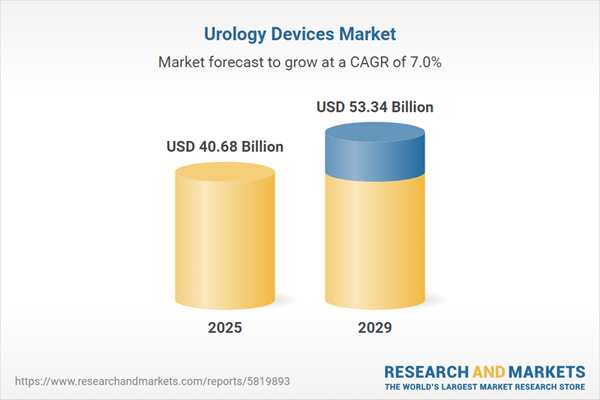

The urology devices market size is expected to see strong growth in the next few years. It will grow to $53.34 billion in 2029 at a compound annual growth rate (CAGR) of 7%. The growth in the forecast period can be attributed to rising geriatric population, preventive healthcare measures, advancements in treatment modalities, global health challenges, patient-centric care. Major trends in the forecast period include focus on female urology devices, development of next-generation urodynamic systems, expansion of urological endoscopy devices, personalized treatment approaches in erectile dysfunction, market growth in emerging economies.

The anticipated rise in the prevalence of urologic conditions is poised to fuel the expansion of the urology devices market in the foreseeable future. Urologic conditions encompass a spectrum of diseases affecting the urinary tract, including urinary tract infections, bladder control issues, kidney stones, and prostate problems. As the global population ages and the incidence of chronic diseases such as diabetes and obesity grows, the occurrence of urological conditions is expected to increase. Urologists necessitate specialized devices and equipment for the accurate diagnosis and treatment of conditions such as erectile dysfunction, kidney stones, prostate cancer, and bladder cancer. In 2022, the Kidney Care Center reported that kidney stones impact approximately one in 10 Americans during their lifetime. Additionally, a 2022 study by the Children's Hospital of Philadelphia indicates a projected increase in kidney stone incidence by 2.2% to 3.9% as global temperatures rise. Consequently, the heightened prevalence of urologic conditions is anticipated to be a driving force behind the urology devices market.

The growth of the urology devices market is expected to be further propelled by an increase in healthcare expenditure. Healthcare expenditure encompasses the total financial outlay on medical services, treatments, pharmaceuticals, facilities, and related expenses within a specific population or country over a defined period. Elevated healthcare expenditure stimulates greater demand and investment in advanced urology devices, facilitated by improved accessibility and innovation. For example, as of September 2022, MedTech Europe reported that, on average, approximately 11% of the gross domestic product (GDP) in Europe is allocated to healthcare. Within this allocation, around 7.6% is dedicated to medical technologies. The expenditure on medical technology in European countries ranges from about 5% to 12% of the total healthcare spending. The per capita expenditure on medical technology in Europe is approximately $346.08 (€284). Consequently, the escalating healthcare expenditure is expected to act as a catalyst for the growth of the urology devices market.

Leading companies in the urology device sector are increasingly prioritizing innovative solutions, such as urology cameras, to improve prostate care. Urology cameras are specialized medical imaging devices utilized in urological procedures to capture high-resolution images of the urinary tract, bladder, urethra, and related structures. For example, in September 2024, Olympus Corporation, a Japan-based optical technology firm, launched its new 4K camera head, the CH-S700-08-LB, specifically designed for urological and gynecological endoscopy procedures. This camera head provides four times the pixel resolution of standard HD camera heads, delivering exceptional imaging quality with 4K white light imaging and 4K Narrow Band Imaging (NBI). This advanced visualization significantly enhances the ability to observe mucosal structures and capillary patterns, which is crucial for diagnosing conditions like bladder cancer.

Key players in the urology devices market are employing a strategic partnership approach to bolster research, development, and market penetration for innovative solutions. Strategic partnerships involve companies leveraging each other's strengths and resources to achieve mutual benefits and success. For instance, in November 2023, Telix, an Australia-based biotechnology firm, joined forces with Mauna Kea Technologies, a France-based global medical device company, to enhance the integration of augmented reality (AR) imaging with Telix's radiopharmaceuticals in urologic oncology surgery. This collaboration aims to improve surgical precision and outcomes by combining cutting-edge imaging technologies with advanced cancer treatments, positioning both companies at the forefront of the evolving urology devices market.

In November 2022, Alleima, a company based in Sweden specializing in the development and production of advanced stainless steels, special alloys, titanium, and other high-performance materials, successfully completed the acquisition of Endosmart for an undisclosed sum. The strategic intent behind this acquisition is to augment Alleima's capabilities and broaden its market reach by incorporating new products and materials obtained from Endosmart. Endosmart, known formally as Gesellschaft für Medizintechnik GmbH, is a Germany-based manufacturing company with a focus on producing medical devices and components, particularly in the fields of urology, oncology, and cardiology. This acquisition aligns with Alleima's strategic growth objectives and is expected to contribute to the expansion of their product portfolio and market presence, leveraging the specialized expertise of both entities in the realm of advanced materials and medical device manufacturing.

Major companies operating in the urology devices market include Boston Scientific Corporation, Cook Medical Incorporated, Stryker Corporation, Intuitive Surgical Inc., Karl Storz SE & Co. KG, Medtronic PLC, Olympus Corporation, Cardinal Health Inc, B. Braun Melsungen AG, Dornier Med Tech, Becton Dickinson and Company, Coloplast Corp., STERIS Corporation, Integer Holdings Corporation, Surgical Holdings Corp., Healthtronics Inc., Argon Medical Devices Inc., Aspivix SA, Aytu BioScience Inc., DistalMotion SA, EDAP TMS, InnovaQuartz LLC, Lumenis, NeoTract Inc., NIKKISO CO. LTD, Pelvital USA Inc., Perineologic, Procept BioRobotics, Promaxo, Promedon GmbH, PSS Urology Inc., Teleflex Incorporated, Urologix LLC, UroMems, Urotech GmbH, Zenflow Inc.

North America was the largest region in the urology devices market in 2024. The regions covered in the urology devices market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the urology devices market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Urology devices encompass instruments and tools utilized for diagnosing and treating diseases related to the urinary tract, offering numerous advantages in managing conditions affecting the kidneys, bladder, ureters, and other urological issues in both men and women.

The primary product types within urology devices include urology endoscopes, robotic surgical systems, laser systems, lithotripters, brachytherapy systems, high-intensity focused ultrasound systems, urodynamic systems, and urology consumables. Urology endoscopes, equipped with attached lighting, enable visualization of the urethra, bladder (urethrocystoscopy), and upper urinary tract (ureterorenoscopy). These devices find application in various conditions such as kidney diseases, urological cancers, Benign Prostatic Hyperplasia (BPH), pelvic organ prolapse, and other related diseases. Technologies involved in urology devices include minimally invasive surgery, robotic surgery, and other innovative technologies. Urology devices are used by a range of end-users, including hospitals, clinics, dialysis centers, and other medical facilities involved in urological care and treatment.

The urology devices market research report is one of a series of new reports that provides urology devices market statistics, including urology devices industry global market size, regional shares, competitors with a urology devices market share, detailed urology devices market segments, market trends, and opportunities, and any further data you may need to thrive in the urology devices industry. This urology devices market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The urology devices market consists of sales of instruments, consumables, accessories, dialysis machines, envision devices, and imaging devices. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Urology Devices Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on urology devices market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for urology devices ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The urology devices market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- the market characteristics section of the report defines and explains the market.

- the market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- the forecasts are made after considering the major factors currently impacting the market. These include:

- the forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- the regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- the competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- the trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Product: Urology Endoscopes; Robotic Surgical Systems; Laser Systems; Lithotripters; Brachytherapy Systems; High-Intensity Focused Ultrasound (HIFU) Systems; Urodynamic Systems; Urology Consumables2) by Disease: Kidney Diseases; Urological Cancer and BPH; Pelvic Organ Prolapse; Other Diseases

3) by Technology: Minimally Invasive Surgery; Robotic Surgery; Other Technologies

4) by End User: Hospitals and Clinics; Dialysis Centers; Other End Users

Subsegments:

1) by Urology Endoscopes: Rigid Endoscopes; Flexible Endoscopes; Video Endoscopes2) by Robotic Surgical Systems: Robotic-Assisted Surgical Systems; Robotic Instruments

3) by Laser Systems: Holmium Laser Systems; Thulium Laser Systems; Diode Laser Systems

4) by Lithotripters: Extracorporeal Shock Wave Lithotripters (ESWL); Laser Lithotripters

5) by Brachytherapy Systems: Seed Implantation Systems; Afterloading Systems

6) by High-Intensity Focused Ultrasound (HIFU) Systems: HIFU Devices For Prostate Treatment; HIFU Devices For Kidney Treatment

7) by Urodynamic Systems: Urodynamic Measurement Systems; Portable Urodynamic Systems

8) by Urology Consumables: Catheters; Biopsy Needles; Surgical Instruments; Imaging Contrast Agents

Key Companies Mentioned: Boston Scientific Corporation; Cook Medical Incorporated; Stryker Corporation; Intuitive Surgical Inc.; Karl Storz SE & Co. KG

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Urology Devices market report include:- Boston Scientific Corporation

- Cook Medical Incorporated

- Stryker Corporation

- Intuitive Surgical Inc.

- Karl Storz SE & Co. KG

- Medtronic PLC

- Olympus Corporation

- Cardinal Health Inc

- B. Braun Melsungen AG

- Dornier Med Tech

- Becton Dickinson and Company

- Coloplast Corp.

- STERIS Corporation

- Integer Holdings Corporation

- Surgical Holdings Corp.

- Healthtronics Inc.

- Argon Medical Devices Inc.

- Aspivix SA

- Aytu BioScience Inc.

- DistalMotion SA

- EDAP TMS

- InnovaQuartz LLC

- Lumenis

- NeoTract Inc.

- NIKKISO CO. LTD

- Pelvital USA Inc.

- Perineologic

- Procept BioRobotics

- Promaxo

- Promedon GmbH

- PSS Urology Inc.

- Teleflex Incorporated

- Urologix LLC

- UroMems

- Urotech GmbH

- Zenflow Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 40.68 Billion |

| Forecasted Market Value ( USD | $ 53.34 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 37 |