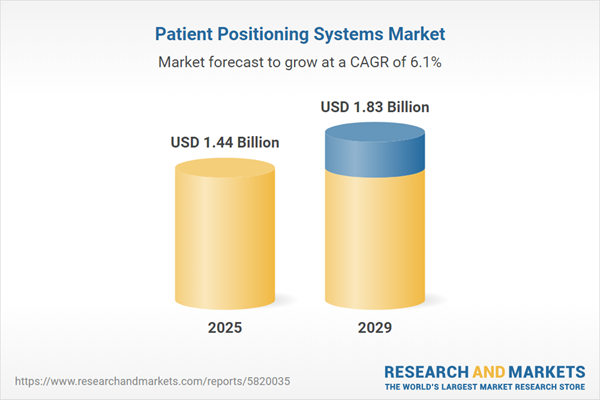

The patient positioning systems market size is expected to see strong growth in the next few years. It will grow to $1.83 billion in 2029 at a compound annual growth rate (CAGR) of 6.1%. The growth in the forecast period can be attributed to rising prevalence of obesity, increasing demand for minimally invasive procedure, expanding applications, emphasis on patient safety and comfort, increasing surgical procedures. Major trends in the forecast period include technological advancements, increasing demand for minimally invasive procedures, regulatory compliance and standardization, rise in ambulatory surgical centers (ASCs), globalization and market expansion.

The anticipated increase in the number of surgeries is expected to drive the growth of the patient positioning systems market. Surgery involves invasive procedures that alter or repair the human body by cutting or destroying tissues. Patient positioning systems play a crucial role in various surgeries, such as orthopedics and cardiology, ensuring that patients are optimally positioned for procedures. For example, the American Joint Replacement Registry's 2022 Annual Report revealed a 14% increase in hip and knee arthroplasty cases in the US, reaching around 2.8 million in 2022 compared to 2021. Consequently, the growth in surgical procedures contributes to the expansion of the patient positioning systems market.

The growth of the patient positioning systems market is further fueled by the rising prevalence of chronic diseases. Chronic diseases are long-term health conditions requiring ongoing medical attention and management. Patient Positioning Systems enhance comfort and safety in managing chronic diseases by facilitating optimal patient positioning during medical procedures and prolonged treatments. According to the World Health Organization in September 2022, non-communicable diseases (NCDs) or chronic diseases accounted for 74% of the 41 million global deaths annually. Cardiovascular diseases, cancer, chronic respiratory diseases, and diabetes were among the leading causes. Additionally, a report from the National Institutes of Health (NIH) in 2023 predicted a 99.5% increase in the number of people aged 50 and older with at least one chronic illness, rising from 71.522 million in 2020 to 142.66 million in 2050. Thus, the escalating number of chronic diseases is a driving force for the patient positioning systems market.

Major companies in the patient positioning systems market are concentrating on developing single-camera unit solutions to enhance accuracy, streamline workflow, and improve patient safety during medical procedures. A single-camera unit solution features a simplified setup where one camera captures all the necessary angles and perspectives, thereby reducing equipment complexity. For instance, in May 2023, BLI-BRAIN LAB INDIA, an India-based software company specializing in advanced technology solutions, launched ExacTrac Dynamic Surface. This innovative system employs a unique single-camera design that continuously tracks patients during treatment, ensuring their position is monitored without obstruction from the treatment gantry.

Leading companies in the patient positioning systems market are emphasizing the development of innovative transfer systems, incorporating unique designs such as skin-friendly foam pads to address challenges and improve safety in patient handling. Skin-friendly foam pads are gentle materials designed for direct skin contact without causing irritation. For instance, Sage Products LLC introduced the Multi-Position MATS Mobile Air Transfer System in March 2022. This system enhances safe patient handling in the operating room, preventing patient sliding during tilt procedures and ensuring nurse safety during lateral transfers. The design includes a skin-friendly foam pad, integrated arm wraps to reduce the risk of nerve damage, and a 2-phase inflation method for safer patient transfers.

In May 2024, Samsung Medison Co., Ltd., a South Korea-based manufacturer of diagnostic ultrasound systems, acquired Sonio SAS for an undisclosed amount. This acquisition is intended to enhance Samsung Medison's capabilities in the medical imaging sector, expand its product portfolio, and bolster its position in the global healthcare market. Sonio SAS is a France-based medical technology company that specializes in developing ultrasound solutions tailored specifically for obstetrics and gynecology.

Major companies operating in the patient positioning systems market include Medtronic plc, Hill-Rom Holdings Inc., Stryker Corporation, Steris Corporation, Span America Medical Systems Inc., Skytron LLC, C-Rad AB, Elekta AB, OPT SurgiSystems Srl, Getinge AB, Mizuho OSI, GF Health Products Inc., Merivaara Corp., Orfit Industries, Medline Industries Inc., Schaerer Medical USA Inc., Smith & Nephew, Guangzhou Renfu Medical Equipment Co. Ltd., Famed Zywiec Sp. zoo, ALVO Medical Sp. zoo, Allen Medical Systems, Schmitz u. Söhne GmbH & Co. KG, Narang Medical Limited.

North America was the largest region in the patient positioning systems market in 2024. The regions covered in the patient positioning systems market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the patient positioning systems market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Patient positioning systems refer to devices utilized to position or immobilize patients during medical procedures such as surgery and imaging, aimed at obtaining clearer and more accurate images. The primary purpose of these systems is to ensure the physical health and safety of patients before, during, and after the procedure.

The main product types of patient positioning systems include tables, surgical tables, radiolucent imaging tables, examination tables, and others. A table in this context is a flat-top piece of furniture specifically designed to assist medical practitioners in accurately placing patients without requiring excessive lifting or exertion. These tables play a crucial role in various medical applications, including surgery, diagnostics, and others, and find use in hospitals, ambulatory surgery centers, diagnostic laboratories, and similar healthcare settings.

The patient positioning systems market research report is one of a series of new reports that provides patient positioning systems market statistics, including patient positioning systems industry global market size, regional shares, competitors with a patient positioning systems market share, detailed patient positioning systems market segments, market trends and opportunities, and any further data you may need to thrive in the patient positioning systems industry. This patient positioning systems market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The patient positioning system market consists of the sale of pediatric immobilizers, scancoat, and chest and hip positioners. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Patient Positioning Systems Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on patient positioning systems market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for patient positioning systems ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The patient positioning systems market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- the market characteristics section of the report defines and explains the market.

- the market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- the forecasts are made after considering the major factors currently impacting the market. These include:

- the forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- the regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- the competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- the trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Product: Tables; Surgical Tables; Radiolucent Imaging Tables; Examination Tables; Other Products2) by Application: Surgery; Diagnostics; Other Application

3) by End User: Hospitals; Ambulatory Surgery Centers; Diagnostic Laboratories; Other End Users

Subsegments:

1) by Tables: General Purpose Tables; Specialty Tables2) by Surgical Tables: Operating Room Surgical Tables; Specialty Surgical Tables

3) by Radiolucent Imaging Tables: Fixed Radiolucent Imaging Tables; Adjustable Radiolucent Imaging Tables

4) by Examination Tables: Manual Examination Tables; Electric Examination Tables

5) by Other Products: Positioning Accessories; Positioning Devices

Key Companies Mentioned: Medtronic plc; Hill-Rom Holdings Inc.; Stryker Corporation; Steris Corporation; Span America Medical Systems Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Patient Positioning Systems market report include:- Medtronic plc

- Hill-Rom Holdings Inc.

- Stryker Corporation

- Steris Corporation

- Span America Medical Systems Inc.

- Skytron LLC

- C-Rad AB

- Elekta AB

- OPT SurgiSystems Srl

- Getinge AB

- Mizuho OSI

- GF Health Products Inc.

- Merivaara Corp.

- Orfit Industries

- Medline Industries Inc.

- Schaerer Medical USA Inc.

- Smith & Nephew

- Guangzhou Renfu Medical Equipment Co. Ltd.

- Famed Zywiec Sp. zoo

- ALVO Medical Sp. zoo

- Allen Medical Systems

- Schmitz u. Söhne GmbH & Co. KG

- Narang Medical Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 1.44 Billion |

| Forecasted Market Value ( USD | $ 1.83 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 24 |