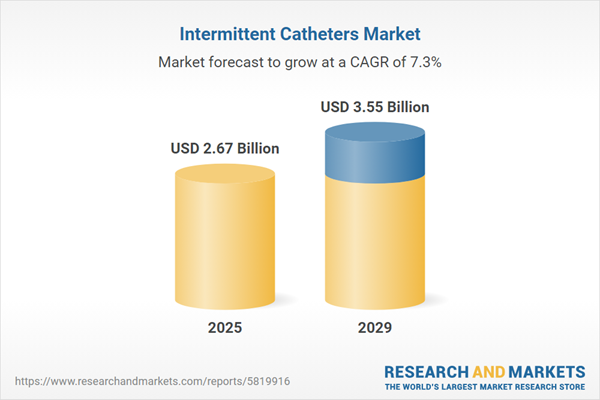

The intermittent catheters market size is expected to see strong growth in the next few years. It will grow to $3.55 billion in 2029 at a compound annual growth rate (CAGR) of 7.3%. The growth in the forecast period can be attributed to rise in chronic conditions, focus on infection prevention, healthcare cost containment strategies, personalized healthcare solutions, telehealth and remote patient monitoring. Major trends in the forecast period include technological innovations in catheter design, advancements in medical technology, focus on patient convenience and quality of life, economic and reimbursement factors, global expansion and market penetration.

The anticipated rise in the prevalence of urinary incontinence is expected to drive the growth of the intermittent catheter market in the coming years. Urinary incontinence (UI) is characterized by the loss of bladder control or the inability to manage urination. Individuals suffering from urinary incontinence often use intermittent catheters, self-catheterizing four to six times a day to regain bladder control. The increasing prevalence of urinary incontinence is set to fuel the demand for intermittent catheters. For example, a report by the National Association for Continence reveals that globally, 200 million people experience urinary incontinence, with 75% to 80% of the 25 million adult Americans affected being female. Stress urinary incontinence, the predominant type among women, is estimated to impact 15 million adult women in the United States. Hence, the growth of the intermittent catheter market is closely tied to the increasing prevalence of urinary incontinence.

The expected rise in healthcare expenditure is likely to contribute to the expansion of the intermittent catheters market. Healthcare expenditure encompasses spending on healthcare goods and services, representing the total amount of money invested in healthcare within a specific system or economy. The role of healthcare expenditure is pivotal in supporting the development and accessibility of intermittent catheters. For instance, data from the Canadian Institute for Health Information in November 2022 indicates that healthcare expenditure increased to 0.8%, totaling $331 billion in 2022, compared to 7.6% in 2021. Consequently, the growth of the intermittent catheters market is influenced by the upward trajectory of healthcare expenditure.

A key trend gaining momentum in the intermittent catheter market is product innovation. Major companies in this market are prioritizing the development of innovative products to maintain their competitive positions. For instance, in February 2023, Denmark-based Coloplast Corp introduced Luja, a male intermittent catheter designed to address significant risk factors for urinary tract infections (UTIs). Luja, featuring Micro-hole Zone Technology, sets a new benchmark for intermittent catheterization by ensuring full bladder emptying in a single free flow. This innovation is poised to revolutionize continence care, offering benefits to both catheter users and the broader healthcare industry.

Leading companies in the intermittent catheters market are investing in innovative technologies such as Feel Clean technology to gain a competitive edge. Feel Clean technology, applied to intermittent catheters, involves a specialized surface coating or treatment aimed at enhancing the user experience by reducing residual stickiness or residue post-use. For instance, in September 2022, UK-based Convatec launched the GentleCathTM range of catheters, incorporating the pioneering FeelClean technology to address challenges associated with intermittent catheterization. This next-generation material, intrinsically slippery when wet and without the need for a coating, exhibits low friction during insertion and avoids becoming sticky upon removal.

In January 2022, HR Pharmaceuticals, Inc., a medical equipment manufacturer based in the United States, acquired MTG Catheters for an undisclosed sum. This acquisition allows HR Pharmaceuticals, Inc. to broaden its range of urology products, improve patient access to specialized catheters, and reinforce its role as the only independent catheter producer in the U.S. The integration will benefit patients with mobility challenges and foster innovation in bladder care. MTG Catheters, a U.S.-based company, focuses on producing high-quality, user-friendly intermittent catheters tailored to individuals with bladder management needs.

Major companies operating in the intermittent catheters market include Adapta Medical Inc., B. Braun SE, Becton Dickinson and Company, Coloplast Corp., Cure Medical LLC, Hollister Incorporated, Hunter Urology Ltd., Teleflex Incorporation, Convatec Group plc, Medical Technologies of Georgia Inc., Cook Group Incorporate, McKesson Medical-Surgical Inc., Medline Industries LP, Romsons Group, Wellspect HealthCare AB, Asid Bonz GmbH, Bard Medical Division, Boston Scientific Corporation, Medtronic PLC, J and M Urinary Catheters LLC, Advin Healthcare.

North America was the largest region in the intermittent catheters market in 2024. The regions covered in the intermittent catheters market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the intermittent catheters market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Intermittent catheters are small, flexible, and soft tubes inserted into the bladder through the urethra, serving the purpose of draining urine. They are employed for situations where the bladder does not empty completely or when a surgical connection has been created between the bladder and the abdominal surface.

The primary products within the category of intermittent catheters include uncoated intermittent catheters and coated intermittent catheters. Uncoated intermittent catheters encompass regular variants and are further categorized as male length catheters, kid length catheters, and female length catheters. These catheters find application in various medical contexts such as urinary incontinence, urinary retention, prostate gland surgery, spinal cord injury, and others. Their usage is prevalent in surgical centers, specialty clinics, academic and research institutions.

The intermittent catheters market research report is one of a series of new reports that provides intermittent catheters market statistics, including intermittent catheters industry global market size, regional shares, competitors with intermittent catheters market share, detailed intermittent catheters market segments, market trends, and opportunities, and any further data you may need to thrive in the intermittent catheters industry. This intermittent catheter market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The intermittent catheter market consists of sales of latex, vinyl, polyvinyl chloride, silicone, and polyurethane catheters. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Intermittent Catheters Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on intermittent catheters market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for intermittent catheters? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The intermittent catheters market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Uncoated Intermittent Catheter; Coated Intermittent Catheter2) By Category: Male Length Catheter; Kids Length Catheter; Female Length Catheter

3) By Application: Urinary Incontinence; Urinary Retention; Prostate Gland Surgery; Spinal Cord Injury; Other Applications

4) By End Users: Hospitals; Surgical Centers; Specialty Clinics; Academic and Research Institutions

Subsegments:

1) By Uncoated Intermittent Catheter: Latex Intermittent Catheter; PVC Intermittent Catheter; Other Material Types2) By Coated Intermittent Catheter: Hydrophilic Coated Intermittent Catheter; Antimicrobial Coated Intermittent Catheter; Other Coating Types

Key Companies Mentioned: Adapta Medical Inc.; B. Braun SE; Becton Dickinson and Company; Coloplast Corp.; Cure Medical LLC

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Adapta Medical Inc.

- B. Braun SE

- Becton Dickinson and Company

- Coloplast Corp.

- Cure Medical LLC

- Hollister Incorporated

- Hunter Urology Ltd.

- Teleflex Incorporation

- Convatec Group plc

- Medical Technologies of Georgia Inc.

- Cook Group Incorporate

- McKesson Medical-Surgical Inc.

- Medline Industries LP

- Romsons Group

- Wellspect HealthCare AB

- Asid Bonz GmbH

- Bard Medical Division

- Boston Scientific Corporation

- Medtronic PLC

- J and M Urinary Catheters LLC

- Advin Healthcare

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 2.67 Billion |

| Forecasted Market Value ( USD | $ 3.55 Billion |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |