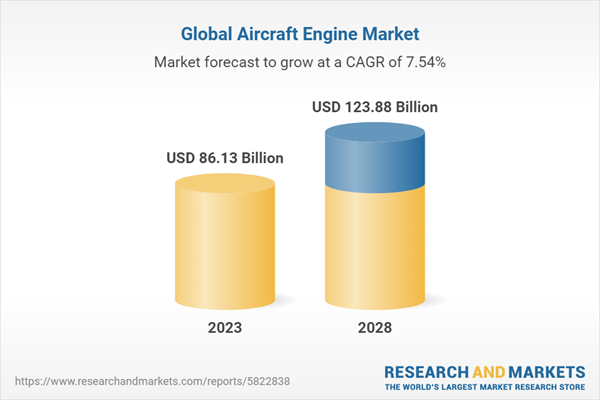

The global aircraft engine market was valued at US$80.09 billion in 2022 and is expected to be worth US$123.88 billion in 2028. An aircraft engine is a crucial component of an aircraft that generates the necessary thrust for flight. It is responsible for converting fuel into mechanical energy, which propels the aircraft forward. Aircraft engines have evolved significantly over time, with advancements in technology and engineering. Modern aircraft engines, such as turbofan engines, are known for their efficiency, reliability, and power.

The market value is expected to grow at a CAGR of 7.54% during the forecast period of 2023-2028. The demand for aircraft engines has been steadily growing due to increasing global demand for air travel. As economies grow and people's disposable incomes rise, more individuals are opting for air transportation. This trend has led to a surge in airline fleets and the need for additional aircraft engines to power these planes. Furthermore, emerging markets, particularly in Asia and the Middle East, have witnessed rapid expansion in their aviation sectors. These regions have experienced a rise in passenger numbers and the establishment of new airlines, which in turn drives the demand for aircraft engines.

Market Segmentation Analysis:

- By Technology: The report provides the bifurcation of the market into two segments based on the technology: Conventional Aircraft Engine and Hybrid Aircraft Engine. The conventional aircraft engine segment held the highest share in the market in 2022. Continuous advancements in materials, design, and manufacturing processes contribute to the development of more efficient and powerful conventional aircraft engines. These advancements enhance fuel efficiency, reduce emissions, and improve overall performance. Increased use of conventional engines in current commercial and military aircraft is further driving the demand of the segment. Combustion engines with conventional powertrains offer the best performance in terms of simple layout, well-known and approved technology and excellent performance in terms of mission range.

- By Platform: The report further provides the segmentation based on the platform: Fixed Wing Aircraft Engine, Rotary Wing Aircraft Engine, and Unmanned Ariel Vehicles. During the forecast period, the rotary wing aricraft is expected to grow at the fastest CAGR. Rotary wing aircraft or helicopters are used for a wide array of applications such as commercial air transport, emergency medical transport, rescue operations, and many other military and defense applications. The growing demand for all the aforementioned applications has promoted rotary-wing aircraft from past decades. Consequently, the demand for engines for rotary aircraft engines is expected to grow consistently in the following years.

- By Engine Type: The aircraft engine market is further bifurcated based on the engine type: Turbofan Engine, Turbojet Engine, Piston and Turboprop Engine and Turboshaft Engine. Turbofan Engine sector held the highest share in the market in 2022. The turbofan engines are commonly used for civil and commercial aircraft. Perpetual development in the field of civil aviation and aircraft engines has been observed for the past few years. This has drawn the attention of many major airline companies to invest in advanced turbofan engines. The demand for such engines is rising consistently due to its fuel economy and reliability of the engines. Owing to the aforementioned factors, the market for the turbofan engine is expected to grow throughout the forecast period.

- By Component: The report provides the bifurcation of the market into into six segments based on the component: Combustor, Turbine, Compressor, Fan, Mixer and Nozzle. Combustor segment held the highest share in the market in 2022. The combustor is responsible for the combustion process, where fuel and air are mixed and ignited. The growth of this segment is driven by the need for more efficient and environmentally friendly engines. Stringent regulations regarding emissions and fuel efficiency have led to the development of advanced combustor technologies, such as lean-burn and low-emission designs. Additionally, the increasing demand for lightweight and durable combustors that can withstand high temperatures and pressures fuels the growth of this segment.

- By End User: The report provides the bifurcation of the market into into two segments based on the end user: Commercial & Military. In 2022, commercial segment hold a dominant position in the aircraft engine market and is expected to continue the dominance during the forecasted period as well. Consistently growing trade and passenger transport among different countries has boosted the commercial aviation industry significantly. The blooming aviation industry has generated the demand for new and advanced aircraft. Manufacturers are continuously engaged in the enhancement of current engines for a more economical and comfortable aviation experience. With the perpetual growth of commercial aviation, the market segment is expected to dominate the overall aircraft engines market throughout the forecast period.

- By Region: The report provides insight into the aircraft engine market based on the geographical operations, namely North America, Europe, Asia Pacific, and ROW. The North American region has emerged as a dominant player in the aircraft engine market, the aviation industry is one of the most profitable industries in North America. Major aircraft manufacturers such as Boeing and Bombardier are based in this region. The high disposable incomes of consumers in North America have contributed to the rise in air travel, which, in turn, is leading to an increase in air passenger traffic. This rise in air passenger traffic has led to an increase in the number of aircraft deliveries in this region, which is leading to the high demand for aircraft engines. The region has been benefiting from low oil prices, improved efficiency in aircraft operations, and a steady labor market. Thus, the profitability of airline owners is higher in North American countries. These are the factors due to which North America is the largest market for aircraft engines.

- During the forecast period, Asia-Pacific is anticipated to expand rapidly. The Asia Pacific region has experienced significant growth in air travel demand, driven by a growing middle class, increasing disposable income, and the emergence of low-cost carriers. This surge in passenger traffic has led to increased aircraft orders and subsequent demand for aircraft engines. Many countries in Asia Pacific, including China and India, are investing heavily in airport infrastructure development. The expansion of airports and the establishment of new ones create opportunities for aircraft engine manufacturers as airlines expand their fleets.

Market Dynamics:

- Growth Drivers: One of the most important factors impacting the global aircraft engine market is the increasing defense budget. Increasing defense budgets play a crucial role in driving the aircraft engine market. The defense sector heavily relies on advanced aircraft and cutting-edge technologies to maintain military superiority and ensure national security. As defense budgets expand, governments allocate significant funds towards the development and acquisition of new aircraft, which in turn stimulates the demand for aircraft engines. Aircraft engines are the heart of any aircraft, providing the necessary power for propulsion and flight. With higher defense budgets, defense organizations can invest in research and development programs to enhance engine performance, fuel efficiency, and reliability. These advancements lead to the creation of more powerful and technologically advanced engines, which are sought after by military aircraft manufacturers. Furthermore, the market has been growing over the past few years, due to factors such as increasing airline capacity, growth in cargo operations, surge in adoption of cost effective and fuel efficient aircraft, increasing commercial aircraft deliveries and introduction of new fuel efficient engines and aircraft models.

- Challenges: However, the market has been confronted with some challenges specifically, high upfront investments with long-term payback, technological complexity, huge entry barriers, etc. Developing and manufacturing aircraft engines requires substantial financial resources, research and development, and engineering expertise. The complex and highly regulated nature of the industry adds to the cost and time required for engine development. Aircraft engines undergo rigorous testing, certification processes, and compliance with stringent safety standards, making the upfront investments significantly high. Moreover, the very high upfront investments required for aircraft engine development, coupled with long-term payback periods, pose a significant challenge to the aircraft engine market.

- Trends: The market is projected to grow at a fast pace during the forecast period, due to various latest trends such as digitalization and IoT integration, increasing use of 3D printed parts in aircraft engines, incorporation of ceramic matrix composites (CMCs) and need to decarbonize aviation. With the advent of advanced sensors, data analytics, and connectivity solutions, aircraft engines are becoming smarter and more efficient than ever before. Digitalization involves the transformation of traditional analog systems into digital ones, enabling the collection and analysis of vast amounts of data in real-time. This allows for more accurate monitoring of engine performance, predictive maintenance, and enhanced operational efficiency. By integrating IoT (Internet of Things) technologies, aircraft engines can communicate with various onboard and ground-based systems, facilitating seamless data exchange and enabling remote monitoring and control. The benefits of digitalization and IoT integration in the aircraft engine market are manifold.

Impact Analysis of COVID-19 and Way Forward:

The COVID-19 pandemic had a profound impact on the aircraft engine market. The global aviation industry experienced a significant decline in air travel demand due to travel restrictions and reduced passenger confidence. This led to a decrease in the need for new aircraft and subsequently affected the demand for aircraft engines. Airlines faced financial challenges, resulting in deferred or canceled maintenance and overhaul activities, which impacted the aftermarket segment. Delays in aircraft deliveries disrupted the supply chain, leading to postponed or canceled engine orders. The financial strain on airlines and engine OEMs resulted in budget cuts and reduced investments in new engines. Additionally, there has been a shift in engine preferences towards more fuel-efficient and environmentally friendly options.

In the post-COVID scenario, the aircraft engine market is expected to gradually recover as air travel demand improves. The COVID-19 pandemic has accelerated the adoption of digitalization in the aviation industry. Aircraft engine manufacturers are using digital technologies to improve the efficiency of their operations, such as using predictive maintenance to reduce the number of engine failures. The aircraft engine market will continue to witness advancements in engine design, materials, and manufacturing processes. Manufacturers will focus on innovations to enhance engine performance, increase reliability, and reduce maintenance costs. Technologies such as additive manufacturing (3D printing) and advanced composite materials will likely play a significant role in the development of next-generation engines.

Competitive Landscape:

The global aircraft engine market is consolidated across five companies: GE, Pratt & Whitney (owned by Raytheon), Rolls-Royce, Safran, and MTU Aero Engines. GE and Safran have a 50/50 JV called CFM International, which dominates the narrow body engine market and enjoys very high margins. GE is also the dominant player in the wide body market.

The key players in the global aircraft engine market are:

- Honeywell International Inc.

- General Electric Company (GE Aerospace)

- Raytheon Technologies Corporation

- MTU Aero Engines AG

- Safran SA

- Rolls-Royce Holdings Plc.

- Textron Inc.

Technological advancements in the market are also bringing sustainable competitive advantage to companies, and the market is witnessing multiple partnerships and mergers. For instance, in November 2022, with the first flight of a modern aero engine powered by hydrogen, Rolls-Royce and easyJet officially announced they had achieved a new aviation milestone.

Table of Contents

1. Executive Summary

Companies Mentioned

- Honeywell International Inc.

- General Electric Company (GE Aerospace)

- Raytheon Technologies Corporation

- MTU Aero Engines AG

- Safran SA

- Rolls-Royce Holdings Plc.

- Textron Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 173 |

| Published | June 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 86.13 Billion |

| Forecasted Market Value ( USD | $ 123.88 Billion |

| Compound Annual Growth Rate | 7.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 7 |