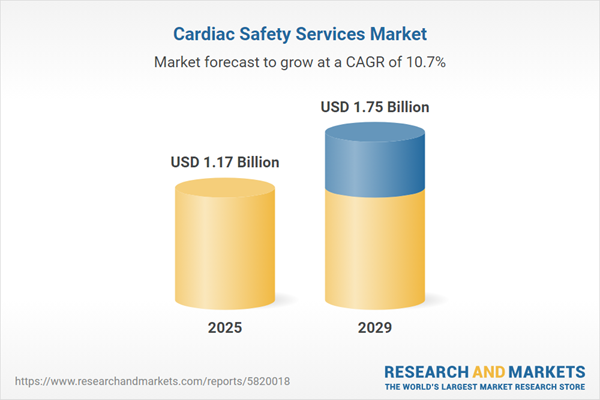

The cardiac safety services market size is expected to see rapid growth in the next few years. It will grow to $1.75 billion in 2029 at a compound annual growth rate (CAGR) of 10.7%. The growth in the forecast period can be attributed to remote patient monitoring, shift towards decentralized clinical trials, rise in orphan drug development, increasing outsourcing of clinical trials, regulatory emphasis on patient-centric approaches. Major trends in the forecast period include integration of wearable technologies, advancements in ECG technologies, decentralized clinical trials, data standardization and interoperability, telehealth and remote consultations, patient-centric approaches.

The rising prevalence of cardiovascular diseases is expected to drive the growth of the cardiac safety services market. Cardiovascular diseases encompass a range of disorders affecting the heart and blood vessels, including peripheral arterial disease, cerebrovascular disease, and coronary heart disease. Cardiac safety services focus on monitoring heart health and safety, identifying risk factors for cardiovascular diseases before they manifest, which aids in implementing preventative measures and reducing mortality risk. For example, a journal published by Oxford University Press in March 2023 reported that over 200 million people were affected by peripheral artery diseases in 2020, with projections suggesting a nearly 50% increase by 2045. Additionally, data from the British Heart Foundation, a UK-based cardiovascular research charity, indicated in September 2024 that approximately 7.6 million people in the UK are living with heart and circulatory diseases, comprising about 4 million men and 3.6 million women. These conditions account for around 27% of all deaths in the UK, resulting in over 170,000 fatalities each year, or about 480 deaths per day, which translates to one death every three minutes. Thus, the increasing prevalence of cardiovascular diseases is fueling the demand for cardiac safety services.

The increasing aging population is anticipated to drive the growth of the cardiac safety services market. The term "aging population" refers to the rising median age within a population, attributed to declining fertility rates and increased life expectancy. As this demographic ages, the prevalence of cardiovascular diseases tends to rise, leading to a greater demand for cardiac safety services. Older individuals require specialized care and management for geriatric syndromes within cardiac intensive care units, which can significantly benefit from these services. For example, a report from the Population Reference Bureau, a U.S.-based nonprofit organization, indicated in January 2024 that the number of Americans aged 65 and older is projected to increase from 58 million in 2022 to 82 million by 2050, representing a 47% growth. Additionally, the proportion of this age group within the overall population is expected to rise from 17% to 23% during the same timeframe. Therefore, the growing aging population is fueling the expansion of the cardiac safety services market.

Innovations in product offerings stand as a pivotal trend gaining momentum within the cardiac safety services market. Notably, prominent market players are dedicated to crafting novel solutions to fortify their market presence. For instance, in March 2022, CATHI, a Germany-based technology-driven company, unveiled the CATHIS RHC 2, an updated version of their Right Heart Catheter (RHC) simulator. This improved model retains the original simulator's features and includes additional benefits such as wire-assisted navigation and compatibility with real liquids (S-HUB), enabling the performance of thermodilution.

Major companies operating in the cardiac safety services sector are leveraging advancements such as AI and ML-powered cardiac safety tools to gain a competitive edge. These tools utilize electrocardiogram (ECG) data to furnish detailed insights into continuous ECG data, assessing its quality and accuracy. Notably, Clario, a US-based healthcare company, introduced its AI-powered ECG quality score tool in November 2023. This tool employs machine learning and artificial intelligence to enhance cardiac safety data quality, enabling sponsors to proactively address any anomalies in the data and potentially allowing waivers for conventional Thorough QT (TQT) investigations. The integration of AI technology enhances Clario's Early Precision QT (EPQT) early phase solution, elevating data quality assurance in cardiac safety assessments.

In October 2023, Motion Equity Partners, a private equity firm based in France, acquired Banook Group for an undisclosed sum. This acquisition is intended to boost Banook Group's growth potential and extend its market presence by utilizing Motion Equity Partners' expertise and resources to foster innovation and improve operational efficiencies within the company. Banook Group is a technology company located in France that focuses on providing digital solutions and services for the media and telecommunications industries.

Major companies operating in the cardiac safety services market include Laboratory Corporation of America Holdings, Banook Group Limited, Pharmaceutical Product Development LLC, Biotrial S.A., Certara Inc., Celerion Inc., Medpace Holdings Inc., Ncardia AG, Richmond Pharmacology Limited, PhysioStim, SGS Société Générale de Surveillance SA, Koninklijke Philips N.V., Clario, NEXEL Co. Ltd., Eurofins Scientific SE, InBody USA Inc., Spaulding Clinical Research LLC, OMRON Healthcare Inc., ERT Inc., IQVIA Holdings Inc., Bioclinica Inc., ICON plc, BioTelemetry Inc., Medidata Solutions Inc., SYNEXUS Clinical Research, PPD Inc., Parexel International Corporation, Chiltern International Limited, ACI Clinical Inc., Biomedical Systems, High Point Clinical Trials Center, Maastricht University Medical Centre+, CCBR-SYNARC, Cytel Inc., CardioSecur Ltd., Medicalgorithmics S.A., Advarra Inc.

North America was the largest region in the cardiac safety services market in 2024. The regions covered in the cardiac safety services market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the cardiac safety services market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Cardiac safety services encompass a range of support dedicated to monitoring and ensuring heart safety throughout various clinical trials and research endeavors. These services aid in the design and execution of trials while maintaining a focus on cardiac safety protocols.

Key services within cardiac safety offerings include ECG or Holter measurements, blood pressure assessments, in vitro cardiac safety evaluations, cardiovascular imaging, real-time telemetry monitoring, central over-reading of ECGs, non-invasive cardiac imaging, physiologic stress testing, and comprehensive QT studies, among others. Holter measurements, for instance, involve the continuous recording of the heart's electrical activity for 24 hours or more, allowing remote monitoring away from medical facilities. The phases involved in these services typically span Phase 1, Phase 2, and Phase 3, primarily utilized by pharmaceutical and biopharmaceutical companies, contract research organizations, as well as academic and research institutes to ensure cardiac safety standards in clinical research and trials.

The cardiac safety services market research report is one of a series of new reports that provides cardiac safety services market statistics, including cardiac safety services industry global market size, regional shares, competitors with cardiac safety services market share, detailed cardiac safety services market segments, market trends, and opportunities, and any further data you may need to thrive in the cardiac safety services industry. This cardiac safety services market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The cardiac safety services market includes revenues earned by companies by providing cardiac safety monitoring, ventricular arrhythmias, and cardiovascular performance services. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Cardiac Safety Services Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on cardiac safety services market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for cardiac safety services? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The cardiac safety services market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Services: ECG or Holter Measurements; Blood Pressure Measurements; in Vitro Cardiac Safety Assessment Services; Cardiovascular Imaging; Real-Time Telemetry Monitoring; Central Over-Read of ECGS; Non-Invasive Cardiac Imaging; Physiologic Stress Testing; Thorough QT Studies; Other services2) By Phase: Phase 1; Phase 2; Phase 3

3) By End User: Pharmaceutical and Biopharmaceutical Companies; Contract Research Organizations; Academic and Research Institute

Subsegments:

1) By ECG or Holter Measurements: Standard ECG Monitoring; 24-Hour Holter Monitoring; Event Monitoring2) By Blood Pressure Measurements: Continuous Blood Pressure Monitoring; Ambulatory Blood Pressure Monitoring; in-Hospital Blood Pressure Measurements

3) By in Vitro Cardiac Safety Assessment Services: Cardiomyocyte Toxicity Testing; Cardiac Ion Channel Testing; Mechanistic Studies

4) By Cardiovascular Imaging: Echocardiography; MRI Imaging; CT Angiography

5) By Real-Time Telemetry Monitoring: Remote Patient Monitoring; Continuous Telemetry Services

6) By Central Over-Read of ECGs: ECG Interpretation Services; Quality Control and Reporting

7) By Non-Invasive Cardiac Imaging: Stress Testing; Nuclear Cardiology

8) By Physiologic Stress Testing: Exercise Stress Testing; Pharmacologic Stress Testing

9) By Thorough QT Studies: Clinical Trial Services; Safety Assessments For Drug Development

10) By Other Services: Cardiac Device Monitoring; Clinical Consultation Services

Key Companies Mentioned: Laboratory Corporation of America Holdings; Banook Group Limited; Pharmaceutical Product Development LLC; Biotrial S.A.; Certara Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Laboratory Corporation of America Holdings

- Banook Group Limited

- Pharmaceutical Product Development LLC

- Biotrial S.A.

- Certara Inc.

- Celerion Inc.

- Medpace Holdings Inc.

- Ncardia AG

- Richmond Pharmacology Limited

- PhysioStim

- SGS Société Générale de Surveillance SA

- Koninklijke Philips N.V.

- Clario

- NEXEL Co. Ltd.

- Eurofins Scientific SE

- InBody USA Inc.

- Spaulding Clinical Research LLC

- OMRON Healthcare Inc.

- ERT Inc.

- IQVIA Holdings Inc.

- Bioclinica Inc.

- ICON plc

- BioTelemetry Inc.

- Medidata Solutions Inc.

- SYNEXUS Clinical Research

- PPD Inc.

- Parexel International Corporation

- Chiltern International Limited

- ACI Clinical Inc.

- Biomedical Systems

- High Point Clinical Trials Center

- Maastricht University Medical Centre+

- CCBR-SYNARC

- Cytel Inc.

- CardioSecur Ltd.

- Medicalgorithmics S.A.

- Advarra Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 1.17 Billion |

| Forecasted Market Value ( USD | $ 1.75 Billion |

| Compound Annual Growth Rate | 10.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 37 |