Legionella Testing Market: Introduction

Legionella testing is the process of detecting and identifying the presence of Legionella bacteria in water systems, such as cooling towers, hot and cold-water systems, and other water-related environments. Legionella is a potentially dangerous bacterium that can cause Legionnaires' disease, a severe and sometimes fatal form of pneumonia, as well as Pontiac fever, a milder, flu-like illness. Legionella testing is crucial for preventing and controlling outbreaks of these diseases, as it helps ensure the safety of water systems in various settings, such as residential buildings, healthcare facilities, and industrial plants.There are several methods used for Legionella testing, including culture testing, polymerase chain reaction (PCR) testing, and rapid antigen testing. Culture testing, the gold standard for Legionella detection, involves taking water samples and cultivating them on a specialized growth medium that encourages the growth of Legionella bacteria. This method allows for the identification of specific Legionella species and quantification of the bacterial concentration in the sample. PCR testing, on the other hand, detects the presence of Legionella DNA in water samples, providing a quicker result but lacking the ability to quantify the bacteria or distinguish between live and dead cells. Rapid antigen testing utilizes immunoassays to detect the presence of Legionella antigens in water samples, offering a fast and convenient screening method but with reduced sensitivity compared to culture testing.

Legionella testing is essential for several reasons. Firstly, it helps ensure compliance with local and international regulations and guidelines related to the prevention and control of Legionnaires' disease. Regular testing of water systems can identify the presence of Legionella bacteria, enabling prompt remediation and reducing the risk of disease transmission.

Additionally, Legionella testing is crucial for maintaining a safe environment in facilities with vulnerable populations, such as hospitals, nursing homes, and other healthcare settings. People with weakened immune systems, chronic lung disease, or other underlying health conditions are at higher risk for developing severe Legionnaires' disease, making the prevention of Legionella exposure especially important in these environments.

Legionella testing is used to evaluate the effectiveness of water treatment and disinfection measures, providing valuable information on the success of control strategies and informing adjustments to these strategies as needed. By regularly testing water systems for the presence of Legionella, facility managers and public health officials can monitor and maintain the safety of water supplies and protect the health of those who rely on them.

Legionella Testing Market Segmentations

The market can be categorised into segments like type, test, end user, and major region.Market Breakup by Type

- Culture Methods

- UAT

- Serology

- DFA Test

- Nucleic Acid-Based Detection

- PCR

Market Breakup by Test

- Water Testing

- Microbial Culture

- DFA Stain

- PCR

- Others

- IVD Testing

- Blood Culture

- Urine Antigen Test

- DFA Stain

- PCR

- Others

Market Breakup by End User

- Hospital and Clinics

- Diagnostic Laboratories

Market Breakup by Region

North America

- United States of America

- Canada

Europe

- United Kingdom

- Germany

- France

- Italy

- Others

Asia Pacific

- China

- Japan

- India

- ASEAN

- Australia

- Others

Latin America

- Brazil

- Argentina

- Mexico

- Others

Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Nigeria

- South Africa

- Others

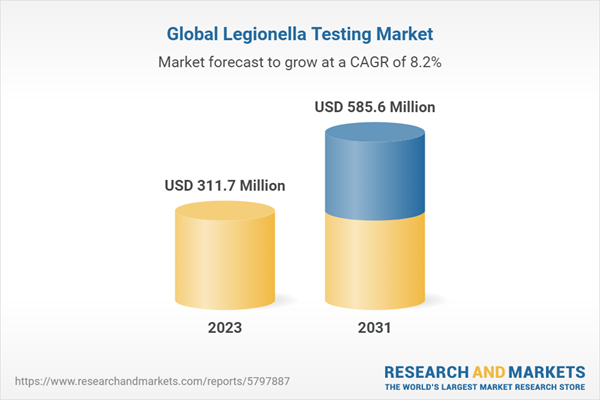

The global Legionella testing market has been experiencing steady growth in recent years and is expected to continue expanding due to several factors, such as increased awareness of Legionella-associated diseases, stricter regulations and guidelines, technological advancements in testing methods, and the rising demand for rapid and accurate diagnostic solutions.

Increased awareness of the risks associated with Legionella bacteria and the potential consequences of Legionnaires' disease and Pontiac fever has led to a greater emphasis on the importance of regular testing of water systems. Governments, regulatory bodies, and public health organizations worldwide have implemented stricter guidelines and regulations to ensure the safety of water systems in various settings, including residential buildings, healthcare facilities, industrial plants, and hotels. These regulations have driven the demand for Legionella testing services, as facility owners and operators seek to maintain compliance and protect the health of occupants and users.

Technological advancements in Legionella testing methods have also contributed to the growth of the market. The development of more sensitive, accurate, and rapid testing techniques, such as PCR and rapid antigen tests, has made it easier for organizations to implement Legionella testing as part of their routine water management programs. These newer testing methods have not only improved the detection capabilities but also reduced the turnaround time for results, enabling faster responses to potential outbreaks and increasing the overall efficiency of water safety programs.

The global Legionella testing market is also fuelled by the rising demand for diagnostic solutions that can help prevent and control outbreaks of Legionnaires' disease and Pontiac fever. With an aging population and an increasing number of people with weakened immune systems or chronic health conditions, the need for effective testing and monitoring of water systems has become even more critical. This growing demand has led to the expansion of the market, with more companies offering Legionella testing services and a broader range of testing options available to consumers.

Despite the overall positive outlook for the Legionella testing market, there are some challenges that may impact its growth, such as the high costs associated with testing and the lack of standardized testing protocols across different regions. However, the continued emphasis on public health, water safety, and technological advancements is expected to drive the market forward, as the importance of Legionella testing in maintaining safe water systems and preventing disease outbreaks becomes increasingly recognized.

Key Players in the Global Legionella Testing Market

The report gives an in-depth analysis of the key players involved in the legionella testing market. The companies included in the market are as follows:- Abbott Laboratories

- Alere Inc

- Becton, Dickinson and Company (BD)

- Bio-Rad Laboratories, Inc

- bioMerieux S.A

- Beckman Coulter, Inc

- Eiken Chemical Co., Ltd

- Hologic, Inc

- Pro-lab Diagnostics, Inc

- QIAGEN

- Roche Diagnostics

- Takara Bio, Inc

- Thermo Fischer Scientific, Inc.

Table of Contents

Companies Mentioned

- Abbott Laboratories

- Alere Inc.

- Becton, Dickinson and Company (Bd)

- Bio-Rad Laboratories, Inc.

- Biomerieux S.A.

- Beckman Coulter, Inc.

- Eiken Chemical Co. Ltd

- Hologic, Inc.

- Pro-Lab Diagnostics, Inc.

- Qiagen

- Roche Diagnostics

- Takara Bio, Inc.

- Thermo Fischer Scientific, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 147 |

| Published | May 2023 |

| Forecast Period | 2023 - 2031 |

| Estimated Market Value ( USD | $ 311.7 Million |

| Forecasted Market Value ( USD | $ 585.6 Million |

| Compound Annual Growth Rate | 8.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |