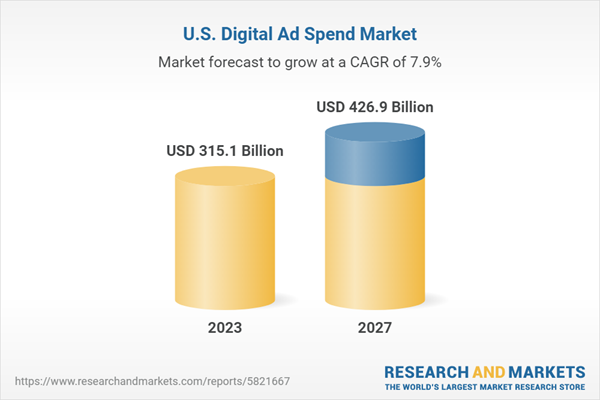

Medium to long term growth story of Digital Advertising Spend in United States remains strong. Digital Advertising Spend adoption is expected to grow steadily over the forecast period, recording a CAGR of 7.9% during 2023-2027. The Digital Advertising Spend Value in the country will increase from US$291,993.9 million in 2022 to reach US$426,859.8 million by 2027.

Despite slower economic growth, marketers continued to spend in online channels in 2022, and this is evident in the growth in online ad revenue. According to a report from Interactive Advertising Bureau and PricewaterhouseCoopers LLP., digital ad revenue increased by 10.8% to reach US$209.7 billion in 2022. While online ad spending increased again last year, it was at a much slower pace, compared to the 35% growth seen in 2021.

Alongside the broader economic uncertainty, which resulted in some firms drawing back on their spending in H2 2022, evolving privacy regulation and increased consumer privacy protection also had an impact on the online ad businesses in the United States. In 2023, though, the industry is expected to grow at a faster rate compared to 2022. Ad-supported streaming services, including those launched by Netflix and Disney+, will aid the market growth in 2023.

Google and Meta are losing their dominance in the online advertising market in the United States

For years, Google and Meta dominated the online advertising market globally. However, amid the growing competition from firms like TikTok, Amazon, Microsoft, and Apple, these players are losing market share in the United States.- According to a report from Insider Intelligence, the United States ad share revenue held by Google and Meta is expected to fall by 2.5% to reach 48.4% in 2023. The year will be the first time when the two firms will not hold the majority of the market share in the United States.

As new players continue to emerge in the fast-growing online ad business in the United States, the publisher expects Google and Meta to remain under pressure from the short to medium-term perspective.

LinkedIn is recording strong market share growth in the United States B2B ad spending business

Ever since the global pandemic outbreak, LinkedIn’s position as the digital platform and the platform for business advertising has strengthened significantly. With all business interactions going virtual, the platform emerged as the best solution to connect with professionals, support remote selling, and attract talent. This also paved the way for LinkedIn to increase its market share in the B2B ad spending category.Over the next three to four years, LinkedIn is expected to attract a significant share of total B2B marketing budgets in the United States. According to a report from Insider Intelligence, the B2B ad spending on the platform is expected to reach US$4.56 billion by 2024. As a result of which, the platform will capture approximately 25% of the total B2B digital ad dollars spent in the United States.

Online advertising aiding the revenue growth for digital commerce platforms in the United States

At a time when consumer disposable income is declining due to the current macroeconomic environment and firms are experiencing dropdown in their sales, online ad business has emerged as a potential revenue growth driver for digital commerce platforms.- For Instacart, one of the leading digital commerce platforms in the United States, advertising has been the key growth driver for the business. In Q4 2022, the firm reported a 50% revenue growth on the back of strong performance in the advertisement segment. With sales volume slowing, the firm has been expanding into brand and full-funnel offerings with shoppable ads and click-to-purchase social video.

This report provides a detailed data-centric analysis of the Digital Ad Spend industry, covering market opportunities and risks across a range of industry categories. With over 50 KPIs at the country level, this report provides a comprehensive understanding of Digital Ad Spend market dynamics, market size and forecast, and market share statistics.

It breaks down market opportunity by type of pricing model, platform (mobile and desktop/ laptop), and channels. In addition, it provides a snapshot of marketing objective and industry spend dynamics in United States. KPIs in both value and share term help in getting in-depth understanding of end market dynamics.

The research methodology is based on industry best practices. Its unbiased analysis leverages a proprietary analytics platform to offer a detailed view on emerging business and investment market opportunities.

Scope

This report provides in-depth data-centric analysis of Digital Ad Spend industry in United States through 57 tables and 67 charts. Below is a summary of key market segments:United States Digital Ad Spend Market Size and Forecast

United States Digital Ad Spend Market Size by Advertising Channel

- Television Advertising

- Print Advertising

- Radio Advertising

- Outdoor Advertising

- Online Advertising

- Direct Mail Advertising

- Event Sponsorship

- Others

United States Digital Ad Spend Market Size by Online Ad Spend Market

- Search Engine Sites

- Ecommerce Sites

- News & Media Sites

- Social Media

- Gaming Platforms

- Forums & Classifieds

- Others

United States Digital Ad Spend Market Size by Social Media Platform

- Line

- Tik Tok

- Others

United States Digital Ad Spend Market Size by Gaming Platforms

- Digital Ad Spend Market Size Around Games Environment Ad Spend

- In Game Environment Ad Spend

- In Game Immersive Ad Spend

- Exclusive Advertising Games Spend

United States Digital Ad Spend Market Size by Format & Media

- Video

- Display

- Influencer Marketing

- Blogging and Podcasting

United States Digital Ad Spend Market Size by Platform

- Mobile

- Desktop and Laptop

United States Digital Ad Spend Market Size by Pricing Model

- Cost Per Mile (CPM)

- Cost Per Click (CPC)

- Performance-Based Advertising

- Others

United States Digital Ad Spend Market Size by Marketing Objective

- Branding

- Increase Traffic

- Direct Online Sales

- Lead Generation

- Product Launch

United States Digital Ad Spend Market Size by Industry

- Technology

- Increase Travel & Hospitality

- FMCG

- Automotive

- Media & Entertainment

- Telecommunications

- Retail & Consumer Goods

- Business and Financial Services

- Pharmaceutical and Healthcare

- Public Sector

- Construction and Real Estate

- Education

- Home Appliances and Furniture

- Other Industries

Reasons to buy

- Gain a thorough understanding of the Digital Ad Spend market dynamics: Market opportunities, significant trends, and forecasting (2018-2028) are listed. To stay ahead of the curve, comprehend market trends using important KPIs like Value and Share.

- Insights by Industry: Evaluate new opportunities across multiple industries, and obtain market dynamics by industry in order to swiftly catch up with the latest and upcoming developments in Digital Ad Spend markets.

- Market-specific strategies: With our unique blend of quantitative forecasting and cutting-edge insights, we can identify growth sectors that are focused on particular opportunities and analyse market-specific risks as well as significant trends in the Digital Ad Spend industry.

- Through industry intelligence, forward-looking research of Digital Ad Spend market spend, and key opportunities in United States, develop proactive and profitable company plans.

Table of Contents

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 81 |

| Published | May 2023 |

| Forecast Period | 2023 - 2027 |

| Estimated Market Value ( USD | $ 315.1 Billion |

| Forecasted Market Value ( USD | $ 426.9 Billion |

| Compound Annual Growth Rate | 7.8% |

| Regions Covered | United States |