

- Ponsse PLC

- The Climate Corporation

- OnFarm Systems Inc.

- SlantRange Inc.

- TELUS Agriculture Solutions Inc.

- Ag Leader Technology

- Autonomous Solutions Inc.

- BouMatic Robotic B.V.

- Helium Systems Inc.

- Benchmark Labs Inc.

- Jala Corporation

- Myriota Pty Ltd

- Ketos Inc.

- FarmInsect Ltd.

- Orbital Insight Inc.

- M5Stack Technology Co. Ltd.

- KisanHub Ltd.

- Amber Agriculture Inc.

- Arable Labs Inc.

- Sencrop SAS

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 16.77 Billion |

| Forecasted Market Value ( USD | $ 25.59 Billion |

| Compound Annual Growth Rate | 11.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 33 |