Aortic Valve Replacement Market: Introduction

Aortic Valve Replacement (AVR) is a surgical procedure used to treat aortic valve diseases, particularly aortic stenosis, and aortic regurgitation. The aortic valve is one of the four heart valves that control blood flow through the heart. It is located between the left ventricle and the aorta, the main artery that carries oxygen-rich blood from the heart to the rest of the body. In aortic valve diseases, the valve is either too narrow (stenosis) or does not close properly (regurgitation), resulting in the heart working harder to pump blood, which can ultimately lead to heart failure.Uses:

AVR is performed to replace a damaged or dysfunctional aortic valve with a prosthetic valve. The procedure is indicated in patients with symptomatic severe aortic stenosis, moderate to severe aortic regurgitation with symptoms or left ventricular dysfunction, or asymptomatic patients with severe aortic stenosis and evidence of left ventricular systolic dysfunction. AVR can be done using two main types of prosthetic valves:- Mechanical valves: These are made from durable materials like titanium or carbon, and they are designed to last a lifetime. However, patients with mechanical valves require lifelong anticoagulation therapy to prevent blood clots

- Biological valves: These valves are made from animal or human tissue, such as porcine (pig) or bovine (cow) valves or human donor valves. Biological valves do not typically require lifelong anticoagulation therapy but have a shorter lifespan, often lasting 10-20 years, depending on the patient's age and other factors

Benefits:

Aortic Valve Replacement offers several benefits for patients with aortic valve diseases:1. Symptom relief: AVR can significantly improve symptoms, such as shortness of breath, chest pain, and fatigue, associated with aortic valve diseases.

2. Improved heart function: By replacing the damaged valve with a functional prosthetic valve, the heart can pump blood more efficiently, reducing the stress on the heart muscle and improving overall heart function.

3. Increased life expectancy: AVR can prevent or delay the progression of heart failure and other complications, thereby increasing life expectancy for patients with severe aortic valve diseases.

4. Enhanced quality of life: By alleviating symptoms and improving heart function, patients can experience an improved quality of life after the procedure, including increased exercise capacity and reduced limitations in daily activities.

While AVR is a life-saving procedure for many patients with aortic valve diseases, it is important to note that it carries inherent risks, as with any major surgery. These risks include bleeding, infection, blood clots, and complications related to anaesthesia. The choice of prosthetic valve type and the decision to undergo AVR should be carefully considered and discussed with a healthcare professional, taking into account the patient's age, lifestyle, and overall health.

Aortic Valve Replacement Market Segmentations

The market can be categorised into product type, procedure, end user, and regionAortic Valve Replacement Market Breakup by Product Type

- Aortic Valve Replacement Valve Type

2. Mechanical

- Suture Type

2. Suture less

- Sheet Hydrogel

Aortic Valve Replacement Market Breakup by Procedure

- Minimally Invasive

- Transfemoral Aortic Valve Replacement (TF-AVR)

- Transcatheter Aortic Valve Replacement (TAVR)

- Open Surgery

- Others

Market Breakup by Therapy End User

- Hospitals

- Ambulatory Surgical Centers

- Others

Aortic Valve Replacement Market Breakup by Region

North America

- United States of America

- Canada

Europe

- United Kingdom

- Germany

- France

- Italy

- Others

Asia Pacific

- China

- Japan

- India

- ASEAN

- Australia

- Others

Latin America

- Brazil

- Argentina

- Mexico

- Others

Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Nigeria

- South Africa

- Others

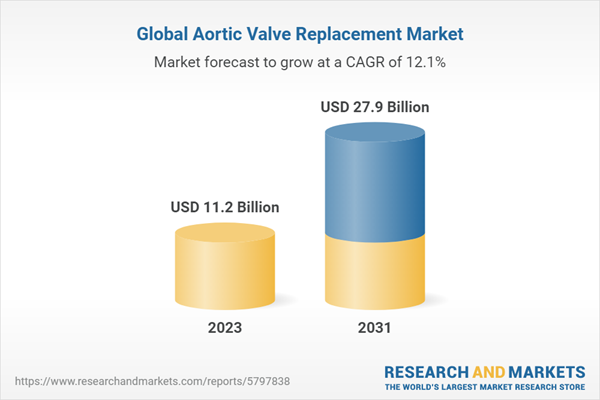

Aortic Valve Replacement Market Scenario

The global aortic valve replacement (AVR) market is witnessing significant growth due to the increasing prevalence of aortic valve diseases, an aging population, and advancements in surgical techniques and prosthetic valve technologies. The market includes various types of prosthetic valves, such as mechanical and biological valves, as well as different surgical approaches, such as open-heart surgery, transcatheter aortic valve replacement (TAVR), and minimally invasive cardiac surgery (MICS).Market Drivers

Several factors are driving the growth of the AVR market. The rising prevalence of aortic valve diseases, such as aortic stenosis and aortic regurgitation, is increasing the demand for valve replacement procedures. Additionally, the growing geriatric population, which is more susceptible to valve diseases, is further contributing to the market growth. Technological advancements, including the development of transcatheter and minimally invasive procedures, are also expanding treatment options and improving patient outcomes, thereby propelling the market forward.Market Challenges

Despite the growing demand for AVR, the market faces some challenges. The high cost of prosthetic valves and surgical procedures can limit access to treatment, particularly in low- and middle-income countries. Furthermore, the inherent risks and complications associated with valve replacement surgeries may deter some patients from undergoing the procedure. Additionally, the limited durability of biological valves and the need for lifelong anticoagulation therapy with mechanical valves are concerns that may affect patient preferences and market dynamics.Regional Analysis

Geographically, the global AVR market can be segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominates the market, driven by its advanced healthcare infrastructure, higher awareness about aortic valve diseases, and the presence of key market players. Europe follows closely, with Asia-Pacific anticipated to be the fastest-growing region, owing to the increasing prevalence of aortic valve diseases, improving healthcare infrastructure, and growing healthcare expenditures in the region.Future Outlook

The AVR market is expected to continue its growth trajectory in the coming years, primarily driven by the increasing prevalence of aortic valve diseases, advancements in prosthetic valve technologies, and the development of minimally invasive and transcatheter procedures. As new technologies emerge and healthcare systems continue to evolve, the market may experience increased access to treatment and improved patient outcomes, resulting in a more robust and dynamic AVR market.Key Players in the Global Aortic Valve Replacement Market

The report gives an in-depth analysis of the key players involved in the aortic valve replacement market, sponsors manufacturing the drugs, and putting them through trials to get FDA approvals. The companies included in the market are as follows:- Medtronic Plc

- LivaNova PLC

- CryoLife, Inc

- Edwards Lifesciences Corporation

- Micro Interventional Devices

- Meril Life Sciences Pvt. Ltd

- JenaValve Technology, Inc

- Auto Tissue Berlin GmbH

- Abbott

- TTK HealthCare

Table of Contents

Companies Mentioned

- Medtronic plc.

- Livanova plc

- Cryolife, Inc.

- Edwards Lifesciences Corporation

- Micro Interventional Devices

- Meril Life Sciences Pvt. Ltd.

- Jenavalve Technology, Inc.

- Auto Tissue Berlin GmbH

- Abbott

- Ttk Healthcare

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 147 |

| Published | April 2023 |

| Forecast Period | 2023 - 2031 |

| Estimated Market Value ( USD | $ 11.2 Billion |

| Forecasted Market Value ( USD | $ 27.9 Billion |

| Compound Annual Growth Rate | 12.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |