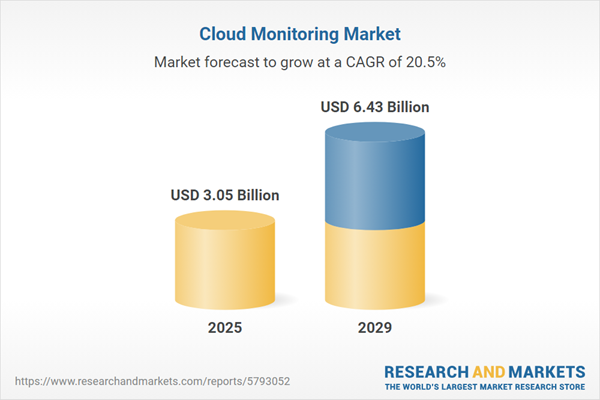

The cloud monitoring market size is expected to see exponential growth in the next few years. It will grow to $6.43 billion in 2029 at a compound annual growth rate (CAGR) of 20.5%. The growth in the forecast period can be attributed to multi-cloud deployments, compliance requirements, edge computing integration, AI and machine learning integration, hybrid IT environments. Major trends in the forecast period include focus on cloud security monitoring, end-to-end visibility across cloud services, automation of incident response, cost management and optimization tools, compliance monitoring and reporting.

The exponential growth in enterprise adoption of cloud technologies stands as a significant driver propelling the expansion of the cloud monitoring market. Enterprises are leveraging cloud adoption as a means to optimize costs, mitigate risks, and enhance the scalability of their Internet-based database capabilities. Cloud monitoring plays a pivotal role in averting potential breaches by facilitating real-time scans and continuous monitoring, thus becoming a necessity for organizations utilizing cloud technologies. This increasing reliance on cloud-based solutions is fueling the demand for robust cloud monitoring services. For instance, data from Zippia Inc., a US-based career expert, revealed that as of December 2022, a staggering 94% of businesses have integrated cloud services into their operations. Additionally, a substantial 92% of enterprises either have a multi-cloud strategy in place or are actively developing one. Moreover, the market for cloud services surged to $206.1 billion in 2022. This surge in cloud adoption among enterprises, coupled with the widespread implementation of multi-cloud strategies, serves as a driving force behind the growth trajectory of the cloud monitoring market.

The burgeoning trend of remote work is anticipated to significantly propel the growth of the cloud monitoring market in the foreseeable future. Remote work, also known as telecommuting or telework, involves conducting professional responsibilities from locations outside the traditional office setting. Monitoring cloud resources plays a crucial role for organizations, allowing them to optimize resource usage effectively. This optimization ensures that remote employees have seamless access to essential computing power, storage, and applications without over-provisioning or unnecessary expenses. For instance, a report published by the United States Census Bureau in September 2022 revealed that approximately 48.3% of the workforce in the District of Columbia engaged in remote work in 2021, marking the highest percentage of individuals working from home among states and state equivalents. Additionally, substantial proportions of remote workers were noted in states such as Washington (24.2%), Maryland (24%), Colorado (23.7%), and Massachusetts (23.7%). Consequently, the surge in remote work practices is a key driving force behind the expansion of the cloud monitoring market.

Collaborative alliances are emerging as a significant trend within the cloud monitoring sector. Key players in this market are actively pursuing partnerships to bolster their standing and capabilities. An illustrative example occurred in May 2022, when the International Business Machines Corporation (IBM), a prominent US-based technology corporation, forged a partnership with Amazon Web Services (AWS), a leading US-based cloud computing platform. Through this strategic collaboration, IBM intends to offer an extensive array of its software catalog in a Software-as-a-Service (SaaS) format via the Amazon Web Services platform. This alliance aims to leverage the strengths of both entities to enhance service offerings and broaden market accessibility for IBM's software solutions.

Prominent companies operating in the cloud monitoring market are developing innovative products, such as cloud operation solutions, to meet larger customer bases, increase sales, and increase revenue. Cloud operations (CloudOps) is an operations-oriented framework that encompasses the integration of an organization's unique set of technologies, people, and processes set up to manage the delivery, performance, and optimization of the IT workloads they run in the cloud. For instance, in April 2023, Amazon Web Services, a US-based provider of cloud computing platforms, launched the AWS Cloud Operations Competency. The distinctive feature of the AWS Cloud Operations Competency lies in its comprehensive coverage of five fundamental solution areas: cloud governance, cloud financial management, monitoring and observability, compliance and auditing, and operations management. This competency empowers customers to choose validated AWS partners offering integrated solutions across these critical domains. AWS Cloud Operations Competency Partners demonstrate expertise in supporting customers across essential technical capabilities, facilitating secure, efficient, and well-operated cloud environments. The competency encompasses rigorous training and testing in five key areas, including financial management for optimized cost, tooling and resource organization for effective cost tracking, and cloud governance to assist clients in planning, building, and managing secure, scalable, and cost-efficient hybrid cloud environments.

In February 2022, the International Business Machines Corporation (IBM), a technology giant based in the US, completed the acquisition of Sentaca Consulting Canada Ltd., an undisclosed financial transaction. This strategic acquisition was aimed at enhancing IBM's capabilities to support communications service providers (CSPs) and major players in the media industry. It intended to aid these entities in upgrading multiple cloud platforms, fostering innovation, transforming their organizations, and accelerating IBM's hybrid cloud consulting business. Sentaca Consulting Canada Ltd., headquartered in Canada, specializes in software consulting and professional services, focusing on automation and cloud-native solutions tailored specifically for telecommunications and future networks. This acquisition sought to integrate Sentaca's expertise and offerings into IBM's portfolio, augmenting their ability to cater to the evolving needs of the telecommunications and media sectors.

Major companies operating in the cloud monitoring market include Amazon.com Inc., Alphabet Inc., Microsoft Corporation, New Relic Inc., IBM Corporation, Oracle Corporation, Broadcom Inc., Splunk Inc., BMC Software Inc., Datadog Inc., Kaseya Limited, Dynatrace Inc., SolarWinds Worldwide LLC, PagerDuty Inc., Sumo Logic Inc., Grafana Labs Inc., Elastic N.V., LogicMonitor Inc., AppDynamics Inc., IDERA Inc., xMatters Inc., InfluxDB Inc., SevOne Inc., VictorOps Inc., Site24x7 Inc., Zenoss Inc., Opsgenie Inc., Stackify Inc., Sematext Group Inc.

North America was the largest region in the cloud monitoring market in 2024. Asia-Pacific is expected to be the fastest-growing region in the global cloud monitoring market report during the forecast period. The regions covered in the cloud monitoring market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the cloud monitoring market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Cloud monitoring involves reviewing and managing cloud-based IT infrastructure workflows to ensure optimal performance and availability of websites, servers, applications, and other cloud components through manual or automated procedures.

Cloud monitoring comprises two primary elements such as solutions and services. Cloud solutions encompass IT resources accessed via the Internet through cloud computing or services. These solutions come in different models such as Infrastructure as a Service (IaaS), Software as a Service (SaaS), and Platform as a Service (PaaS). They cater to organizations of varying sizes, from small and medium-sized enterprises (SMEs) to large corporations. Industries leveraging these monitoring capabilities span across sectors such as banking, financial services, insurance, healthcare, life sciences, telecommunications, IT, government, defense, manufacturing, retail, consumer goods, media, entertainment, and more.

The cloud monitoring market research report is one of a series of new reports that provides cloud monitoring market statistics, including cloud monitoring industry global market size, regional shares, competitors with a cloud monitoring market share, detailed cloud monitoring market segments, market trends and opportunities and any further data you may need to thrive in the cloud monitoring industry. This cloud monitoring market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The cloud monitoring market includes revenues earned by entities by providing services such as Logging as a service (LaaS). The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Cloud Monitoring Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on cloud monitoring market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for cloud monitoring? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The cloud monitoring market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Component: Solution; Services2) By Model: Infrastructure As a Service(IaaS); Software As a Service(SaaS); Platform As a Service(PaaS)

3) By Organization Size: Small and Medium Sized Enterprises (SMEs); Large Enterprises

4) By Industry: Banking, Financial Services and Insurance; Healthcare and Life Sciences; Telecommunications and IT; Government and Defense; Manufacturing; Retail and Consumer Goods; Media and Entertainment; Other Industries

Subsegments:

1) By Solution: Performance Monitoring Solutions; Security Monitoring Solutions; Log Management Solutions2) By Services: Managed Monitoring Services; Consulting Services; Support and Maintenance Services

Key Companies Mentioned: Amazon.com Inc.; Alphabet Inc.; Microsoft Corporation; New Relic Inc.; IBM Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Amazon.com Inc.

- Alphabet Inc.

- Microsoft Corporation

- New Relic Inc.

- IBM Corporation

- Oracle Corporation

- Broadcom Inc.

- Splunk Inc.

- BMC Software Inc.

- Datadog Inc.

- Kaseya Limited

- Dynatrace Inc.

- SolarWinds Worldwide LLC

- PagerDuty Inc.

- Sumo Logic Inc.

- Grafana Labs Inc.

- Elastic N.V.

- LogicMonitor Inc.

- AppDynamics Inc.

- IDERA Inc.

- xMatters Inc.

- InfluxDB Inc.

- SevOne Inc.

- VictorOps Inc.

- Site24x7 Inc.

- Zenoss Inc.

- Opsgenie Inc.

- Stackify Inc.

- Sematext Group Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 3.05 Billion |

| Forecasted Market Value ( USD | $ 6.43 Billion |

| Compound Annual Growth Rate | 20.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 29 |