Dry shampoo is showcasing more demand as weather is changing continuously because of which people suffer from oily skin issues. Thus, it is anticipated to generate approximately 1/5thshare of the market by 2029. Since herbal and organic versions are now available, demand for it is rapidly rising. Kaolin clay and Fuller's Earth are two examples of natural components found in dry shampoo, reducing the potential of harm from overusing chemicals. Customers' hectic and fast-paced lifestyles are another significant element driving the increase in demand for dry shampoo. Men and women are choosing quick and easy products as society becomes more modern.

The major strategies followed by the market participants are Acquisitions as the key developmental strategy to keep pace with the changing demands of end users. For instance, In April, 2022, Wella Company acquired Briogeo that would advance the acquiring company's sustainable portfolio, and further, Briogeo's hair care products perfectly complement Wella Company's existing hair care product offerings. In addition, In January, 2023, P&G Beauty signed an agreement to take over Mielle Organics for better serving the black communities.

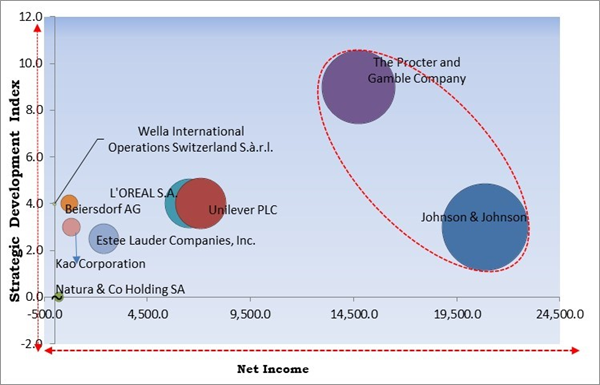

The Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the Cardinal matrix; The Procter and Gamble Company, and Johnson & Johnson are the forerunners in the Market. Companies such as Unilever PLC, L'OREAL S.A., and Beiersdorf AG are some of the key innovators in Market. In June, 2022, Unilever signed an agreement to acquire Nutrafol that perfectly complements the acquiring company's supplements and wellness brands.Market Growth Factors

Increasing demand for organic hair care products

The majority of businesses have created goods with elements inspired by nature, such as plant-inspired and premium botanical ingredients, due to the high demand for natural ingredients. The organic hair care product categories that are well-liked by both sexes globally due to their extensive use include conditioners and shampoos, serums & oils, and styling. Additionally, a significant increase in demand for organic hair oils that fight dandruff is anticipated during the projection period. In Western Europe, the market products is anticipated to significantly increase.Increased accessibility of customized hair care

Manufacturers are concentrating on giving their consumers the best-in-class hair care solutions because there are an increasing number of well-established market competitors engaged in severe competition across the haircare sector. Additionally, an increasing number of new players are entering the market with the intention of developing a solid customer base. The competitive market led to the development of customized hair care products. These products are also developed in response to specific difficulties that a specific consumer is facing. In order to address the demand for customized hair care products, the business would be able to establish a solid customer base. Therefore, it is predicted that these elements will fuel the market's expansion during the projection period.Market Restraining Factors

Availability of counterfeit products

Customers might be unable to distinguish between these products due to the availability of counterfeit goods, which has slowed the growth of products. The entry of counterfeit goods into the market has become a serious threat to the overall global economy. Online and in small beauty supply stores, these products are available for purchase. Additionally, the prices of the aforementioned knockoff and counterfeit hair care products are far lower than those found in the genuine market. Therefore, these companies pricing policies and sales strategies have a detrimental effect on the products they sell in the market. As a result, counterfeit products' availability negatively impacts the market.Product Outlook

By product, the market is segmented into shampoo, dry shampoo, hair color, conditioner, hair styling products, hair oil, and others. In 2022, the hair color segment projected a prominent revenue share in the market. One of the key reasons that will drive the market expansion during the forecast period is the significant increase in the popularity of hair coloring combined with the rise in elderly people globally. The market is also growing due to considerable product innovation in product formulation and formats, as well as rising fashion trends.Distribution Channel Outlook

Based on distribution channels, the market is fragmented into supermarkets & hypermarkets, departmental stores, specialty stores, pharmacy & drug store, online and others. In 2022, the online segment held the highest revenue share in the market. Because there are so many brands available and it's so convenient, consumers prefer to buy goods through online channels. In addition, compared to physical retail establishments, several online channels offer the products at a lower price, which is likely to increase product sales via this channel. Premium hair care product sales through this channel are primarily driven by value-added services provided by online retailers, including a simple return policy, steep discounts, free shipping, accessibility to a large range of global brands, and cash on delivery.Demography Outlook

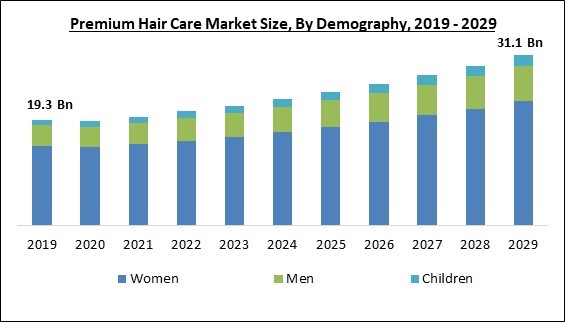

On the basis of demography, the market is bifurcated into men, women, and children. The men segment recorded a remarkable revenue share in the market in 2022. The market is mainly driven by male consumers' growing awareness of their well-being and appearances. Also, men's interest in personal care goods like hair care has significantly expanded due to social media's rising use in society. Manufacturers recently introduced new products to advertise their luxurious goods and worked with well-known brands and celebrities. Male consumers often respond favourably to these celebrity endorsements, marketing, and campaigns. As a result, the market is predicted to grow in this segment.Regional Outlook

Region wise, the market is analyzed across North America, Europe, Asia Pacific and LAMEA. In 2022, the Asia Pacific region led the market by generating the highest revenue share. With many Asian customers becoming aware of the many advantages of luxury cosmetics made from sustainably produced ingredients, organic premium hair care products are now emerging as the most prominent trend in the region. One of the key factors driving the demand for high-end hair care products is the expanding middle-class population in the Asia Pacific region. These consumers are interested in high-end products.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include The Procter and Gamble Company, L'OREAL S.A., Johnson & Johnson, Unilever PLC, Estee Lauder Companies, Inc., Beiersdorf AG, John Masters Organics, Inc. (Aspirant Group, Inc.), Kao Corporation, Natura & Co Holding SA, Wella International Operations Switzerland S.à.r.l.

Recent Strategies Deployed in the Market

Partnerships, Collaborations and Agreements:

- Jun-2022: L’Oréal partnered with Hotel Shilla, a South-Korea based company operating in the hospitality industry, and Anchor Equity Partners, a Korea-based investment company to introduce a new luxury beauty brand. This collaboration would maintain the beauty products company's brand presence in the Asian region.

- Jun-2022: The Procter & Gamble Company came into collaboration with Microsoft, a US-based technology company. The collaboration involves cashing in on Microsoft cloud to support digital manufacturing at P&G. Through this collaboration, the company aims at advancing and broadening P&G's digital manufacturing platform.

- Apr-2022: L'Oréal Professional Products Division came into partnership with Myntra, an India-based provider of an online marketplace. The partnership involves equipping shoppers with salon-inspired hair care. Additionally, this partnership enables the company to cater to the needs of fashion and beauty enthusiasts and further enables the enthusiasts to order hair care products easily from the comfort of their homes.

- Apr-2022: ELCA Cosmetics Pvt Ltd, a subsidiary of Estee Lauder Companies teamed up with Nykaa, an India-based operator of consumer technology platform. The partnership involves launching premium salons in India. The salons will be branded as Aveda X Nykaa. The new salons would primarily focus on delivering luxury professional hair care services.

Product Launches and Product Expansions:

- Jul-2022: Johnson & Johnson launched a new hair and skin care brand intended for toddlers and babies. Initially, the company plans to launch three products under the brand, Vivvi & Bloom 2-in-1 Wash & Shampoo Cleansing Gel; Vivvi & Bloom 2-in-1 Face & Body Whip Lotion; Vivvi & Bloom 2-in-1 Scalp & Body Massage Oil. The products are Environmental Working Group (EWG) verified, vegan, pH-balanced, dermatologist-tested, ophthalmologist-tested, and pediatrician-tested.

- Apr-2021: Kao Corporation through its subsidiary Kao Salon Japan, unveiled ORIBE in Japan. ORIBE is a hair salon brand. The brand launch in Japan expands the company's customer reach and further reinforces its global presence.

Acquisitions and Mergers:

- Jan-2023: P&G Beauty signed an agreement to take over Mielle Organics, a US-based manufacturer of skin and hair care products. This acquisition enables the company to better serve the black communities.

- Jun-2022: Unilever signed an agreement to acquire Nutrafol, a US-based developer of pharmaceuticals intended for healthy hair. The addition of Nutrafol perfectly complements the acquiring company's supplements and wellness brands.

- Apr-2022: Wella Company acquired Briogeo, a hair care company. This acquisition would advance the acquiring company's sustainable portfolio, and further, Briogeo's hair care products perfectly complement Wella Company's existing hair care product offerings.

Geographical Expansions:

- Jun-2022: The Estée Lauder Companies expanded its footprint by setting up a new distribution center in Galgenen, Switzerland. The new distribution center would be dedicated to the travel retail channel. This new distribution center adds value to the company's existing distribution network.

Scope of the Study

By Demography

- Women

- Men

- Children

By Product

- Shampoo

- Hair Styling Products

- Hair Oil

- Hair Color

- Conditioner

- Dry Shampoo & Others

By Distribution Channel

- Online

- Specialty Stores

- Departmental Stores

- Supermarkets & Hypermarkets

- Pharmacy & Drug Store

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Taiwan

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- The Procter and Gamble Company

- L'OREAL S.A.

- Johnson & Johnson

- Unilever PLC

- Estee Lauder Companies, Inc.

- Beiersdorf AG

- John Masters Organics, Inc. (Aspirant Group, Inc.)

- Kao Corporation

- Natura & Co Holding SA

- Wella International Operations Switzerland S.à.r.l.

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- The Procter and Gamble Company

- L'OREAL S.A.

- Johnson & Johnson

- Unilever PLC

- Estee Lauder Companies, Inc.

- Beiersdorf AG

- John Masters Organics, Inc. (Aspirant Group, Inc.)

- Kao Corporation

- Natura & Co Holding SA

- Wella International Operations Switzerland S.à.r.l.