Hydrophobic Interaction Chromatography: Introduction

Hydrophobic interaction chromatography (HIC) is a type of liquid chromatography that separates molecules based on their hydrophobicity or water-avoiding characteristics. It is widely used in the purification of proteins, especially those that are difficult to purify using other chromatographic methods. In HIC, the stationary phase is a hydrophobic resin that interacts with the hydrophobic regions of the protein, causing it to bind to the resin. The binding is then reversed by decreasing the salt concentration in the elution buffer, which reduces the hydrophobic interactions and causes the protein to be released from the resin.HIC has many advantages over other chromatographic methods, including its ability to separate proteins based on subtle differences in hydrophobicity, its compatibility with a wide range of buffer conditions, and its ability to work at high salt concentrations. These properties make it a popular choice for the purification of proteins for use in the biopharmaceutical industry.

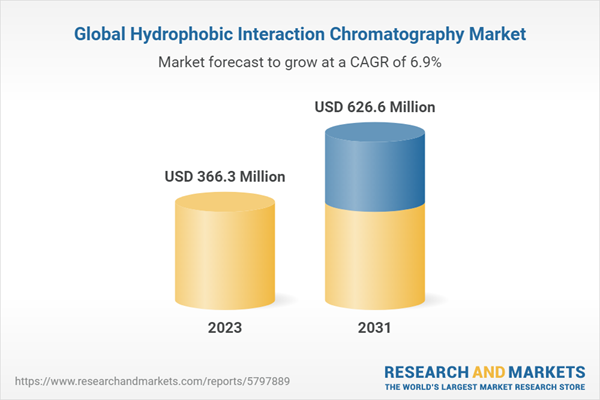

The global hydrophobic interaction chromatography market is expected to experience significant growth in the coming years due to the increasing demand for biopharmaceuticals and the growing need for efficient protein purification techniques. The increasing prevalence of chronic diseases such as cancer and diabetes is also expected to drive demand for biopharmaceuticals, which in turn is expected to fuel growth in the HIC market. The market is also expected to benefit from technological advancements in the field of chromatography and the growing adoption of HIC in the biopharmaceutical industry.

Hydrophobic Interaction Chromatography Market Scenario

Hydrophobic Interaction Chromatography (HIC) is a popular technique used in protein purification. It is a chromatography process that separates molecules based on their hydrophobicity or lack thereof. The technique is particularly useful for purifying proteins that are unstable in more hydrophilic environments, such as those found in other chromatography techniques.The demand for HIC has been growing in recent years due to the increasing demand for biopharmaceutical products. HIC is used extensively in the biopharmaceutical industry for the purification of therapeutic proteins, vaccines, and other biologics. This has led to an increase in the production and consumption of HIC resins and related products.

The HIC market is expected to continue to grow due to the increasing demand for biopharmaceuticals and the need for more efficient and cost-effective purification techniques. The market is also driven by the technological advancements in the field of HIC and the development of new products and services to meet the growing demand.

In addition, the HIC market is expected to benefit from the increasing investment in research and development activities by key players in the industry. The growth in the biopharmaceutical industry, especially in emerging markets, is also expected to drive the demand for HIC in the coming years.

Hydrophobic Interaction Chromatography Market Segmentations

Market Breakup by Product

- Resins

- Columns

- Buffers

- Others

Market Breakup by Sample Type

- Monoclonal Antibodies

- Vaccines

- Others

Market by Application

POC

- Glucose Monitoring

- Cardiac Marker

- Infectious Disease Detection

- Coagulation Monitoring

- Pregnancy Testing

- Blood Gas and Electrolyte Detection

- Detection of Tumor or Cancer Marker

- Urinalysis Testing

- Cholesterol Testing

Home Diagnostic

- Glucose Monitoring

- Pregnancy Testing

- Cholesterol Testing

- Research Labs

- Environmental Monitoring

- Food and Beverages

- Biodefence

Market Breakup by End User

- Home Healthcare Diagnostics

- POC Testing

- Food Industry

- Research Laboratories

- Security and Biodefence

Market Breakup by Region

North America

- United States of America

- Canada

Europe

- United Kingdom

- Germany

- France

- Italy

- Others

Asia Pacific

- China

- Japan

- India

- ASEAN

- Australia

- Others

Latin America

- Brazil

- Argentina

- Mexico

- Others

Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Nigeria

- South Africa

- Others

Key Trends in the Hydrophobic Interaction Chromatography Market

Some key trends in the Hydrophobic Interaction Chromatography market include:

- Growing demand in biopharmaceutical industry: The increasing use of hydrophobic interaction chromatography in the purification of therapeutic proteins, monoclonal antibodies, and vaccines in biopharmaceutical production is driving the growth of the market

- Technological advancements: Advances in technology have led to the development of improved hydrophobic interaction chromatography resins that offer higher resolution, greater selectivity, and better recovery rates, thus boosting the adoption of these products

- Increasing R&D activities: The rise in research and development activities in the fields of proteomics and genomics is expected to fuel the growth of the hydrophobic interaction chromatography market

- Growing demand for biosimilars: The increasing demand for biosimilars is expected to create significant opportunities for hydrophobic interaction chromatography in the coming years, as these drugs require purification to meet regulatory standards

- Focus on cost-effectiveness: Manufacturers are increasingly focusing on developing cost-effective hydrophobic interaction chromatography resins to cater to the demands of customers and gain a competitive edge in the market

Hydrophobic Interaction Chromatography: Competitor Landscape

The key features of the market report include patent analysis, grants analysis, clinical trials analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:- Bio-Rad Laboratories, Inc

- GE Healthcare

- Sartorius AG

- Tosoh Bioscience GmbH

- Sepax Technologies, Inc

- Thermo Fisher Scientific Inc

- Cecil Instrumentation Services Ltd

- Hitachi High-Tech America, Inc

- Agilent Technologies, Inc

- Restek Corporation

- PerkinElmer Inc. (U.S.)

- JASCO Corporation

- Hitachi High-Tech America, Inc

- Tosoh Bioscience

Table of Contents

Companies Mentioned

- Bio-Rad Laboratories, Inc.

- Ge Healthcare

- Sartorius AG

- Tosoh Bioscience GmbH

- Sepax Technologies, Inc.

- Thermo Fisher Scientific Inc.

- Cecil Instrumentation Services Ltd.

- Hitachi High-Tech America, Inc.

- Agilent Technologies, Inc.

- Restek Corporation

- Perkinelmer Inc. (U.S.)

- Jasco Corporation

- Hitachi High-Tech America, Inc.

- Tosoh Bioscience

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 147 |

| Published | May 2023 |

| Forecast Period | 2023 - 2031 |

| Estimated Market Value ( USD | $ 366.3 Million |

| Forecasted Market Value ( USD | $ 626.6 Million |

| Compound Annual Growth Rate | 6.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |