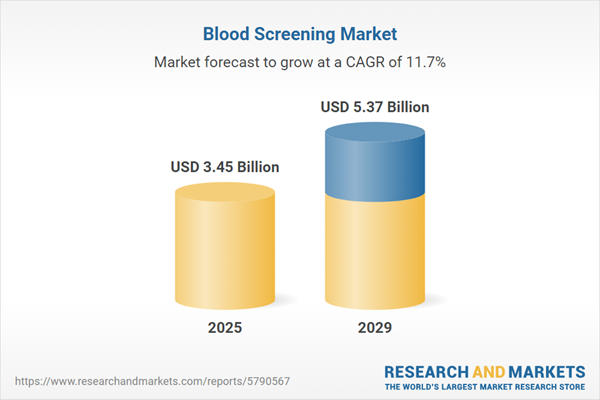

The blood screening market size is expected to see rapid growth in the next few years. It will grow to $5.37 billion in 2029 at a compound annual growth rate (CAGR) of 11.7%. The growth in the forecast period can be attributed to healthcare infrastructure development, public health awareness programs, advancements in infectious disease diagnostics, global health concerns and pandemic preparedness. Major trends in the forecast period include rise in infectious diseases, automation and efficiency, rising blood transfusion demands, focus on transfusion safety, research in pathogen detection.

The rising prevalence of infectious diseases is anticipated to drive the growth of the blood screening market in the future. Blood tests are routinely conducted to detect specific antibodies produced in response to infectious agents, assisting healthcare professionals in treating these diseases and preventing further transmission among patients. For example, in June 2022, the National Center for Biotechnology Information, a U.S.-based government agency, reported that the prevalence of infectious diseases in outpatient care has nearly tripled over the past two decades, increasing from 8 to 26 per 1,000. Therefore, the growing incidence of infectious diseases is fueling the expansion of the blood screening market.

In the blood screening market, the increasing prevalence of chronic diseases is a significant driver of growth. Chronic diseases, manageable but not curable long-term conditions, necessitate precise blood compatibility matching for transfusions during medical treatments. The importance of blood transfusions is evident in managing various chronic conditions, including autoimmune diseases, hematological disorders, and cancers. Notably, projections from January 2023 by the National Library of Medicine indicate a substantial increase in the number of individuals aged 50 and older with at least one chronic condition, expected to reach 142.66 million by 2050. The rising prevalence of chronic diseases and the demand for compatible blood screening contribute significantly to the expanding blood screening market.

Leading companies in the blood screening market are advancing technologies such as liquid biopsy to improve early cancer detection, enhance treatment monitoring, and support personalized medicine strategies. A liquid biopsy is a minimally invasive procedure that examines blood or other bodily fluids to identify cancer cells or genetic material from tumors. For example, in November 2023, Guardant Health, Inc., a biotechnology firm based in the U.S., introduced its Shield blood-based screening tests. This test analyzes cell-free DNA (cfDNA) in the bloodstream, helping to identify the presence of colorectal tumors or precancerous lesions by detecting specific alterations in DNA fragments released into the blood by cancer cells.

Leading companies in the blood screening market are innovating technologies such as Vacutainers to improve the efficiency, accuracy, and safety of blood collection and testing procedures. A Vacutainer is a vacuum-sealed tube designed for collecting and preserving blood samples for laboratory analysis. For example, in April 2024, Becton Dickinson, a U.S.-based medical device manufacturer, introduced the UltraTouch feature. This advancement enables the use of a thinner needle, which is essential for reducing pain during insertion. The thinner needle aims to enhance patient comfort during blood collection procedures.

In October 2022, Pfizer Inc., a U.S.-based pharmaceutical and biotechnology company, acquired Global Blood Therapeutics, Inc. for an undisclosed sum. This acquisition is intended to enhance Pfizer's portfolio, expand its research and development capabilities, and strengthen its position in the market. Global Blood Therapeutics, Inc. is a U.S.-based biotechnology firm that focuses on providing innovative therapies for sickle cell disease and other rare blood disorders.

Major companies operating in the blood screening market include Abbott Laboratories, Grifols S.A., Becton Dickinson and Company, F. Hoffmann-La Roche AG, bioMérieux S.A., Bio-Rad Laboratories Inc., Thermo Fisher Scientific Inc., Ortho Clinical Diagnostics Inc., Beckman Coulter Inc., Siemens Healthineers AG, GE Healthcare, DiaSorin S.p.A., Merck KGaA, PerkinElmer Inc., Bio-Techne Corporation, Roche Diagnostics GmbH, Danaher Corporation, Sysmex Corporation, Natera Inc., GenMark Diagnostics Inc., QIAGEN N.V., Hologic Inc., Luminex Corporation, Trinity Biotech plc, Fujirebio Inc., OraSure Technologies Inc., Immunetics Inc., Accelerate Diagnostics Inc., Cepheid Inc., T2 Biosystems Inc., Haemonetics Corporation, HTG Molecular Diagnostics Inc., Verax Biomedical Inc.

North America was the largest region in the blood screening market in 2024. The regions covered in the blood screening market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the blood screening market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Blood screening involves the examination of blood, plasma, or blood components intended for transfusion or incorporation into blood-based products. This process aims to detect antibodies, tumor markers, disease-causing agents, or indicators of illnesses, and to assess the effectiveness of treatments.

The primary products used in blood screening include reagents and kits, instruments, software, and associated services. Reagents are compounds or substances enabling reactions crucial for detecting, measuring, or preparing components due to their biological or chemical activity. Kits, on the other hand, are test kits used in laboratory settings or in the field to identify specific compounds in a sample. Technologies utilized in blood screening encompass nucleic acid testing, enzyme-linked immunosorbent assay (ELISA), rapid tests, western blot assays, and next-generation sequencing (NGS). These screening methods find application in various healthcare settings such as blood banks, diagnostic centers, pathology labs, hospitals, clinics, and ambulatory surgical centers (ASCs).

The blood screening market research report is one of a series of new reports that provides blood screening market statistics, including blood screening industry global market size, regional shares, competitors with a blood screening market share, detailed blood screening market segments, market trends and opportunities, and any further data you may need to thrive in the blood screening industry. This blood screening market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The blood screening market consists of revenues earned by entities by providing transcription mediated amplification (TMA) and real-time PCR. The market value includes the value of related goods sold by the service provider or included within the service offering. The blood screening market also includes sales of analyzer, photo colorimeter, flame photometer, hemoglobin meter, blood roller mixer, dry bath incubators, and differential blood counter. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Blood Screening Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on blood screening market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for blood screening ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The blood screening market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- the market characteristics section of the report defines and explains the market.

- the market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- the forecasts are made after considering the major factors currently impacting the market. These include:

- the forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- the regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- the competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- the trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Product: Reagents and Kits; Instruments; Software and Services2) by Technology: Nucleic Acid Testing; Enzyme-Linked Immunosorbent Assay (ELISA); Rapid Tests; Western Blot Assays; Next-Generation Sequencing (NGS)

3) by End User: Blood Banks; Diagnostic Centers and Pathology Labs; Hospitals; Clinics; Ambulatory Surgical Centers (ASCs)

Subsegments:

1) by Reagents and Kits: Diagnostic Reagents; Testing Kits2) by Instruments: Automated Analyzers; Manual Testing Equipment

3) by Software and Services: Laboratory Information Management Systems (LIMS); Data Analysis Software; Support and Consulting Services

Key Companies Mentioned: Abbott Laboratories; Grifols S.A.; Becton Dickinson and Company; F. Hoffmann-La Roche AG; bioMérieux S.A.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Blood Screening market report include:- Abbott Laboratories

- Grifols S.A.

- Becton Dickinson and Company

- F. Hoffmann-La Roche AG

- bioMérieux S.A.

- Bio-Rad Laboratories Inc.

- Thermo Fisher Scientific Inc.

- Ortho Clinical Diagnostics Inc.

- Beckman Coulter Inc.

- Siemens Healthineers AG

- GE Healthcare

- DiaSorin S.p.A.

- Merck KGaA

- PerkinElmer Inc.

- Bio-Techne Corporation

- Roche Diagnostics GmbH

- Danaher Corporation

- Sysmex Corporation

- Natera Inc.

- GenMark Diagnostics Inc.

- QIAGEN N.V.

- Hologic Inc.

- Luminex Corporation

- Trinity Biotech plc

- Fujirebio Inc.

- OraSure Technologies Inc.

- Immunetics Inc.

- Accelerate Diagnostics Inc.

- Cepheid Inc.

- T2 Biosystems Inc.

- Haemonetics Corporation

- HTG Molecular Diagnostics Inc.

- Verax Biomedical Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 3.45 Billion |

| Forecasted Market Value ( USD | $ 5.37 Billion |

| Compound Annual Growth Rate | 11.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 34 |