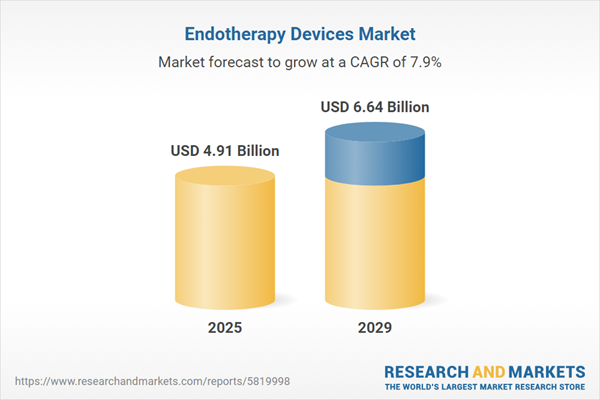

The endotherapy devices market size is expected to see strong growth in the next few years. It will grow to $6.64 billion in 2029 at a compound annual growth rate (CAGR) of 7.9%. The growth in the forecast period can be attributed to advancements in minimally invasive techniques, the growing burden of chronic diseases, expansion of healthcare infrastructure, increased focus on early detection, regulatory support and standardization. Major trends in the forecast period include advances in imaging technologies, integration of artificial intelligence, technological advancements, global expansion of healthcare infrastructure, and increased prevalence of gastrointestinal disorders.

The increasing incidence of gastrointestinal diseases is projected to drive the growth of the endotherapy devices market in the future. Gastrointestinal illnesses affect the digestive tract from the mouth to the anus and include conditions such as colorectal cancer, gastroesophageal reflux disease, ulcerative colitis (UC), inflammatory bowel disease (IBD), and Crohn's disease (CD). Endotherapy devices are employed in the treatment and diagnosis of gastrointestinal diseases through non-invasive or minimally invasive surgical procedures, addressing issues like ulcers, bleeding, celiac disease, obstructions, inflammation, and tumors within the gastrointestinal tract. They also assist in identifying the source of unexplained symptoms such as heartburn, abdominal pain, nausea, vomiting, and bleeding. For instance, reports from Cancer Australia, an Australian organization, indicate that in 2023, Australia is expected to see 2,576 new cases of stomach cancer, comprising 1,647 in males and 929 in females. The lifetime risk of diagnosis by age 85 is approximately 1 in 117 (0.85%), with males facing a risk of 1 in 91 (1.1%) and females 1 in 164 (0.61%). Therefore, the rising incidence of gastrointestinal diseases is driving growth in the endotherapy devices market.

The growth of the endotherapy devices market is further fueled by the rising prevalence of obesity. Obesity, characterized by the excessive accumulation of body fat with adverse effects on health, can be effectively managed with endotherapy devices. These devices play a crucial role in weight loss, appetite reduction, improving the quality of life, providing minimally invasive treatment, and offering temporary interventions for obesity management. According to World Obesity, the number of obese individuals is expected to increase to 892 million in 2025 and reach 1.02 billion in 2030. In England, it was projected that 25.9% of individuals aged 18 and older were obese in 2021-2022. Consequently, the growing prevalence of obesity is a key driver for the expansion of the endotherapy devices market.

Key companies in the endotherapy devices market are developing innovative solutions, such as red dichromatic imaging (RDI), to improve the visualization of blood vessels and bleeding sites during endoscopic procedures. RDI enhances the visibility of blood vessels and lesions by utilizing two different wavelengths of light, which improves diagnostic accuracy during procedures. For example, in October 2023, Olympus Corporation, a medical technology company based in Japan, launched the EVIS X1 endoscopy system. This cutting-edge system integrates advanced imaging technologies and artificial intelligence to enhance visualization and diagnostic capabilities. The EVIS X1 features texture and color enhancement imaging (TXI), which improves the visibility of lesions and polyps by enhancing their color and texture. Additionally, RDI focuses on deep blood vessels and bleeding points, while brightness adjustment imaging with maintenance of contrast (BAI-MAC) ensures balanced brightness levels throughout the image.

Major companies in the endotherapy devices market are strategically focusing on innovative products such as endoscopy systems to drive market revenues. An endoscopy system is a minimally invasive medical technology used for internal organ examination. For example, Olympus Corporation, a Japan-based manufacturer of optics and reprography products, launched EVIS X1 in October 2023. Equipped with cutting-edge imaging technologies such as red dichromatic imaging (RDITM) and texture and color enhancement imaging (TXITM), the system enhances visibility and abnormality identification in the gastrointestinal tract. Notable features include a 10% lighter ErgoGrip control section for improved user comfort and scope handling. The introduction of the EVIS X1 endoscopic system reflects Olympus' commitment to advancing endoscopy technology and providing medical professionals with the tools necessary for high-quality treatment.

In January 2024, Olympus Corporation, a medical technology company based in Japan, acquired Taewoong Medical Co. Ltd. for an undisclosed sum. This acquisition allows Olympus to improve patient outcomes by providing a wider range of clinically differentiated technologies, thereby elevating the standard of care in gastrointestinal treatments. Taewoong Medical Co. Ltd. is a manufacturer located in South Korea that specializes in medical devices, including gastrointestinal (GI) metallic stents.

Major companies operating in the endotherapy devices market include Olympus Corporation, Boston Scientific Corporation, Conmed Corporation, Medtronic Plc, Fujifilm Holdings Corporation, Johnson & JohnsonCook Group Incorporated, Karl Storz SE & Co. KG, Stryker Corporation, Taewoong Medical Co. Ltd, Smith & Nephew Plc., Steris Corporation, Micro-Tech (Nanjing) Co Ltd., HOYA Corporation, Cook Group Incorporated, B. Braun Melsungen AG, Frontier Healthcare, Pentax Medical, Nipro Corporation, MEDIVATORS B.V., US Endoscopy Group Inc., Richard Wolf GmbH, Cantel Medical Corp., Fujinon Corporation, Gyrus ACMI, Cogentix Medical Inc., Endogastric Solutions Inc.

North America as the largest region in the endotherapy devices market in 2024. Asia-Pacific is expected to be the fastest-growing region in the global endotherapy devices market report during the forecast period. The regions covered in the endotherapy devices market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the endotherapy devices market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Endotherapy devices are medical instruments employed in endoscopic procedures aimed at diagnosing, treating, and managing various disorders across different medical fields such as gastrointestinal, colonoscopy, laparoscopy, anoscopy, arthroscopy, bronchoscopy, and others. These devices are specifically designed for use in conjunction with an endoscope, a flexible tube equipped with a light and camera that enables physicians to visually inspect the internal organs more effectively.

The primary categories of endotherapy devices include gastrointestinal devices and accessories, endoscopic retrograde cholangiopancreatography devices and accessories, and other endotherapy devices. Gastrointestinal devices and accessories are medical tools utilized in the diagnosis and treatment of gastrointestinal (GI) disorders. They play a crucial role in various procedures, including endoscopic examinations that allow visualization and access to the inside of the GI tract, covering areas such as the esophagus, stomach, duodenum, and colon. Additionally, these devices are employed in surgical interventions to deliver targeted therapies directly to affected areas. These devices find extensive applications in bronchoscopy, arthroscopy, laparoscopy, urology endoscopy, neuro-endoscopy, gastrointestinal endoscopy, and other medical procedures performed by hospitals, ambulatory surgical centers, and other end-users.

The endotherapy devices market research report is one of a series of new reports that provides endotherapy devices market statistics, including endotherapy devices industry global market size, regional shares, competitors with an endotherapy devices market share, detailed endotherapy devices market segments, market trends and opportunities, and any further data you may need to thrive in the endotherapy devices industry. This endotherapy devices market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The endotherapy devices market consists of sales of devices such as mechanically enhanced colonoscopies, endoscopic hemostasis, tissue sampling devices, metallic stents, dilation balloons, foreign body retrieval devices, electrosurgical needs, and UCR insufflators. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Endotherapy Devices Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on endotherapy devices market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for endotherapy devices? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The endotherapy devices market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Gastrointestinal Devices and Accessories; Endoscopic Retrograde Cholangio Pancreatography Devices and Accessories; Other Endotherapy Devices2) By Application: Bronchoscopy; Arthroscopy; Laparoscopy; Urology Endoscopy; Neuro-Endoscopy; Gastrointestinal Endoscopy; Other Applications

3) By End-Use: Hospital; Ambulatory Surgical Centers; Other End-Users

Subsegments:

1) By Gastrointestinal Devices and Accessories: Endoscopic Mucosal Resection (EMR) Devices; Endoscopic Submucosal Dissection (ESD) Devices; Biopsy Forceps; Clips and Closure Devices; Electrosurgical Devices2) By Endoscopic Retrograde Cholangio Pancreatography (ERCP) Devices and Accessories: ERCP Cannulas; Balloon Sweep Devices; Stents; Guidewires; Sphincterotomes

3) By Other Endotherapy Devices: Endoscopic Ultrasound (EUS) Devices; Ablation Devices; Foreign Body Retrieval Devices; Laser Therapy Devices

Key Companies Mentioned: Olympus Corporation; Boston Scientific Corporation; Conmed Corporation; Medtronic Plc; Fujifilm Holdings Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Olympus Corporation

- Boston Scientific Corporation

- Conmed Corporation

- Medtronic Plc

- Fujifilm Holdings Corporation

- Johnson & JohnsonCook Group Incorporated

- Karl Storz SE & Co. KG

- Stryker Corporation

- Taewoong Medical Co. Ltd

- Smith & Nephew Plc.

- Steris Corporation

- Micro-Tech (Nanjing) Co Ltd.

- HOYA Corporation

- Cook Group Incorporated

- B. Braun Melsungen AG

- Frontier Healthcare

- Pentax Medical

- Nipro Corporation

- MEDIVATORS B.V.

- US Endoscopy Group Inc.

- Richard Wolf GmbH

- Cantel Medical Corp.

- Fujinon Corporation

- Gyrus ACMI

- Cogentix Medical Inc.

- Endogastric Solutions Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 4.91 Billion |

| Forecasted Market Value ( USD | $ 6.64 Billion |

| Compound Annual Growth Rate | 7.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |